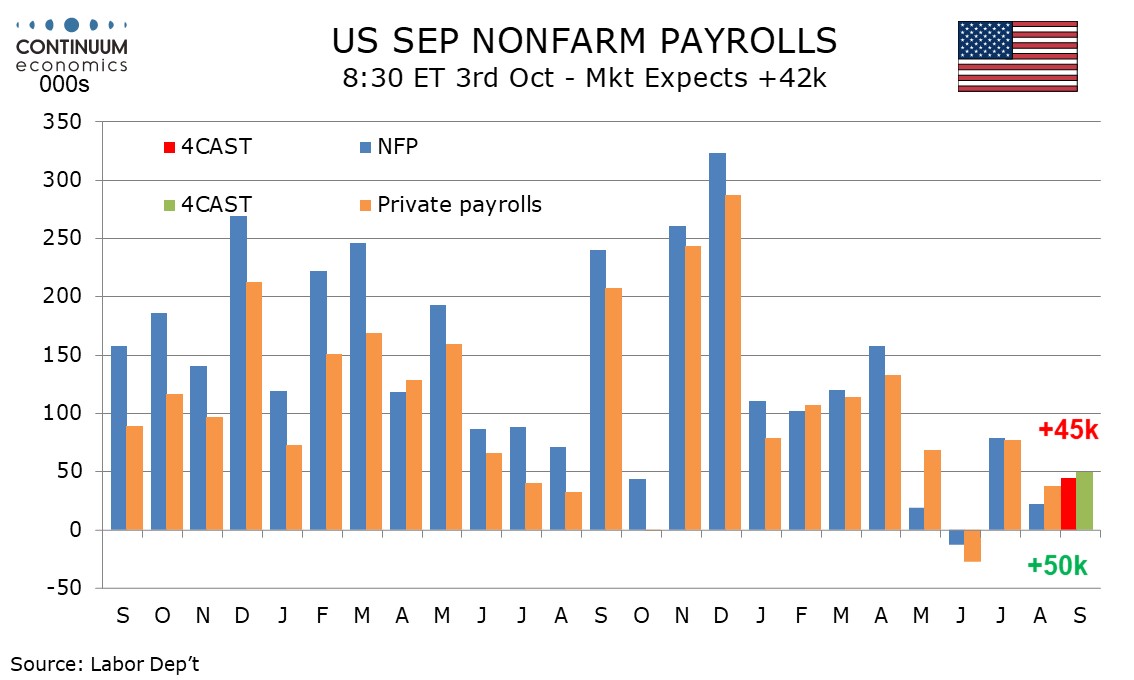

Preview: Due October 3 - U.S. September Employment (Non-Farm Payrolls) - Still subdued, but slightly stronger than in August

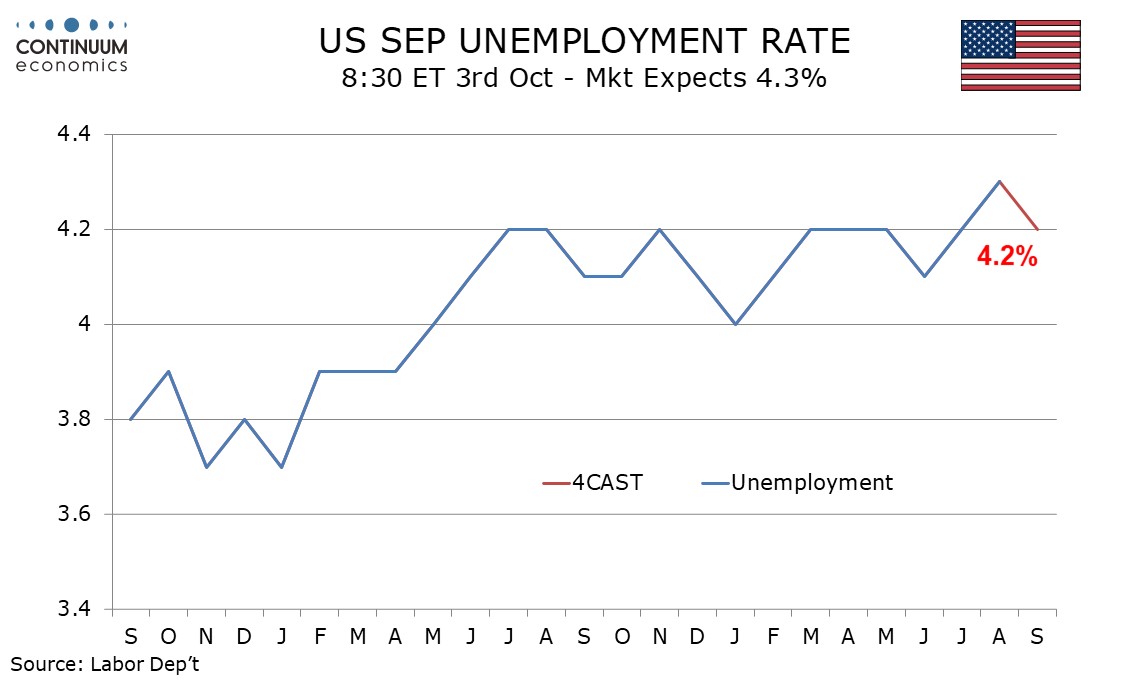

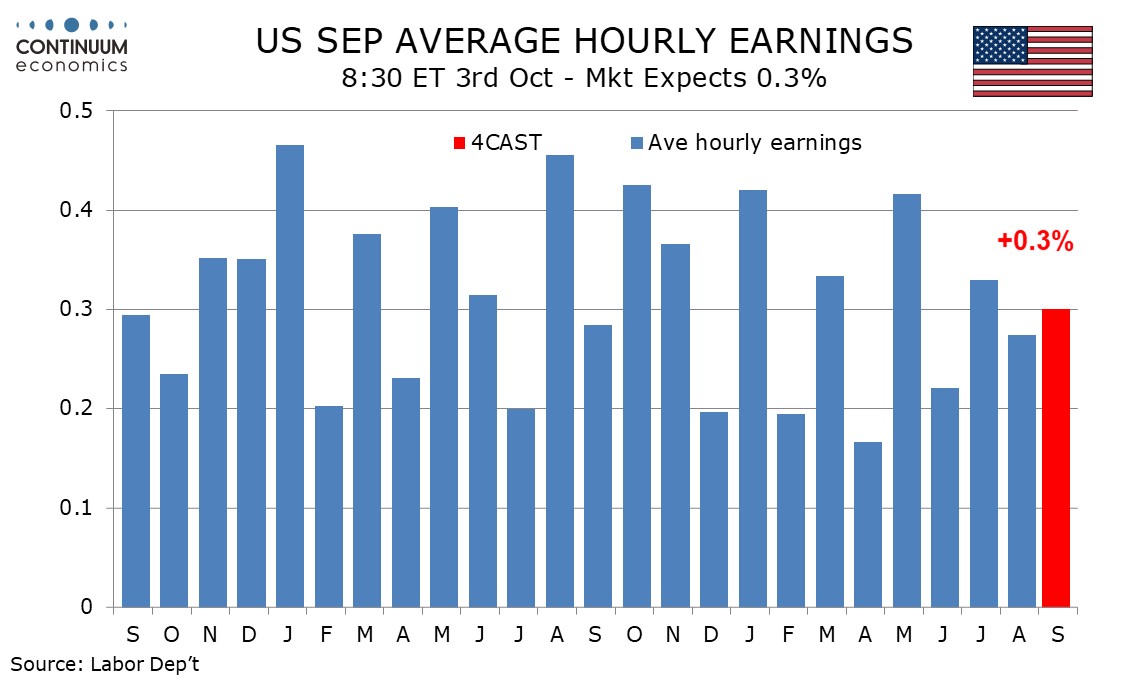

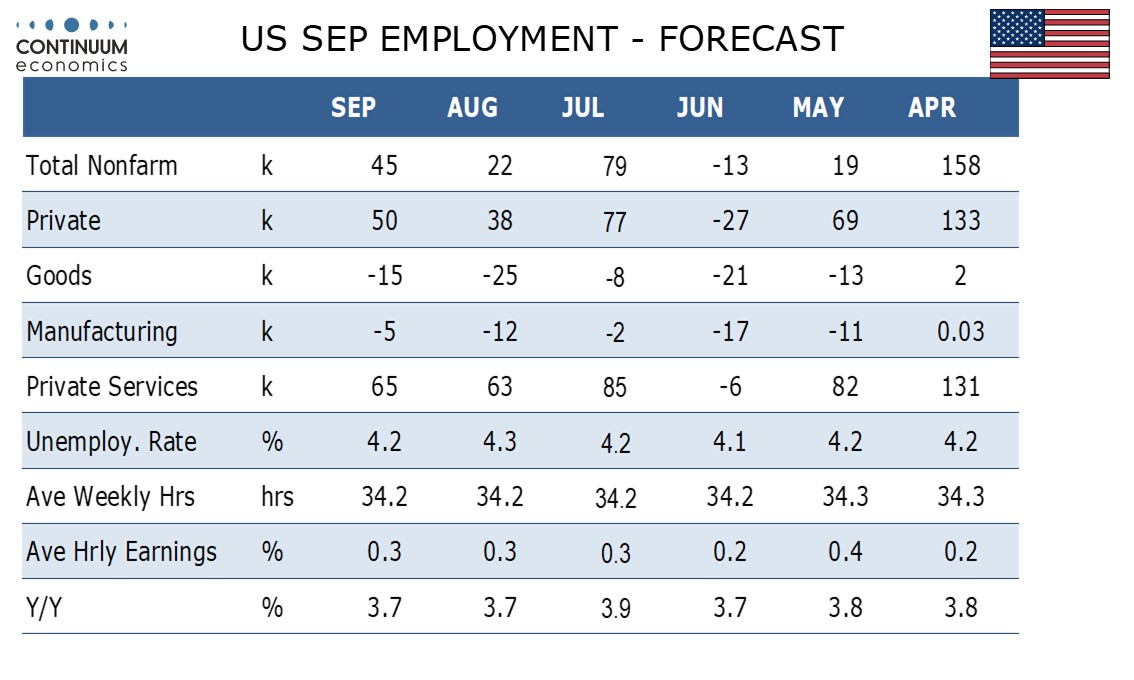

We expect September’s non-farm payroll to show another subdued rise, of 45k, with 50k in the private sector, but marginally stronger than July’s respective gains of 22k and 38k. We expect unemployment to slip to 4.2% from 4.3% on a fall in the labor force, while average hourly earnings maintain trend with a rise of 0.3%.

We expect goods employment to fall by 15k versus a 25k decline in August, with stronger new home sales suggesting a less negative picture from construction. We expect private services to look similar to August’s 63k increase, with a rise of 65k. Health care is likely to provide most of this. We expect government to fall by 5k, with August’s 16k drop having corrected two straight gains.

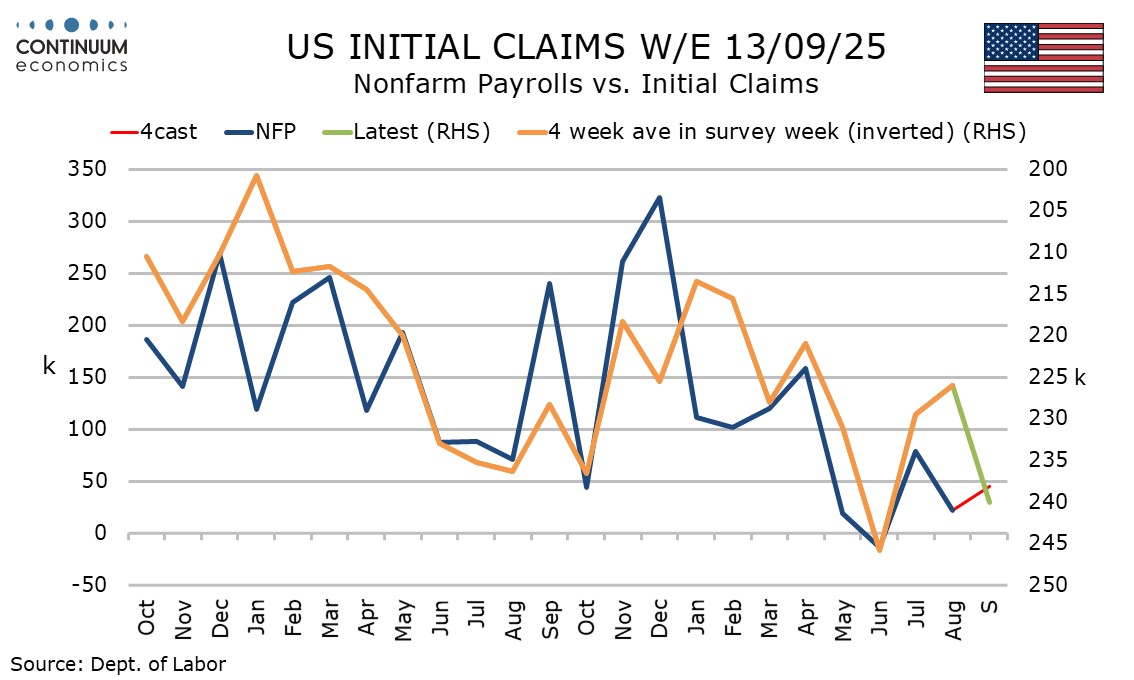

The four week initial claims average is higher in September’s payroll survey week than in August’s but inflated by a particularly high figure that came in the week including Labor Day, that may have seen seasonal adjustment issues. The four week average remains below that seen in June’s survey week, a month in which payrolls were marginally negative.

Lower continued claims suggest that September’s payroll will be a little less weak than August’s, while seasonal adjustments are more supportive in September than in August.

An August rise in unemployment to 4.3% from 4.2% was due to a sharp rise in the labor force that is unlikely to be representative of trend, and we look for a correction in the labor force to see unemployment returning to 4.2%. August’s rate was however 4.32% before rounding, making a fall to 4.1% unlikely.

We expect average hourly earnings to rise by 0.3% exactly, which would be in line with trend after a 0.27% August increase followed Jul’s 0.33%. Yr/yr growth would then remain at 3.7%.

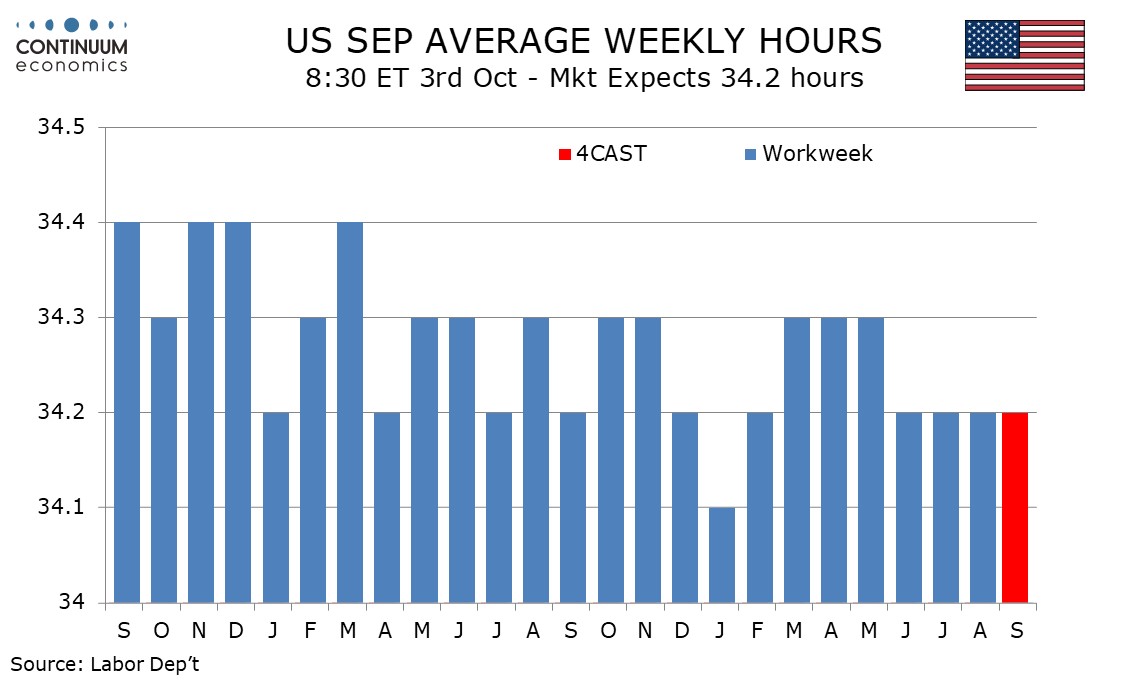

We expect the workweek to remain at 34.2 hours for the fourth straight month. This would be down from 34.3 in March, April and May, supporting the message of the employment data of a loss in momentum, though not signaling a recession.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.