Preview: Due October 16 (dependent on shutdown ending) - U.S. September Retail Sales - Still growing, if more on prices than volumes

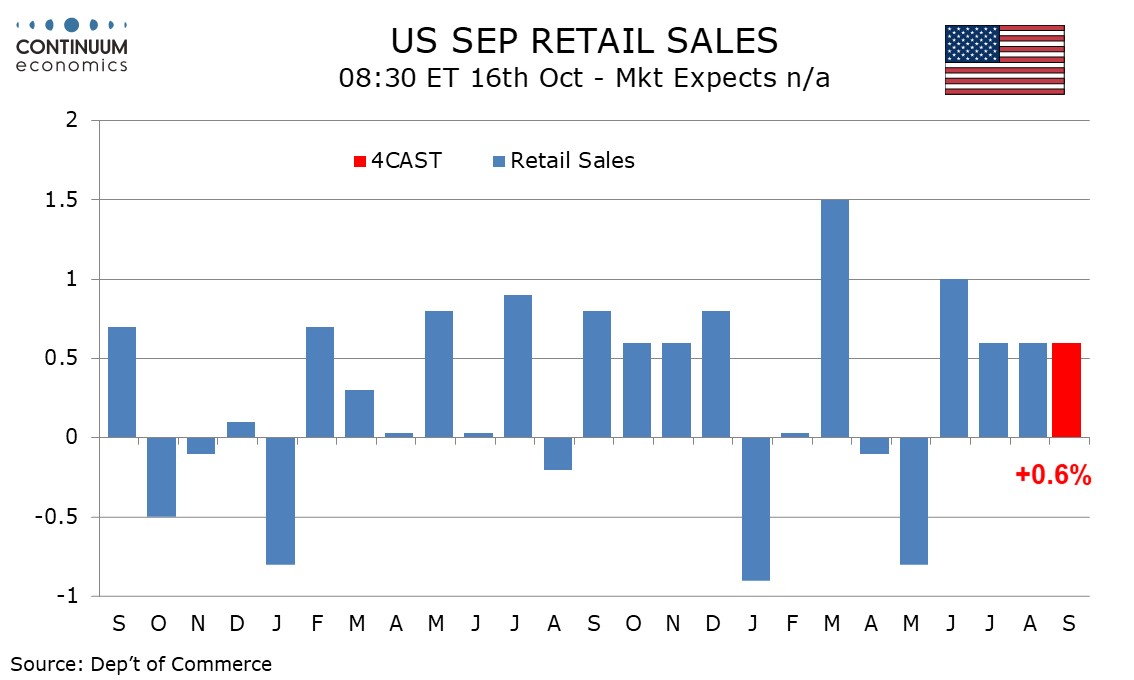

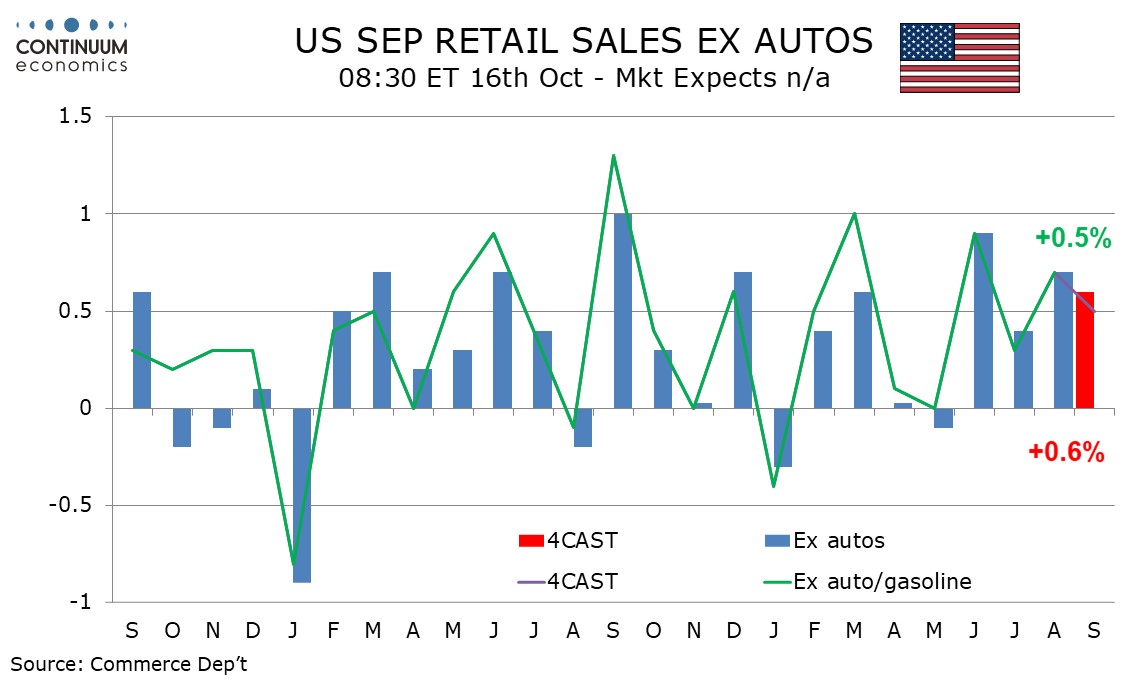

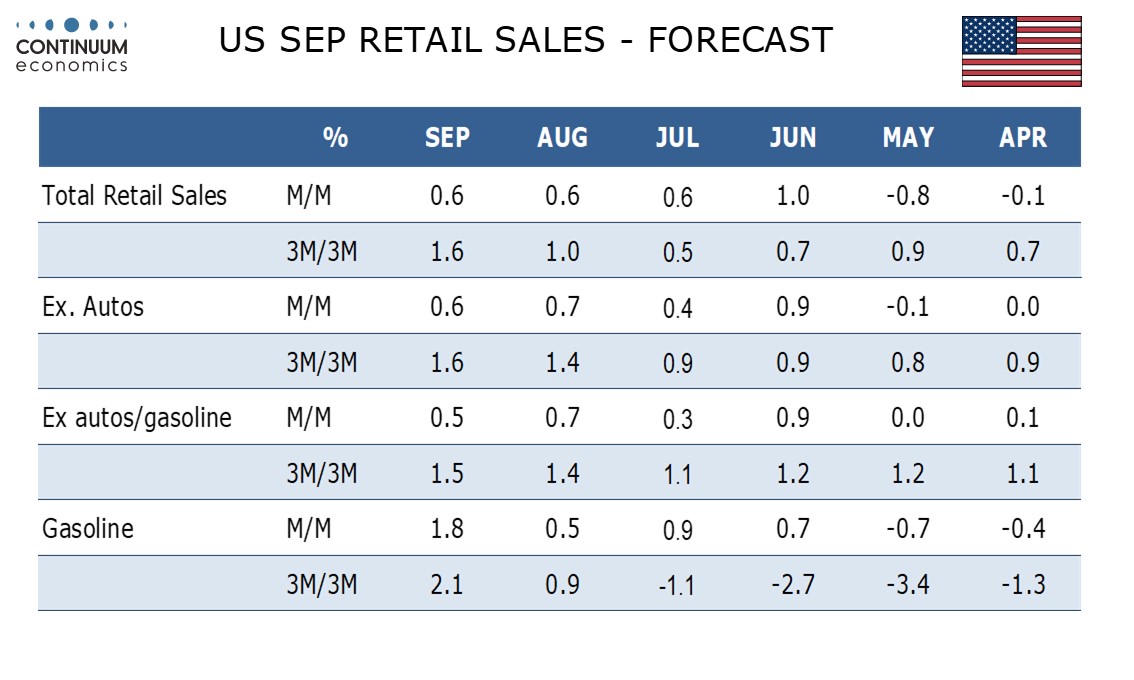

We expect a third straight 0.6% increase in retail sales in September, with slightly over half of the increase coming in prices, leaving only moderate growth in real terms. We also expect 0.6% increase ex autos but a slightly weaker 0.5% increase ex autos and gasoline.

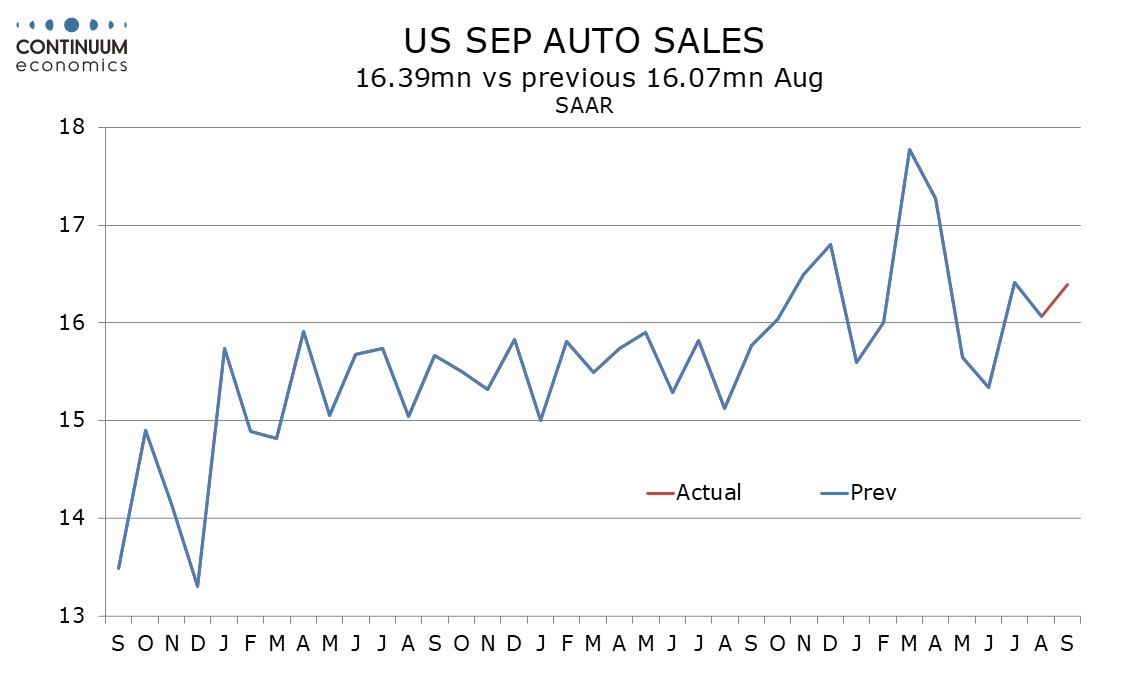

Industry data shows auto sales saw a modest bounce in September to reverse a modest decline in August. Retail auto data in contrast managed a modest increase in August so we do not expect a strong rise in September retail auto sales.

Gasoline prices are likely to provide a stronger lift to September retail sales values, while prices elsewhere are likely to see tariffs continuing to feed through.

A 0.5% rise ex autos and gasoline would be similar to the average of August’s 0.7% and July’s 0.3%, as well as similar to the average of June’s 0.9% and May’s unchanged outcome. Consumer confidence looks shaky, however, and real disposable income has lost momentum since May, so there are downside risks heading into Q4.

Quarterly gains under our forecasts and in the absence of revisions would be 1.6% overall and ex autos, and 1.5% ex autos, showing respectable growth given that these numbers are not annualized, even if slightly over half of the increase is likely to be due to price increases.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.