Sweden Riksbank Review: Riksbank Delivers Final Rate Cut?

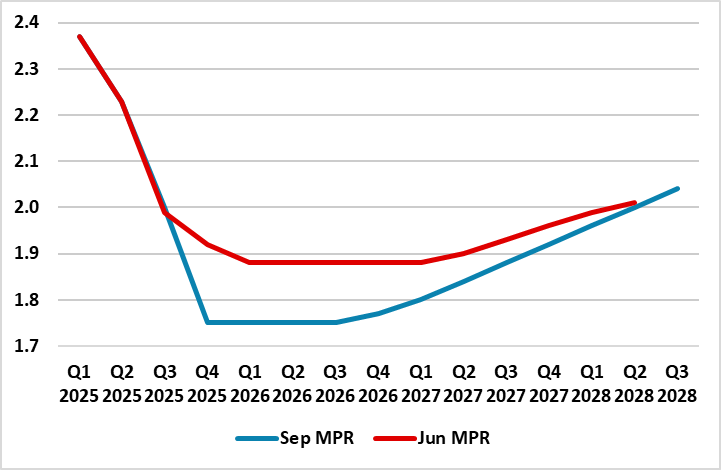

Although aware of the possible impact of recent both real activity and adjusted CPI data having delivered upside news and surprises as well as what now looks to be a clear fiscal loosening, the Riksbank delivered the 25 bp final rate cut we expected. The Board was very clear that no further easing is expected but that rates will stay at this new lower level (1.75%) for some time to come – the projections show a lower rate profile but a slightly earlier policy reversal (Figure 1). There was one dissent, preferring a deferral of any cut partly on fiscal easing considerations. The rationale is clear; the Board accept that growth and now the labor market have been weak for a long time and any recovery may arrive later, so there is a need to support to the recovery and to stabilise inflation We go along with the Riksbank thinking although it may have to revise any suggestion that the hefty tax cuts dished out into 2027 as the recent Budget envisages will have no inflationary consequences. Regardless, we do not see any looming policy reversal, as we see this projected rate cut to 1.75% staying in place into 2027.

Figure 1: Updated Riksbank Policy Outlook

Source; Riksbank, (%)

As for fiscal policy, it will now be expansionary into 2026 which is an election year. The measures include 1.9% of GDP) n unfunded reforms for next year, which include: military support, defence rearmament and an regular measures.

After the Riksbank cut its policy rate by a further 25 bp to a new cycle low of 2.0% in June, the Board then suggested that a further move is possible and did so again after last month’s decision. Implicitly, it seems that the flagged rate cut would have occurred last time around were it not for the CPI spike seen in the July data tyat partly persisted into August. Admittedly, and as the Board acknowledges more clearly this time around, that spike is almost certainly a reflection of temporary factors, most notably energy price swings, alongside what may be a more sustained but far from demand-driven recent tripling in food inflation. To us, the underlying picture is reassuring as seen in the ex-energy CPIF measures is still consistent with target and this is despite the impact on this measure of food inflation now running at over 5% (something more supply driven and also likely to weigh on spending power). Indeed, the Board view still suggests that ‘several indicators support the view that inflation will fall back to target going forward’. Notably the updated Riksbank CPIF forecast show inflation well above target through 2028 but his is a result of tax swing induced base effects that anything underlying.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.