September Fed ease now more likely than not, but far from assured

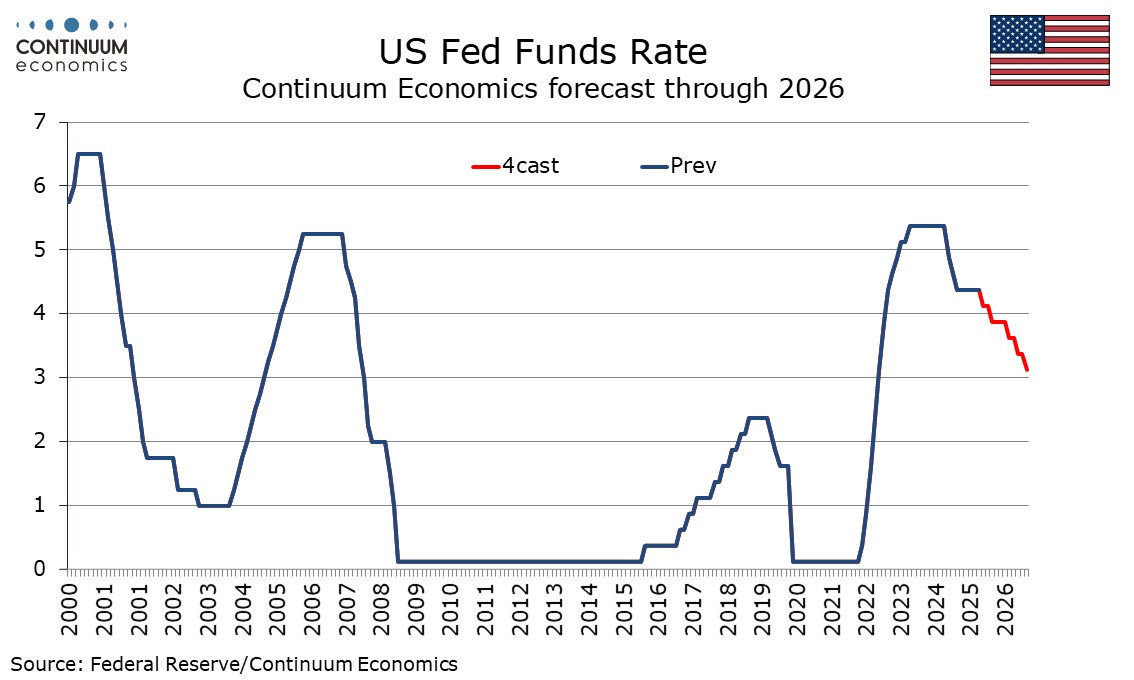

A September FOMC easing now looks more likely than not, but remains far from a done deal. We are however revising our call to two 25bps FOMC easings this year, in September and December, from just one, in December. 2026 is harder still to call given threats to Fed independence, but we continue to expect three 25bps eases, in Q2, Q3 and Q4. This would see the Fed Funds target range ending 2026 at 3.0-3.25%, rather than 3.25-3.5% as was our previous view.

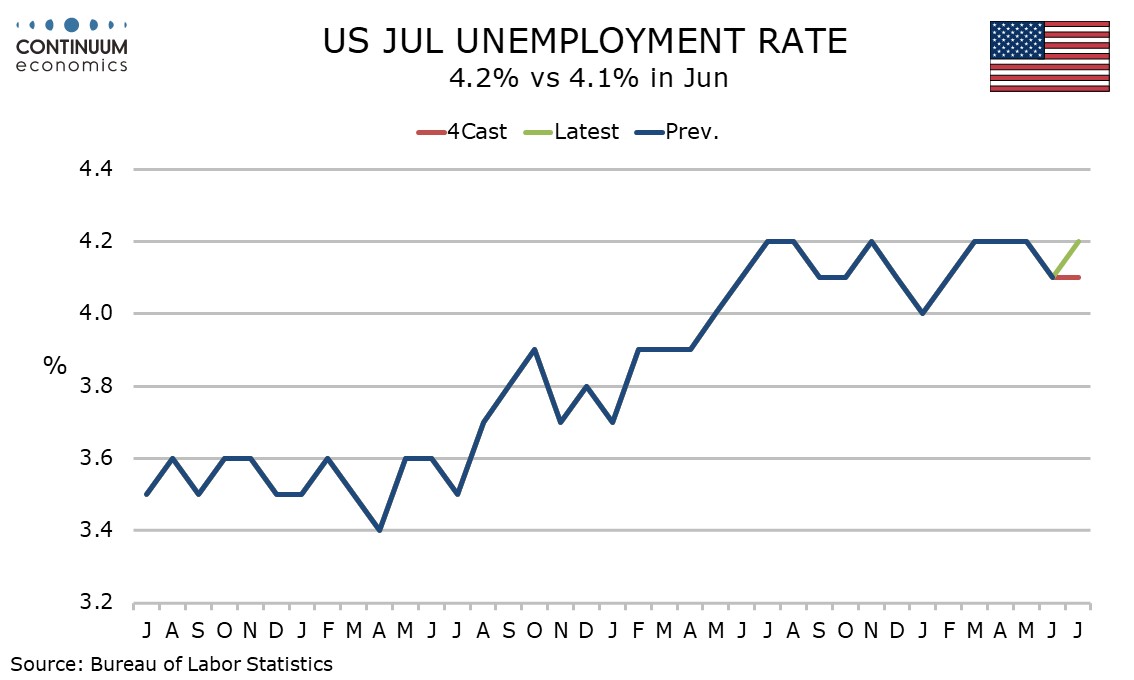

At the July 30 meeting Chairman Powell sounded cautious over tariff-related inflationary risks leading markets to doubt whether the Fed would ease in September, despite dissenting votes for easing from Governors Waller and Bowman. A sharp downside surprise in July’s employment report, largely due to revisions to May and June, raised the risk for easing, which a consensus July CPI left markets feeling more comfortable of.

Fed speakers since the employment report have generally agreed that downside risks to the employment mandate have increased, but have also continued to express concern that inflation remains above target with the eventual impact of tariffs still uncertain. Some hawks have remained hawkish, with Kansas City Fed’s Schmid saying that restrictive policy remains appropriate for now, and St Louis Fed’s Musalem stating that the Fed is missing on the inflation mandate, but not employment. Both are voters this year. However, others have sounded increasingly open to a September easing, with Governor (and thus voter) Cook describing the jobs data as concerning and San Francisco Fed’s Daly and Minneapolis Fed’s Kashkari both suggesting easing may soon be appropriate, though the latter two do not have votes this year.

The case for easing is far from overwhelming. While the 3-month average non-farm payroll increase is weak at 35k the unemployment rate of 4.2% is unchanged from not only from March but also July 2024. In 2024 the July unemployment rate had risen from 3.7% in January 2024, prompting the Fed to start easing in September, with a 50bps move. Only if August’s non-farm payroll shows a significant rise in unemployment, and a significant decline in non-farm payrolls, is a 50bps move likely to be considered this time.

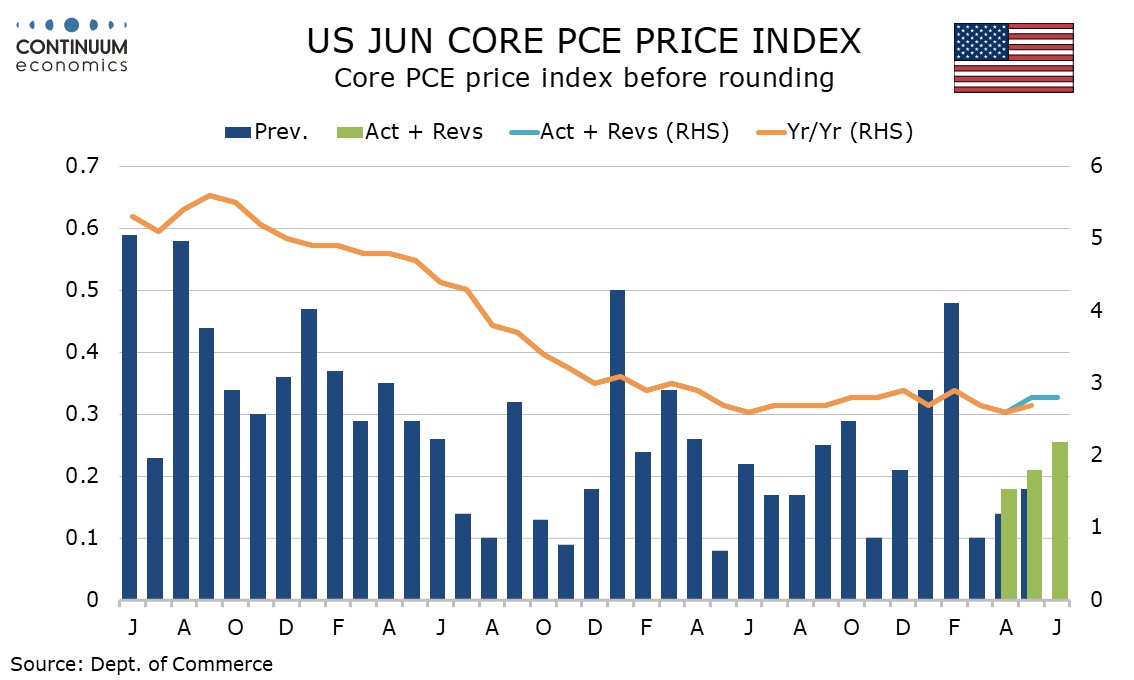

Core PCE prices at 2.8% yr/yr in June remain above target and this rate has changed little in the last year. It is actually above a 2.6% pace seen in June 2024. July’s core CPI was slightly above 0.3% before rounding with the acceleration from June coming in services rather than tariffed goods. That is problematic for the doves who have argued that a one-time lift from tariffs can be overlooked as long as inflation excluding the impact of tariffs is heading towards target. The bulk of the impact of tariffs is probably still to come, and with the picture becoming clearer in August, there is risk of August CPI seeing an acceleration. A strong August CPI and a resilient August employment report could still persuade the FOMC to leave rates on hold in September.

However, it now looks that a September hold will probably require upside surprises in both employment and CPI. A downside surprise in either or consensus results from both would probably be enough to see easing delivered. A downside surprise in both could even put 50bps on the table. This suggests 25bps is the most likely option, though far from assured, and we see a hold as more likely than a 50bps cut.

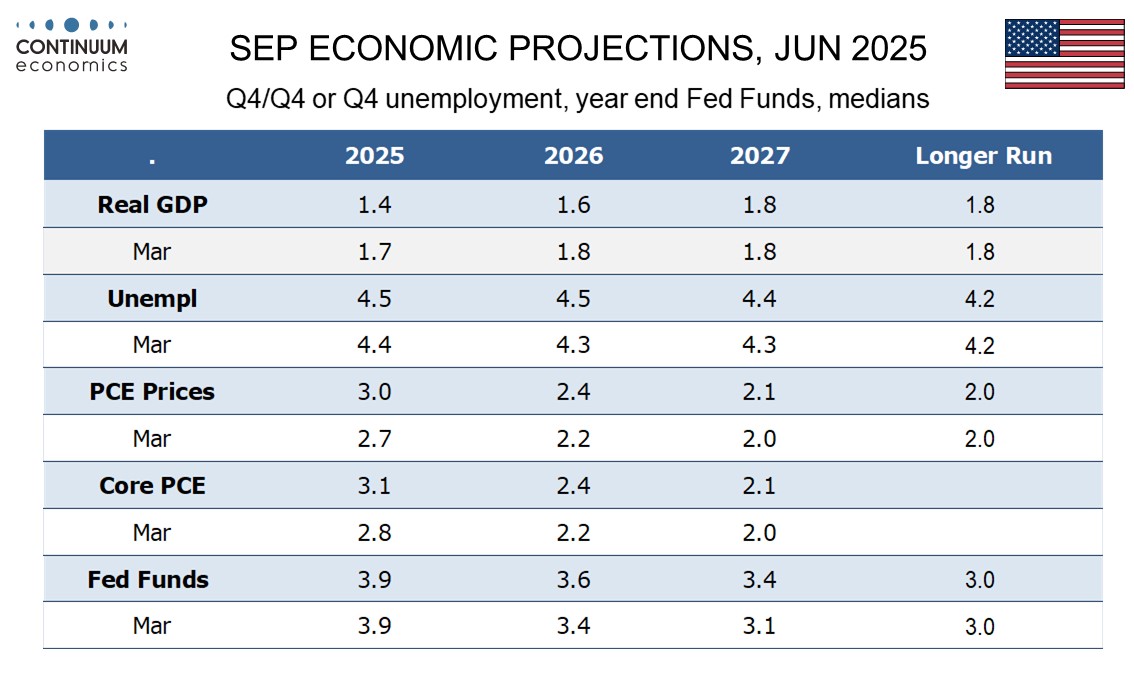

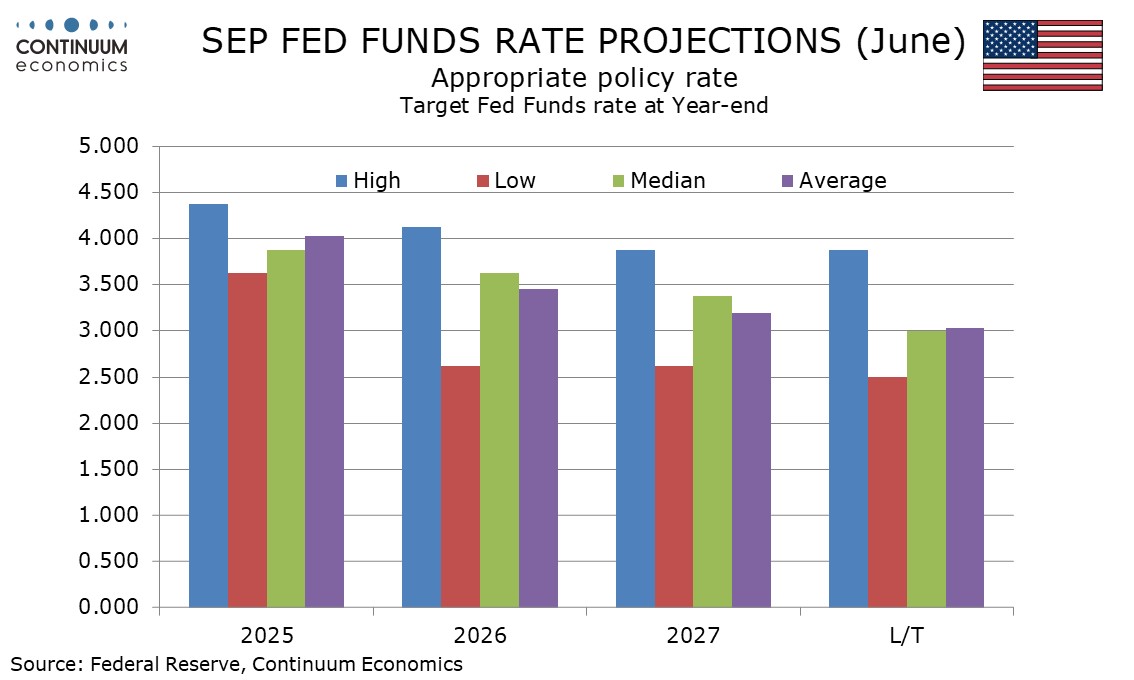

Whatever the September decision, we would expect some dissenting votes. June’s dots showed two participants (almost certainly Waller and Bowman) wanting three 25bps easings in 2025, eight on the median for two easings, two wanting only one and 7 wanting no moves at all. The employment data has probably moved the bias in the dots down somewhat, suggesting what was a marginal bias for two moves may now be a solid one, and that suggests two easings in 2025 is the most likely outcome. The majority are likely to follow Powell, who will try his best to deliver a degree of consensus. A cautious easing is likely to be chosen, with moves on successive meetings still unlikely given high uncertainty and risks on both sides of the mandate. We thus look for 25bps moves in September and December, when the dots will be updated, but no move in October.

For 2026 June’s median dot showed only one further 25bps easing, to 3.625%, though nine were below the median and only six above. Forecasting the 2026 FOMC moves is particularly difficult given the likelihood of Powell being replaced by a more dovish chairman in May, and the doves likely to get an extra vote before then given the resignation of Governor Kugler. Still, it is unlikely that Trump will be able to achieve an FOMC where the majority will do as he wishes. Given that we expect some boost to inflation from tariffs and only modest gains in unemployment given a shrinking labor force, a rapid move to neutral policy, seen as 3.0% by June’s SEP, would be hard to justify. We still look for policy to be kept on hold in Q1 of 2026, in the final full quarter under Powell, before 25bps moves in Q2, Q3 and Q4 of 2026. This would take the Fed Funds rate to 3.0-3.25%, which we suspect will be a little lower than what the FOMC actually should do.