Fed Powell: Signals September Cut

Fed Chair Powell spent the first 10 minutes at Jackson hole reviewing current data and discussing the policy stance. Powell clearly signaled a September cut, given downside risks to employment after the July employment report revisions. However, Powell did not signal whether the move will be 25bps or 50bps, though 25bps is more likely if the August NFP number is around the +80k consensus. Powell did note that policy can proceed carefully, which is more consistent with 25bps than 50bps. A further 25bps move in December now is highly likely, as the Fed are likely to undertake multiple cuts in late 2025/H1 2026.

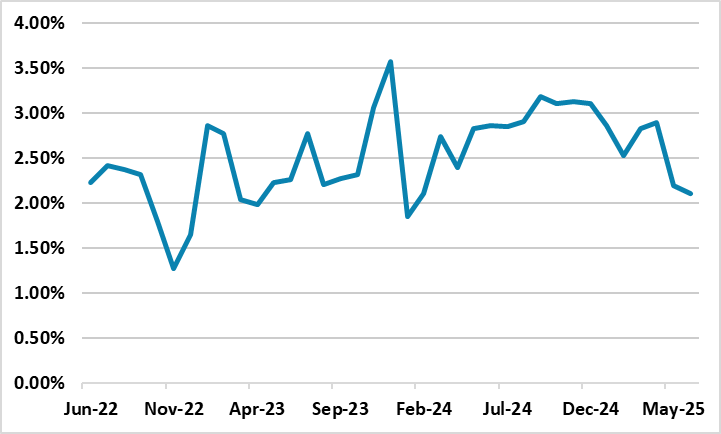

Figure 1: Real Personal Consumer Expenditure (% Yr/Yr)  Source: Fred St Louis

Source: Fred St Louis

Fed Powell message at Jackson Hole is clear that downside risks to employment are rising and that the Fed are sensitive to this. Powell wording clearly signaled that the Fed are likely to ease at the September 17 meeting, but he did not provide clarity on whether this is 25bps and 50bps or how much further easing will be seen in 2025 and 2026. Internal debate exists within the Fed, as interpretation exists over the scale of the U.S. slowdown and potential inflation pick up from President Donald Trump’s trade tariffs. Two alternative mechanisms exist for the feedthrough of the tariffs.

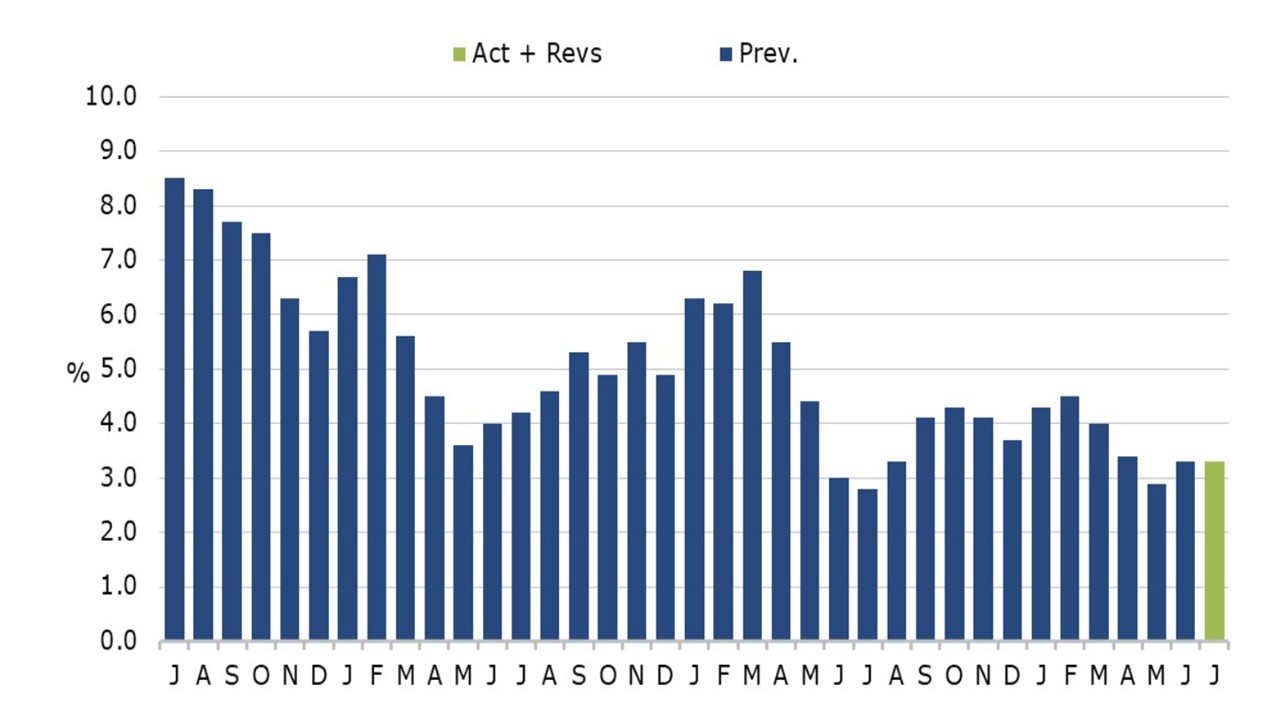

• Tariff price hikes, consumer then jobs market slowdown. The CPI numbers show some signs of Trump tariffs feeding through but the effect has so far been more modest than expected with effective tariffs of 15-17% on the U.S. economy. This could be lagged effect as companies use previous inventories first or alternatively delay price hikes to understand consumer behavior or get greater certainty about the new tariff regime. CPI has also been on the high side for Fed desires, with service inflation (Figure 2) being a little sticky despite wage growth slowing (here). Fed Powell Jackson Hole speech also noted the upside risk to inflation are causes a challenge for the Fed, though he ruled out a CPI rise moving into wages given the labor market. Meanwhile, consumption shows mixed signs with some resilience and other numbers seeing volatility, while monthly real PCE continues to remain reasonable (Figure 1) and has not been derailed by the tariff’s drama and then implementation. This mechanism could still kick in more if CPI gets impacted more from August when greater certainty has been seen on tariffs (here).

Figure 2: U.S. CPI 3mth/3mth Annualized Change (%)

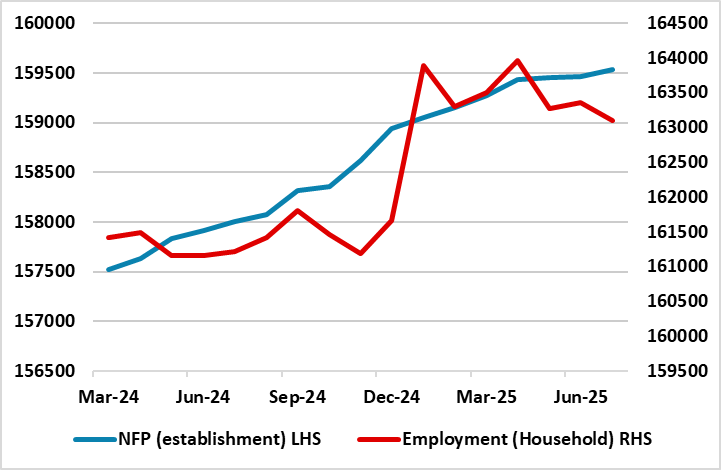

• Companies squeeze profit margins; curtailing hiring then hits income then consumption growth. The 2nd mechanism that tariffs could impact the U.S. economy is by companies squeezing hiring and investment, which then impact income growth and finally hurts consumption momentum. The slowdown in employment growth in the establishment data is a cause for concern in this context, but the unemployment rate has not risen in contrast to the pick-up in the unemployment rate last year. Powell noted this contrast during the Jackson Hole conference. The volatility of the employment data from the household data (Figure 3) used to calculate the unemployment rate is an added uncertainty for Fed policymakers and they will want to see the August employment report on Sep 5 and the Sep 9 benchmark revisions of previous data. Moreover, the slower employment growth could be a reflection of less immigration, which is a structural more than cyclical issue. Meanwhile, corporate earnings reports and guidance has not seen a major adverse impact yet. Overall, this mechanism of companies curtailing hiring and then hitting income and consumption could be underway, but the scale is not large yet.

Figure 3: Employment from Establishment and Household Data Surveys (000)  Source: Fred St Louis

Source: Fred St Louis

Overall, Powell noted that employment risks are tilted to the downside and inflation to the upside, but the employment situation may warrant adjusting our policy stance. This is a clear signal that the majority of the Fed are planning on a cut at the September 17 meeting. Whether this is 25bps or 50bps depends on data in the coming weeks, with employment report and CPI likely to be key. A consensus type August NFP number around 80k would probably mean 25bps and this is our baseline. Powell did note that policy can proceed carefully, which is more consistent with 25bps than 50bps. However, a negative NFP number would likely see active consideration of 50bps. After the September meeting, the market is not discounting the next easing until the December meeting and that is our forecast as well. However, the shift signaled by Powell at Jackson Hole meaning that an October cut could not be ruled out, depending on the incoming data. Additionally, Waller and Bowman could push for 50bps at the September meeting, which would increase speculation that a cut at the October meeting is possible.