Expecting a Negative Non-Farm Payroll Benchmark Revision

Tuesday sees the release of the preliminary Labor Dep’t estimate for the March 2025 non-farm payroll benchmark, with expectations for a significant negative, possibly as large as the -818k preliminary estimate for the March 2024 benchmark delivered a year ago. The eventual revision to March 2024 payrolls delivered with the January 2025 non-farm payroll was not as large, but still significant at -589k.

The direction of the benchmark revision tends to reflect the state of the economy at the time. The March 2009 benchmark, during the Great Recession, was revised down by 902k. The 2024 revision was surprisingly large given that the economy was growing steadily at the time. March 2023 saw a more moderate revision of -266k while March 2022 saw a strong upward revision of 568k as the economy rebounded from the pandemic.

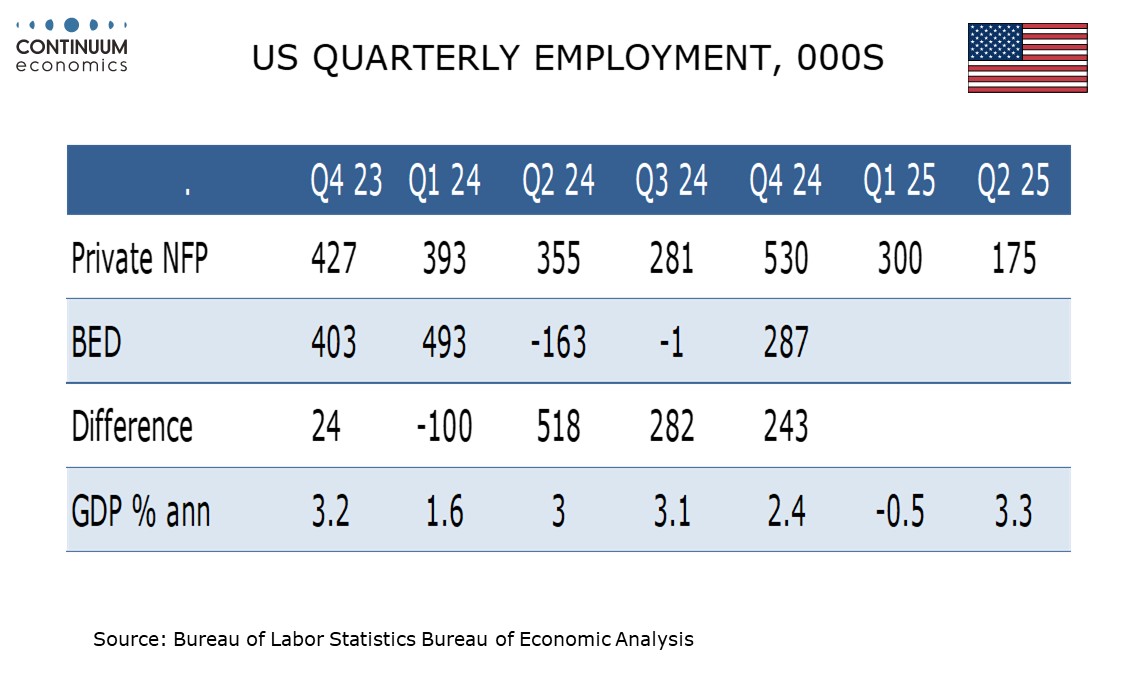

One warning sign that the March 2025 revision will be large is the Quarterly Business Employment Dynamics survey which measures private sector job gains and losses both from existing establishments, as well as firm births and deaths, which the non-farm payroll estimates rather than measures. This data is available only through Q4 2024 but its net employment calculations sharply underperform the non-farm payroll by over a million, with the biggest discrepancy coming in Q2 2024. The Business Embayment Dynamics survey suggests private sector payrolls actually fell in Q2 and (marginally) Q3 of 2024. We doubt the benchmark revision to payrolls will be as sharp as this given solid GDP growth in those quarters, but a significant negative revision, in line with that seen last year, looks likely.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.