U.S. July Employment - Revisions to May and June mean trend has slowed significantly

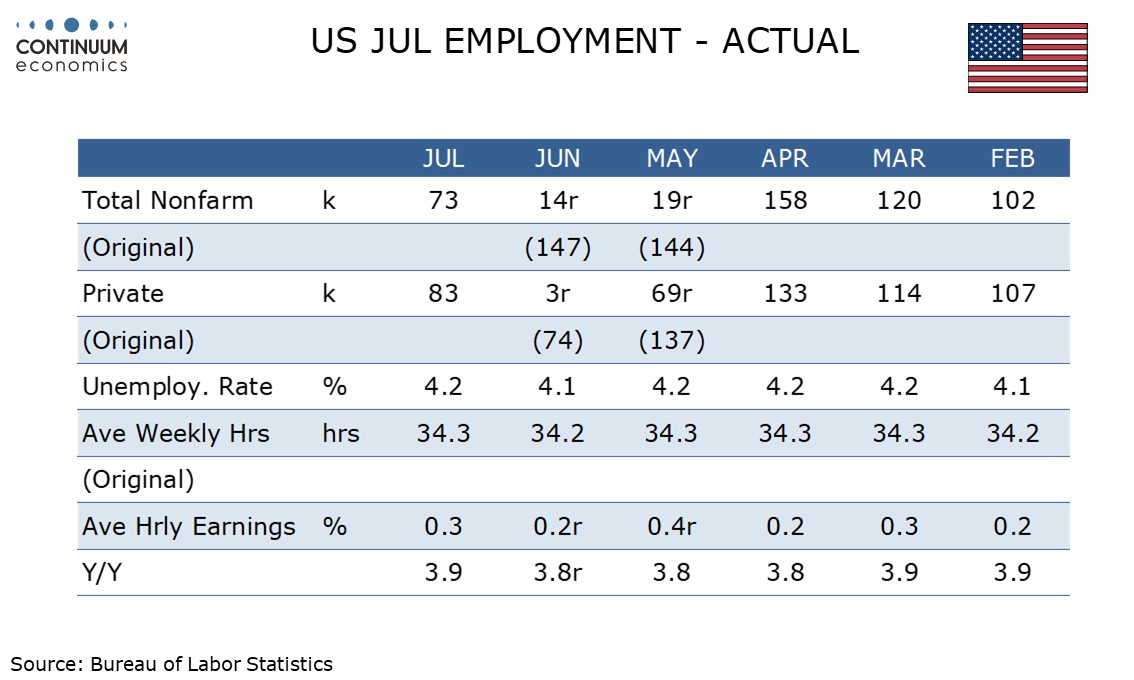

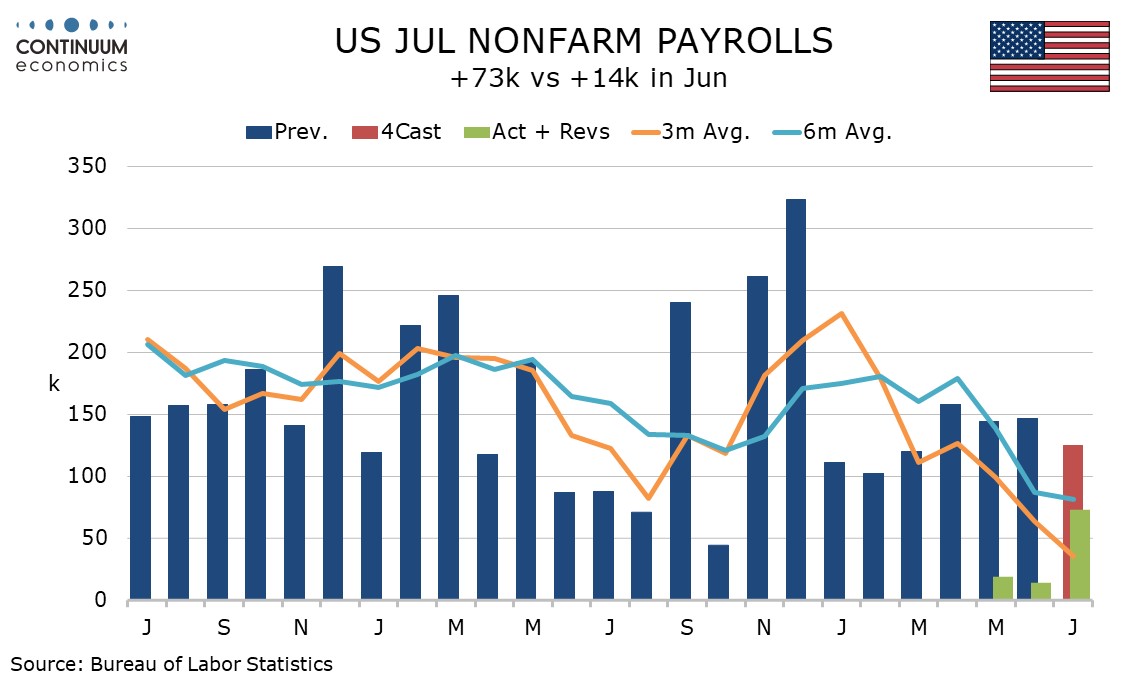

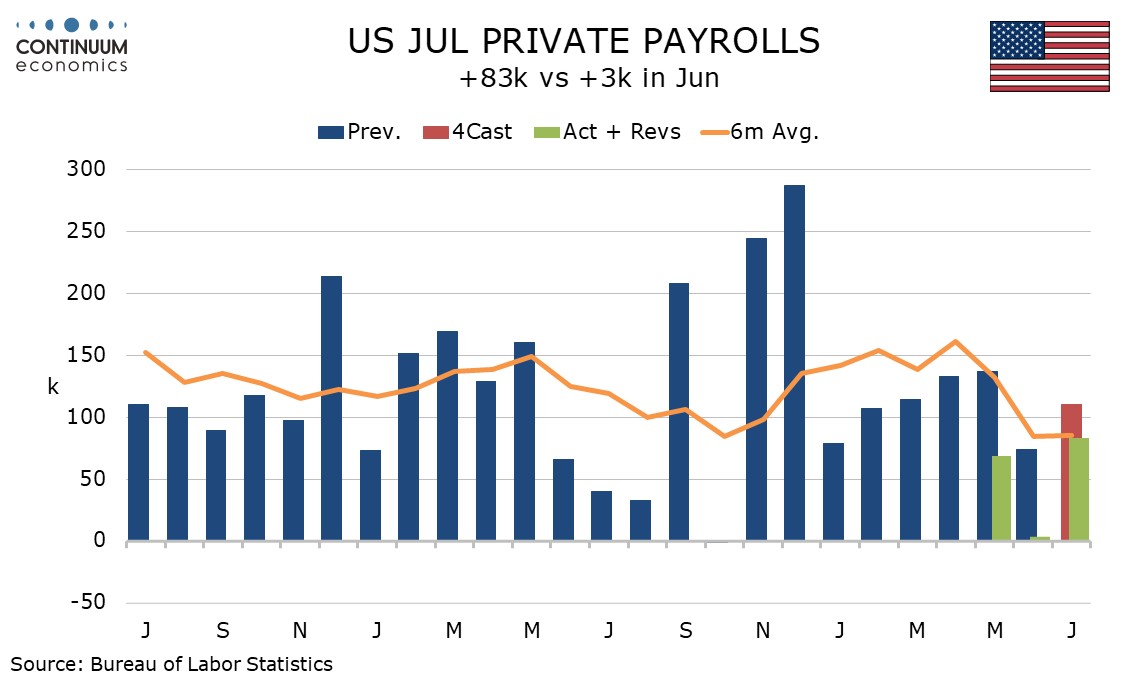

July’s non-farm payroll is weaker than expected not only with the 73k headline and 83k rise in the private sector, but also with large downward revisions totaling 258k for May and June. Unemployment remains low but edged up to 4.2% from 4.1% while average hourly earnings were on consensus at 0.3%, here with modest upward net revisions.

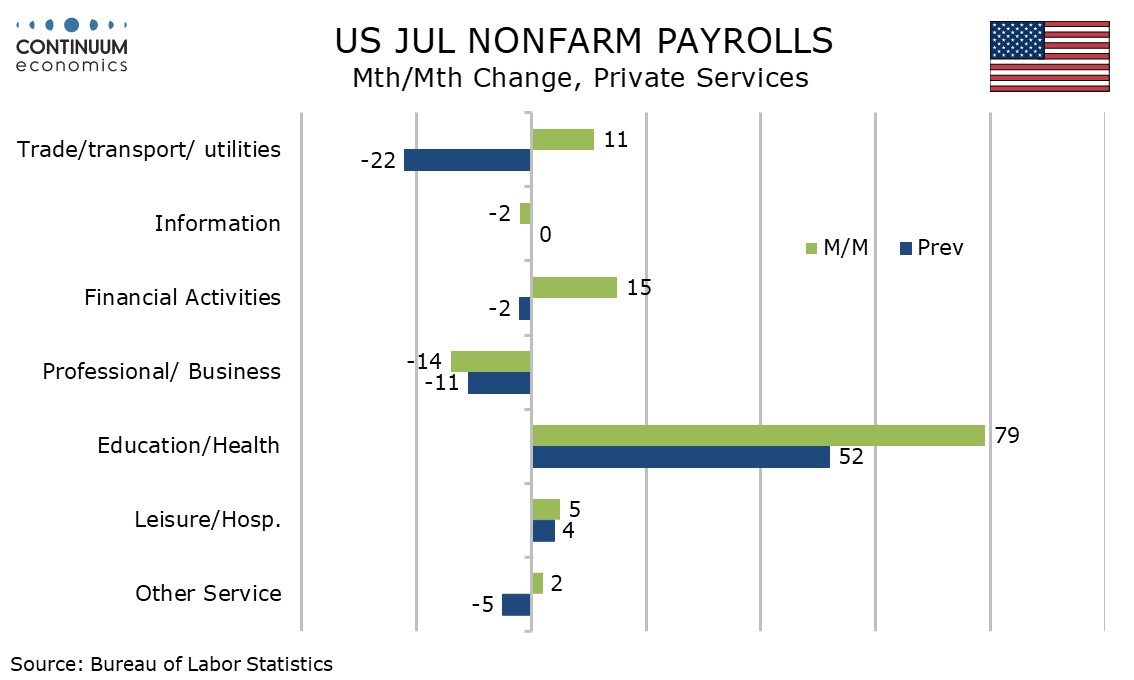

The revisions to June and May are sharply negative, June’s rise now at 14k from 147k and May at 19k from 144k, with the respective private sector data now at 3k in June from 64k and 69k in May from 137k. July’s weaker than expected data is therefore an improvement from May and June, consistent with recent declines in initial claims, but still unimpressive. Three month averages now stand at 35k overall and 52k in the private sector, suggesting minimal employment growth.

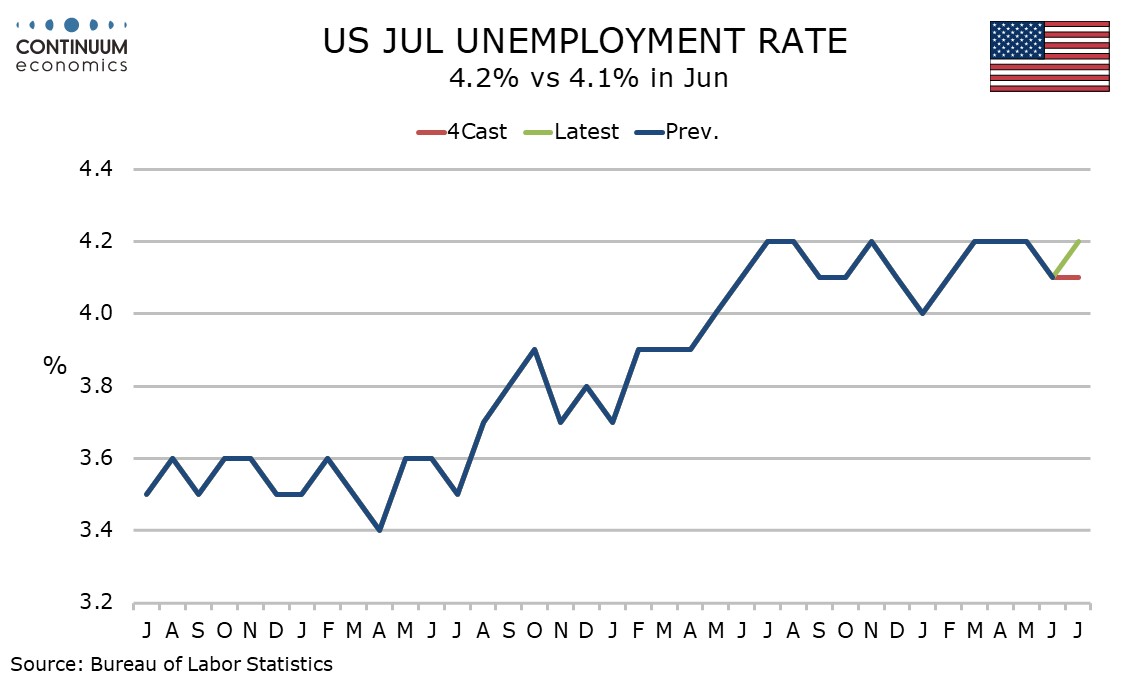

The household survey which calculates the unemployment rate showed a 260k decline in employment with a 38k fall in the labor force, lifting the rate to 4.2% from 4.1%, though this simply puts the rate back at the level seen in March, April and May, leaving the rate as essentially stable.

How this impacts Fed policy depends on whether the Fed focuses on employment, which has slowed more significantly than a moderate slowing seen in the summer of 2024, or the unemployment rate, which was rising in early 2024 reaching the current rate of 4.2% in July 2024 from a low of 3.4% in April 2023. Slower employment growth may argue for easing, but stable unemployment does not.

There is still one more employment report to see before the Fed meets in September and probably even more importantly, two CPIs. August CPI will be particularly significant as it could reflect a response to the latest tariff moves. We will not change our Fed call of no easing until December on this data, but the risk of a September move is slightly increased.

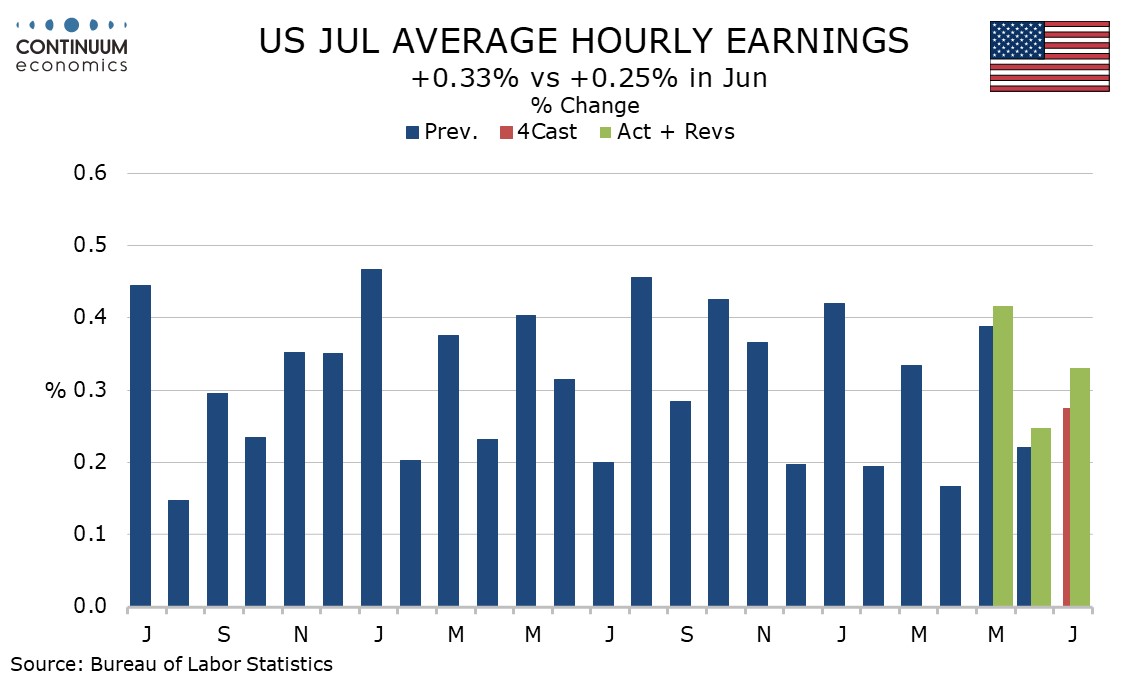

Average hourly earnings with a 0.33% rise before rounding are far from weak with yr/yr growth at 3.9% versus an upwardly revised 3.8% in June (from 3.7%). May at 0.4% and June and 0.2% were both unrevised after rounding but before rounding both saw marginal upward revisions.

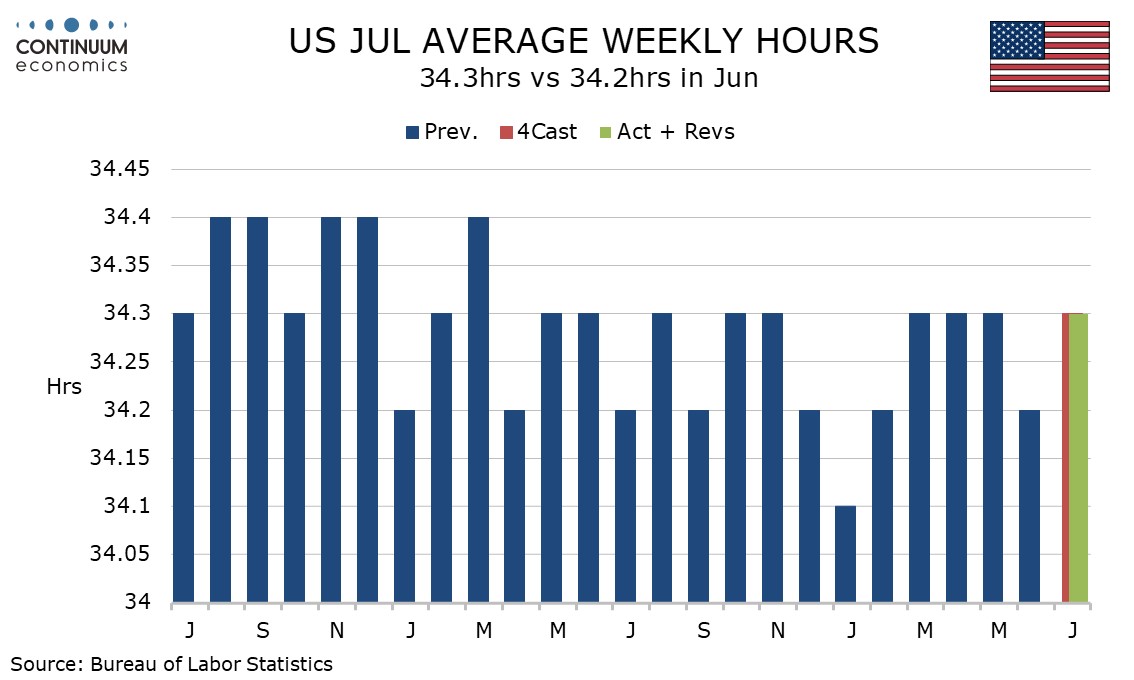

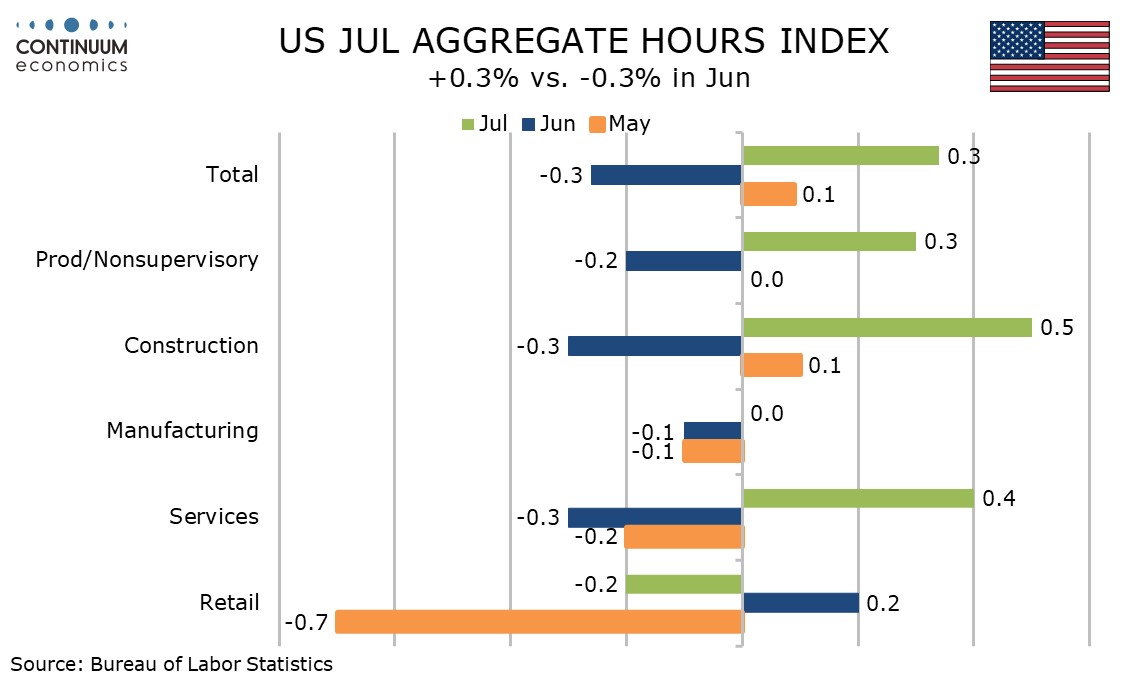

The workweek at 34.3 hours reverses a June dip. Aggregate hours worked increased by 0.3% to largely reverse a June dip, suggesting that while employment is slower, the economy continues to grow.

Aggregate hours worked increased for both goods and services but manufacturing was flat and retail fell by 0.2%.

The employment rise came fully from a 73k increase in health care and social assistance, which has consistently led recent payroll gains. Most other components were near flat with manufacturing weak with a fall of 11k. A 10k fall in government came fully at the Federal level.