U.S. August Retail Sales - Still Resilient

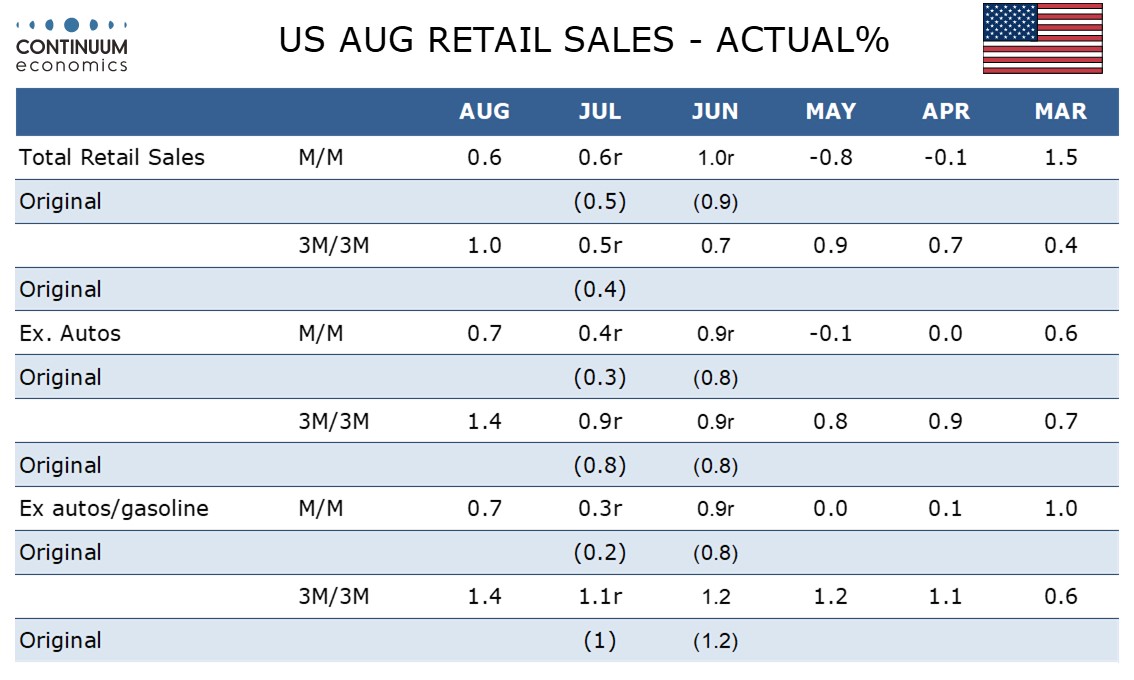

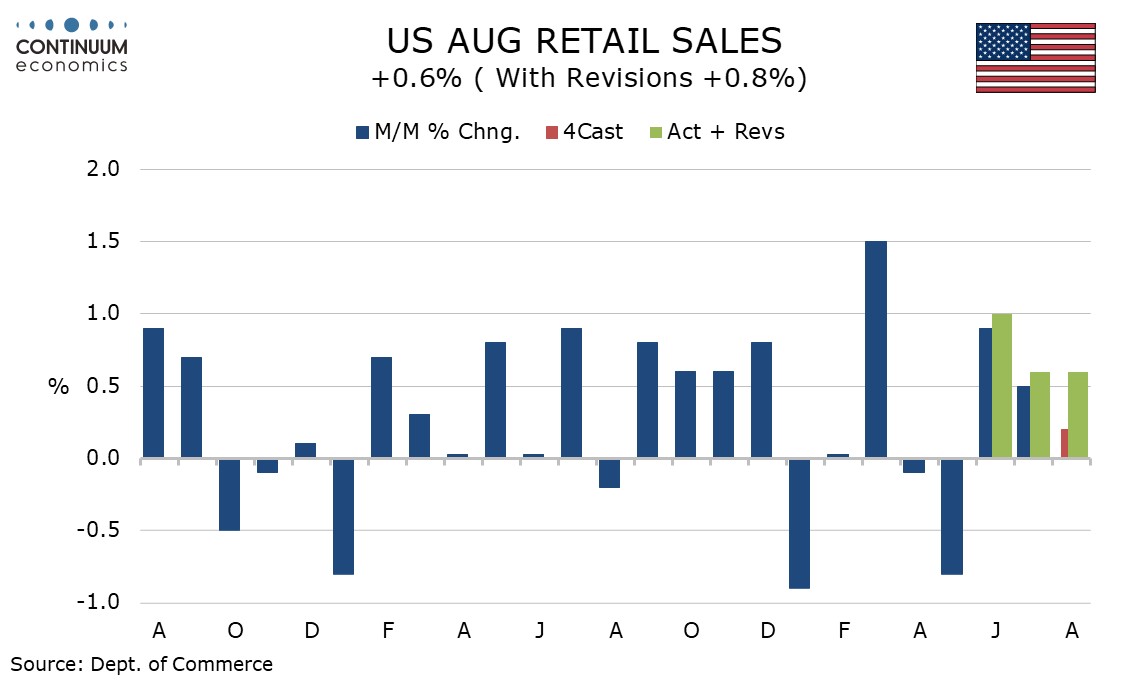

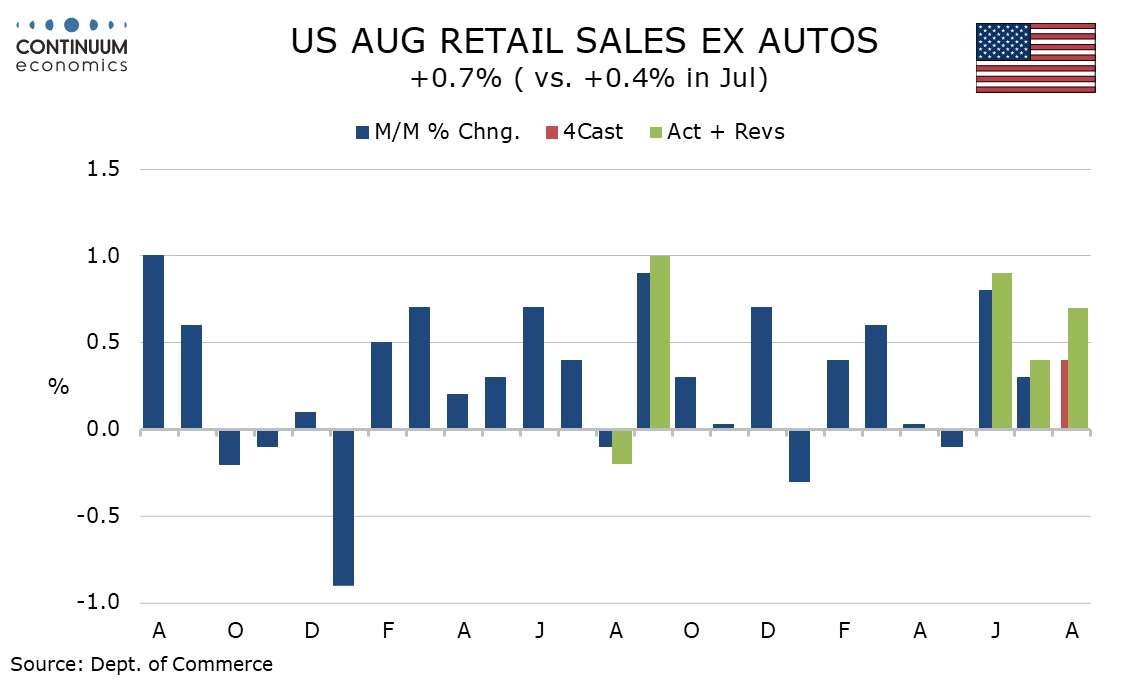

August retail sales with a 0.6% increase, with the ex-auto and ex auto and gasoline gains both at 0.7%, are stronger than expected and suggest continued consumer resilience despite a slowing in employment growth. The rise modestly exceeds a 0.5% rise in CPI commodity prices in August.

Real disposable income growth exceeded spending in Q1 and Q2 which gives consumers some support as slowing employment growth and tariff-induced price hikes eat into real disposable income in Q3. We do however expect consumer spending to start losing momentum before the end of the year.

Back month revisions are marginally positive, with July and June gains both revised up to 0.6% and 1.0% respectively. That means three straight gains after declines seen in April and May. The performance of equities may have restrained consumer sentiment in April and May before recovering.

There are few standouts in the monthly detail. Clothing was particularly strong at 1.0% but tariffs may be increasingly lifting prices there. General merchandise was relatively weak with a 0.1% decline.

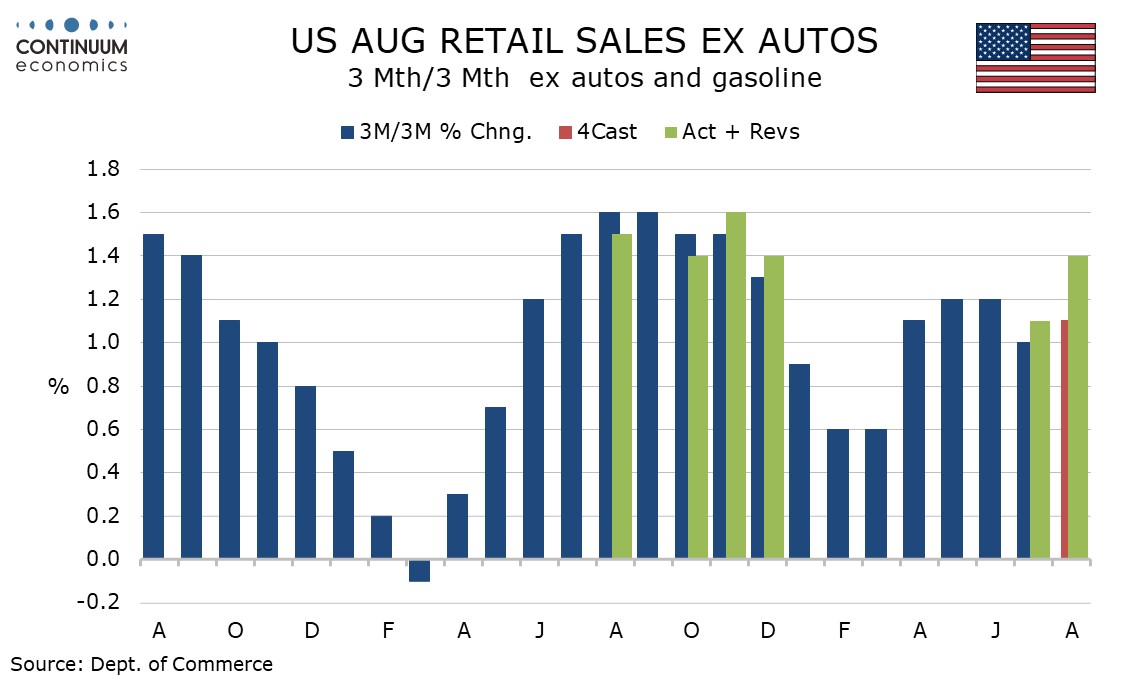

3m/3m growth of 1.0% overall is the highest since January while ex auto at 1.4% is the highest since October 2023. Ex auto and gasoline at 1.4% is the highest since December 2024. These are resilient numbers even when taking into account that goods price inflation is picking up.