U.S. August CPI, Weekly Initial Claims - Risks on both sides of Fed mandate but possible seasonal adjustment issues for Claims

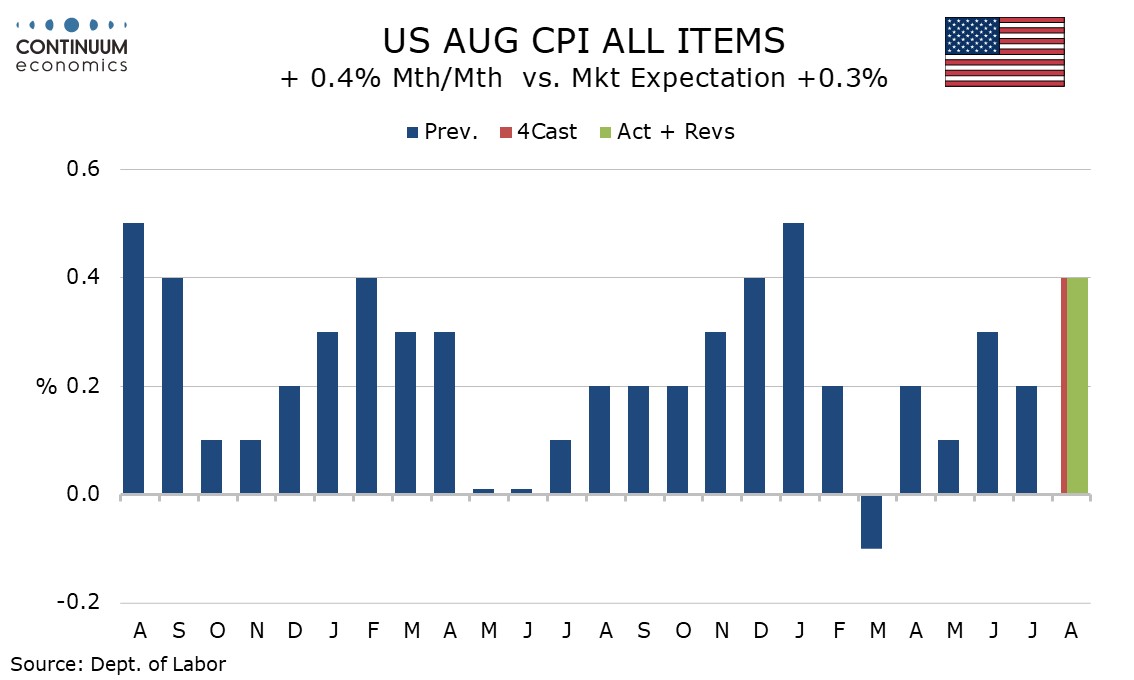

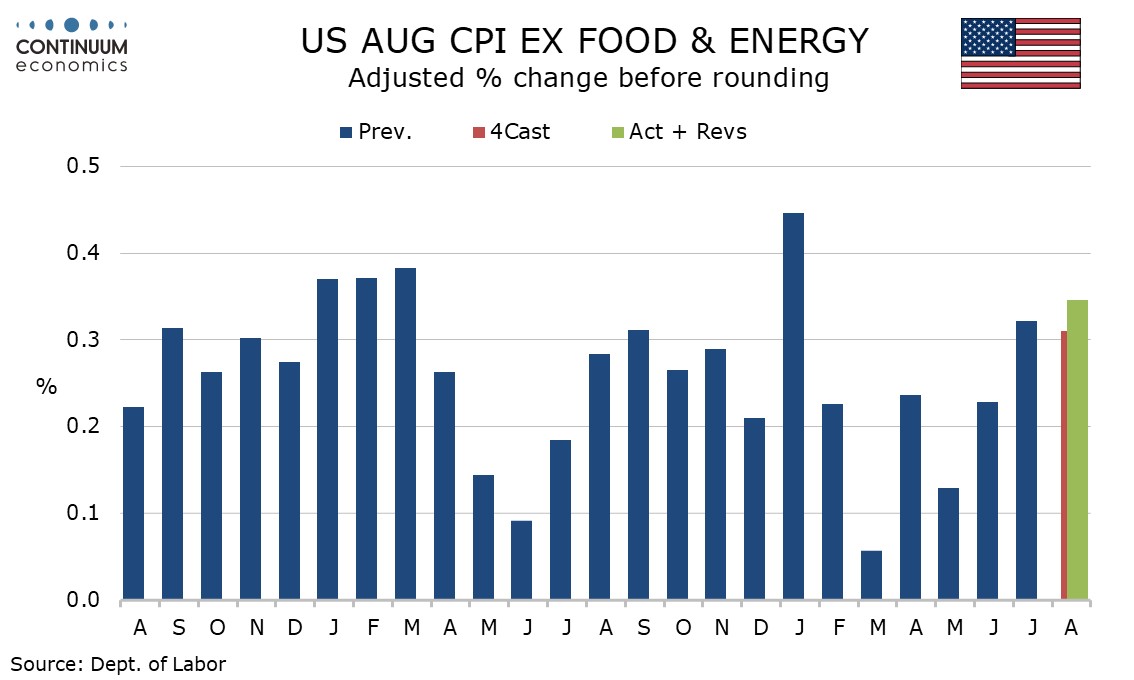

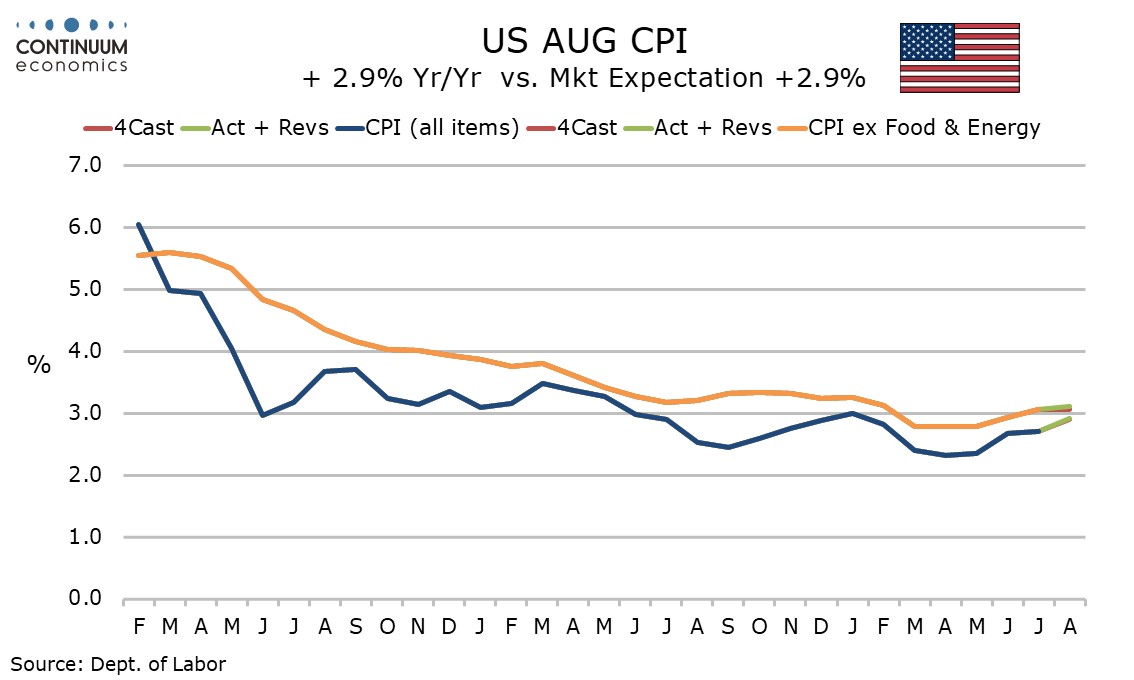

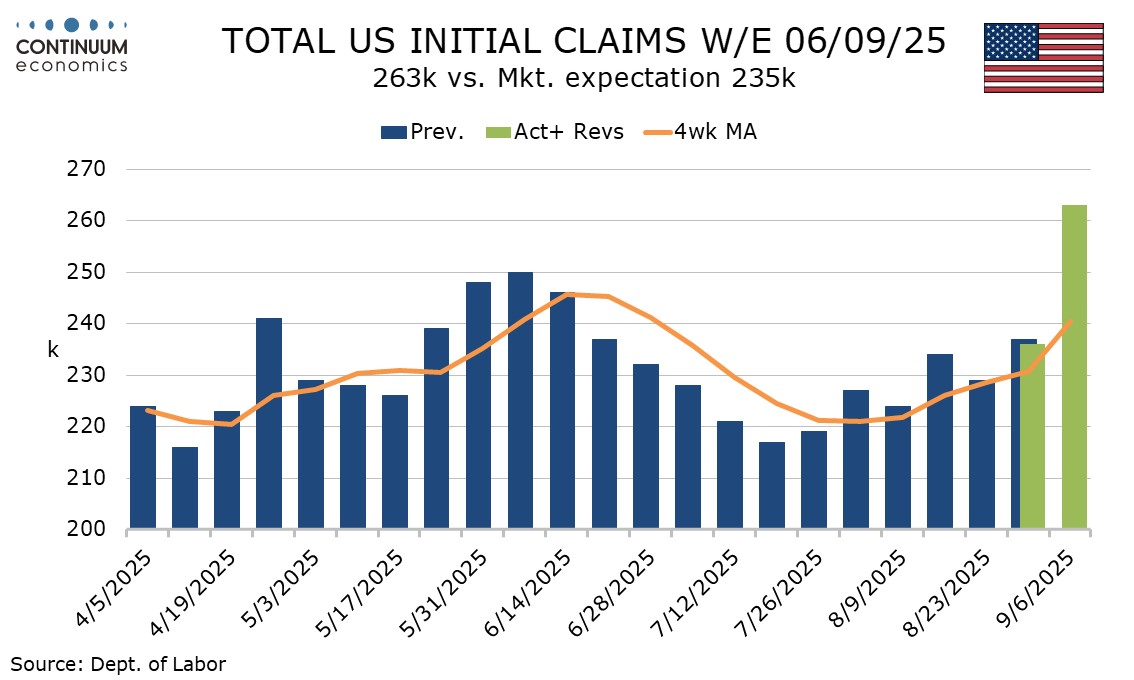

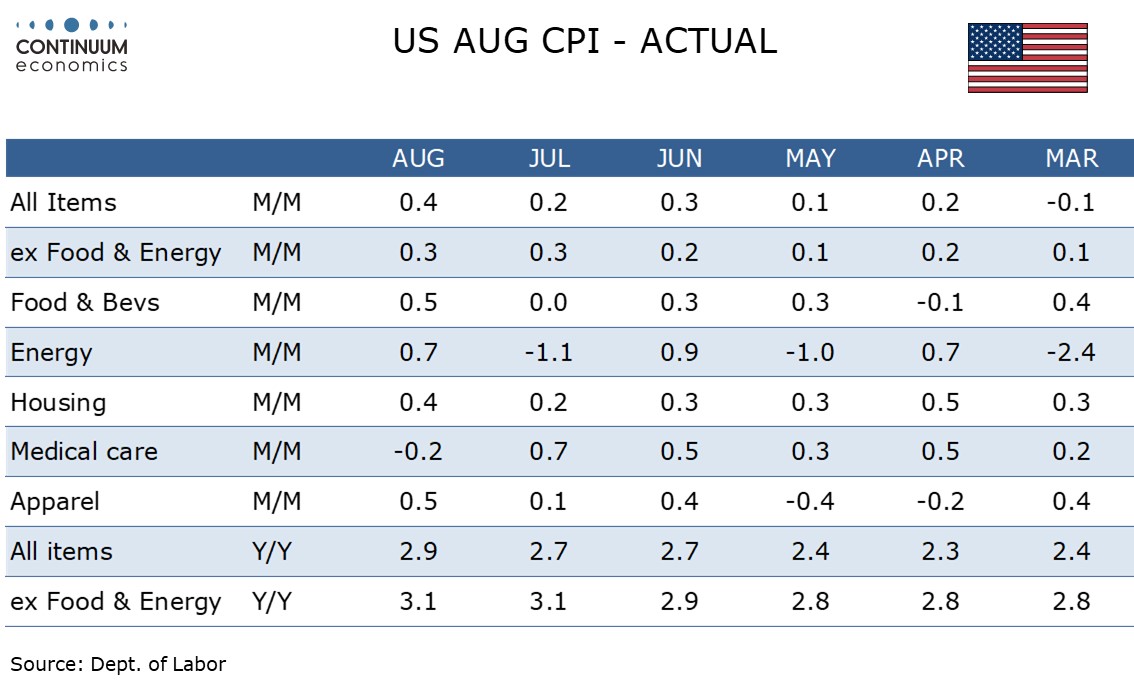

August CPI is firmer than expected overall at 0.4% and while the core rate was as expected at 0.3% its rise before rounding at 0.346% is uncomfortably high emphasizing the upside risks to the Fed’s inflation mandate. Initial claims at 263k from 236k however point to downside risks to the Fed employment mandate, though it is possible the Labor Day holiday caused seasonal adjustment issues.

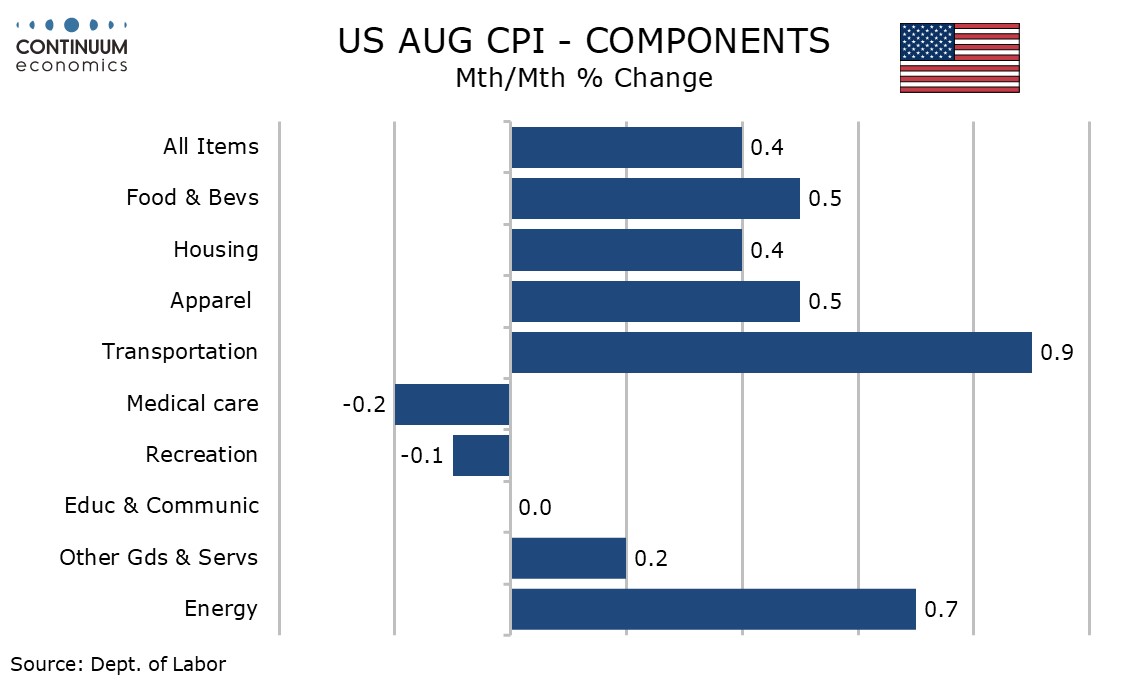

CPI detail shows commodities less food and energy and services ex energy both increased by 0.3%, with the former being an acceleration after two straight months at 0.2% and suggesting an increasing feed through from tariffs. Used autos rose by 1.0% after a 0.5% July rise, a second straight ruse after four straight declines, while new autos at 0.3% saw their first rise since March. Apparel, seen as tariff-sensitive but recently subdued, picked up by 0.5%.

The service detail showed air fares up by 5.9%, a second straight strong rise, while lodging away from home rose by 2.6% to correct two straight significant declines. Owners’ equivalent rent was on the firm side of trend with a 0.4% increase. Weighing against these strong increases was a 0.1% decline in medical care services to correct a 0.8% increase in July.

Food saw a strong rise of 0.5% which like core goods may have seen some impact from tariffs. Energy rose by 0.7% in a correction from a 1.1% July decline, with gasoline up by 1.9% after a 2.2% July decline. Seasonal adjustment helped to subdue gasoline in July but inflate it in August.

On a yr/yr basis overall CPI accelerated to 2.9% from 2.7% moving closer to the core rate which was unchanged from July at 3.1%. The core rate dropped below 3.0% in March but appears to have received a fresh boost from tariffs.

The initial claims total of 263k from 236k is the highest since October 2021 and that is quite alarming, and a negative sign for September’s payroll which will be surveyed next week. However some caution is required as this week contains the Labor Day holiday and that can cause seasonal adjustment issues. Unadjusted claims rose by 8k to 205k.

That claims rose at all in a holiday shotted week unadjusted is disappointing, and there is probably some underlying increase taking pace, but it is unlikely there has been a sharp change in the labor market picture compared with late August.

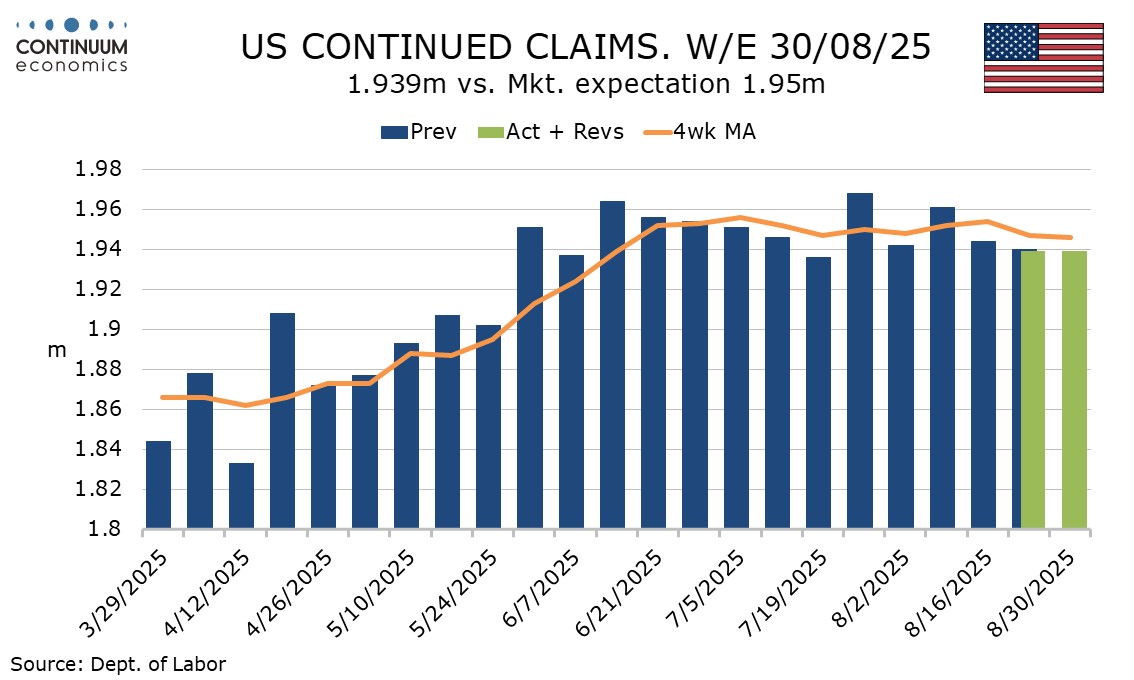

Continued claims cover the week before initial claims and were unchanged at a lower than expected 1.939m, suggesting a more stable labor market picture than initial claims imply. The initial claims data imply that continued claims will bounce next week, though it is also likely that initial claims will correct lower.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.