Russia’s Inflation is Expected to Continue to Soften in September

Bottom Line: We expect Russian inflation to continue its decreasing pattern in September, after hitting the softest rate since April of 2024 with 8.1% YoY in August, particularly thanks to lagged impacts of previous aggressive monetary tightening coupled with softening services and food prices. September inflation figures will be announced on October 10, and we foresee Yr/Yr prices to hike by around 7.3%-7.5%. Despite inflation will likely ease for the sixth straight month in September, we think inflation will continue to stay higher than Central Bank of Russia’s (CBR) 4% target in 2025 and 2026 as the war in Ukraine continues. Our 2025 average headline inflation projection stays at 9.1%.

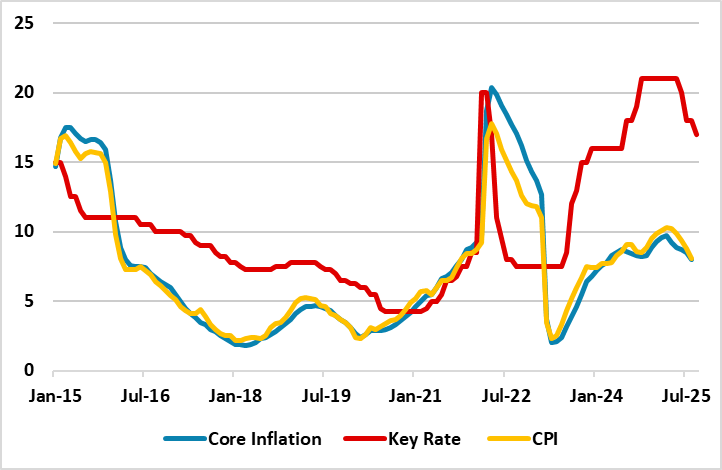

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – September 2025

Source: Datastream, Continuum Economics

After annual inflation edged down for services in August (11.1% in August vs 11.9% in July), and for food items (9.8% vs 10.8%), we expect the decreasing trend to continue in September thanks to lagged impacts of previous aggressive monetary tightening coupled with softening services and food prices. We foresee Yr/Yr prices to hike by around 7.3%-7.5% in September. (Note: September inflation figures will be announced on October 10).

It is worth noting that inflation moderately softened in Q3 as previous tight monetary policy affected bank lending and private consumption, and the RUB has shown relative resilience, particularly after June. Despite inflation will likely ease for the sixth straight month in September, we foresee inflation will continue to stay higher than CBR's 4% target in 2025 and 2026 since the country continues to be squeezed by the sanctions and the war in Ukraine. We believe reaching CBR’s target will be tough since cooling off inflation will take longer than CBR anticipates.

We believe a peace deal in Ukraine would be the real key to ease pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a full-scale peace deal in Ukraine is very unlikely in 2025. (Note: The probability of war continuing remains at 70% considering peace negotiations continue to develop very slowly, as president Putin maintains a hard line stance and there are no significant moves yet by president Trump such as implementation of secondary tariffs on Russia oil buyers. Our second scenario is based on a Russia-friendly peace deal (30% probability) with Russia annexing areas in and around four Ukrainian oblasts that it occupied, and securing no NATO membership for Ukraine).

Under these circumstances, our 2025 average headline inflation projection stays at 9.1% since high military spending, global uncertainties, and rising wages do not signal a significant permanent inflation slowdown in the horizon yet despite fall in the inflation in the last five months.

I,Volkan Sezgin, the Senior EMEA Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.