France

View:

September 11, 2025

ECB Council Meeting Review: Complacency Rules the Day!

September 11, 2025 2:08 PM UTC

A second successive stable policy decision was the almost inevitable outcome of this month’s ECB Council meeting resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. Also as expected, the ECB offered little in terms of policy guidance; after

September 09, 2025

France: Kicking the Fiscal Can (Again)

September 9, 2025 8:41 AM UTC

That France has seen the departure of yet another prime minister is no surprise, hence why financial markets took the confidence vote in its stride. Admittedly, French sovereign spreads and yields have risen in the last month, but even so the actual level of bond yields remains well below that of

September 03, 2025

ECB Council Meeting Preview (Sep 11): No Change and Little Guidance

September 3, 2025 9:20 AM UTC

A second successive stable policy decision is very likely at next week’s ECB Council meeting resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. We see the ECB offering little in terms of policy guidance; after all, in July the Council sugge

September 02, 2025

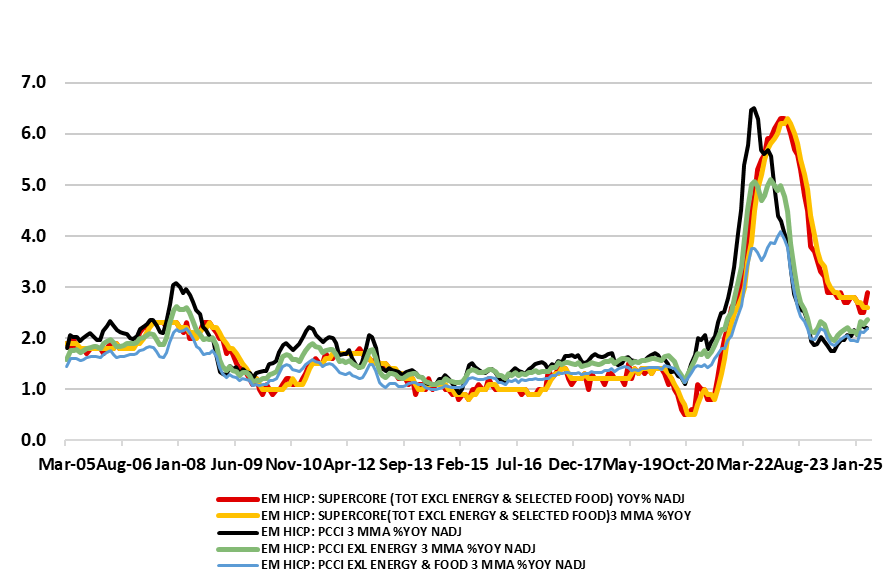

EZ HICP Review: Headline Inflation Edges Higher as Services Fall to Fresh Cycle-low

September 2, 2025 9:34 AM UTC

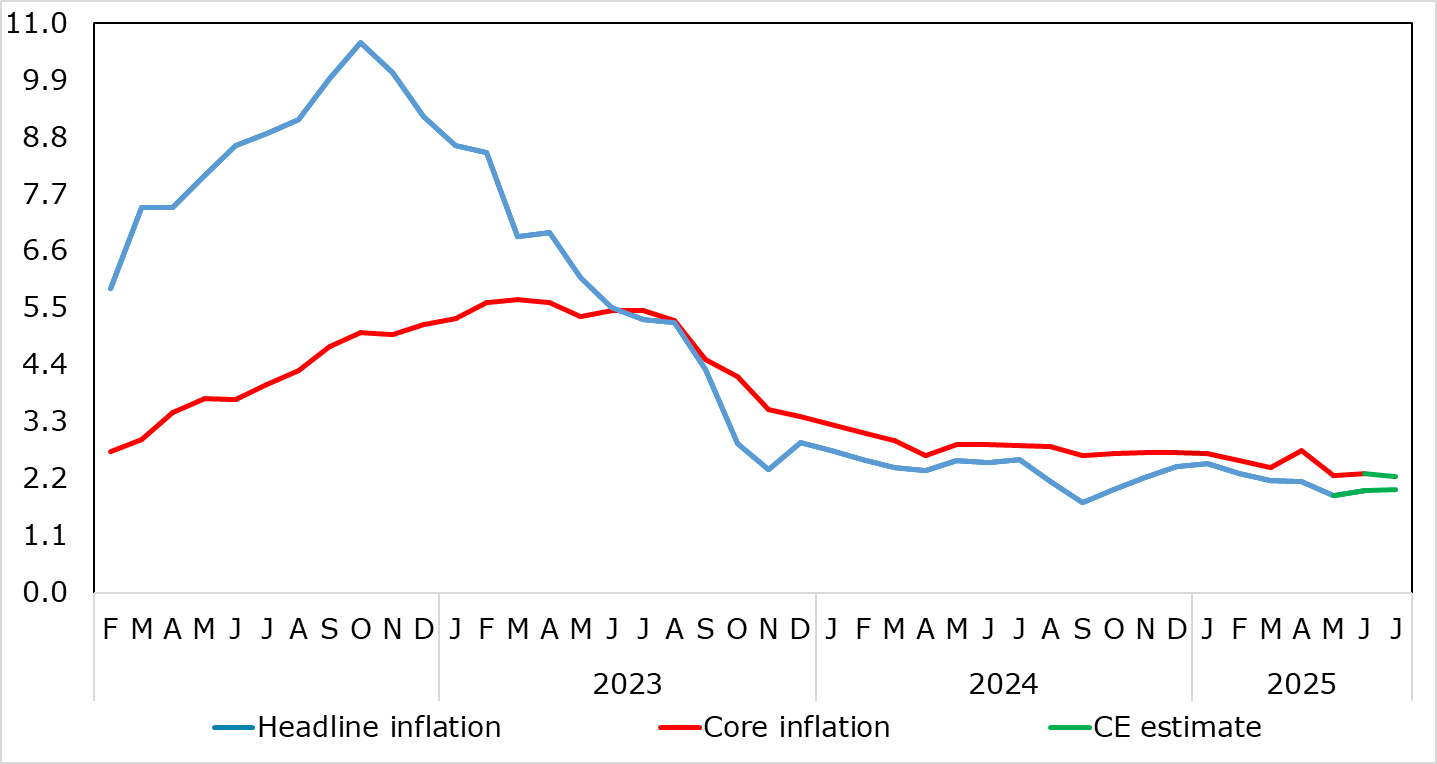

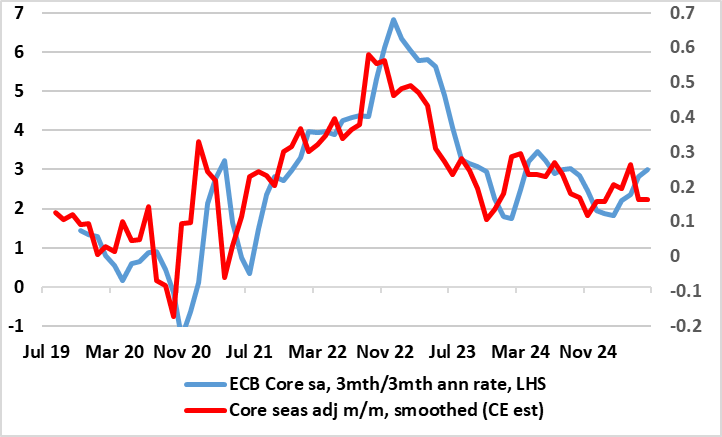

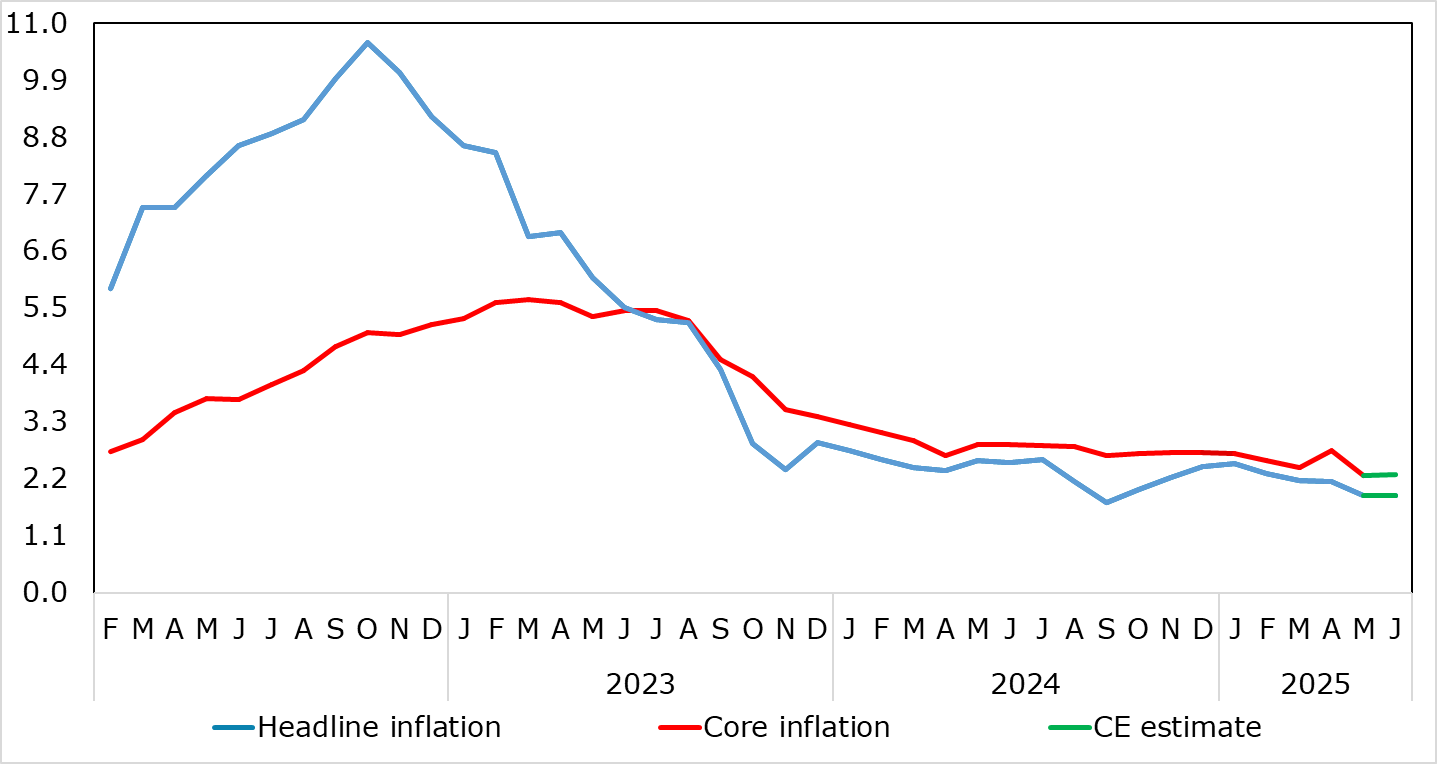

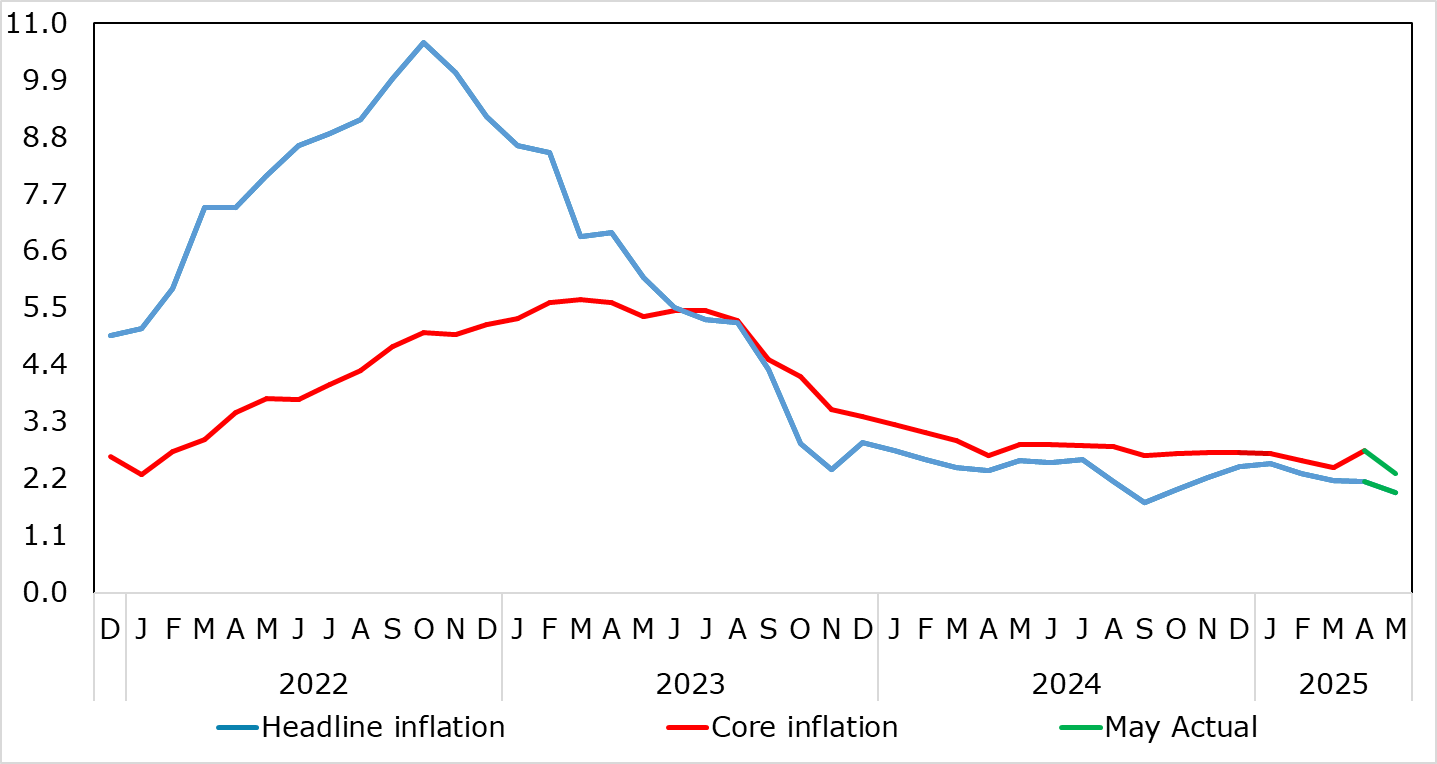

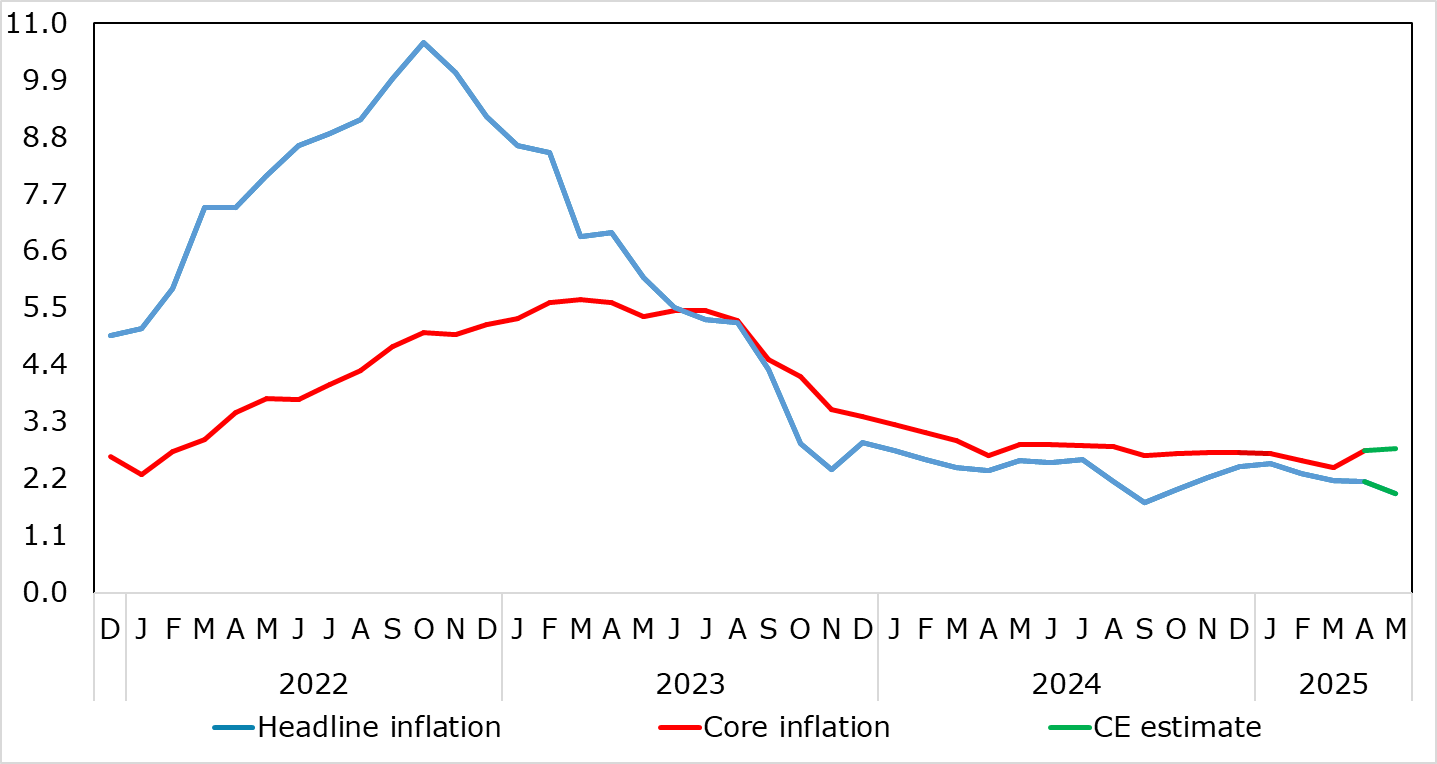

As we repeated again, HICP inflation – even now a notch above target – is very much a side issue for the ECB at present, offset instead by moderate concerns whether the apparent resilience of the real economy may yet falter. This mindset will not have been altered by the flash HICP data for Au

August 28, 2025

ECB July Account: Policy ‘On Hold’ Leaves Easing Door Open But Less Widely So

August 28, 2025 12:37 PM UTC

The account of the July 23-24 ECB Council meeting saw some discussion about cutting at that juncture but with no immediate pressure to change policy rates what was then exceptional uncertainty added to arguments for keeping interest rates unchanged. In particular, it was seen that maintaining policy

August 26, 2025

EZ HICP and Jobs Review: Headline at Target as Services Inflation at Fresh Cycle-low

August 26, 2025 11:51 AM UTC

HICP, inflation – still at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation and a low but far from authoritative jobless rate (Figure 3) possibly accentuating existing and looming Council divides. Regardless, despite adverse

France and Italy: Deficit, ECB QT and Foreign Debt Holders Stories

August 26, 2025 7:35 AM UTC

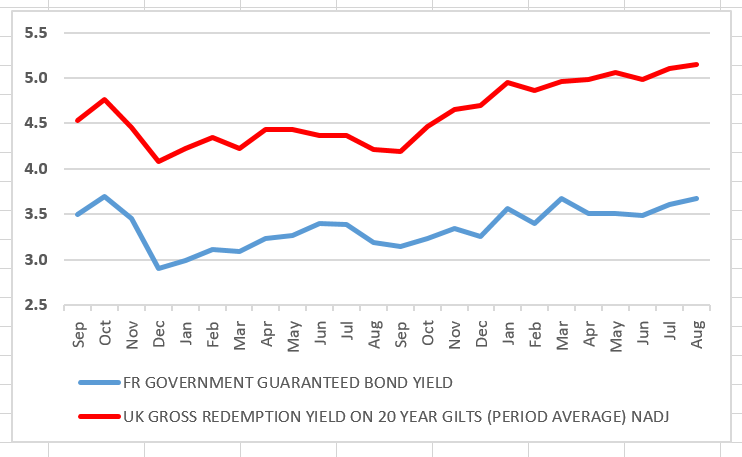

A large budget deficit in France, looking persistent given the current political impasse, combined with ECB QT means that the market has to absorb a very large 8.5% of GDP of extra bonds. Our central scenario is that persistent French supply causes a further rise in 5yr plus French government yields

August 21, 2025

Eurozone: ECB Feels it Has More Reason to ‘Wait and See’?

August 21, 2025 10:02 AM UTC

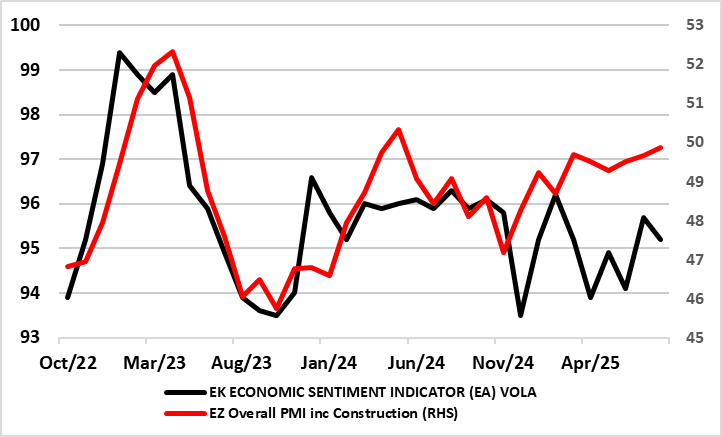

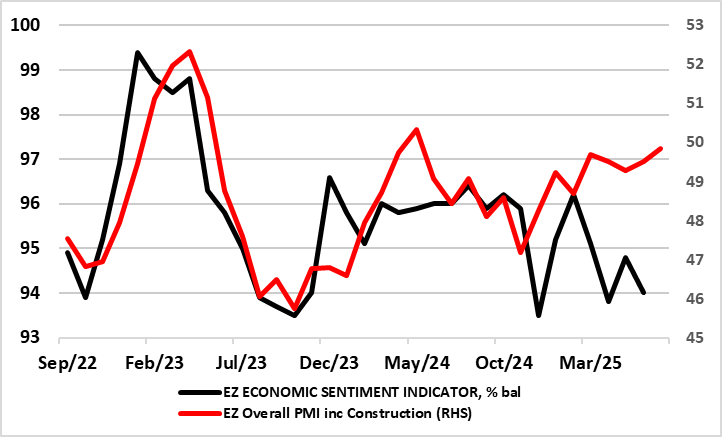

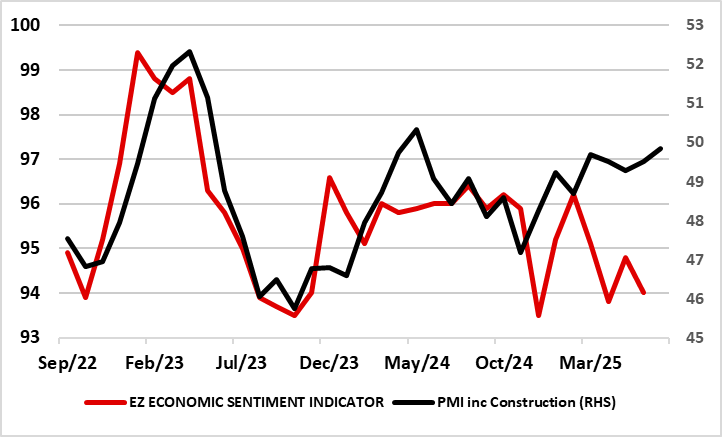

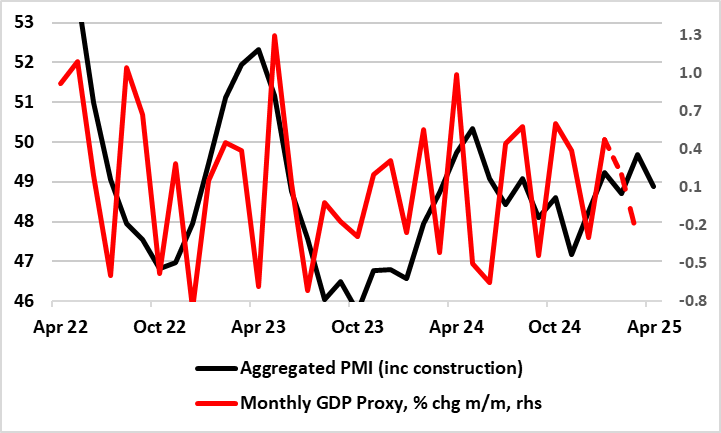

To suggest that recent EZ real economy indicators, such as today’s August PMI flashes, have been positive would be an exaggeration. But, at the same time, the data (while mixed and showing conflicts - Figure 1) have not been poor enough to alter a probable current ECB Council mindset that the ec

August 18, 2025

U.S. Strategic Fiscal Comparisons

August 18, 2025 9:05 AM UTC

The U.S. short average term to maturity is a structural fiscal weakness if higher rates lift U.S. government interest costs close to the nominal GDP trend. Hence, Trump’s pressure for fiscal dominance of the Fed to deliver lower policy rates and reduce U.S. government interest rate costs. Howeve

August 04, 2025

EZ HICP and Jobs Review: Headline at Target as Services Inflation at Fresh Cycle-low

August 4, 2025 8:25 AM UTC

HICP, inflation – still at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation and a low but far from authoritative jobless rate (Figure 3) possibly accentuating existing and looming Council divides. Regardless, despite adverse

July 30, 2025

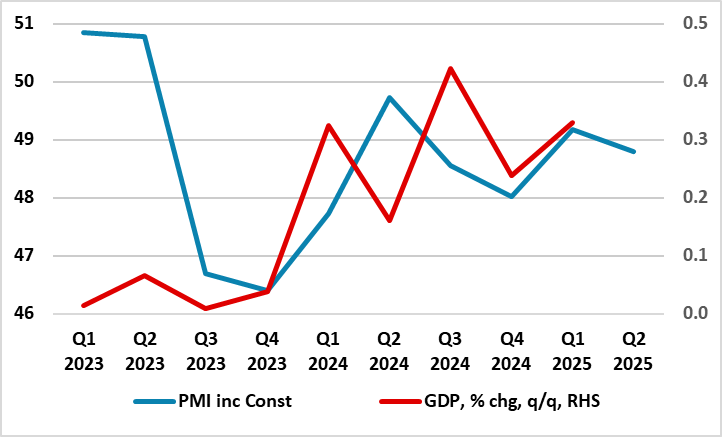

Eurozone Flash GDP Review: Resilience or Irrelevance?

July 30, 2025 9:52 AM UTC

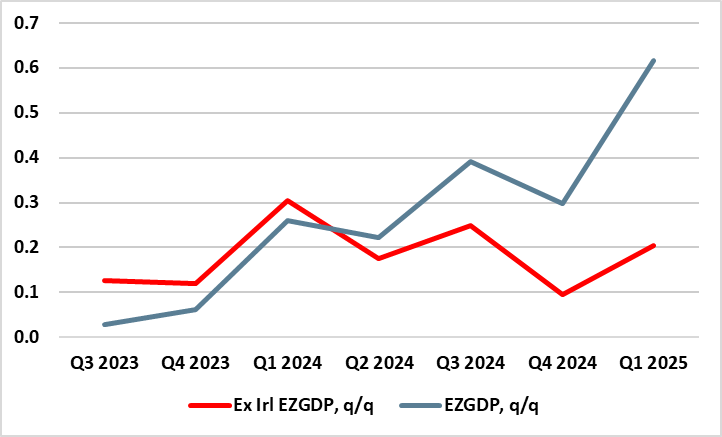

As we highlighted in our preview, for an economy that has seen repeated upside surprises and above trend growth, now some 1.4% in the year to Q2, GDP data do not seem to have had much impact is shaping, let alone dominating, ECB policy thinking. We think this will continue to be the case even after

July 29, 2025

EZ Real Economy – Diverging Sentiment Indictors Complicate Outlook

July 29, 2025 9:26 AM UTC

The ECB contends that the EZ economy has shown resilience of late. Maybe so, albeit where GDP data (likely to average a satisfactory 0.3% q/q performance so far this year) are probably offering a misleading picture of underlying trends in real activity. Indeed, recent GDP data gains have been pr

July 28, 2025

U.S.-EU Trade Agreement: More a Framework Than a full Deal

July 28, 2025 9:08 AM UTC

In what seems to have been a fully-fledged political capitulation to the U.S. the EU, it seems, is accepting an agreement that would see an almost-blanket reciprocal 15% tariff on its exports to the U.S. But there still some imponderables, not least the range of sectoral concessions, whether EU me

July 24, 2025

ECB Review: Policy ‘On Hold’ Leaves Easing Door Open

July 24, 2025 1:48 PM UTC

Given the uncertainty overhanging policy makers worldwide, let alone in the EZ, the ECB was always likely to revert to stable policy after seven consecutive cuts which have taken the discount rate to its current 2%. In a much shortened statement, but which was more willing to highlight disinflatio

July 23, 2025

EZ HICP Preview (Aug 1): Headline at Target as Services Inflation at Fresh Cycle-low?

July 23, 2025 10:35 AM UTC

HICP, inflation – now at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation possibly accentuating Council divides. Despite adverse energy base effects, we see the flash July HICP staying at June’s 2.0% but up from May’s eig

July 22, 2025

DM Rates: QT adds to Budget Deficits Pressures

July 22, 2025 10:05 AM UTC

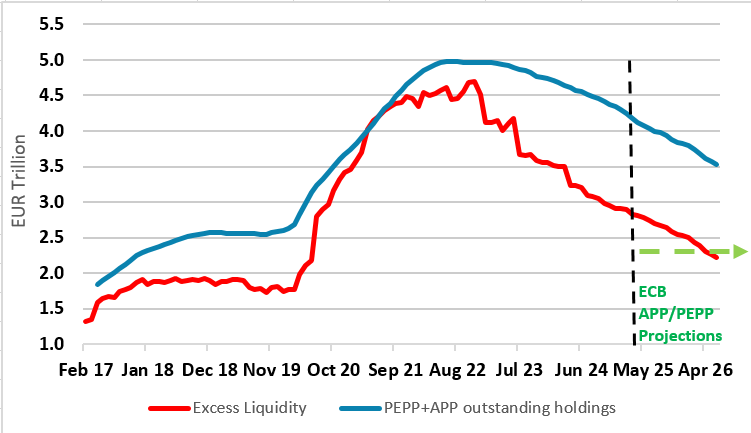

· Heavy issuance due to the U.S. budget deficit, plus Fed rate cuts will help further yield curve steepening in H2 2025. In EZ and UK, ECB and BOE QT is large and amplifies the amount of debt that the rest of the market has to absorb, which will also drives yield curve steepening al

Eurozone Flash GDP Preview (Jul 30): A Pause that Does Not Refresh?

July 22, 2025 9:13 AM UTC

For an economy that has seen repeated upside surprises and above trend growth of 1.5% in the year to Q1, GDP data do not seem to have had much impact is shaping, let alone dominating, ECB policy thinking. We think this will continue to be the case even where the looming Q2 data may show a modest con

July 21, 2025

2yr Germany and ECB Expectations

July 21, 2025 10:07 AM UTC

· Money markets are putting too much weight on ECB communications and we feel that a softening labour market/financial conditions and more tariffs from the U.S. will be enough to shift the ECB to deliver two final 25bps cuts in H2 2025. Though the 2yr Germany to ECB depo rate spread w

July 16, 2025

ECB Preview (Jul 24, Part Two): Policy Pause Despite Tighter Financial Conditions

July 16, 2025 1:07 PM UTC

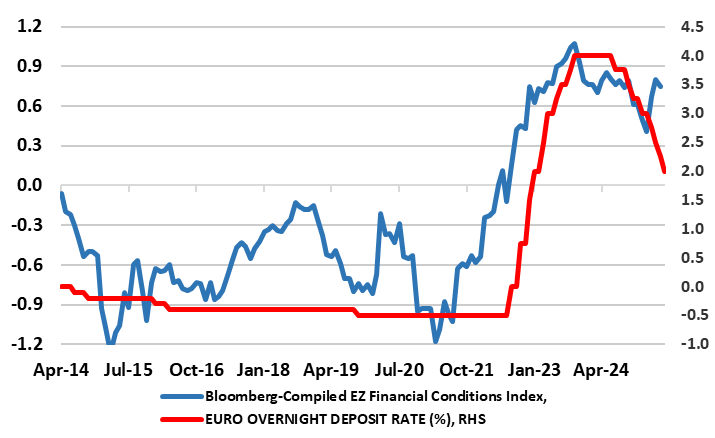

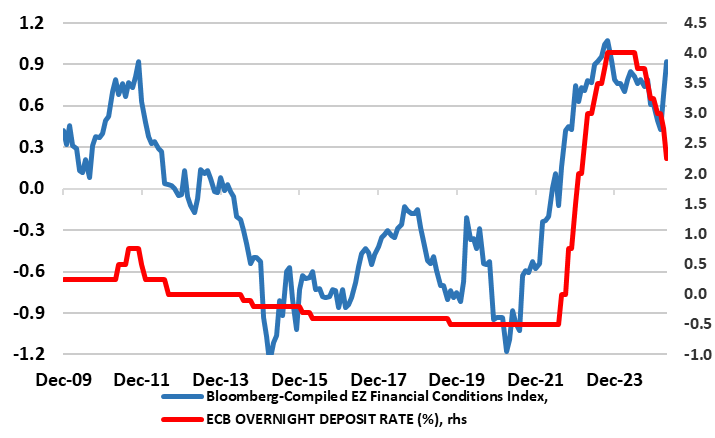

The next ECB Council meeting decision on Jul 24 looms but (as we noted in the part one preview) markets (understandably) sees no further cut, at least at that juncture. However, we think that the ECB will ultimately still have to ease further - two more 25 bp cuts in H2 - and would not even rule o

July 15, 2025

ECB Preview (Jul 24, Part One): Labor Market Looking Softer than Council Thinking

July 15, 2025 8:45 AM UTC

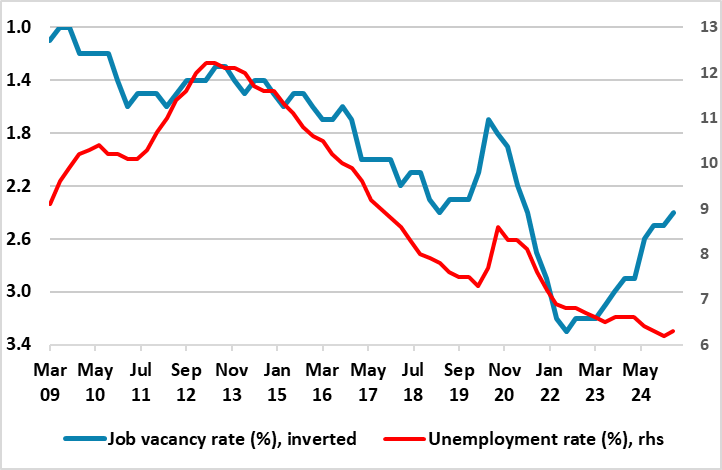

The next ECB Council meeting decision on Jul 24 looms but where market (understandably) sees no further cut, at least at that juncture. Indeed, the ECB may signal signs of economic resilience albeit noting that the added uncertainty emanating from the latest U.S. tariff threat warrants more circum

July 14, 2025

EU Blindsided by Latest Tariff Threat

July 14, 2025 6:56 AM UTC

Having announced over the weekend a 30% “reciprocal” tariff from August 1 on EU exports to the U.S., the EU seems to be a state of somewhat shock, wary that months of negotiations have failed, let alone succeeded in reducing the tariff threat from the original 20%. In response, European Commis

July 09, 2025

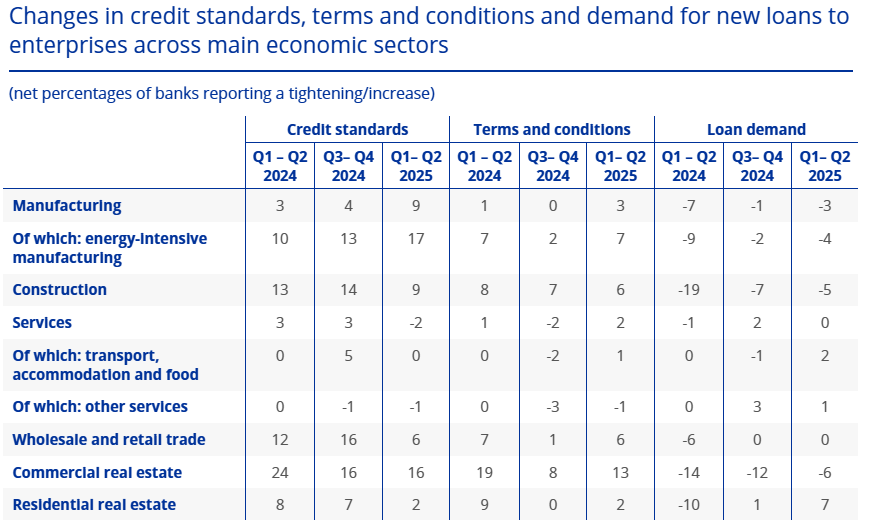

Eurozone: Damage Limitations on Tariffs, Uncertainty to add to Banks' Caution??

July 9, 2025 9:37 AM UTC

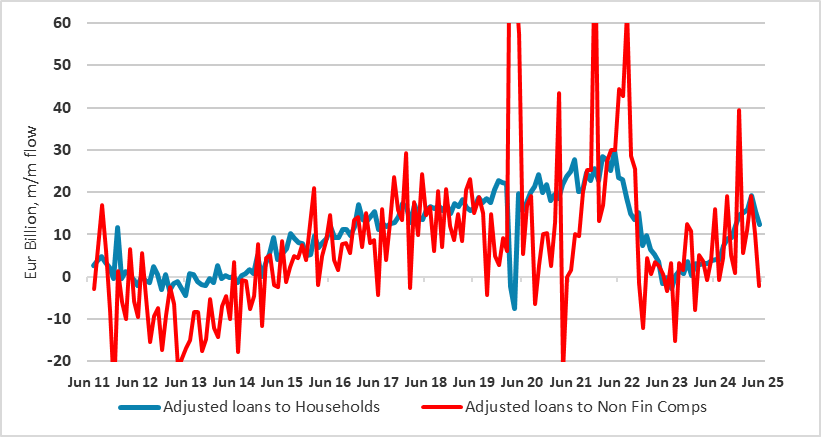

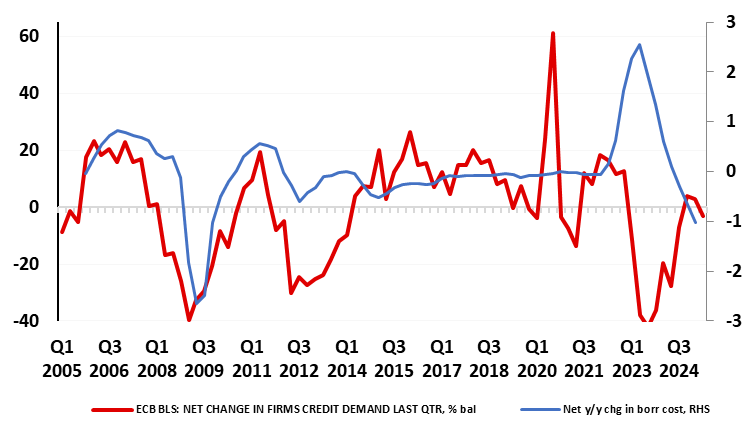

It remains unclear just how much of a movable feast the new U.S. tariff deadline of Aug 1 actually is. Trade deals with the US were supposed to be agreed by today, or face the reciprocal tariffs as outlined in April. But that has now been deferred to, with US Treasury Secretary Bessent, hinting ac

July 03, 2025

June ECB Council Meeting Account Review: Divides Continue if Not Widen

July 3, 2025 12:24 PM UTC

The account of the June 3-5 Council meeting just about left the door open for a move at the July 24 policy verdict given the array of news (probably negative particularly regarding tariffs but also bank lending) due beforehand. But the account adds to the impression we has initially that a pause

July 01, 2025

EZ HICP and ECB Strategy Review: Headline Up to Target as Services Inflation Rises Back?

July 1, 2025 9:32 AM UTC

Despite its updated its monetary policy strategy detailed yesterday, inflation – now at target – is very much a side issue for the ECB at present, albeit with oil prices possibly accentuating Council divides. Admittedly, the flash June HICP rose a notch to 2.0% matching the -consensus, but up

June 26, 2025

June 24, 2025

EZ HICP Preview (Jul 1): Headline Stays Below Target as Services Inflation Rises Back?

June 24, 2025 8:57 AM UTC

Inflation – now below target – is very much a side issue for the ECB at present, albeit with oil prices possibly accentuating Council divides. Indeed, we see the flash June HICP staying at May’s below-consensus, eight-month low and below-target 1.9% (Figure 1). More notably, having jumped

June 20, 2025

Eurozone Outlook: In Tariff Limbo Land?

June 20, 2025 9:24 AM UTC

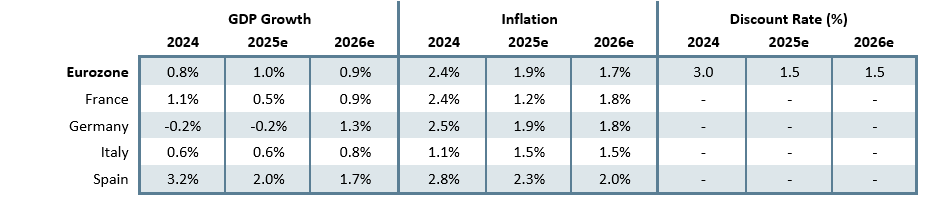

· Amid what may still be tightening financial conditions and likely protracted trade uncertainty, we have pared back the EZ activity forecast for 2026. However, the picture this year appears to be slightly better but this is largely a distortion and we think that the economy has instead

June 10, 2025

ECB: Time to Reassess and Slow QT?

June 10, 2025 2:25 PM UTC

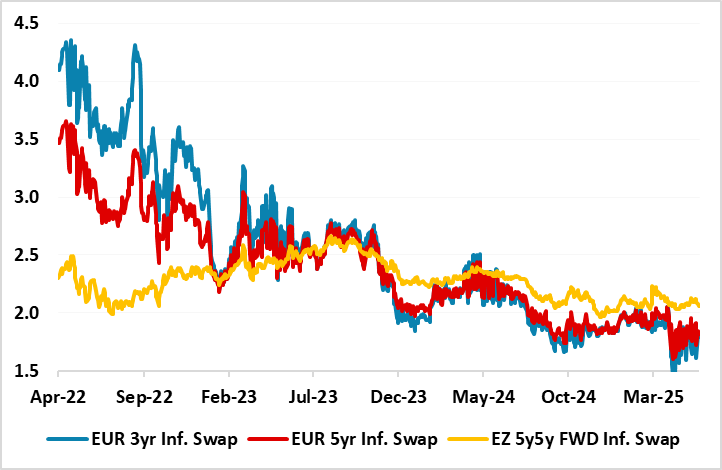

Further ECB easing is on the cards, the question being whether this should start to encompass toning down quantitative tightening (QT) plans too! Notably, the two ppt fall in the discount rate cuts has come against a backdrop where the ECB has continued unconventional tightening by scaling back its

June 06, 2025

Eurozone: The Tail Wagging the Dog?

June 6, 2025 10:26 AM UTC

Given what now looks to have been an outstanding first quarter, the ECB’s assertion at this month’s Council press conference that it is a good position to navigate the uncertain conditions looks more tenable. After all, GDP jumped 0.6%, twice the previous estimate. But this is no indicator o

June 05, 2025

ECB Council Meeting Review: Easing Window Stays Open

June 5, 2025 1:58 PM UTC

This widely seen 25 bp deposit rate cut (to 2.0%) now means the previous degree of tightening has been effectively halved. Notably, it comes alongside an ECB policy and economic outlook/bias little changed from that of recent months. The door is thus left open for a move at the July 24 policy ve

June 03, 2025

EZ HICP and Labor Market Review: Headline Back Below Target as Services Inflation Reverses Easter Effect

June 3, 2025 9:42 AM UTC

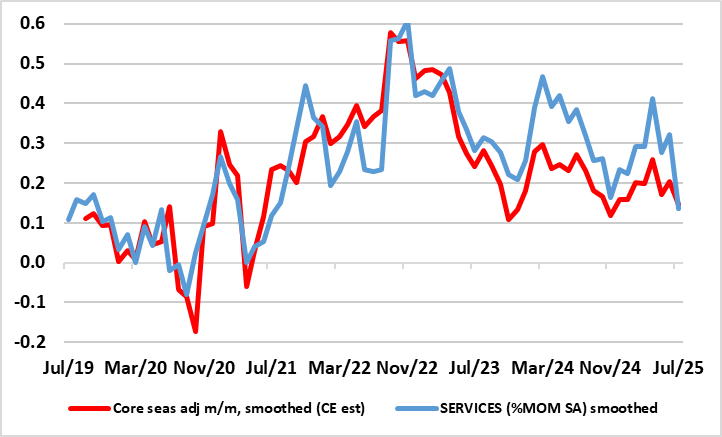

EZ HICP inflation met our below-consensus expectation in dropping to an eight-month low and below-target 1.9% (Figure 1) helped by rounding and a further m/m fall in fuel prices. More notably, having jumped 0.5 ppt to 4.0% in April, very probably due to the impact of the timing of Easter affecting

May 28, 2025

ECB Council Meeting Preview (Jun 5): Much Earlier Sub-Target Inflation Outlook?

May 28, 2025 2:30 PM UTC

What is widely seen as an eighth 25 bp deposit rate cut in the current cycle on June 5 may be overshadowed by the ECB’s implicit if not explicit shift about the outlook thereafter. The door will be left open for a move at the July 24 policy verdict given the array of news (probably negative part

May 27, 2025

EZ HICP and Labor Market Preview (Jun 3): Headline Back Below Target as Services Inflation Reverses Easter Effect?

May 27, 2025 11:17 AM UTC

Exceeding expectations, EZ HICP inflation failed to fall in April, instead staying at 2.2%. More notably, services inflation jumped 0.5 ppt to 4.0%, very probably due to the impact of the timing of Easter affecting airfares and holiday costs. As already seen in flash French May numbers, and as was

Eurozone: US Stepped-Up Tariff Threat – Negotiations or Concessions?

May 27, 2025 9:22 AM UTC

At least within markets there is some relief that President Trump has deferred his ramped up 50% tariff threat from early June to July 9. Unambiguously positive is the fact that a better line of communication, if not rapport, now seems to exist between the U.S. president and EU Commission Presiden

May 23, 2025

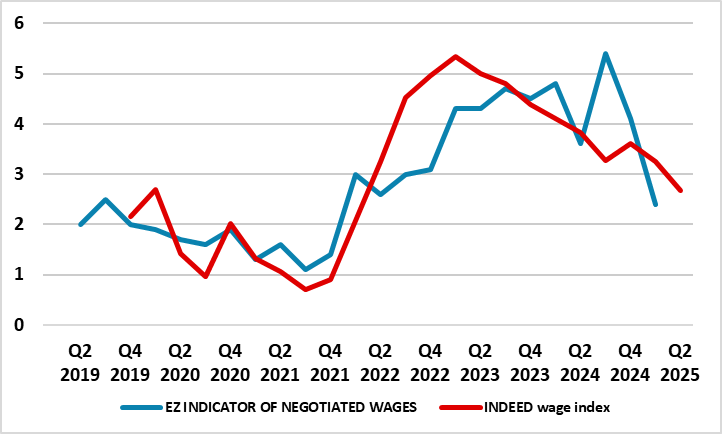

Eurozone: Waging War on Wages

May 23, 2025 1:35 PM UTC

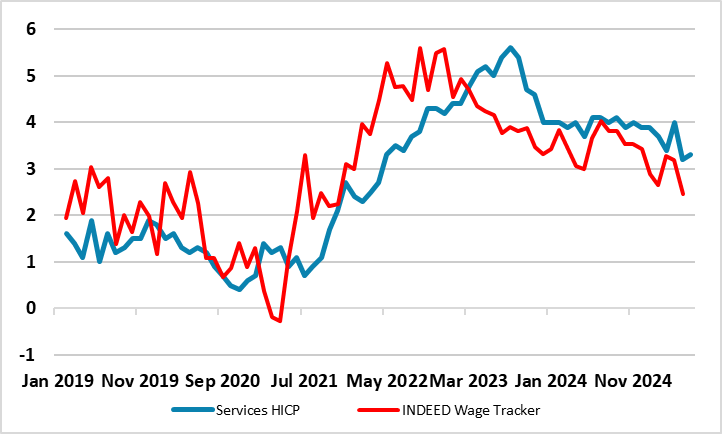

After a protracted period of elevated EZ cost and price pressures, a reversal seems to be very much underway. Headline and underlying HICP inflation have moved back toward target, but to reinforce this downtrend there are an increasing array of softer cost pressure signals. ECB wage tracker and

May 22, 2025

ECB April Account: Neutral Rate Not Necessarily a Terminal Rate

May 22, 2025 12:46 PM UTC

The account of the April 16-17 ECB Council meeting suggested that the policy decision was more of a clearly agreed consensus, this papering over continued divides regarding the outlook; the risks from tariffs; and where inflation risks lie. The seventh and widely expected 25 bp deposit rate cut (w

Eurozone: Services Offer Sobering News

May 22, 2025 9:00 AM UTC

The May flash composite PMI data may have fallen into apparent contraction territory as the index dropped to 49.5 in May from 50.4 in April, below the 50.0 no-change mark for the first time in five months and thereby signalling a reduction, albeit a marginal one. We do not take much issue whether

May 19, 2025

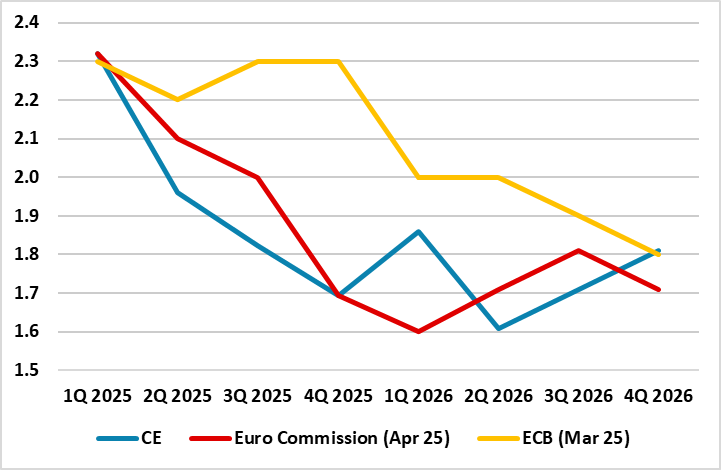

Eurozone: The European Commission Diverges From the ECB on Inflation

May 19, 2025 10:07 AM UTC

The European Commission (EC) Spring Forecast projects real EZ GDP growth in 2025 at 0.9%, some 0.4 ppt below its previous (autumn) view. There is also a downgrade to the 2026 growth picture by 0.2 ppt to 1.4%, projections that carry downside risks and where we think they are still too optimistic

May 14, 2025

Europe Portfolio Leverage Over Trump

May 14, 2025 9:05 AM UTC

The U.S. will likely introduce a 25% tariff on pharmaceuticals, which will increase pressure on the EU and other European countries (e.g. Switzerland) and also delay serious negotiations close to the 90 day reciprocal tariff deadline on July 9, adding to pressure on Europe by deliberately prolonging

May 07, 2025

Eurozone Labor Market: Rising Supply Adding to Lower Wage Pressures

May 7, 2025 9:34 AM UTC

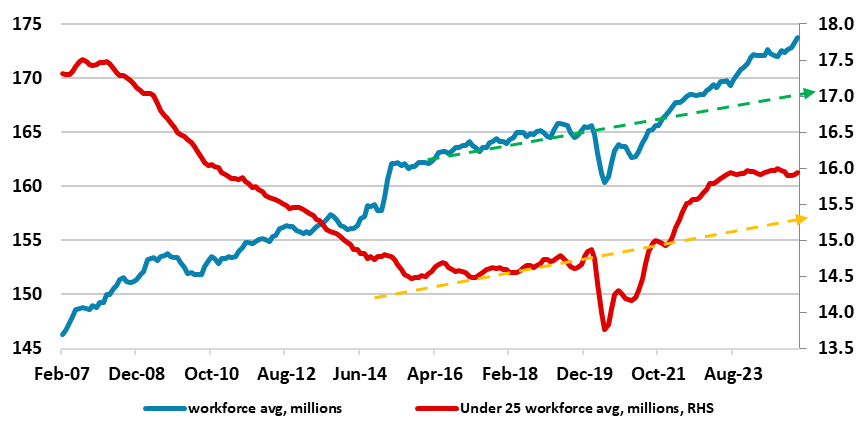

With the EZ jobless rate nestling at record lows, it would support the ECB assessment that the EZ labor market is strong, the central bank seeing only a small rise in the jobless rate this year and on to be reversed from early next year onwards. However, that glosses over the fact that the labor m

May 02, 2025

EZ HICP Review: Headline Fails to Fall as Services Inflation Rises on Easter Effect?

May 2, 2025 9:46 AM UTC

EZ HICP inflation failed to fall back toward the 2% target in flash April data, instead staying at 2.2%. More notably, services inflation jumped 0.4 ppt, very probably due to the impact of the timing of Easter affecting airfares and holiday costs. As was the case when this Easter effect last happe

April 28, 2025

April 24, 2025

EZ HICP Preview (May 2): Headline Lower Again But Mainly Energy?

April 24, 2025 8:39 AM UTC

EZ HICP inflation is likely to fall back to the 2% target in flash April data, this six-month low would largely reflect a fall in fuel prices, but with services largely consolidating the clear fall seen last time around (Figure 1). All of which would mean a stable core reading of 2.4% but where th

April 23, 2025

Eurozone Flash GDP Preview (Apr 30): The Calm Before the Storm that Surveys May Be Flagging?

April 23, 2025 9:18 AM UTC

Continuing a series of upside surprises, EZ GDP overshot both consensus and ECB expectations in Q4), albeit only after what was a cumulative 0.2 ppt upward revisions compared to the flash. We see a further rise in Q1 data (Figure 1), partly reflecting recent m/m increases in both manufacturing and s

April 17, 2025

ECB Review: Discussing Policy Restriction No Longer Appropriate

April 17, 2025 1:48 PM UTC

A seventh and widely expected 25 bp deposit rate cut was overshadowed by the ECB’s communication shift about the outlook hereafter, no longer talking about how restrictive policy may be. This shift is entirely appropriate not least given the manner in which financial conditions are now tightenin

April 15, 2025

Eurozone Banks Offer ECB More Cause for Concern

April 15, 2025 11:14 AM UTC

The ECB can draw comfort from signs that credit demand and supply for EZ households continues to improve. But the ECB’s latest bank lending survey (BLS) also offers worrying signs in regard to firms as well as questioning the alleged neutrality of the QT program. It shows a further (admittedly

April 09, 2025

ECB Preview (Apr 17): Deeper Cuts on Trade Tariffs Broadening Impact

April 9, 2025 8:03 AM UTC

It is surely not a question of whether the ECB cuts rates again at its Apr 17 decision, but what it communicates about policy thereafter. Not least given the manner in which financial conditions have tightened, the then-notable change in rhetoric last month to suggest the policy stance had become