ECB Preview (Apr 17): Deeper Cuts on Trade Tariffs Broadening Impact

It is surely not a question of whether the ECB cuts rates again at its Apr 17 decision, but what it communicates about policy thereafter. Not least given the manner in which financial conditions have tightened, the then-notable change in rhetoric last month to suggest the policy stance had become less restrictive is already out of date as the ECB instead grapples with increasing downside risks (to both growth and inflation that now require risk management as the theme driving policy ahead). These risks stem not just from the direct consequences to trade from the U.S. imposed tariffs but also from export diversions and the increasing threats of inter-twined slumping business confidence and capex intentions as well as the surging euro damaging competitiveness, the latter accentuating already tighter financial conditions. And amid a backdrop where EZ banks have already shown fresh signs of tightening credit, heighted uncertainty may merely accentuate this downside risks as the Bank Lending Survey (BLS) due two days before the decision may highlight. All of which suggest to us that there will be 2-3 more 25 bp cuts after the assumed move this month and where ECB may even admit it may have to revisit the QT outlook.

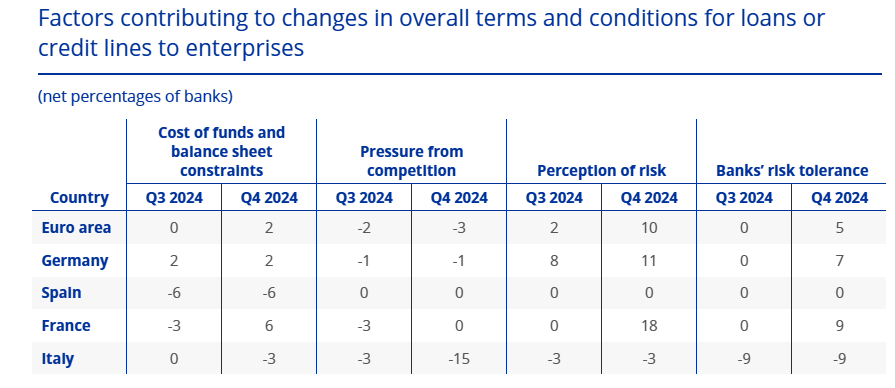

Figure 1: Banks Already Reducing Risk Tolerance

Source: ECB BLS

Downside Risk or Downside Reality

Although not quite (yet) what is on the cards, we would not contest significantly the ECB view that a US tariff of 25% on imports from Europe would lower EZ growth by about 0.3 ppt in the first year, which is good guidance given the 20% imposed by the U.S. so far on goods ex cars/steel. A European response in the form of raising tariffs on U.S. imports would almost double the likely damage but where the brunt of the impact on economic growth would concentrate around the first year after the rise in tariffs. It would then diminish over time, however still leaving a persistent negative effect on the level of output. But the margins around such estimates are large and increasing and surely skewed to the downside as they encompass slumping business confidence and stock prices hurting demand in a further veneer of economic damage this even so if some of the tariffs are scaled back or delayed – initial EU offers to cut tariffs have been rejected by Trump (here). And there is a further risk posed by what are called trade diversions, in the case of the EZ being the extent to which the massive additional tariffs China is facing see it ‘dump’ goods into other markets. This would be both a risk to net demand and on the downside to prices and where both are also likely to be amplified by the surge in the trade weighted euro to its current record-high.

But that central estimate alluded to above would broadly halve our pre-tariff announcement EZ outlook GDP outlook for this year of 0.9% – and where the risk of recession (ie two successive negative quarters) would have risen to well above 50% – we would not rule out zero growth in Q1 given both base effects and the message of business surveys. Of course, there are some upside growth risks, not least given the plummet in commodity and especially energy price drops now unfolding. These are being accentuated by the leap back in the euro – the effective index has risen some 6% in the last week – all the more notable as in late March the ECB thought that tariffs imposition may raise HICP inflation in the short-term via euro depreciation. But we would caution the rationale behind the drops in energy prices – while they may improve spending power they are symptomatic of uncertainty and slumping confidence.

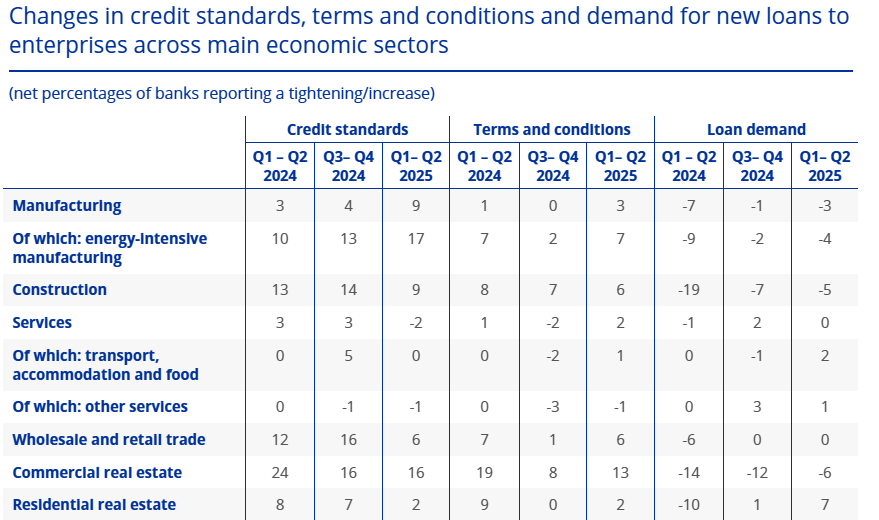

ECB Reassessing as Banks Caution Grows

Regardless, the ECB may have a similar overall view for this year as it too was anticipating a similar 2025 GDP outlook. It will also be aware of, if not perturbed by, the tightening in financial conditions now unfolding, not just via the euro but credit spreads, equity prices etc. But there is an added downside risk in terms of financial conditions, one posed by banks possibly increasingly reluctant to lend as they reduce their risk tolerance and raise their perception of risk, given fears of a spill-over of a potential recession. This was already evident in the last ECB compiled BLS in January (Figure 1) with credit standards raised across the board for companies, but most notably for (export and energy sensitive) manufacturing (Figure 2). Banks also then reported a net increase in the share of rejected loan applications for firms, this net increase being the largest since the fourth quarter of 2023. The next BLS arrives two days before the next ECB decision albeit it having been compiled well before the tariff announcements of last week.

Figure 2: Banks Tightening Credit More Toward Export Based Firms?

Source: ECB BLS

But the survey is likely to see banks risk awareness having risen regardless, and where the BLS may start to show fresh signs that the ECB’s balance sheet reductions are affecting banks’ ability to lend. Indeed, the ECB does seem to be leaning away from its previous view that its balance sheet reduction has been ‘absorbed by markets in a very innocuous way over the course of time’. Instead, a view by Board member Piero Cipollone who has overseen ECB research which shows that the composition of central bank reserves is very important for banks’ lending ability. The research estimates that debt portfolio holdings (under the ECB’s asset purchase programme (APP) and pandemic emergency purchase programme (PEPP)) will decrease by around EUR 500 billion in 2025. This is associated with a possible EUR75 billion decline in credit supply, ie between 0.5 and a full ppt in terms of growth rates damage. To put this into perspective, it is roughly equivalent to the amount of loans that banks granted to non-financial corporations in 2024. The possibility is that if the ECB sees more signs of banks wariness about lending both/either from risks awareness and/or the reduction of the ECB balance sheet is putting pressure on banks’ lending capacity, the Council will need to monitor this effect and take it into consideration when calibrating its monetary policy stance. This may mean greater/faster conventional easing and even revisiting the planned further reduction in its balance sheet.