EZ HICP Preview (May 2): Headline Lower Again But Mainly Energy?

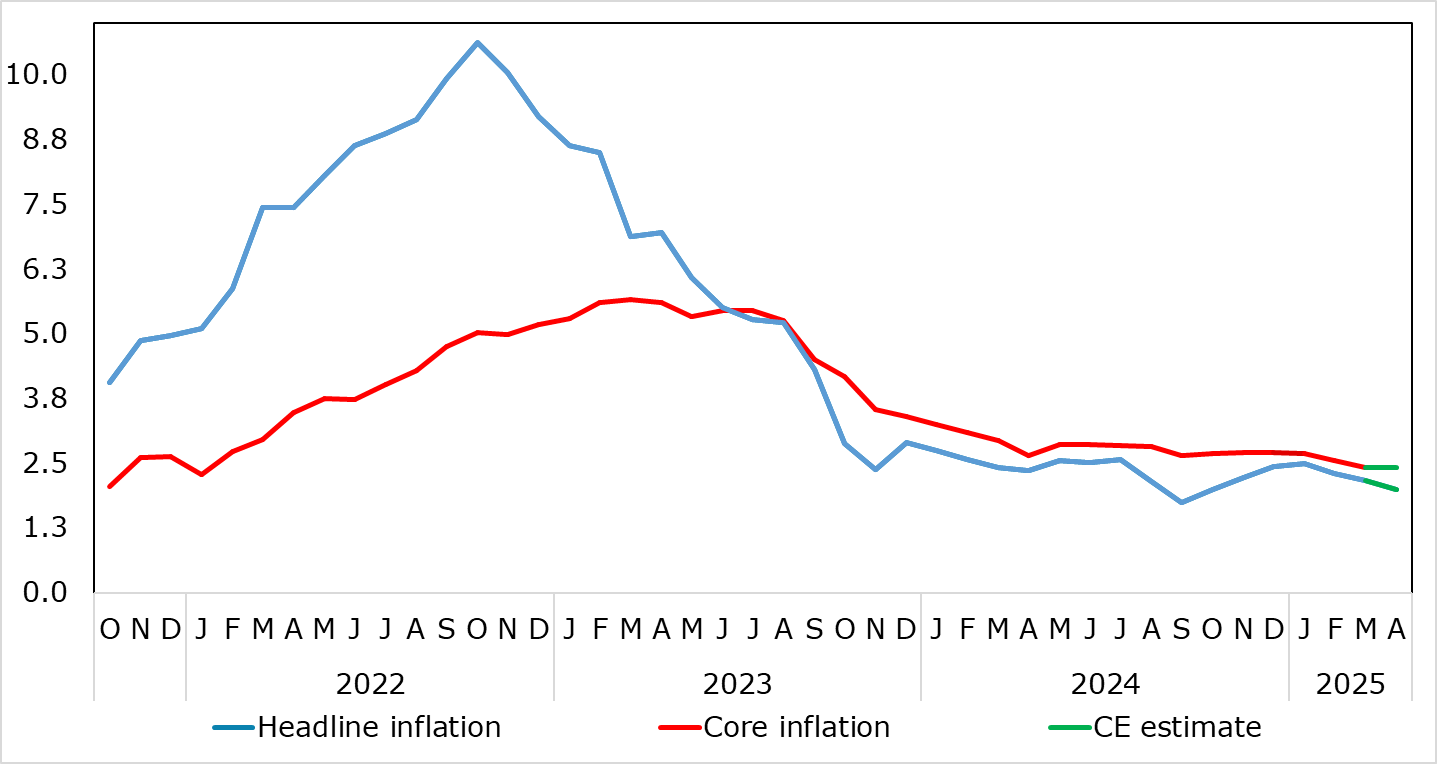

EZ HICP inflation is likely to fall back to the 2% target in flash April data, this six-month low would largely reflect a fall in fuel prices, but with services largely consolidating the clear fall seen last time around (Figure 1). All of which would mean a stable core reading of 2.4% but where the late Easter may pose some upside risks to the headline, most notably in a further rise in food inflation. Regardless, the data would add to the case of more ECB easing, the question being when. The HICP data will arrive alongside March labor market numbers which may also consolidate the fresh drop to new record-low jobless seen in the last set of such data, but where that drop largely reflects a further increase in the workforce, this possibly being a major factor in the manner in EZ wage inflation has been falling.

Figure 1: Headline to Slip Back Further as Services Drop Consolidates

Source: Eurostat, CE, ECB

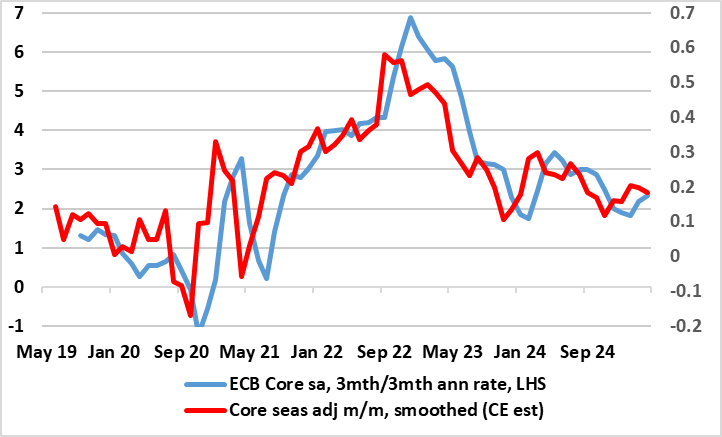

Despite higher food inflation, partly offset by a drop in fuel costs, March’s flash details showed, most notably, a further and clearer easing in what had previously been seemingly relatively stable services inflation, down 0.3 ppt to a 33-mth low of 3.4%. The softer core and services messages have been flagged by shorter-term price momentum data and persistent price gauges which already suggest that core and even services inflation have slowed and are running around target (Figure 2). The March headline chime with implicit ECB thinking that pointed to a 2.3% headline and 2.5% core average in the current quarter.

Figure 2: Core Inflation Already Around Target in Shorter-Term Dynamics?

Source: Eurostat ECB, CE

As we have noted previously, there are some signs in retailing surveys suggesting disinflation may have stalled. But this may be of increasing secondary importance to most of the ECB Council as a) inflation is already consistent with target; b) cost pressures are under control and may indeed be easing when it comes to softening wage inflation possibly helped by a swelling workforce and c) a fresh and more demand driven disinflation could be triggered by what seems to be a weaker real economy backdrop that could also exacerbate financial stability risks and which risks being accentuated on the downside by a possible trade war. And it is the latter factor that seems to be driving policy now, this over and beyond any consideration of reaching a neutral policy setting.