ECB Review: Discussing Policy Restriction No Longer Appropriate

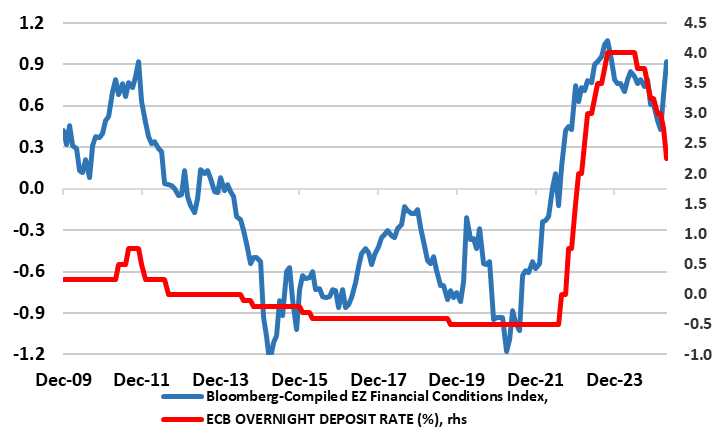

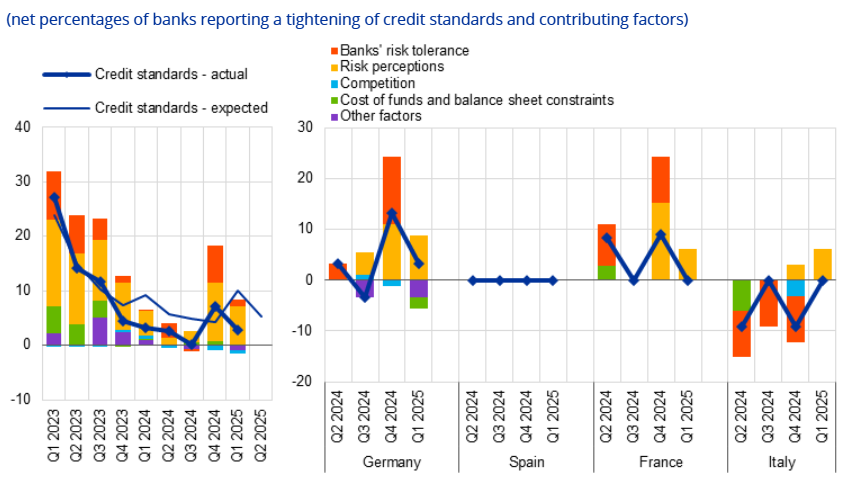

A seventh and widely expected 25 bp deposit rate cut was overshadowed by the ECB’s communication shift about the outlook hereafter, no longer talking about how restrictive policy may be. This shift is entirely appropriate not least given the manner in which financial conditions are now tightening; the fall in official rates is giving misleading signals about policy restriction (Figure 1). Now the ECB instead grapples with increasing downside risks (to both growth and inflation) that require risk management to drive policy ahead and which we feel is consistent with ECB following what it has termed an agile, data-dependent and meeting-by-meeting approach to determine policy. If anything, the ECB may also have been perturbed by bank lending developments (Figure 2), which suggest financial conditions may be tightening more broadly that suggested in Figure 1. All of which suggest to us that the damage that tariffs may accentuate will trigger 2-3 more 25 bp cuts after and where ECB may even admit it may have to revisit the QT outlook.

Figure 1: Lower Policy Rate Not Stopping Financial Conditions Tightening

Source: ECB, Bloomberg

Admittedly, given that tariff clarity may still be muddied by the time of the June ECB meeting, there is possibility (but may be not a probability) of a pause at that juncture. But as for the outlook, the increase in downside risk the ECB now recognises stem not just from the direct consequences to trade from the U.S. imposed tariffs but also from export diversions and the increasing threats of inter-twined slumping business confidence and capex intentions as well as the surging euro damaging competiveness, the latter accentuating already tighter financial conditions.

Added Downside Risk Accentuate Downside Reality

Given the uncertain and likely very changeable outlook, most notably regarding tariffs, we understand the ECB’s reticence to provide firm updates to its economic outlook. However, the ECB has offered clues which to us remain plausible regarding what it justifiably denotes as a negative demand shock. Although not quite (yet) what is on the cards, we would not contest significantly the ECB view that a US tariff of 25% on imports from Europe would lower EZ growth by about 0.3 ppt in the first year, which is good guidance given the circa-13% already effective in terms of tariffs. But the margins around such estimates are large and increasing and as the ECB admits are skewed to the downside as they encompass slumping business confidence and stock prices hurting demand in a further veneer of economic damage this even so if some of the tariffs are scaled back or delayed – initial EU offers to cut tariffs have been rejected by Trump. And there is a further risk posed by what are called trade diversions, in the case of the EZ being the extent to which the massive additional tariffs China is facing see it ‘dump’ goods into other markets. This would be both a risk to net demand and on the downside to prices and where both are also likely to be amplified by the surge in the trade weighted euro to its current record-high. But disinflation is the main story, this also be accentuated by the marked fall in freight costs Europe is now facing, most notably in trade from China!

But that central estimate alluded to above would broadly halve our pre-tariff announcement EZ GDP outlook for this year of 0.9% – and where the risk of recession (ie two successive negative quarters) would have risen to well above 50% also given the message of business surveys. Of course, there are some upside growth risks, not least given the plummet in commodity and especially energy price drops now unfolding. But we would caution the rationale behind the drops in energy prices – while they may improve spending power they are symptomatic of uncertainty and slumping demand. But they will add to any disinflation push; the fall in fuel prices could knock HICP inflation down 0.2 ppt in April alone.

ECB is Reassessing as Banks Caution Grows

Regardless, the ECB justifiably seems perturbed by the tightening in financial conditions now unfolding, not just via the euro, but credit spreads, equity prices etc. But there is an added downside risk in terms of financial conditions, one posed by banks becoming increasingly reluctant to lend as they reduce their risk tolerance and raise their perception of risk, given fears of a spill-over of a potential recession. Indeed, the ECB’s latest bank lending survey (BLS) offers worrying signs in regard to firms as well as questioning the alleged neutrality of the QT program. The BLS shows a further (admittedly more modest) tightening in actual and expected credit standards (Figure 2) and a fresh fall in company’s credit demand with smaller firms also facing increasing rejection rates in pursuit of loans. Higher perceived risks related to the general economic and firm-specific outlooks drove the further net tightening of credit standards with the tariff threat evident amid increased scrutiny of corporate borrowers particularly exposed to exports to the United States. As for weaker demand, this reflected a negative contribution from firm inventories and working capital and came despite support from declining interest rates. But the BLS points to economic and geopolitical uncertainties as a dampening factor for firms’ longer-term planning and thus capex plans. Thus the point here is that the tariff threat was taking a toll on banks’ willingness to lend and firm’s appetite to borrow even in March, ie well before the possible scale and breadth of the tariff threat emerged.

With this in mind the gauge of financial conditions in Figure 1 (comprising short and long terms rates the effective exchange, equity market and credit spreads) may actually be under-estimating the extent to which overall tightening is occurring. What is clear is that the ECB’s policy rate is far from encompassing how financial conditions are currently faring – this seventh cut has come against a backdrop where financial conditions are seemingly back at the highs of late 2023. Thus we think the ECB is fully justified in no longer talking about its latest cut having eased policy restriction further. Indeed, as far as financial conditions are concerned, the very opposite may be occurring as Figure 1 illustrates.

Figure 2: Banks Tightening Company Credit As Risk Awareness Rises and Tolerance Drop?

Source: ECB BLS - Changes in credit standards for firms regarding approval of loans or credit lines and contributing factors

But the BLS also showed fresh signs that the ECB’s balance sheet reductions may be affecting banks’ ability to lend. Indeed, the ECB does seem to be leaning away from its previous view that its balance sheet reduction has been ‘absorbed by markets in a very innocuous way over the course of time’. The possibility is that if the ECB sees more signs of banks wariness about lending both/either from risks awareness and/or the reduction of the ECB balance sheet is putting pressure on banks’ lending capacity, the Council will need to monitor this effect and take it into consideration when calibrating its monetary policy stance. This may mean greater/faster conventional easing and even revisiting the planned further reduction in its balance sheet.