EZ HICP Review: Headline Fails to Fall as Services Inflation Rises on Easter Effect?

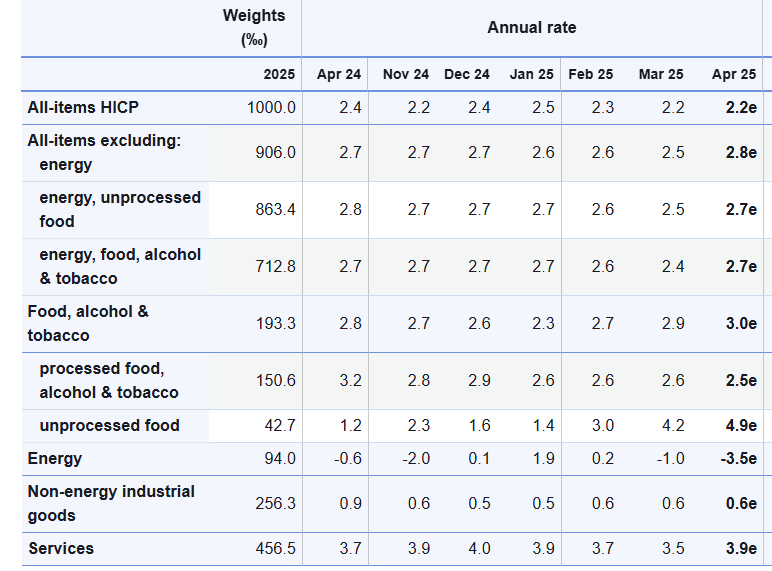

EZ HICP inflation failed to fall back toward the 2% target in flash April data, instead staying at 2.2%. More notably, services inflation jumped 0.4 ppt, very probably due to the impact of the timing of Easter affecting airfares and holiday costs. As was the case when this Easter effect last happened in 2019, services inflation is very likely to drop back in May, this also likely to reverse the higher April flash core reading of 2.7%, ie which was up from 2.4%. Easter effects may Have been behind the jump in unprocessed food inflation too. The data may cause some prevarication within the ECB but the expected June rate cut still looks on the cards unless the May flash HICP (due 2 days before the June 5 verdict) also surprises on the upside. Regardless, we see headline HICP inflation below target as soon as June!

The HICP data arrived alongside March labor market numbers which showed a revision up from what was previously a fresh drop to new record-low jobless seen in the last set of such dat. Indeed, the data showed the largest jump in actual jobless ness in the cycle despite the rate stable at 6,2%. Regardless, the low jobless rate comes alongside a recent increase in the workforce, this possibly being a major factor in the manner in EZ wage inflation has been falling.

Figure 1: Headline Stable as Services Rises

Source: Eurostat, CE, ECB