German & EZ HICP Preview (Mar 31/Apr 1): Headline Edges Lower Again With Friendlier Services Messages?

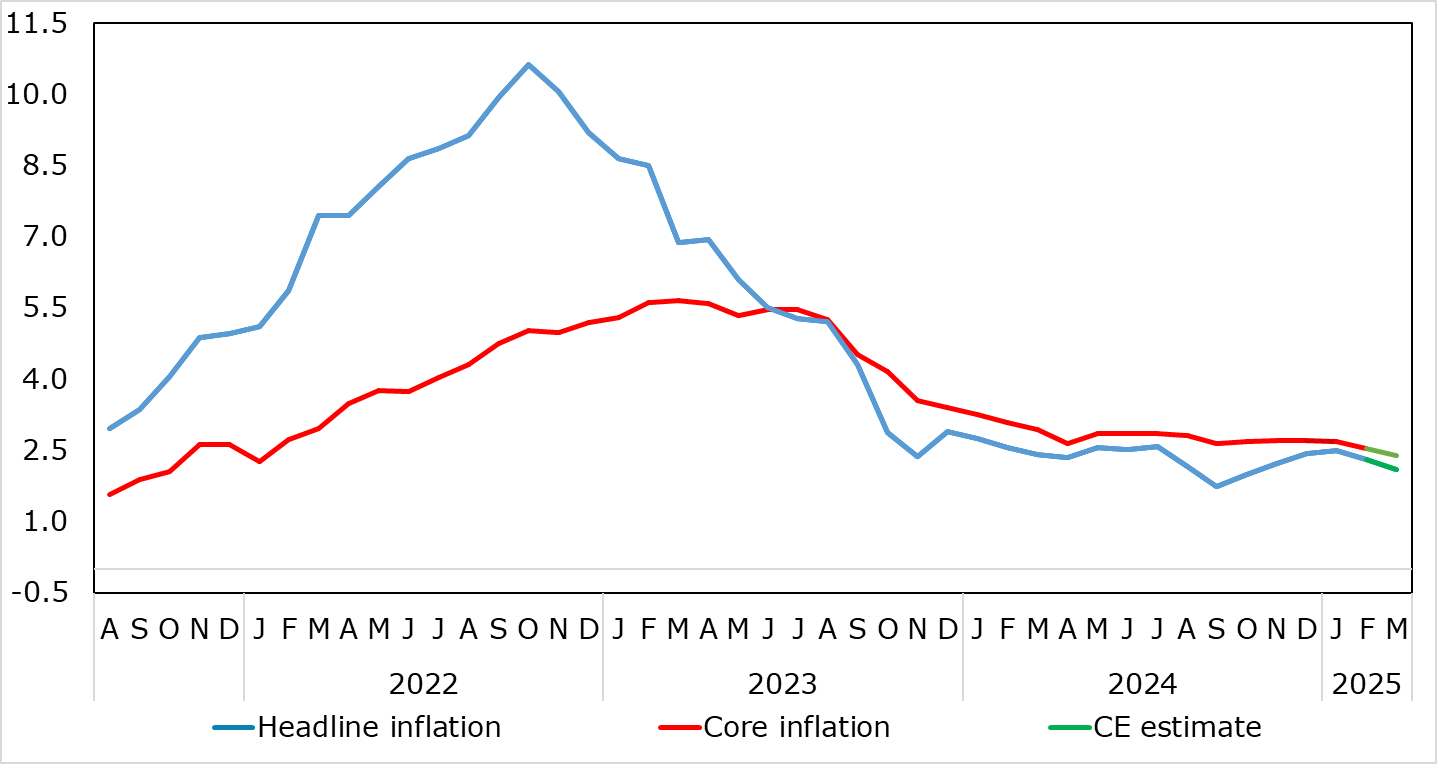

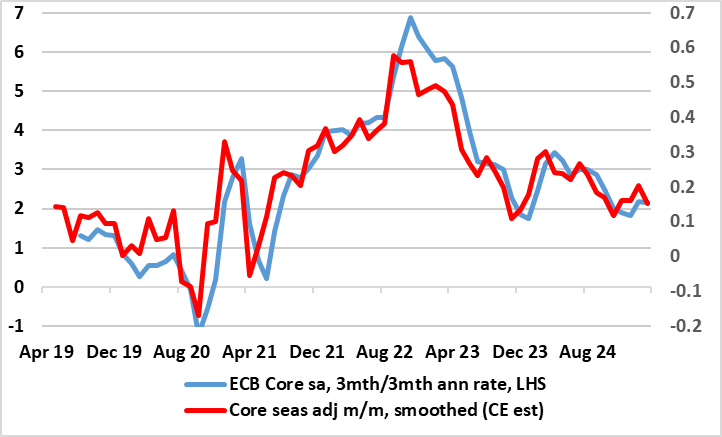

February HICP inflation numbers did deliver better news and broadly and less marginally so after revisions with the headline dropping 0.2 ppt to an as-expected 2.3%. This ended a run of three successive rises and came about despite a rise in food inflation. Regardless, the core also eased 0.1 ppt from January’s six-month high to 2.6%. We see more supportive news in the March flash numbers, with the headline and core down 0.2 ppt (the former to 2.1% and hence the lowest since last autumn), services down perhaps a little more sizeable and the core down (Figure 1) and where adjusted data continue to suggest underlying price pressures are consistent with the ECB target (Figure 2).

Figure 1: Headline Slips Back Further as Services Resilience Cracks Again?

Source: Eurostat, CE, ECB

February’s details showed, most notably, an easing in what had previously been seemingly relatively stable services inflation, down 0.2 ppt to a 22-mth low of 3.7%. The softer core and services messages have been flagged by shorter-term price momentum data and persistent price gauges which already suggest that core and even services inflation have slowed and are running around target. As for March, our projections chime with implicit ECB thinking that pointed to a 2.3% headline and 2.5% core average in the current quarter.

As we have noted previously, there are some signs in retailing surveys suggesting disinflation may have stalled. But this may be of increasing secondary importance to most of the ECB Council as a) inflation is already consistent with target; b) cost pressures are under control and may indeed be easing when it comes to wages and c) a fresh and more demand driven disinflation could be triggered by what seems to be a weaker real economy backdrop that could also exacerbate financial stability risks.

Figure 2: Core Inflation Around Target in Shorter-Term Dynamics?

Source: Eurostat ECB, CE

This is all visible in adjusted core HICP readings. As for the March flash HICP we see it down, partly a result of drop back in fuel costs (although this may feature more in April numbers) but also where more signs of softer services inflation are likely to be seen, this also evident in adjusted short-term numbers.

German Data Preview

Ahead of the EZ HICP figures come an array if national numbers. Germany’s disinflation process continues, but there have been signs that the downtrend is flattening out but this changed somewhat in February. Indeed, HICP inflation fell back from January’s 2.8% to a 3-mth low of 2.6%, this despite a pick-up in food inflation. Moreover, perhaps clearer disinflation news was evident in the where the core which fell back 0.5 ppt to 3.1% and services eased 0.4 ppt to cycle-low of 4.7%. We see the headline rate dropping another notch to 2.5% in data due Mar 31 with services and core also lower and more decisively so. Moreover, adjusted m/m data may show some fresh downtick in core rates.

German inflation data is preceded on Mar 28 with CPI numbers firstly from n France , where March data may rise 0.2 ppt from February 0.9% in February, driven primarily by unfavorable baseeffects, partly accentuated by an increase in the VAT rate of gas and electricity. The same day sees Spanish numbers where the headline may drop around 0.4 ppt to a 3-mth low of 2.5% and where CPI data may show the core rate nearing 2%.