Eurozone Flash GDP Preview (Apr 30): The Calm Before the Storm that Surveys May Be Flagging?

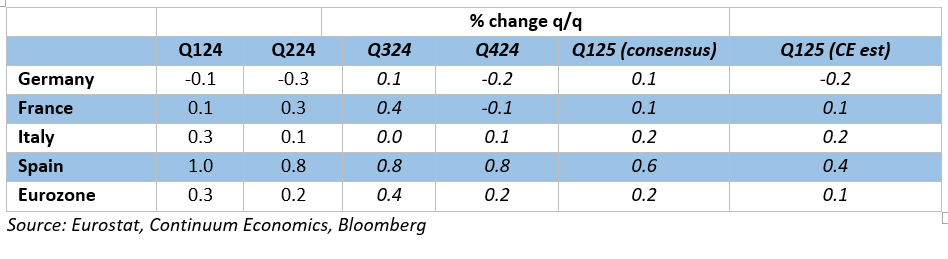

Continuing a series of upside surprises, EZ GDP overshot both consensus and ECB expectations in Q4), albeit only after what was a cumulative 0.2 ppt upward revisions compared to the flash. We see a further rise in Q1 data (Figure 1), partly reflecting recent m/m increases in both manufacturing and services that both conflict with softer survey messages but still show geographical divergences. Regardless even though the flash GDP is released just a few weeks after the quarter it relates to, it may be even more effectively historic this time around. This is because whatever message it does provide will offer little guidance to the months and quarters ahead where the U.S tariff threat looms larger and threateningly, as the EZ PMIs very much highlight. Indeed, while the April PMIs stressed that into early Q2, activity was held back by a faster reduction in new orders and waning confidence in the year-ahead outlook, they are not (yet) consistent with recession. But with business sentiment the lowest for well over two years and weakness stressing afresh into hitherto solid services (where confidence was the weakest in almost five years), the PMIs do suggest stormier conditions ahead. We see flat GDP for this and the next quarter, but with downside risks!

Figure 1: Divergent EZ GDP Picture Continues?

Little to be Learned from Looking Backwards…

There is a certain irony that for an ECB Council that has evidently shifted its main concern away from broadly falling inflation to real economy weakness, any apparent Q1 GDP resilience may make little difference to the ECB’s thinking, even if draws some comfort should further signs of a consumer recovery appear. But notably, on the consumer side, the question here both being to what extent this may reflect a running down of excess household savings and the extent to which the business side may weaken regardless. Moreover, the GDP numbers are likely to continue to suggest an EZ economy that is still diverging as Germany stutters, if not contracts, while Spain prospers, even though it should slow. Recently this has reflected political uncertainty disparities but these are now being very much accentuated by trade and more general worries and on a broader geographical basis.

…As a New World Awaits

As for the tariffs, given what we know at present, models that include both short- and long-term estimates foresee an overall GDP drop of about 0.3 ppt for the EU/EZ, albeit where such estimates do not account for all effects, such as the risks posed by a financial crisis in the US. Such estimates chime with recent projections by the likes of the IMF and even the ECB itself. Notably, the impact is relatively small compared to other shocks (eg COVID at 5 ppt-plus; the energy crisis caused by Russia’s invasion of Ukraine at 2 ppt-plus) because of the relatively limited exposure of the EU economy to trade with the US. While 20% of extra-EU exports go to the US, this exposes only around 2% of EU GDP in 2021. As most other economies will be equally affected by Trump’s tariffs (and China much more severely), the main effect will be from a hit to US demand, rather than a negative competitiveness shock relative to other economies. As a result, we see GDP growth this year at around 0.5%, a figure that apparently may see a recession avoided.

Amid Broader Downside Risks

But there is an added downside risk in terms of financial conditions, one stemming from EZ banks becoming increasingly reluctant to lend as they reduce their risk tolerance and raise their perception of risk, given fears of a spill-over of a potential recession. Indeed, the ECB’s latest bank lending survey offered worrying signs in regard to firms. It showed a further (admittedly more modest) tightening in actual and expected company credit standards and a fresh fall in company’s credit demand with smaller firms also facing increasing rejection rates in pursuit of loans. Higher perceived risks related to the general economic and firm-specific outlooks drove the further net tightening of credit standards with the tariff threat evident amid increased scrutiny by banks of corporate borrowers particularly exposed to exports to the United States.

Vital Services Momentum Ebbing

Regardless, the message from surveys is that hitherto solid services (which have been the main support to growth of late seems to be slowing). Indeed, April PMIs suggested a sharp drop in EZ business confidence, with sentiment down to the lowest since November 2022. The drop in confidence was widespread, both in terms of sector and geographical coverage. Each of the manufacturing and services categories posted lower optimism, with services confidence the weakest in almost five years. Geographically, France registered a pessimistic outlook for the first time in five months, while optimism waned in both Germany and the rest of the Eurozone.

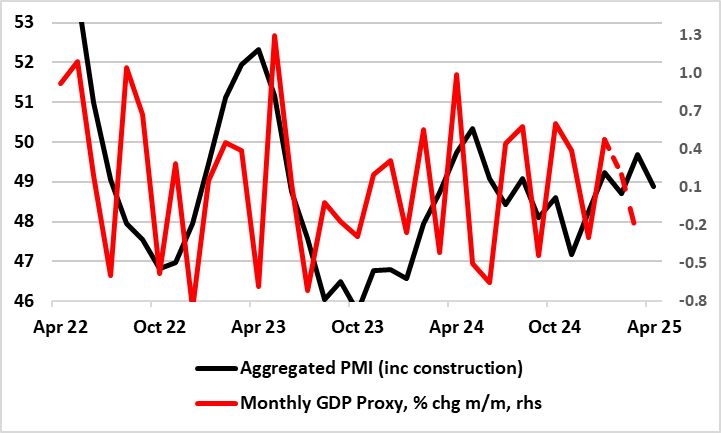

Figure 2: PMI Surveys Flashing Warning Signs…

Source: Eurostat, Markit; dashes are CE projection

GDP Flash Shortcomings

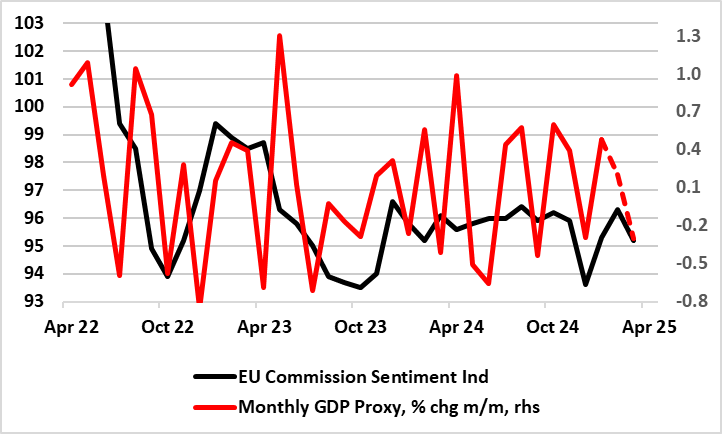

Amid a paucity of reliable data, it is important to recognize that there are clear shortcomings to the flash estimate for EZ GDP. No details come with these flashes and they are prone to clear revisions, where even a 0.1 ppt change can be very meaningful when the economy is hardly growing, ie half that seen for Q424 numbers. They are based on incomplete activity numbers with usually only one monthly published value for services and two for construction and manufacturing. However, aggregating these three output sectors allows the creation of a monthly GDP proxy, albeit a figure that is volatile far from tallies with actual GDP outcomes. Ever so, this suggest that after positive outcomes early in Q4, to get a modest rise for the last quarter implies that monthly GDP probably fell in both/either Feb/Mar (Figure 2). If so, this chimes with the survey data suggesting an adverse base effect in Q1, pointing to a loss of momentum spilling over into the current quarter – as the surveys suggest with those provided by the European Commission softer than the PMIs figures – this notable given the wider sector and geographical coverage (Figure 3).

Figure 3: European Commission Surveys Flashing More Notably…

Source: Eurostat, European Commission; dashes are CE projection

This to us implies that the economy could contract this quarter. But at this juncture we pencil in a flat outcome, one that may be b repeated in Q3!