Eurozone Banks Offer ECB More Cause for Concern

The ECB can draw comfort from signs that credit demand and supply for EZ households continues to improve. But the ECB’s latest bank lending survey (BLS) also offers worrying signs in regard to firms as well as questioning the alleged neutrality of the QT program. It shows a further (admittedly more modest) tightening in actual and expected credit standards and a fresh fall in company’s credit demand with smaller firms also facing increasing rejection rates in pursuit of loans. Higher perceived risks related to the general economic and firm-specific outlooks drove the further net tightening of credit standards with the tariff threat evident amid increased scrutiny of corporate borrowers particularly exposed to exports to the United States. As for weaker demand, this reflected a negative contribution from firm inventories and working capital and came despite support from declining interest rates. But the BLS points to economic and geopolitical uncertainties as a dampening factor for firms’ longer-term planning and thus capex plans. Thus the tariff threat was taking a toll on banks’ willingness to lend and firm’s appetite to borrow even in March, ie well before the possible scale and breadth of the tariff threat emerged.

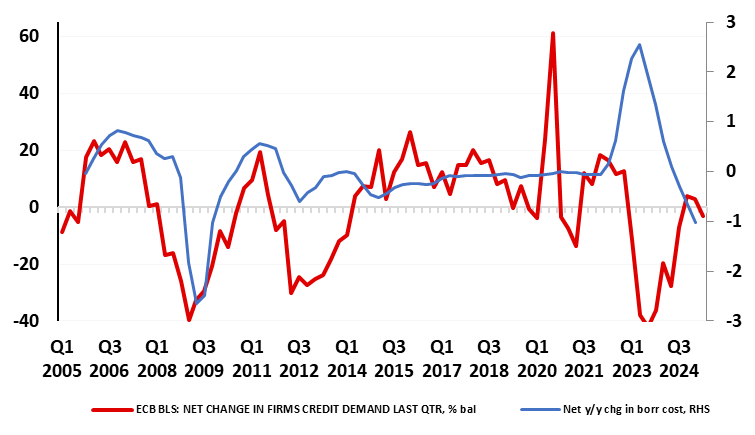

Figure 1: Firm Loan Demand Not Responding to Lower Borrowing Costs?

Source: ECB

Tariff Threat Broader?

Not least given the manner in which financial conditions have been tightening, the then-notable change in rhetoric from the ECB last month to suggest the policy stance had become less restrictive is already out of date as the ECB instead grapples with increasing downside risks (to both growth and inflation that now require risk management as the theme driving policy ahead. These risks stem not just from the direct consequences to trade from the U.S. imposed tariffs but also from export diversions and the increasing threats of inter-twined slumping business confidence and capex intentions as well as the surging euro damaging competitiveness, the latter accentuating already tighter financial conditions. Moreover, the ECB thus now knows that the tariff threat has not only a clear direct impact via a reduction in demand for EZ exports but a wider and more indirect impact in that it may already be inhibiting both the demand and supply of bank credit. Notably, as Figure 1 shows, it is unusual for company loan demand to be persistently negative against a backdrop of a clear and increasing fall in borrowing rates. All of which adds to the argument that gauging policy restriction by looking at certain policy rates relative to their historical position is very naïve, if not erroneous

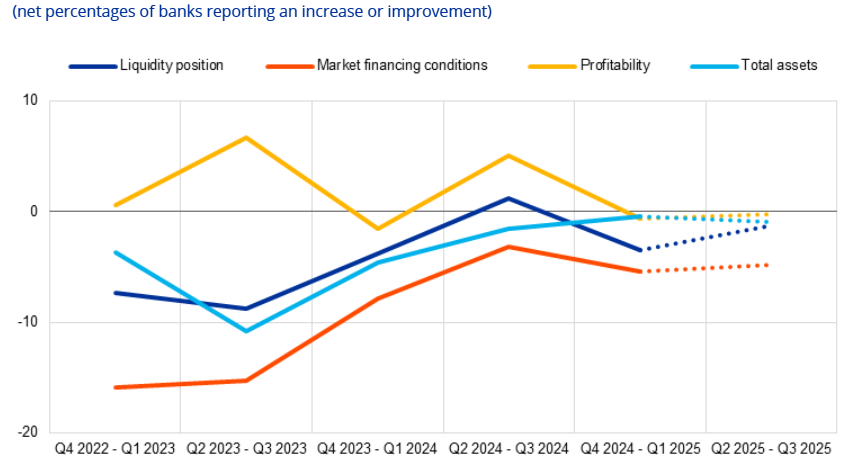

Figure 2: Assessing Impact of the ECB’s Balance Sheet on EZ Banks’ Financial Situations

Source: ECB

QT and Balance Sheet Questions

But the ECB has another worrying message it is getting from its BLS – namely that QT is not as neutral as it has been alleging. The BLS was very clear that the reduction in the ECB monetary policy asset portfolio had a negative impact on both the market financing conditions and liquidity positions of EZ banks over the last six months, admittedly a modest one. This reflects the tightening impact of redemptions of the Eurosystem’s bond holdings under the ECB’s asset purchase programme and under the pandemic emergency purchase programme. Notably, the deterioration in market financing was slightly stronger than in the previous six months. Indeed, as Figure 2 shows, banks’ liquidity and financing conditions have worsened in the last year and both are expected to remain negative in the year ahead.

All of which may make the ECB more formally lean away from its overall assessment that its balance sheet reduction has been ‘absorbed by markets in a very innocuous way over the course of time’. Indeed, a view by Board member Piero Cipollone who has overseen ECB research which shows that the composition of central bank reserves is very important for banks’ lending ability. The research estimates that debt portfolio holdings will decrease by around EUR 500 billion in 2025. This is associated with a possible EUR75 billion decline in credit supply, ie between 0.5 and a full ppt in terms of growth rates damage. To put this into perspective, it is roughly equivalent to the amount of loans that banks granted to non-financial corporations in 2024. The possibility is that if the ECB sees more signs of banks wariness about lending both/either from risks awareness and/or the reduction of the ECB balance sheet is putting pressure on banks’ lending capacity, the Council will need to monitor this effect and take it into consideration when calibrating its monetary policy stance. This alone may potentially mean greater/faster conventional easing and even revisiting the planned further reduction in its balance sheet.