Eurozone Labor Market: Rising Supply Adding to Lower Wage Pressures

With the EZ jobless rate nestling at record lows, it would support the ECB assessment that the EZ labor market is strong, the central bank seeing only a small rise in the jobless rate this year and on to be reversed from early next year onwards. However, that glosses over the fact that the labor market is actually easing at present with the run of six successive jobless numbers at 6.2% masking a rise in the level of joblessness through that period. This reflects what has been a further but slightly different rise in the EZ labor force (Figure 1), a factor we have repeatedly suggested that has helped contain wage pressure and may continue to do so. In context, this labor force rise may have prevented the jobless rate from rising to a high as 7%.

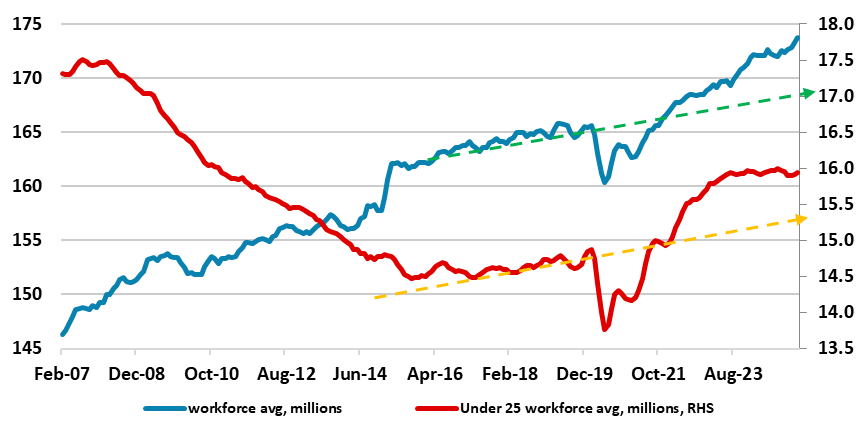

Figure 1: EZ Labor Supply Continues to Grow Faster that Pre-Pandemic Trend

Source: Eurostat - dashed line are pre-pandemic trends

EZ labor market data is short on detail at least on a timely basis, but with unemployment rates and level figures available, a measure of the labor force (ie the denominator in the jobless rate calculation) can be estimated. As we have repeatedly suggested in the last few years, the EZ stands out among the DM world for having a backdrop where the labor force or supply has been increasing post pandemic. Indeed, the EZ is even more of a DM exception in that labor supply has not only continued to rise but has been doing so at a faster pace than prior to the pandemic (Figure 1). But this rise has seen subtle changes of late. Initially, it was very much driven by an increase in the supply of younger workers (ie under 25 years), the fact that they being much more likely to seek new jobs in pursuit of added remuneration possibly helping to contain wage pressures. But more recently, older works have started to lead the rise in labor supply. It is unclear what is driving this trend, whether it be immigrants seeking employment and or economic pressures; the fact that it has been more driven by females does at least support the latter factor.

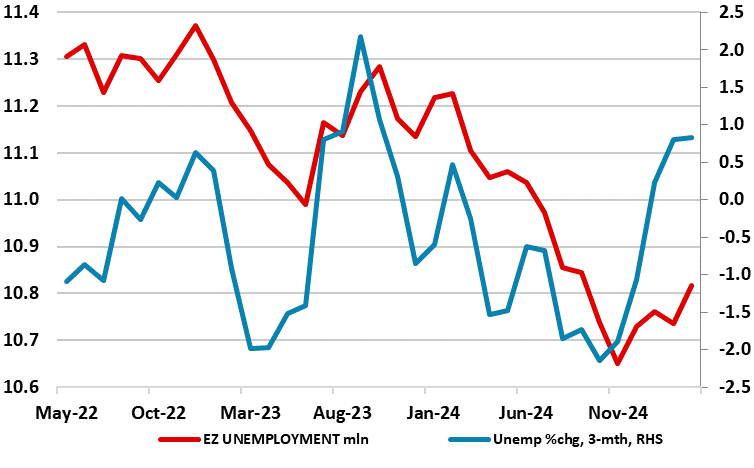

Figure 2: EZ Unemployment is Rising Despite Stable Jobless Rate

Source: Eurostat

But notably in the last 5-6 months the rate of labor supply growth has picked up markedly, rising by almost 3 mln or over 2% y/y. Unsurprisingly, not all this added supply of labor have found jobs, with a portion instead becoming formally unemployed. In fact, around 170 K have been added to the jobless total, and by around 1% in the last three months alone (Figure 2), this rise not showing up in a higher jobless rate due to the offsetting impact from labor supply. We would caution that this rise is a result of increased supply, not reduced demand with little sign that companies are making or even entertaining the idea of redundancies, at least at this juncture – NB labor hoarding has clearly been a major factor in company labor planning. But the fact is that added supply, against even stable demand, would be consistent with downward pressure on wages, something that the ECB’s wage tracker has increasingly found of late – the latter suggesting negotiated wage growth of less than 2% by year end – ie lower than the average of the last decade.