Eurozone

View:

February 20, 2026

Reciprocal Tariffs: Supreme Court Strike Down

February 20, 2026 4:31 PM UTC

· The 6-3 vote by the Supreme court and full ruling against reciprocal tariffs means that the Trump administration will likely resort to other tariffs for negotiating leverage. However, the Trump administration will also pressure to codify existing trade framework deals that have be

February 12, 2026

Cuba: Pressure Grows

February 12, 2026 8:05 AM UTC

· The Donroe doctrine has pressured Mexico into halting oil exports to Cuba, which is intensifying pressure on Cuba’s regime. While chaos and attempted mass immigration is a risk, the baseline is for a negotiated deal as U.S./Cuba discussions deepen – though with the added complex

February 10, 2026

EUR/USD: Europe’s Counter Threats to Trump

February 10, 2026 11:05 AM UTC

· Europe is highly unlikely to weaponize its existing portfolio holdings or new flows into the U.S., as Europe is dependent on the U.S. nuclear umbrella and as EZ/EU decision making is slow and modest in action. Such a move would be strongly opposed by EZ/European investors. Even so,

February 05, 2026

ECB: Papering Over the Cracks

February 5, 2026 2:51 PM UTC

· As widely expected the ECB kept the policy rate unchanged at the February meeting. The broad message remains that the ECB Council is comfortable with current policy rates, which provides short-term forward guidance of no change in rates. This message came from the ECB statement an

February 04, 2026

U.S. Inflows: Portfolio Dominates

February 4, 2026 12:05 PM UTC

· Portfolio flows have dominated U.S. C/A financing looking at the breakdown of the balance of payment data (BOP), with no material slowdown in 2025 from foreign investors. U.S. investors did accelerate buying of overseas equities but this was counterbalanced by slower U.S. buying of

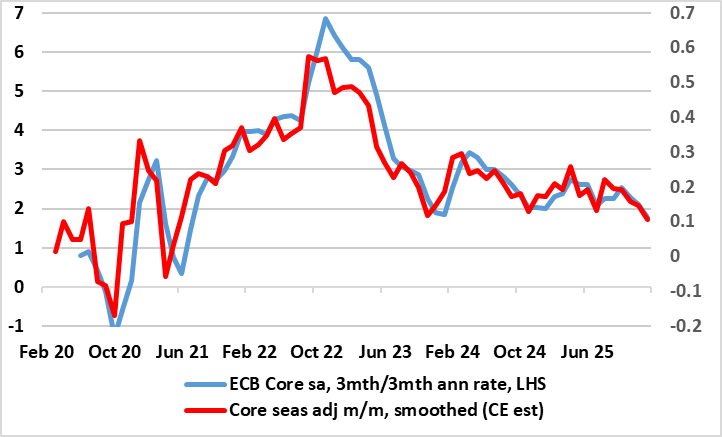

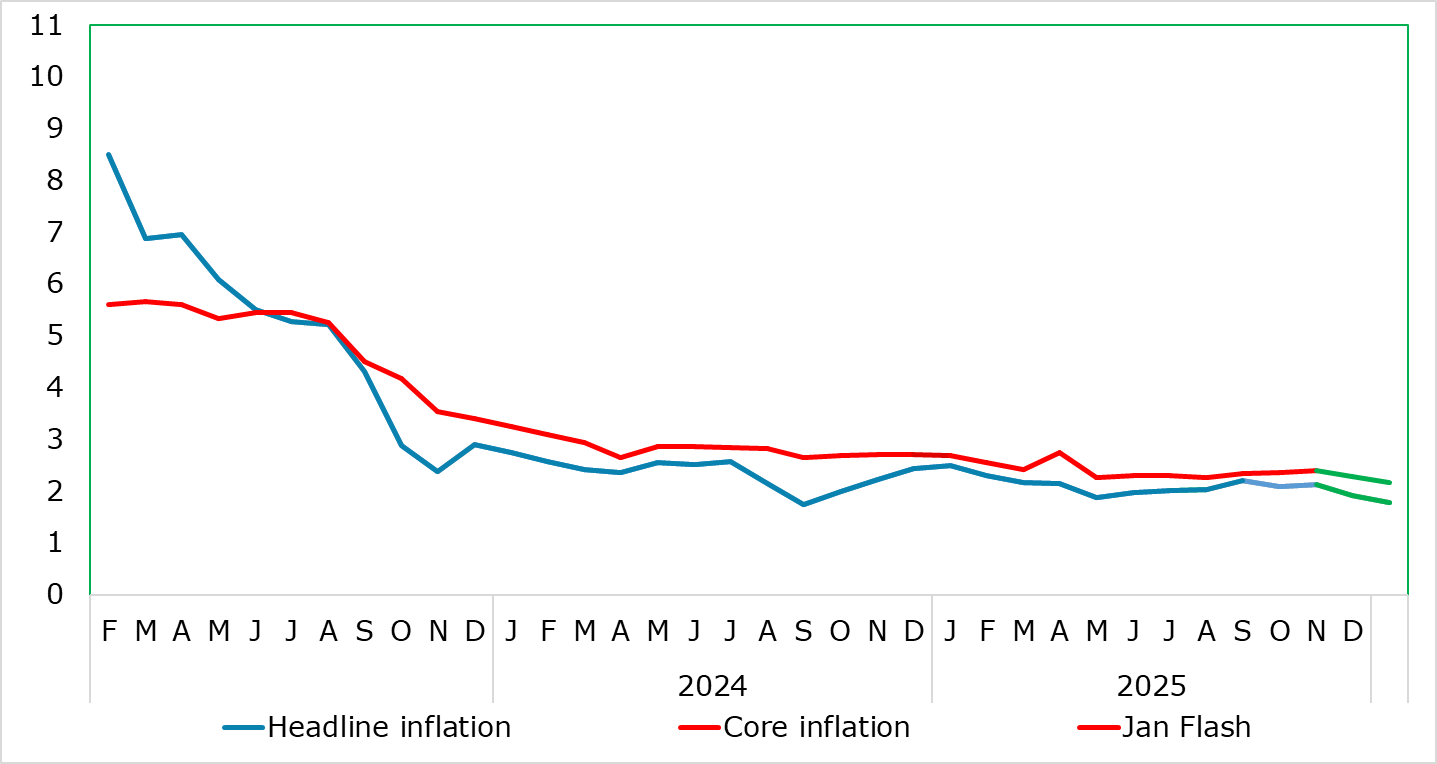

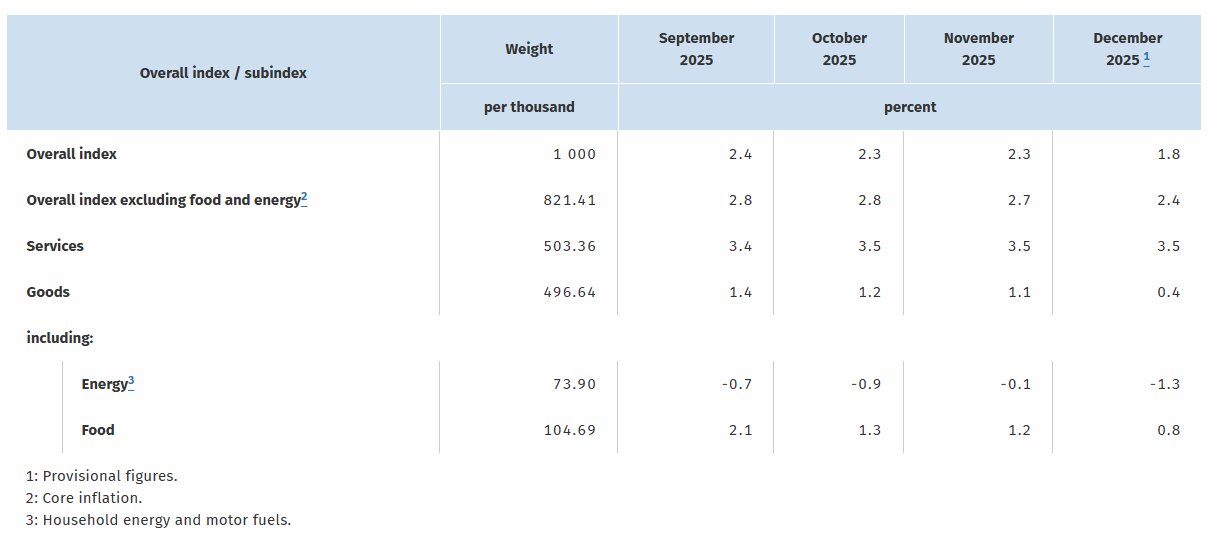

EZ HICP Review: Services Inflation Less Resilient as Core Hits Cycle-Low

February 4, 2026 11:19 AM UTC

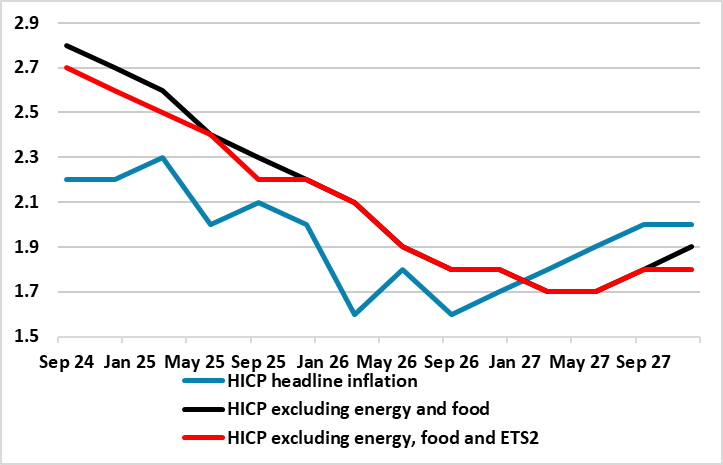

Having been range bound for some 5-6 months between 2.0% and 2.2% until November but after a fall to 1.9% in December headline HICP inflation dropped to 1.7% in the flash January data, thereby matching expectations and the short-lived Sep 24 outcome. The drop came in spite of higher food inflation

February 03, 2026

Europe Nuclear Weapons; NATO and Greenland

February 3, 2026 11:05 AM UTC

· Without the U.S. nuclear weapon umbrella, Europe’s nuclear deterrent is too weak. Secondly, European countries are highly reliant on U.S. missile defense, command, intelligence and reconnaissance, which military experts estimate could take 10 years to replace. Major European count

February 02, 2026

EZ HICP Preview (Feb 4): Services Inflation Less Resilient as Headline to Slip Further

February 2, 2026 12:07 PM UTC

HICP inflation had been range bound for some 5-6 months between 2.0% and 2.2% with the November and October numbers in the middle of that range. And it seemingly stayed in that range falling to 2.0% in the December flash numbers, only to be revised down a further notch to 1.9% in the final HICP figu

Markets: Profit-Taking or More?

February 2, 2026 9:22 AM UTC

• For now we see some further profit-taking on risky positions in gold/silver/copper/equities and short USD positions. However, a bigger macro catalyst is required to produce a deep correction in equities and major risk off. The nomination of Kevin Warsh for Fed chair is unlikely to be

January 30, 2026

ECB Preview: After GDP and Before Feb Meeting

January 30, 2026 10:05 AM UTC

· Most on the ECB council appear to be comfortable with steady policy in H1 2026, after a cumulative 200bps of cuts. This will likely be the overall message from the February 5 ECB meeting. This will paper over differences for 2027 among ECB council members. However, we agree with the

January 29, 2026

January 28, 2026

Trump’s Problems

January 28, 2026 8:35 AM UTC

Overall, the Trump administration’s hyperactive start to 2026 is unlikely to achieve success on the number one issue for voters in the shape of cost of living concerns. Meanwhile ICE’s immigration tactics in Minnesota are causing concerns among swing voters, though Trump geopolitical adventuri

January 27, 2026

USD Hurt by Hedging More than Asset Outflows

January 27, 2026 10:53 AM UTC

The Greenland drama and fears of BOJ/Fed Intervention on USDJPY has put the USD under renewed downward pressure against DM Currencies. What happens next? Overall, we see scope for further USD decline versus DM currencies in 2026 on more currency hedging; some diversification away from the U.S.

January 19, 2026

ECB Steady Signals, But

January 19, 2026 8:55 AM UTC

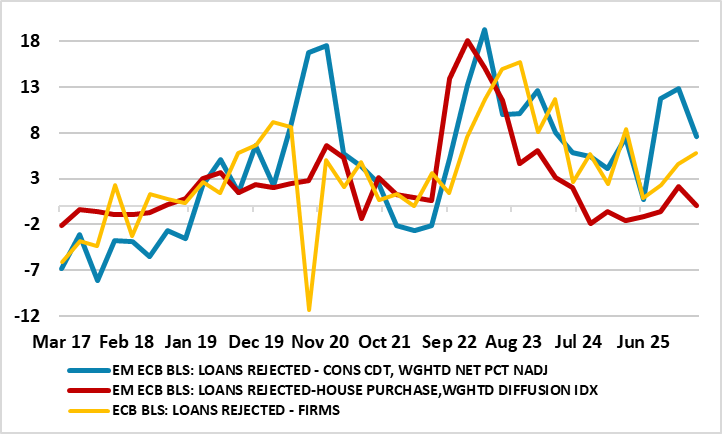

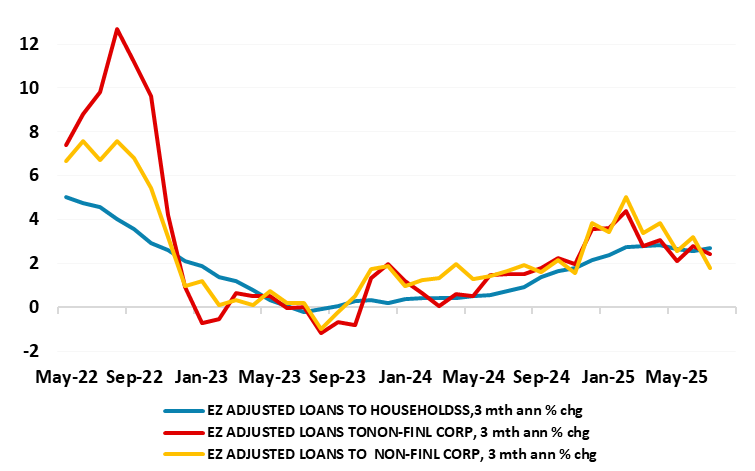

• We remain of the view that financial conditions and lending rates are worse than the current ECB depo rate level suggest and means that 2026 EZ growth does not really pick-up. Combined with a mild undershoot in inflation, this can build the case for the ECB to deliver two 25bps cuts.

January 14, 2026

DM Government Debt: 2026 Supply & Voters’ Resistance To Fiscal Consolidation

January 14, 2026 11:55 AM UTC

· We see the most persistent issue being supply (budget deficit + QT) in 2026, which should lessen into 2027 with a slowdown in ECB/BOE QT and a partial U turn by the BOJ. However, governments are also struggling with electorates that are resistant to higher taxes or lower governmen

January 13, 2026

Taiwan: Worst Case Consequences

January 13, 2026 3:26 PM UTC

· The most likely option for China is to continue the air and naval grey zone warfare around Taiwan, combined with support for pro-China factions in Taiwan’s parliament to build pressure for reunification at some stage before 2049 (the 100th anniversary of the communist party). Wi

January 12, 2026

Maximum Trump

January 12, 2026 9:55 AM UTC

· Overall, though Trump action can cause volatility in financial markets, the major issues remain the performance of the U.S. economy and whether the current scale of AI optimism will remain. Monthly TICS data since the April reciprocal tariffs show that global investors continue inwa

January 08, 2026

Reciprocal Tariffs: Supreme Court Ruling and The Aftermath

January 8, 2026 8:05 AM UTC

· A Supreme Court ruling, partially or in full against reciprocal tariffs, would not produce a major slowdown in U.S. inflation or boost to growth, as the Trump administration would be full of threats for replacement tariffs – Trump would be worried about the loss of negotiating pow

January 07, 2026

EZ HICP Review: Services Inflation Still Resilient But Core Goods Soften Further

January 7, 2026 10:44 AM UTC

HICP inflation has been range bound for the last 5-6 months between 2.0% and 2.2% with the November and October numbers in the middle of that range. And it stayed in that range falling to 2.0% in the December flash numbers, albeit where adverse rounding pre vented a fall to 1.9%. We see this as th

Greenland: U.S. Sphere of Influence or More?

January 7, 2026 8:05 AM UTC

· Trump will likely go for more pressure and then seek to negotiate with Denmark and Greenland. Denmark and Greenland already have mutual interests with the U.S. on security; minerals and Russia/China that are already covered by previous agreements and understandings. Trump would li

January 06, 2026

German HICP Review: Headline and Core Down Afresh

January 6, 2026 4:25 PM UTC

Germany’s disinflation process resumed with a bang as December saw a larger-than-expected fall in both headline and core inflation. Indeed, the headline HICP fell 0.6 ppt to a five-month low of 2.0%. This was largely food and energy driven but still with some fall in core at least according to

January 05, 2026

Venezuela: Oil and Geopolitics

January 5, 2026 12:02 PM UTC

· Venezuela’s oil production will likely take years to increase substantively due to poor infrastructure, the need for substantive investment, and a lack of democratic political stability. In terms of geopolitics, operations in Venezuela reinforce the Trump administration’s pivot

AI and U.S. Productivity

January 5, 2026 8:04 AM UTC

· Structural labor and overall productivity will be boosted if current AI adoption is sustained at a pace quicker than the adoption of the internet. However, not all areas of the U.S. economy are exposed to AI benefits, as manual work can only be replaced by humanoid robots with maj

January 02, 2026

December 22, 2025

December 19, 2025

December 18, 2025

ECB Review: On Hold Message to Convert to Easing on Disinflation

December 18, 2025 3:09 PM UTC

· The ECB increased its 2026 GDP and inflation forecast and appears happy with current policy rate levels. However, still tight financial conditions, plus easing wage growth, point to disinflation and growth disappointment. We see this switch the ECB from an on hold message to easin

DM FX Outlook: Scope for USD decline against JPY, AUD and NOK

December 18, 2025 2:31 PM UTC

· Bottom Line: We expect some modest USD losses across the board over the next couple of years, but there is much more scope for losses against the JPY, AUD and NOK than the other G10 currencies, as yield spreads have moved dramatically in favour of these currencies, and the currencies

December 17, 2025

DM Rates Outlook: 2026 Yield Curve Steepening Before 2027 Flattening

December 17, 2025 9:21 AM UTC

· Multi quarter, we still look for 50bps of further Fed easing by end 2026, which will likely initially bring 2yr yields down to 3.35%. However, once the Fed Funds rate get closer to 3.0-3.25% and the assumed slowdown turns into a soft landing, the 2yr will likely move to a premium ve

December 12, 2025

Equities Outlook: Choppy Up For 2026 and Down for 2027?

December 12, 2025 8:05 AM UTC

· The U.S. equity market is underpinned by the bullish AI/tech story and a soft economic landing into 2026. However, overvaluation is clear and this leaves the market vulnerable to a 5-10% correction on moderate bad news e.g. economic data. We see the S&P500 having a choppy year a

December 11, 2025

Eurozone Outlook: Running to Keep Fiscally Still?

December 11, 2025 10:09 AM UTC

· Amid what may still be tightening financial conditions and likely protracted trade uncertainty, we retain our below consensus activity forecast for 2026 but see a fiscally driven pick-up into 2027. However, the picture this year appears to be slightly better but the economy has actual

December 09, 2025

ECB Preview (Dec 18): Still in Good Place – or Even Better?

December 9, 2025 7:52 AM UTC

A fourth successive stable policy decision will be the almost inevitable outcome of the ECB Council meeting verdict on Dec 18, with the discount rate left at 2.0%. The likely unanimous vote will mask splits about whether policy has troughed or not, this mainly a result of differences within the Co

December 08, 2025

AI and U.S. Equities

December 8, 2025 8:50 AM UTC

· The AI story has driven broad momentum in the U.S. equity market, but will likely become narrower driver in 2026 and 2027, as not all big AI/tech companies will generate clear explosive revenue from areas outside cloud computing and semiconductor chips. Companies that are also depende

November 28, 2025

China’s Hidden Gold Buying: Why?

November 28, 2025 1:05 PM UTC

Speculation has been growing in the gold market that the surge in unrecorded gold purchases could be linked to China.

Overall, some unreported buying of gold by China could have occurred in 2025 and also in 2022-24. This could be a combination of wanting to avoid upsetting Trump during a tense U.S.-C

November 27, 2025

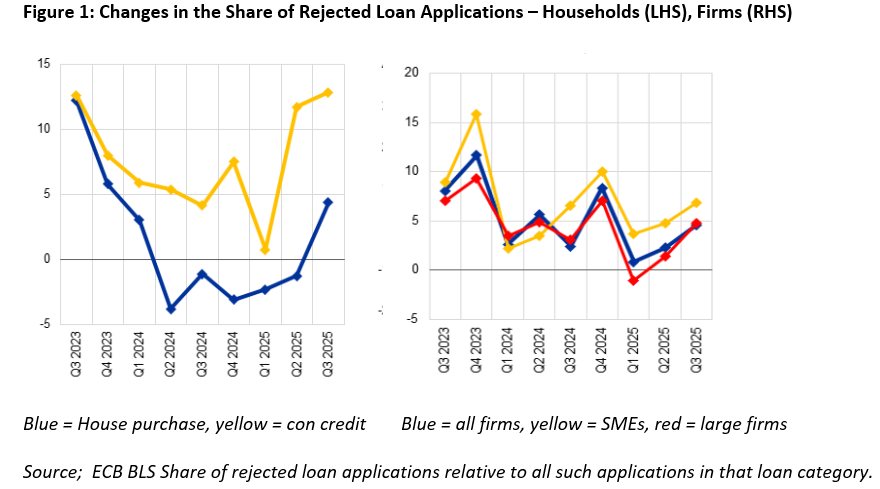

Eurozone: Tighter Corporate Credit Standards Continues and More Loans Applications Rejected

November 27, 2025 1:36 PM UTC

Given the early January timing of the survey, which far from fully embraced the added uncertainty caused by President Trump’s trade threats, it was still hardly a surprise despite that the reported net tightening credit standards merely accentuates trends in the three previous Bank Lending Surveys

November 26, 2025

U.S. Corporate Bonds Into 2026

November 26, 2025 10:15 AM UTC

· Though U.S. corporate bond spreads are tight, absolute yield levels are reasonable due to higher U.S. Treasury yields than most of the post GFC period. The main risk remains of a U.S. recession, though economic data is more consistent with a soft landing and we have reduced the prob

November 24, 2025

Japan Aging: Consumption Lessons for Eurozone/China?

November 24, 2025 10:55 AM UTC

· China will likely suffer slowing consumption from population aging in the coming years, as consumption per head falls for over 55’s and large scale immigration is not a likelihood. China’s household wealth is also heavily concentrated in falling illiquid residential property. Chin

November 21, 2025

U.S. Asset Inflows After April’s Trump Tariffs

November 21, 2025 8:00 AM UTC

· Net foreign portfolio inflows have not been hurt by Trump’s April tariff drama, with the AI and tech boom attracting new equity inflows. Flows could become more volatile with a U.S. equity bear market or recession, but these are modest risk alternative scenarios rather than high r

November 18, 2025

Markets 2026

November 18, 2025 10:30 AM UTC

· The Fed, ECB and BOE will likely drive further 10-2yr government bond yield curve steepening, with 10yr Bund yields rising due to ECB QT and German fiscal expansion. 10yr JGB yields are set to surge through 2%, as BOJ QT remains excessive and underestimated. The BOJ could partiall

November 17, 2025

Financial Stability Risks: Vulnerable To A Recession

November 17, 2025 1:00 PM UTC

The November Fed financial stability review highlights continued concern over hedge funds and insurance company leverage, while the IMF GSFR is concerned about U.S. equity market overvaluation and growing links between banks and non-bank financial intermediaries. However, the main adverse shock wo

November 14, 2025

ECB – In a Good Place or Just Complacent?

November 14, 2025 11:55 AM UTC

The ECB is of the view that downside growth risks have dissipated somewhat, this possibly helped by its recent actions which it suggests leave its current policy stance in a good place. However, amid a hint of what we think is a complacent upgrade about the EZ’s alleged resilience, we think, the

November 11, 2025

EZ Rates: 2026 ECB Easing But 2027 French Crisis?

November 11, 2025 9:45 AM UTC

· Financial conditions are tighter than suggested by a 2% ECB depo rate, which will both dampen an EZ economic pick-up and cause further disinflation. We see the ECB delivering two further 25bps cuts to a 1.5% ECB depo rate, which can mean a further decline in 2yr Bund yields. Howev

November 06, 2025

U.S. Equities: Smaller Correction But Still Overvalued

November 6, 2025 10:25 AM UTC

· We are revising up our end 2025 S&P500 forecast from 6000 to 6500 for a number of reasons. Private sector data shows the risk of a U.S. hard landing is lower than a couple of months ago, with economic data more consistent with a soft landing. Additionally, the tech/AI optimism has n

October 31, 2025

U.S./China Trade Framework: Avoiding Escalation

October 31, 2025 7:48 AM UTC

· The U.S./China framework deal avoids renewed escalation of trade tension, but is unlikely to be followed by a comprehensive trade deal in 2026 as China does not want major import and bilateral trade commitments. The economic effects will likely be small and the deal main aim app

October 30, 2025

ECB Review: Hedging its Bets, Hoping to Stay in a Good Place

October 30, 2025 3:23 PM UTC

There ie nothing tangible in the ECB update today to suggest that a further easing is likely at the next meeting on Dec 17-18. However, amid a hint of what we think is a complacent upgrade about the EZ’s resilience alongside a perceived reduction in global risks, the easing window has not been c

October 21, 2025

ECB Preview (Oct 30): Assessing the ‘Punchbowl’

October 21, 2025 12:55 PM UTC

As with recent Council meetings, what is important when the ECB gives its next (almost certain) stable verdict on Oct 30, is not what it says. Instead, in particular, it is how much the impression is left that the easing window has not closed. The ECB is clearly split about whether policy has trou

October 17, 2025

EZ Inflation Outlook: The Deeper Debate About 2028?

October 17, 2025 10:24 AM UTC

The ECB is clearly split about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation risks lie. Hawks perceive upside risks emerging while the dovish camp feels the opposite. These divisions are likely to magnify when the ECB updates its