ECB Preview: After GDP and Before Feb Meeting

· Most on the ECB council appear to be comfortable with steady policy in H1 2026, after a cumulative 200bps of cuts. This will likely be the overall message from the February 5 ECB meeting. This will paper over differences for 2027 among ECB council members. However, we agree with the doves concerns. We remain of the view that financial conditions and lending rates are worse than the current ECB depo rate level suggest and means that 2026 EZ growth does not really pick-up. Combined with a mild undershoot in inflation, this can build the case for the ECB to deliver two 25bps cuts in June and September 2026.

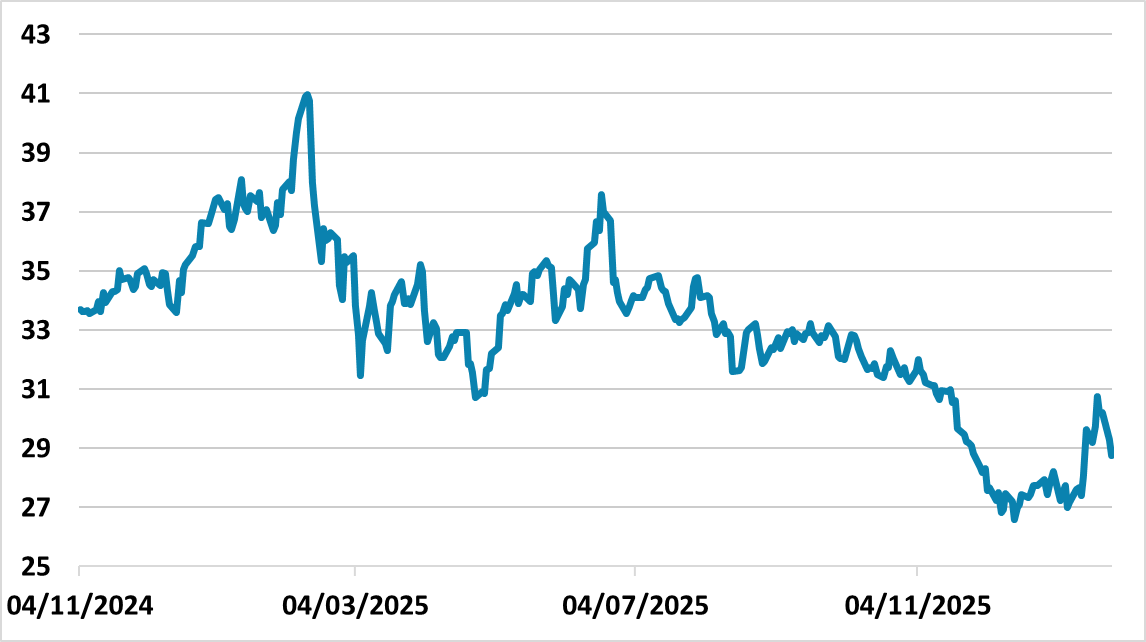

Figure 1: December 2026 TTF Gas Prices (EURs)

Source: Bloomberg/Continuum Economics

While an unchanged policy rate is expected on February 5 from the ECB, the communications will be watched closely for forward guidance. Key points to make are.

· ECB Steady, but Council Splits. Similar communications to the December meeting will likely be evident, with the ECB consensus towards keeping rates unchanged in the coming meetings after 200bps of easing. However, the December ECB minutes show a clear division between doves and hawks. The doves are concerned about the economic recovery, but also that slowing wage inflation could mean an undershoot of inflation. This could mean further rate cuts are needed. The hawks take a more upbeat view of the GDP trajectory, but are also concerned that recent wage compensation data means that inflation could now be slow to fall. For the hawks this could mean that tightening is required into 2027. ECB president Lagarde will likely diplomatically want to avoid showing these differences and will likely try to navigate the Q/A, without providing much clarity.

· Q4 GDP data and trend GDP. The Q4 GDP at 0.3% versus expectations of 0.2%, as Spain, Germany and Italy were marginally ahead of expectations. At face value the ECB will be comfortable with the headline until the details are released in March. Meanwhile, the February ECB meeting could also see a new view on trend GDP, with some hints that it could be revised upwards. We would feel that this would be incorrect, as Irish GDP has inflated 2025 GDP. Additionally, German defense spending will take time and not be matched elsewhere. Finally, trend productivity growth has not shown any improvement and labor force growth will slow with population aging and less net migration into the EZ.

· Other data since December. The December CPI 1.9% Yr/Yr shows that the disinflationary process remains in place and we look for the quarterly numbers to come down to 1.7% by Q2. The December EZ PMI composite has slowed to 51.5, though the January EU Economic confidence index jumped to 99.4 after previous months had suggests the broader economy is weaker. Finally, November M3 at 3.0% Yr/Yr is still weak.

· Trump threats and Gas prices. Though the threat of extra U.S. tariffs over Greenland has been defused for now, ECB council members will know that the Trump administration could threaten extra tariffs unless the EU quickly implements the trade framework deal. This is a clear downside risk to 2026 growth and argues for caution. This could mean that Lagarde leans against 2026 rate hike talk. Meanwhile, the spike in TTF gas prices due to cold weather in the U.S. has attracted some attention. However, this is mainly spot prices and the Dec 26 TTF contract has reacted less (Figure 1), while 2027 futures prices are unchanged. Gas prices are likely to be a transitory concern.

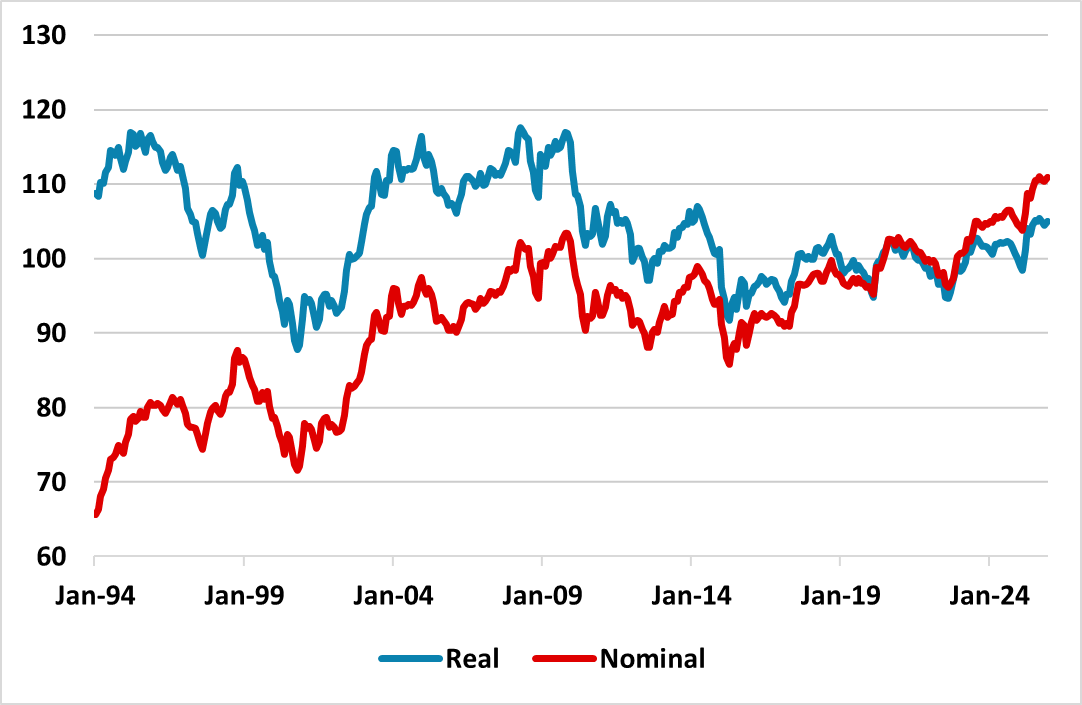

· Euro TWI. The Euro on a TWI basis continues to be very firm on a nominal basis (Figure 2), due to FX hedging of the huge portfolios from EZ institutions in the U.S.. Narrower interest rate differentials, Trump bias for a lower USD and a still overvalued USD v EUR have contributed. Some ECB officials are becoming concerned. However, ECB officials will also look at the real EUR (Figure 2), which is not as overvalued as the nominal TWI.

Figure 2: EZ Nominal and Real Exchange Rate (%)

Source: Datastream/Continuum Economics

· Steady for now, but. Most on the ECB council appear to be comfortable with steady policy in H1 2026, after a cumulative 200bps of cuts. This will likely be the overall message from the February 5 ECB meeting. This will paper over differences for 2027 among ECB council members. However, we agree with the doves concerns. Firstly, the ECB focus on compensation for workers is backward looking, with forward looking data (e.g. Indeed survey and wage tracker) suggesting wage inflation will be consistent with CPI inflation just below target. Secondly, we have also argued that financial conditions and lending are worse than the ECB depo rate would suggest, which reflects the extra refinancing costs for loans taken out between 2008-21 or return of investment calculations for new loans. The ECB Quarterly lending survey on February 3 is unlikely to see a significant improvement in credit demand or supply. Additionally, a wide set of economic indicators suggest the EZ economy is not really picking up, which the ECB should come round too. Finally, though defense and infrastructure spending will help Germany in 2026, other major EZ countries are fiscally restrained (see EZ Outlook here). Incoming economic data will build the case for further rate cuts and we have penciled in the June and September meetings, though we do not expect any hints yet.