EZ HICP Preview (Feb 4): Services Inflation Less Resilient as Headline to Slip Further

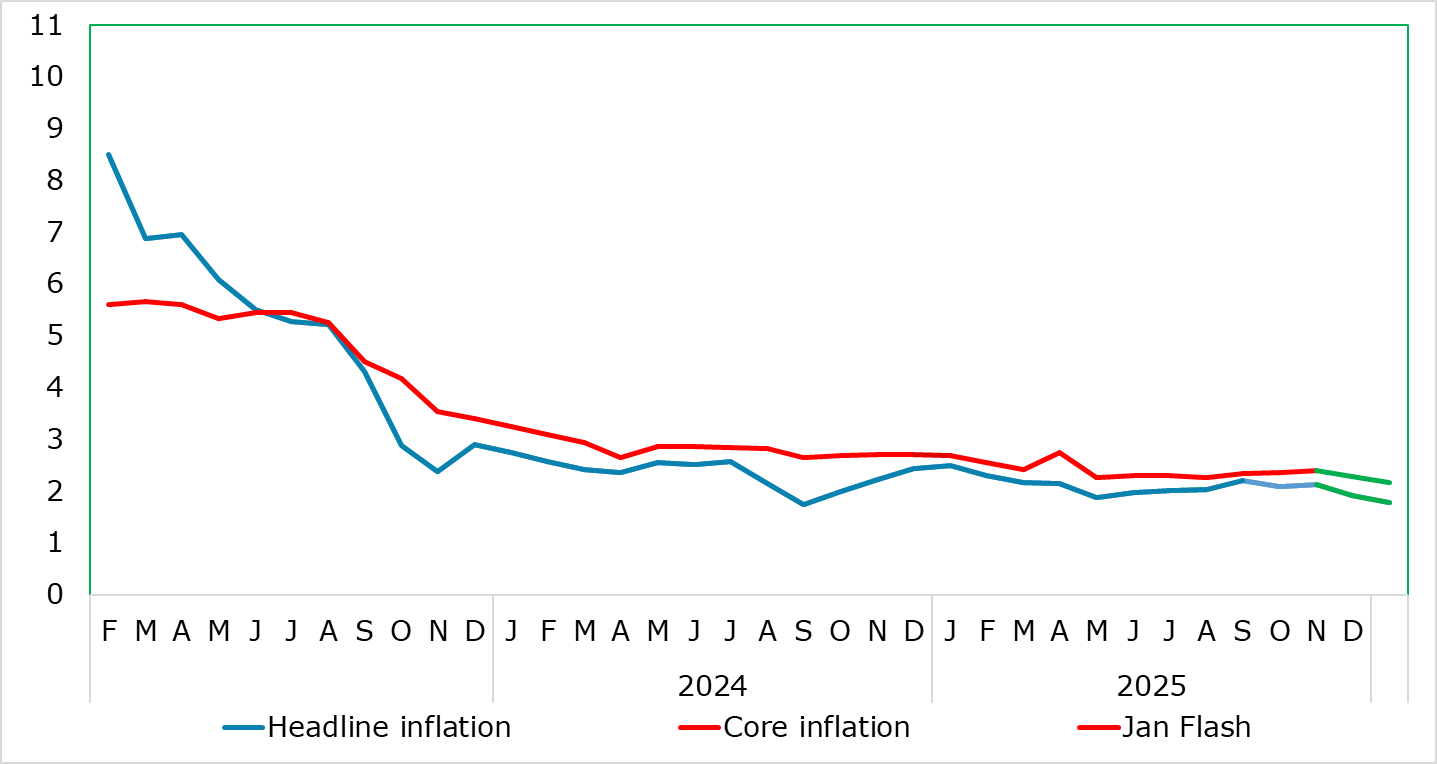

HICP inflation had been range bound for some 5-6 months between 2.0% and 2.2% with the November and October numbers in the middle of that range. And it seemingly stayed in that range falling to 2.0% in the December flash numbers, only to be revised down a further notch to 1.9% in the final HICP figure and thus to an eight-mth low. We see this as the start of a fresh but what may be a short-lived fall toward 1.5% in the current quarter, with a fall to 1.8% in the January flash – a fall to the cycle low of 1.7% last seen in Sep 24 is also possible. Much of this of this January drop will be energy related but a 0.2 ppt correction back in services last month is on the cards but probably not enough to pull the core down any further from its current cycle low of 2.3%. There are risks posed by the usual annual changes to the makeup and weighting of the HICP and perhaps form a further fall in non-energy industrial goods (NEIG) inflation, this possibly an increasing sign of softer import prices possibly related to Chinese export dumping.

Figure 1: Headline and Services To Edge Lower

Source: Eurostat, CE

As of this month’s numbers, several methodological changes will take effect in the HICP. Over and beyond the usual annual reweighting of the components, he index will be also now be compiled according to the new classification. Games of chance will be included in the HICP under the division of recreation, sport and culture. The index reference period will also be updated to 2025=100. What is clear is that with (relatively resilience) services having seen an increase in its weighting in the last three years this has acted to push up recorded overall inflation.

Regardless, the diehard hawks at the ECB will have focused on the recent rise in services inflation to a seven month high of 3.4%, a shift higher far less echoed by less favourable, but still target-consistent, adjusted m/m data. Even so, this seems to have reverberated within the ECB and seemingly prompted the upward revisions to the 2026 HICP outlook. Even so, the fresh fall back to 3.2% which we envisage (seemingly very much transport price driven) will not placate the hawks. What may do so is the other component of core inflation.

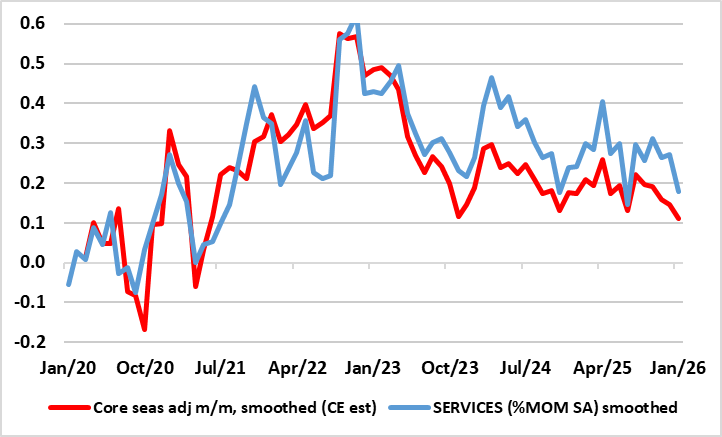

Even so, any further fall in non-energy industrial goods inflation from its 15-mth low of 0.4% may increasing be seen as increasing evidence of softer import prices possibly related to Chinese export dumping – ie such evidence is echoed by the clear fall in overall import price numbers of late. The question is whether what may be more than a cyclical fall in core goods inflation will offset any further (but not expected) resilience in services, should the latter not succumb to lower wage pressures as we think will be the case. Instead, core inflation may see a two-pronged downward push in the coming year, something already evident in m/m adjusted core and services data (Figure 2). This may be a major issue for the ECB, even if it goes against the worries and thinking of the hawks.

Figure 2: Core and Services Adjusted Inflation Looking Friendlier

Source: Eurostat, CE

In flat we see official headline core inflation slipping toward 2% in coming months even when adverse energy base effects may pull the headline figure back higher (to 2% in Q2) this year.