Maximum Trump

· Overall, though Trump action can cause volatility in financial markets, the major issues remain the performance of the U.S. economy and whether the current scale of AI optimism will remain. Monthly TICS data since the April reciprocal tariffs show that global investors continue inward net portfolio flows at a good pace into U.S. assets, though with hedging of existing FX exposure. Our financial market views for 2026 are available (here).

President Donald Trump has started 2026 with maximum force. How will this impact financial markets?

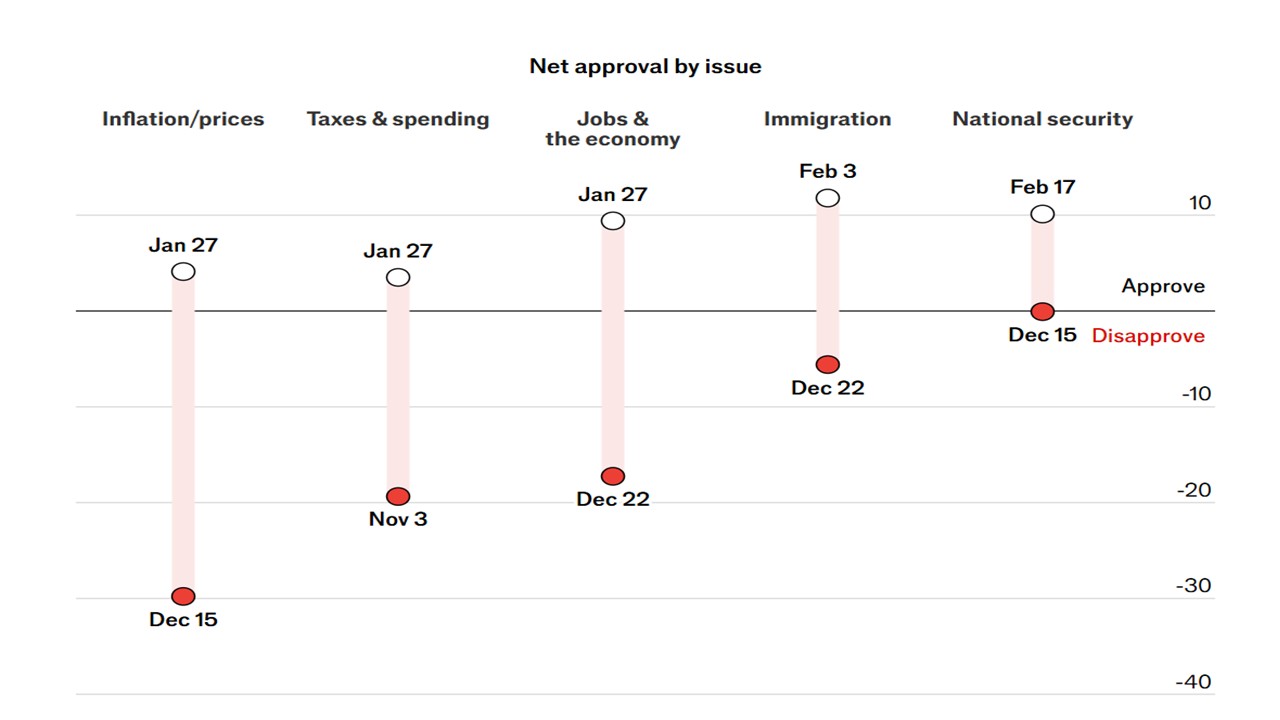

Figure 1: Trump Net Approval Rating By Issue

Source: You Gov/Economist

Trump has followed up the military operation in Venezuela, with threats against Iran/Greenland and Cuba, as well DOJ subpoena against the Fed Chair Powell. What will be the impact on financial markets?

· Venezuela. The oil market has not reacted noticeably to the military operation in Venezuela (here), as the consensus is that it will take political stability and many years for a significant ramp-up in oil production. Trump is working with the existing regime, rather than pushing for free elections that some of the oil majors see as a precondition for significant investment. Meanwhile, though the U.S. could relax sanctions against the Venezuelan government later in the year, this would add only a small amount of oil to the global market.

· Iran. Trump is threatening military action against Iran, as early as this week. Any operation would likely be designed to be surgical and potentially against military targets, but this may not hurt the existing Iran regime on a lasting basis and would likely be meet with retaliation against the U.S. The Iran protests are also being meet with a brutal crackdown by the regime and most experts still feel that this will continue and the existing regime is unlikely to fall. Iran can produce short-term volatility in financial markets, but is unlikely to produce a lasting trend. If Iran was to see a successful revolution followed by free elections, then it would produce a big geopolitical shift in the region that reduces long-term risks. Multi-year it could also mean extra oil exports, but especially Iran emerging as a major gas exporter.

· Greenland. The Trump administration is due to have talks this week with Denmark over Greenland (here), where Denmark will likely reject U.S. desires to buy Greenland. This will see tensions remaining between the U.S. and Denmark/Europe. However, any near-term military operation against Greenland remains unlikely, given that the U.S. military assets are not in area. We see a risk of the U.S. having a show of strength against Greenland in the coming months, but stopping short of a blockade or invasion. Additionally, the Trump administration also have their hands full with Venezuela; the forthcoming Supreme court ruling on reciprocal tariffs (here); economic crisis in Cuba that could threaten the existing regime and the proposed Trump trip to China in April. Greenland can also cause short-term volatility, without producing lasting direction in financial markets.

· Mid-term elections. Trump foreign escapades in 2026 appear to be partially designed to deflect attention from the lack of succuss in meeting voters concerns over the cost of living crisis (Figure 1) given the surge in prices since 2019. Though Trump claims some success against cost of living, voters are not convinced. The DOJ subpoena action against Fed chair Powell over the weekend also appears to be designed to shift the blame to the Fed over cost of living – though actual FOMC voting is unlikely to be impacted by Trump now that the district Fed presidents have been reappointed until 2031. Meanwhile, though the backlash against Trump military adventures within Maga has so far been mixed, opinion polls shows that this military adventurism is unpopular. Any U.S. military casualties could risk a backlash in the U.S. All of this is also leading to Trump administration pressure for more fiscal easing (demands for 2k per person tariff windfall and USD1.5trn of military expenditure in 2026). If congress swings behind these desires, then it could upset the U.S. Treasury market and mean a steeper yield curve.

Overall, though Trump action can cause volatility in financial markets, the major issues remain the performance of the U.S. economy and whether the current scale of AI optimism will remain. Monthly TICS data since the April reciprocal tariffs show that global investors continue inward net portfolio flows at a good pace into U.S. assets, though with hedging of existing FX exposure. Our financial market views for 2026 are available (here).