ECB Steady Signals, But

• We remain of the view that financial conditions and lending rates are worse than the current ECB depo rate level suggest and means that 2026 EZ growth does not really pick-up. Combined with a mild undershoot in inflation, this can build the case for the ECB to deliver two 25bps cuts. However, these are more likely to come later than we thought and we now pencil in June and September 2026. In the meantime, ECB communications will continue to lean against early ECB rate hike talk.

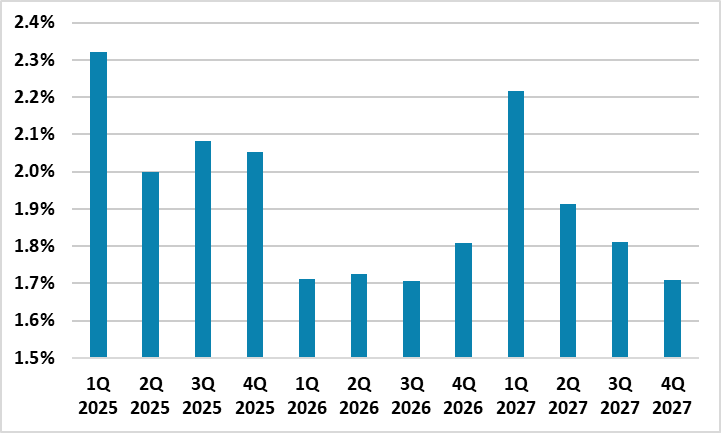

Figure 1: Money Market ECB Depo Rate Expectations (%)

Source: Bloomberg/Continuum Economics

ECB officials guidance in January so far remains that the consensus on the ECB council is that interest rates have reached an appropriate level. What will happen in the remainder of 2026?

• Leaning against 2026 hike talk. A number of ECB officials have dismissed ideas that the ECB could hike in 2026, as money markets have tilted towards the next moving being a 25bps rate hike in 2027 (Figure 1) – fueled by hawks likely Schnabel suggesting the next move in policy rates is up. This will likely be the ECB communications throughout 2026, as the ECB needs lagged easing to feedthrough and wants to avoid lending rates rising due to hike speculation.

• Steady for now, but. Most on the ECB council appear to be comfortable with steady policy in 2026, after a cumulative 200bps of cuts. This will likely be the message from the December minutes on January 22 and at the February 5 ECB meeting. ECB Lane reemphasized this stance on January 16 and he is normally a good guide to policy. Though we look for a further two 25bps cuts in 2026, the economics are only partially in place. We have argued that financial conditions and lending are worse than the ECB depo rate would suggest, which reflects the extra refinancing costs for loans taken out between 2008-21 or return of investment calculations for new loans. Additionally, a wide set of economic indicators suggest the EZ economy is not really picking up, which the ECB should come round too. Thirdly, the ECB focus on compensation for workers is backward looking, with forward looking data (e.g. Indeed survey and wage tracker) suggesting wage inflation will be consistent with CPI inflation just below target (Figure 2). Finally, though defense and infrastructure spending will help Germany in 2026, other major EZ countries are fiscally restrained (see EZ Outlook here). Incoming economic data will build the case for further rate cuts, but it is unlikely to be in place for the March ECB meeting and so we have delayed our rate cut forecasts to 25bps in June and September. We also still see the ECB slowing the monthly pace of APP and PEPP QT by 25% in 2026, given the adverse impact on lending and financial conditions.

Figure 2: EZ CPI Inflation Forecast Yr/Yr (%)  Source: Bloomberg/Continuum Economics

Source: Bloomberg/Continuum Economics

• Risks to the downside? The implementation of existing tariffs in 2026 is in our baseline, but a high risk exists of Trump reciprocal tariffs being partially or fully ruled against (here). The EU is likely to still implement the trade framework deal at current agreed tariff levels, but Trump could threaten 15% section 122 tariffs if the EU does not do this quickly. This creates trade policy uncertainty. An invasion of Greenland by the U.S. would severly intensify trade and long-term security concerns in Europe, but we see this as a 5% probability risk in 2026. However, Trump has announced a 10% tariff on 8 European countries from Feb 1, until they give Greenland to the U.S. Another risk is within Europe relating to fiscal policy, where voters are reluctant to see tightening (here). The greatest risks surround France, where non-resident investors still have huge holdings and could reduce them after the March 2026 French municipal elections and before the May 2027 presidential elections. This could be a headwind to French growth, but could also worsen the monetary policy transmission mechanism in other EZ countries by high spreads versus Bunds. Upside risks for the economy comes from the household savings rate falling and pushing up consumption momentum, though we remain of the view that this is unlikely to be substantive as EZ consumers want higher structural savings post COVID/Ukraine and given the pre-retirement needs of the babyboomers.