EZ HICP Review: Services Inflation Still Resilient But Core Goods Soften Further

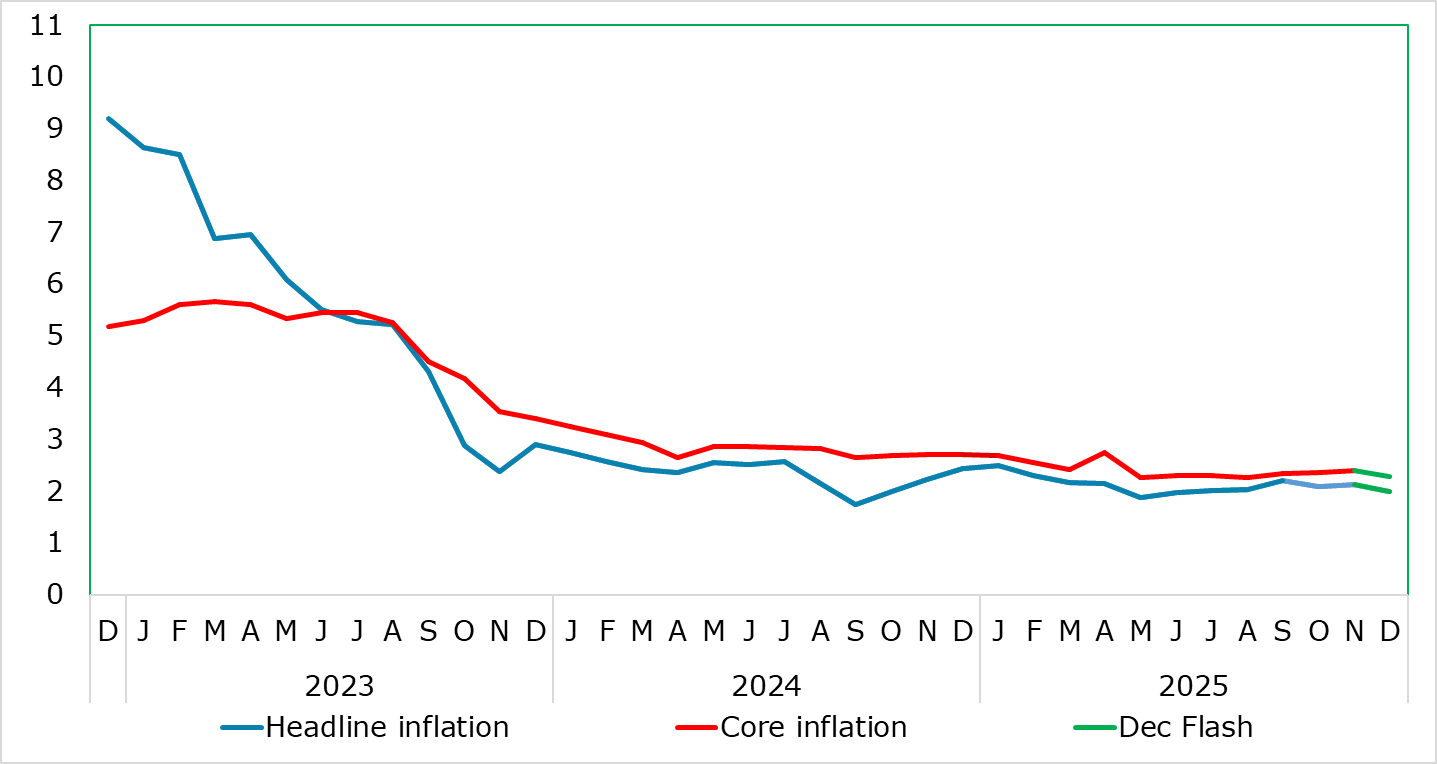

HICP inflation has been range bound for the last 5-6 months between 2.0% and 2.2% with the November and October numbers in the middle of that range. And it stayed in that range falling to 2.0% in the December flash numbers, albeit where adverse rounding pre vented a fall to 1.9%. We see this as the start of a fresh but what may be a short-lived fall toward 1.5% in H1 2026. Some of this may be energy related but a 0.1 ppt correction back in services last month did the core down a notch to a new cycle low of 2.3%. However, this also reflected a further fall in non-energy industrial goods (NEIG) inflation, this possibly an increasing sign of softer import prices possibly related to Chinese export dumping. While this may temper hawkish thinking, the December data very much chime with the ECB’s latest projection.

Figure 1: Headline and Services Edge Lower

Source: Eurostat, CE

With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. This reversed in the flash November numbers but which were later revised down to match the October outcome. But the diehard hawks at the ECB will have focused on the small further rise in services inflation to a seven month high of 3.5%, a shift higher echoed by less favourable, but still target-consistent, adjusted m/m data. Even so, this seems to have reverberated within the ECB and seemingly has prompted the upward revisions to the 2026 HICP outlook.

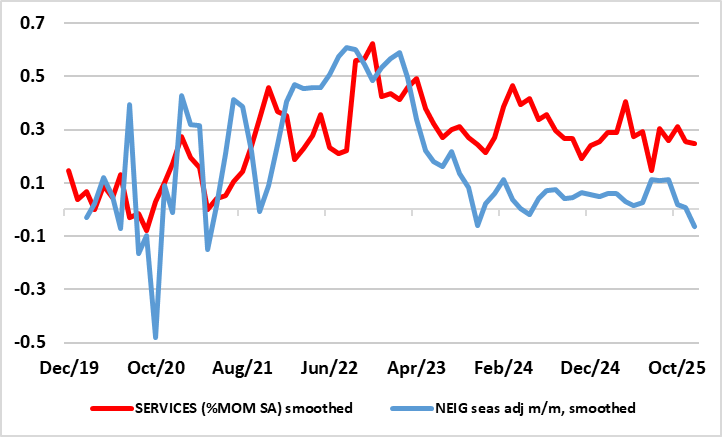

Even so, the fresh fall back to 3.4% (seemingly very much transport price driven) will not placate the hawks. What may do so is the other component of core inflation. Indeed, a fall in non-energy industrial goods inflation to a 15-mth low of 0.4% is possibly an increasing sign of softer import prices possibly related to Chinese export dumping – ie such evidence is echoed by the clear fall in overall import price numbers of late. The question is whether what may be more than a cyclical fall in core goods inflation will offset any further resilience in services (Figure 2), should the latter not succumb to lower wage pressures as we think will be the case. If so, then core inflation may see a two-pronged downward push in the coming year. This may be a major issue for the ECB, even if it goes against the worries and thinking of the hawks.

Figure 2: Core Inflation Caught Between Steady Services and Weaker Goods Inflation

Source: Eurostat, ECB, CE

Regardless, talk of more resilience services may be an excessive reaction as the higher services inflation is purely due to base effects in regard to recreation. And as suggested above services, still seems to be belatedly following in the footsteps of lower wage pressures. Moreover, recent labor market data are showing a still clear rising workforce which may explain such weaker cost pressures.

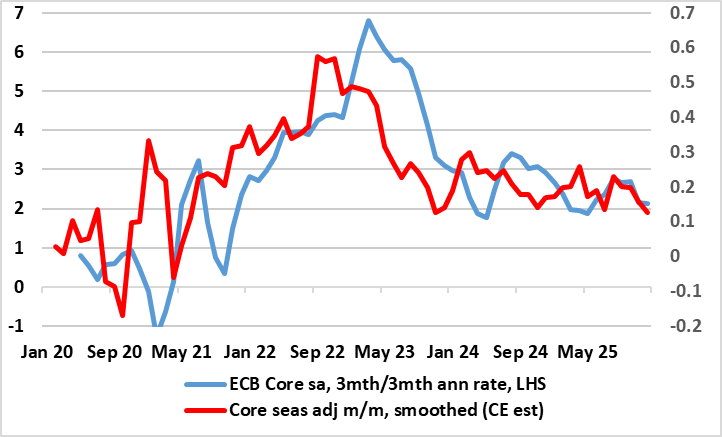

As a result, this trend and noise could bring the headline and core rate are seen dipping below 2% this month to as low as 1.8% with base effects pulling the headline down further in Q1, especially if demand weakness starts to accentuate what have largely been supply factors driving the disinflation process hitherto. Notably, as recent calendar distortions unwind, what has looked like fresh price pressures in seasonally adjusted short-term m/m movements for core have eased if not reversed and are consistent with on-target inflation (Figure 3), even with some fresh further spikes in adjusted services numbers!

Figure 3: Core Inflation Still Around Target in Shorter-Term Dynamics?

Source: CE, Eurostat, ECB