USD Hurt by Hedging More than Asset Outflows

The Greenland drama and fears of BOJ/Fed Intervention on USDJPY has put the USD under renewed downward pressure against DM Currencies. What happens next? Overall, we see scope for further USD decline versus DM currencies in 2026 on more currency hedging; some diversification away from the U.S.; high trade and geopolitical uncertainty and the risk that the U.S. administration could jawbone the USD lower to substitute for any loss of reciprocal tariff revenue. We forecast 1.20 on EUR/USD by end 2026 and 140 on USD/JPY (here).

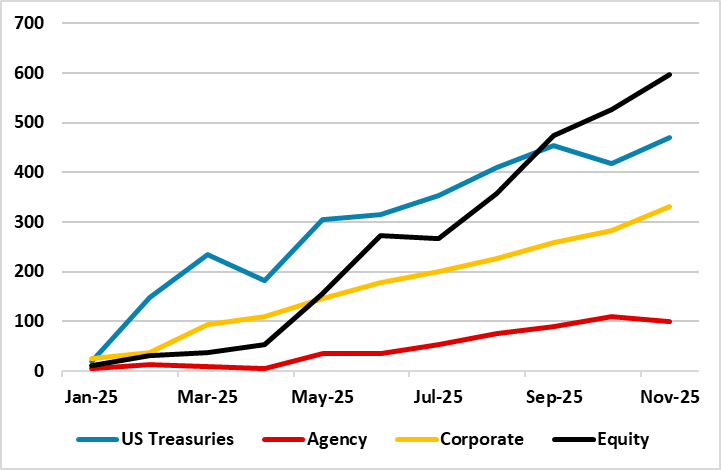

Figure 1: Cumulative Foreign Purchases of U.S. Assets (USD Blns)

Source: U.S. Treasury /Continuum Economics

What is causing the USD decline from a flow as well as economic/policy standpoint?

• Net Portfolio Inflows Still. Figure 1 shows that net portfolio inflows remained good since the start of 2025 led by net inflows to U.S. Equities of USD600bln for the data up to November 2025. This reflects the AI story and the lead that U.S. companies have in the field and the lack of hyperscalers outside the U.S. except in China. U.S. hyperscaler and AI companies will maintain their advantage in semiconductor chips with Nvidia Blackwell and Rubin stacks, which are banned for China. However, U.S. Tech is overvalued and any slowing of exponential AI revenue growth could risk a U.S. equity correction and slowing of portfolio inflows. U.S. Treasury net inflows have also been positive through November 2025, though this is largely private sector with China reducing it’s U.S. Treasury holdings. Part of the pull factor is that 10yr U.S. Treasury have real yields around 2%, which is higher than other DM government bond markets. Corporate bonds net inflows have also been consistent, though narrow spreads could curtail interest in the future. Even so, some portfolio diversification away from the U.S. has occurred in 2025 and the U.S. Treasury TICS data is only up until November 2025.

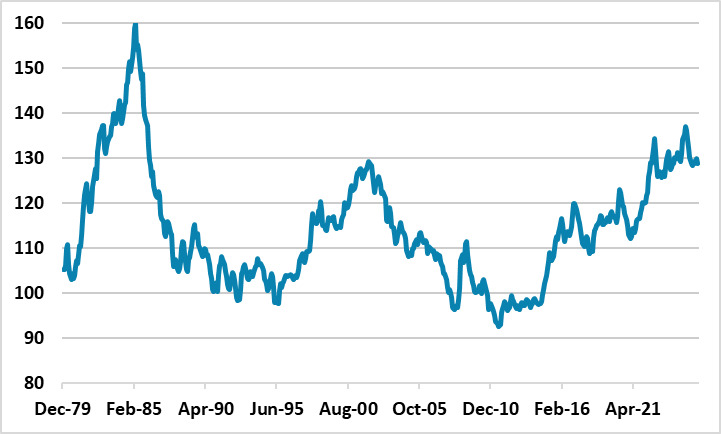

Figure 2: Real Effective USD Exchange Rate (%)  Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

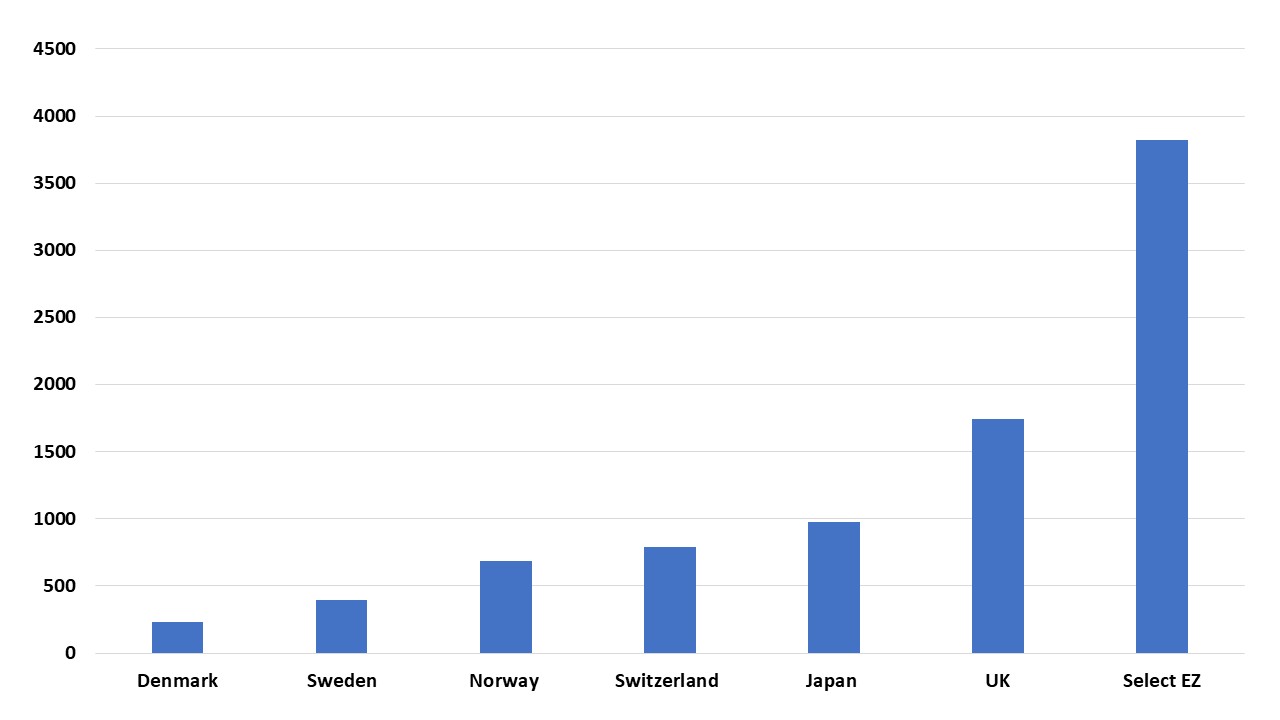

• Hedging USD assets. Foreign investors have been more actively hedging FX for their huge U.S. portfolio exposure. By early 2025, the U.S. exceptionalism story had seen a large buildup of exposure to U.S. equities and also a positive run for the USD prompt lower FX hedging than normal. The April 2025 U.S. reciprocal tariffs have prompted a rethink by foreign investors that has seen them hedge some of their FX risk. The overvalued USD (Figure 2) also meant that foreign investors became worried about a multi-year USD decline as occurred from 1985 and 2002 impacting total returns. This has been more noticeable in 2025 against European currencies rather than the Japanese Yen, as European investors have huge holdings of U.S. equities compare to Japan (Figure 3).

Figure 3: Select Countries Holdings on U.S. Equities June 2024 (USD Blns)

• Lower Trust in the U.S. Global investors have become worried about trust in U.S. policymaking. Decisions and announcements have been erratic and at times unclear. Threats have been plentiful in the trade front in 2025 and now the geopolitical front in 2026, which is creating trade and geopolitical uncertainty around the U.S., that is upsetting global investors. This has seen some inflows into non U.S. DM equities and EM equities in 2025, which will likely continue in 2026 – though EM could be more favored with non U.S. DM equities no longer cheap. The Greenland saga is important, as European investors have huge holdings of U.S. equities and aggressive U.S. action could have accelerated portfolio diversification. For now Trump appears to have backed off and is focusing on other issues. Fed leadership is also important for fixed income investors around the world. If the Fed objectives and operations sees fundamental change, then it will undermine Fed credibility and net inflows into U.S. Treasuries. The market now awaits Trump’s decisions, with the current favorite having switched to Rick Rieder but Bessant talking about changes to the Fed inflation target.

• USD/JPY FX intervention. The U.S. administration appear to agree with Japan’s authorities that the JPY is too weak. However, if this prompted joint BOJ/Fed FX intervention, then it could produce a noticeable jump of the JPY versus the USD. The impact on other DM currencies could be mixed. The USD could be hurt across the board by USDJPY movements, but the JPY is also significantly undervalued against European currencies. Additionally, the FX market would see BOJ/Fed intervention as been a JPY issue rather than a general signal for the USD.

• Supreme court ruling. We have highlighted our view that the Supreme court will likely rule against reciprocal tariffs. The Trump administration response will likely be pressure to codify existing trade framework deals and threats of other tariffs e.g. 102 or 301 – see (here). However, the Trump administration could also allow some USD weakness as well and may feel inclined to jawbone the USD lower – which could be dangerous if done by Trump himself.

Overall, we see scope for further USD decline versus DM currencies in 2026 on more currency hedging; some diversification away from the U.S.; high trade and geopolitical uncertainty and the risk that the U.S. administration could jawbone the USD lower to substitute for any loss of reciprocal tariff revenue.