ECB: Papering Over the Cracks

· As widely expected the ECB kept the policy rate unchanged at the February meeting. The broad message remains that the ECB Council is comfortable with current policy rates, which provides short-term forward guidance of no change in rates. This message came from the ECB statement and also Lagarde’s press conference. However, the December minutes show a split between the doves and hawks multi quarter and we agree with the doves’ concerns. We remain of the view that financial conditions and lending rates are worse than the current ECB depo rate level suggest and means that 2026 EZ growth does not really pick-up. Combined with a mild undershoot in inflation, this can build the case for the ECB to deliver two 25bps cuts in June and September 2026.

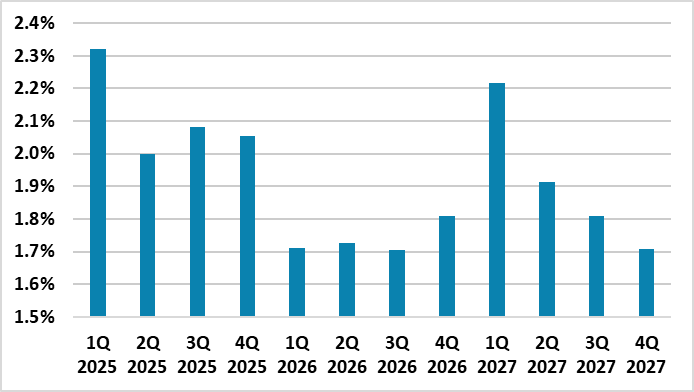

Figure 1: EZ HICP Including Projections (%)

Source: Continuum Economics

A number of points are worth making from the February ECB statement and Q/A.

· ECB Steady, but Council splits multi quarter. ECB Lagarde emphasized what the majority of the council could agree on, which is that policy rates are currently appropriate and expect no change in policy rates in the near-term amid a broadly balanced risk assessment. However, Lagarde is talking mainly about the near-term and the December ECB minutes show a clear division between doves and hawks multi quarter. The doves are concerned about the economic recovery, but also that slowing wage inflation could mean an undershoot of inflation. Either could mean further rate cuts are needed. The hawks take a more upbeat view of the GDP trajectory, but are also concerned that recent wage compensation data means that inflation could now be slow to fall. For the hawks this could mean that tightening is required into 2027. The ECB moved away from risk assessment on each to a broad list, with Lagarde admitting that views diverged on the ECB council.

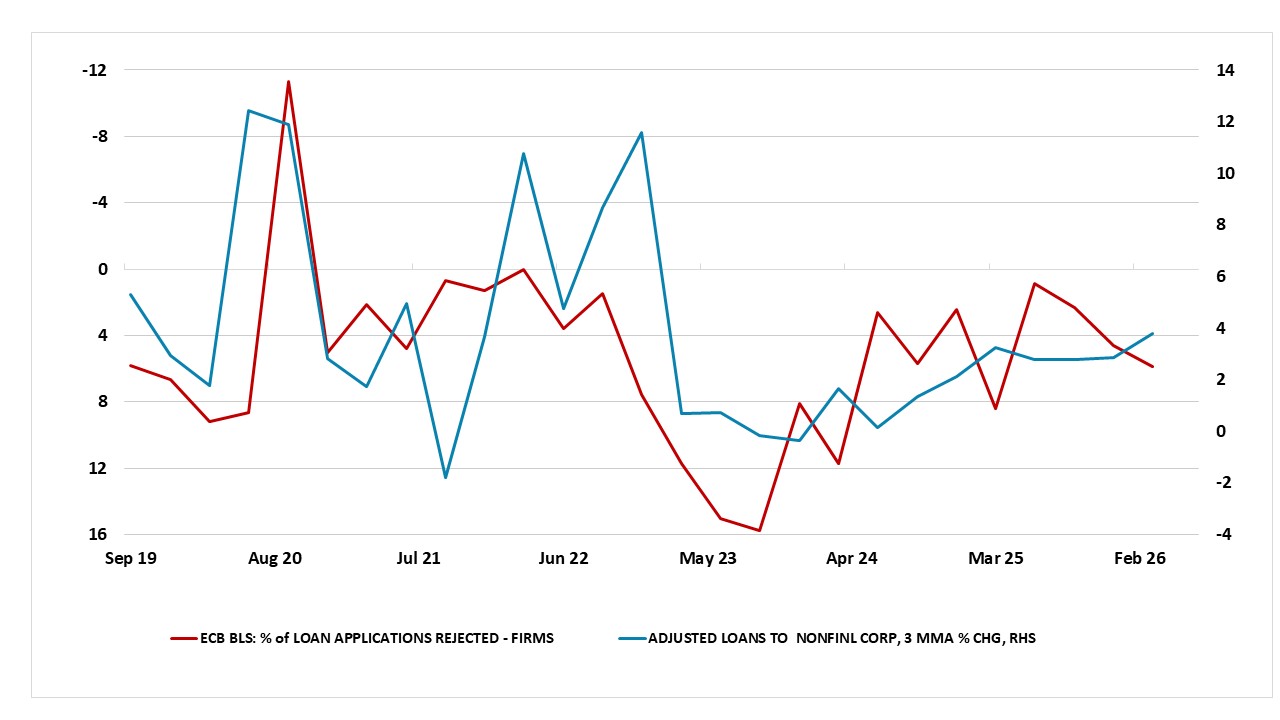

· Banks Getting Warier. Given the late Dec/early Jan timing of the latest ECB survey, which far from fully embraced the added uncertainty caused by President Trump’s trade threats, it was still hardly a surprise despite that the latest Bank Lending Survey (BLS) reported net tightening credit standards. This tightening received only a very brief mention in Lagarde’s press conference. But we think it merits much greater attention and analysis, not least as merely accentuates trends in the three previous BLS but also as it reflected an ongoing and perhaps deeper concerns about the outlook for firms and the broader economy, as well as banks’ lower risk tolerance. This updated BLS therefore echoes what we have seen in other ECB surveys despite somewhat less soft actual credit dynamics seen of late. At least as far as firms and consumers seeking credit are concerned, the BLS again underscores that banks are rationing, if not out rightly curbing, the supply of credit as rejecting a loan is obviously the most stringent manner in which banks can tighten credit standards. In fact, the BLS noted a further net increase in the share of rejected loan applications notably for firms, something that understandably correlates inversely with actual lending and this implies a clear slowing in the latter ahead (Figure 2). As such, the latest BLS both corroborates and continues an ever worrying pattern, namely weakness in corporate credit demand and supply and which suggest ever more clearly that banks are ever warier in regard to lending, especially to firms exposed to export sectors. The question is whether this is even more tangible evidence of the threat posed by U.S. tariffs, alongside global uncertainties, something likely to weigh further credit dynamics the sluggishness of which we see as being driven by tight(er) financial conditions.

Figure 2: BLS Sees More Loan Applications Rejected – To Curb Lending Growth

Source: ECB

· EUR, Trump threats and gas prices. ECB Lagarde and the ECB statement noted caution about the adverse economic effects of a further strengthening of the EUR, though Lagarde noted the previous EUR/USD and nominal TWI rise is already in the baseline forecasts. We would see scope for a modest rise in EUR/USD to 1.20 by end 2026, but a correction in the U.S. equity market and or a U.S. harder landing would bring us towards 1.30 and cause concern for the ECB. Though the threat of extra U.S. tariffs over Greenland has been defused for now, ECB council members will know that the Trump administration could also threaten extra tariffs unless the EU quickly implements the trade framework deal. This is a clear downside risk to 2026 growth and argues for caution. Meanwhile, the volatility in TTF gas prices due to cold weather in the U.S. has attracted some attention. However, this is mainly spot prices and the Dec 26 TTF contract has reacted less, while 2027 futures prices are unchanged. Gas prices are likely to be a transitory concern.

· Steady for now, but. Most on the ECB council appear to be comfortable with steady policy in the next few meetings, after a cumulative 200bps of cuts. However, we agree with the doves concerns. Firstly, the ECB focus on compensation for workers is backward looking, with forward looking data (e.g. Indeed survey and wage tracker) suggesting wage inflation will be consistent with CPI inflation just below target (Figure 1). Secondly, as noted above we feel that financial conditions and lending are worse than the ECB depo rate would suggest. Finally, though defense and infrastructure spending will help Germany in 2026, other major EZ countries are fiscally restrained (see EZ Outlook here). Incoming economic data will build the case for further rate cuts and we have penciled in 25bps cut for the June and September meetings.