Taiwan: Worst Case Consequences

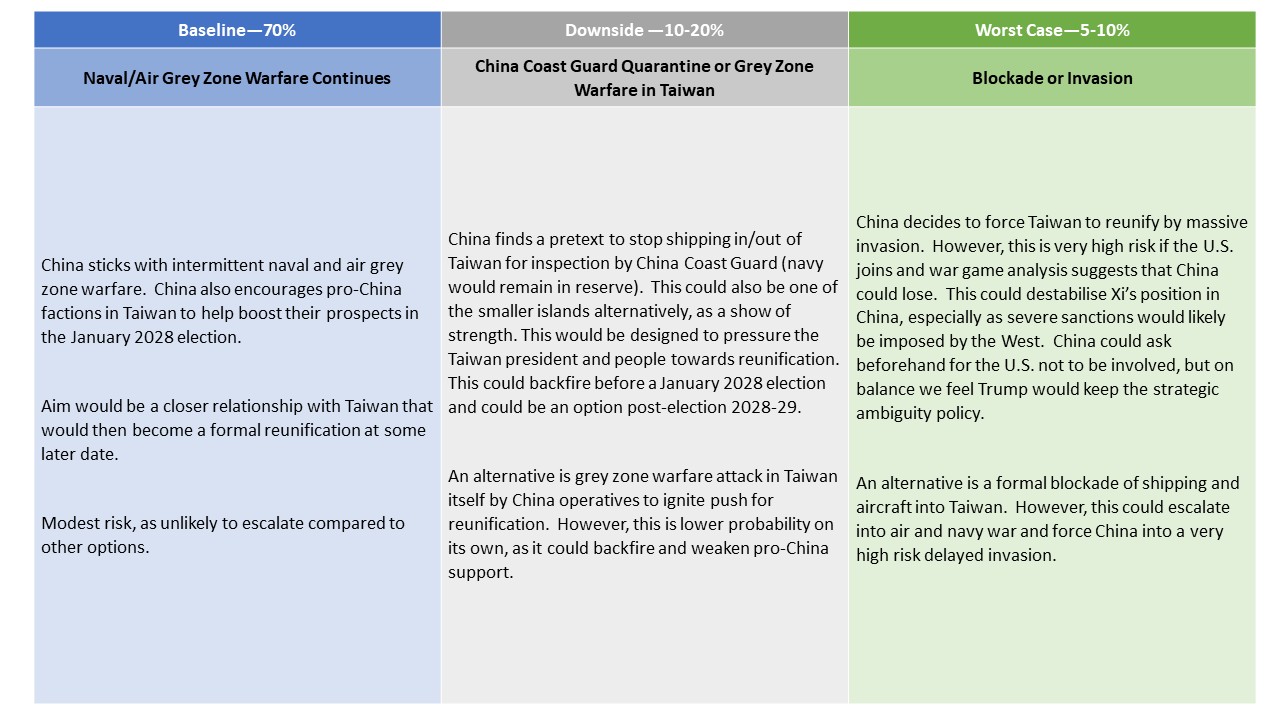

· The most likely option for China is to continue the air and naval grey zone warfare around Taiwan, combined with support for pro-China factions in Taiwan’s parliament to build pressure for reunification at some stage before 2049 (the 100th anniversary of the communist party). With invasion being too high risk for President Xi (with the U.S. maintaining strategic ambiguity policy), an alternative option from 2027 onward would be a temporary China Coast Guard quarantine and inspection of some shipping to/from Taiwan. This would be designed to increase pressure before the crucial January 2028 Taiwan presidential and parliamentary elections.

· Any of the alternative scenarios (Figure 1) would cause global risk off in financial markets on fears it could lead to a China-U.S. war and on fears of the disruption of advanced semiconductor chips exports to the global economy and for AI development. Western sanctions would likely be imposed on a blockade, but would be more severe in a scenario of invasion. The adverse economic impact on China would be severe in the scenario of an invasion.

Figure 1: Taiwan Scenario 2027

Source: Continuum Economics

President Xi could ask U.S. President Trump for an understanding that reunification will eventually happen and that other countries should not be involved if China takes action over reunification. Xi could fold this into a U.S./China trade deal. Trump is provisionally scheduled to visit China in April and Xi to visit the U.S. in the fall of 2026. However, the Trump administration is likely to counter that reunification should not occur via military methods and that the strategic ambiguity policy remains in place. Trump’s tech friends will warn him that a China takeover of Taiwan could curtail or stop advanced semiconductor exports to the U.S. and derail U.S. leadership in AI. Many in Washington also remain biased to strategic restraint toward China, beyond Trump’s desire for a trade deal. Trump’s focus on the Americas does not mean that the U.S. is abandoning its sphere of influence in Asia.

For President Xi, this makes an invasion (Figure 1) too high risk, as war game analysis suggests that China could lose if the U.S. become militarily involved (here). Defeat would be destabilizing for Xi and the Communist Party and Xi is not a gambler. It is worth remembering that Xi wants China ready for the option of a regional war by 2027, but full military capability by 2035. 2049 is also the 100th anniversary for the communist party and is seen to be a date to achieve reunification. A blockade is also very high risk, as it could spiral into a China/U.S. military clash. The U.S. may not break a blockade by force or counterattack China’s armed forces in the invasion scenario, but Xi cannot be confident about the Trump administration not reacting without a formal understanding. The U.S. has a crucial advantage in advanced submarines, which could seriously hurt China’s navy. Even a quick successful China invasion would still have severe adverse consequences on China economy, currency and financial markets, as Russia found out with the invasion of Ukraine. Additionally, though opinion polls in Taiwan show voters oppose invasion and would prefer the status quo, they do signal a majority of voters expect reunification at some stage. This gives China the opportunity to encourage pro-China and reunification factions within Taiwan. January 2028 is a pivotal date with parliamentary and presidential elections.

Our baseline (Figure 1) for 2026 and 2027 remains that China maintains the existing air and naval grey zone warfare, which is low risk for China. We have the probability of an invasion or full blockade in 2027 at 10%, but have the temporary China Coast Guard quarantine option at 10-20% -- this could be Taiwan as a whole or one of its islands, as occurred in the 1950s. The probabilities are likely lower in 2026, as Xi could try to convince Trump a couple of times in 2026 to weaken the strategic ambiguity policy.

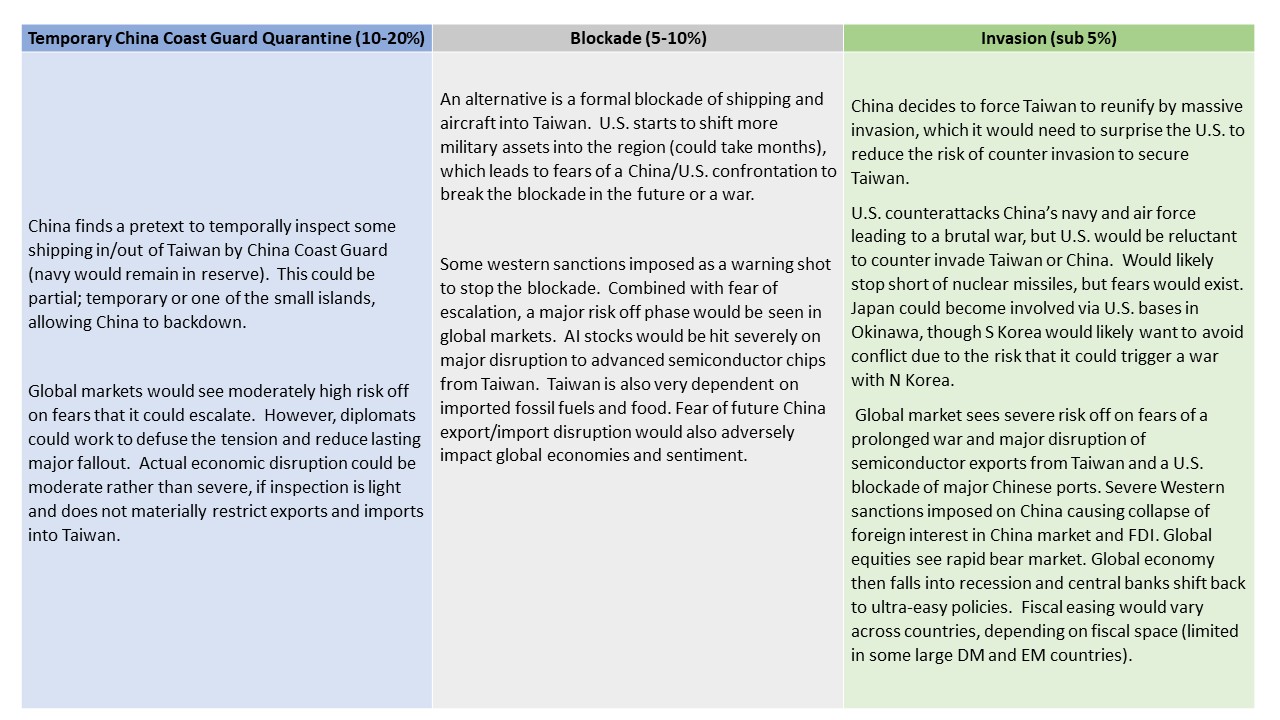

What would be the impact of the alternative scenarios if they actually occurred? We have some initial thoughts on the economic/policy and market consequences in Figure 2. A temporary and potentially partial quarantine by the China coast guard is aggressive, but less than a formal sea and air blockade by the PLA. China Coast Guard is separate from the PLA Navy, but has a lot of large ships and has been at the forefront of China grey zone warfare in the South China sea (here).

A blockade or invasion (Figure 2) would severely restrict Taiwan’s semiconductor exports, which would cause a crisis for U.S. big tech given that 45% of their advanced semiconductors come from Taiwan according to USITC data (this is direct only; including indirect could be higher). TSMC Arizona chips are sent back to Taiwan for finishing and U.S. production will likely only become self-sustaining between 2028-30 – with the U.S. still needing to import from Taiwan. An invasion has the most severe economic and financial impact, as China exports and imports could be restricted by military action around Taiwan and also be fear of a counterattack by the U.S. This would likely cause a global recession and financial crisis.

Figure 2: Economic, Market and Policy Consequences

Source: Continuum Economics