German HICP Review: Headline and Core Down Afresh

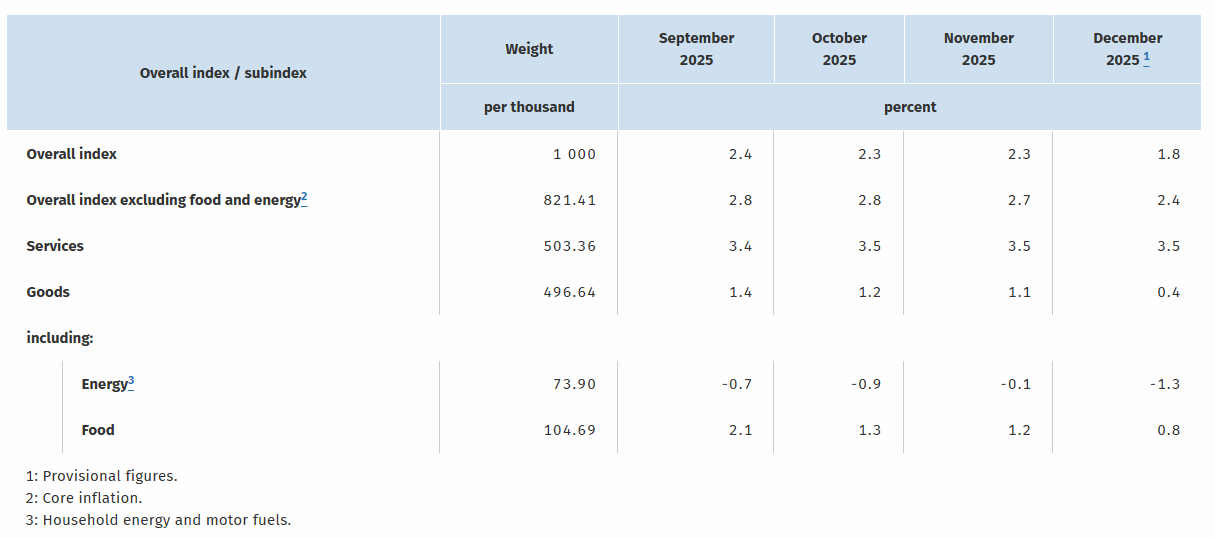

Germany’s disinflation process resumed with a bang as December saw a larger-than-expected fall in both headline and core inflation. Indeed, the headline HICP fell 0.6 ppt to a five-month low of 2.0%. This was largely food and energy driven but still with some fall in core at least according to the CPI measure. Admittedly services inflation was stuck in the CPI measure but the lower core rate must therefore reflect a fall in non-energy industrial goods, this possibly an increasing sign of softer import prices possibly related to Chinese export dumping. Regardless, and as we have suggested before, core adjusted data are telling an ever-more reassuring tale as these preliminary numbers suggest that the pick-up t 3.0% seen in Nov/Oct was fully reversed last month.

Figure 1: German HICP Inflation Resumes Downtrend?

Source: German Federal Stats Office, CE, % chg y/y

The various national HICP readings to support our flagging that the EZ HICP data (due Jan) 7 may show both a fall back below the 2% target and a correction back in services that should bring the core down a notch to a new cycle low of 2.3%. Admittedly overall services inflation in Germany did not fall but state-level CPI data released earlier today suggest a fresh fall in the volatile package-holiday component. Lower road fuel costs may have added further downward pressure. But the data also suggest that a fall in non-energy industrial goods inflation, this possibly an increasing sign of softer import prices possibly related to Chinese export dumping – ie such evidence allied to clear fall in overall import price numbers of late. This may be a major issue for the ECB, even if it goes against the worries and thinking of the hawks.

Moreover, this fresh disinflation should continue in coming months. We expect Germany’s HICP inflation to average 1.8% in 2026 and 2027. Lower electricity prices and the abolition of the natural are expected while the lower VAT on restaurant meals since January is likely to offset some upward pressure on core inflation from a costlier nationwide public transport pass.