EUR/USD: Europe’s Counter Threats to Trump

· Europe is highly unlikely to weaponize its existing portfolio holdings or new flows into the U.S., as Europe is dependent on the U.S. nuclear umbrella and as EZ/EU decision making is slow and modest in action. Such a move would be strongly opposed by EZ/European investors. Even so, FX hedging of Europe’s huge hoard of U.S. assets could drive further EUR gains this year. A U.S. recession or Trump jawboning the USD lower could accelerate a move well into the 1.20’s.

Europe has huge holdings of U.S. assets. Could this be used to counter threaten Trump geopolitical moves?

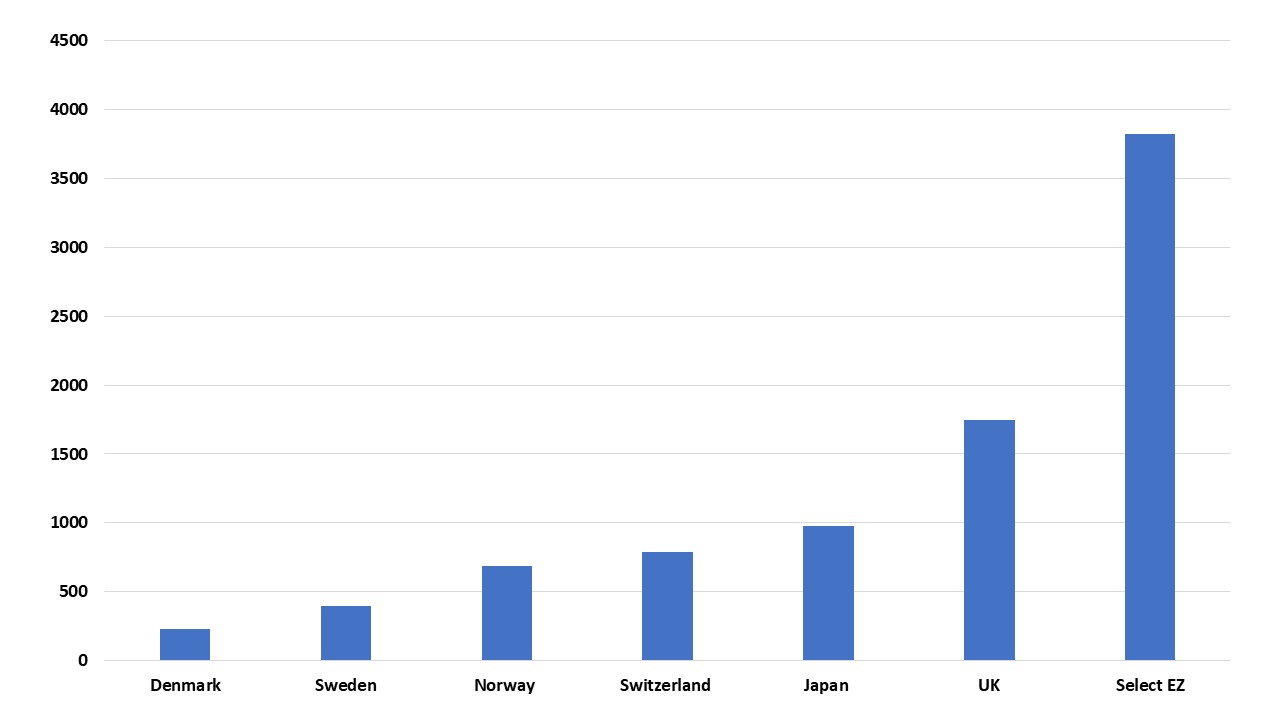

Figure 1: Select Countries Holdings on U.S. Equities June 2024 (USD Blns)

Source: U.S. Treasury /Continuum Economics (select Eurozone is Luxembourg/Ireland/Germany/France/Netherlands and Belgium)

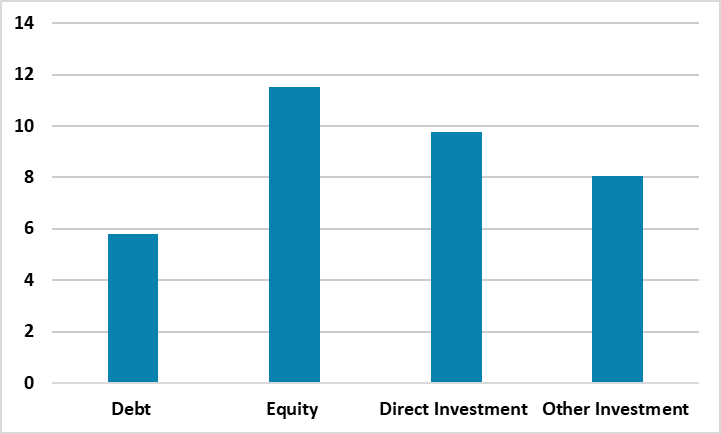

EZ and other European countries have vast holdings of U.S. equities; Treasuries and corporate bonds. Figure 1 shows select EZ countries according to U.S. Treasury data. Add in non EZ European countries in Figure 1 and it totals USD7.7trn, while Japan (the next greatest holdings) is US0.97trn. Looked at from a EZ viewpoint using ECB data, Europe holds huge foreign asset holdings (Figure 2) – with a healthy portion in the U.S. Could Europe weaponize its vast asset holdings against Trump geopolitical adventures?

Figure 2: Outstanding EZ Foreign Holdings (EUR Trns)

Source: ECB/Continuum Economics

We have our doubts about this idea.

· EZ/EU slow and modest decision making. Decision making in the EZ and EU remains slow and the most urgent issue is ensuring the security of Europe against a future Russian threat should the Trump administration continue to reduce its commitment to NATO. Our baseline remains that on Greenland (here) that Europe’s acute dependence on the U.S. nuclear umbrella will mean compromise and a solution is eventually reached. However, in the alternative world where Trump reimposes tariffs or actually invades Greenland, Europe would struggle to agree a common response. The main counter weapon against Trump could be counter tariffs, which the EU could agree on tariffs that are targeted and designed to deescalate – though the 2025 U.S./China trade tariff spiral shows that Trump could retaliate. A 2nd alternative is the EU Anti-Coercion Instrument that can impose or increase customs duties, restrict exports or imports through quotas or licenses, and impose restrictions on trade in services. It also can curb access to public procurement, foreign direct investment, intellectual property rights and access to the bloc’s financial markets. The problem is that Germany is reluctant to use this weapon, which means it is a threat but unlikely to be used.

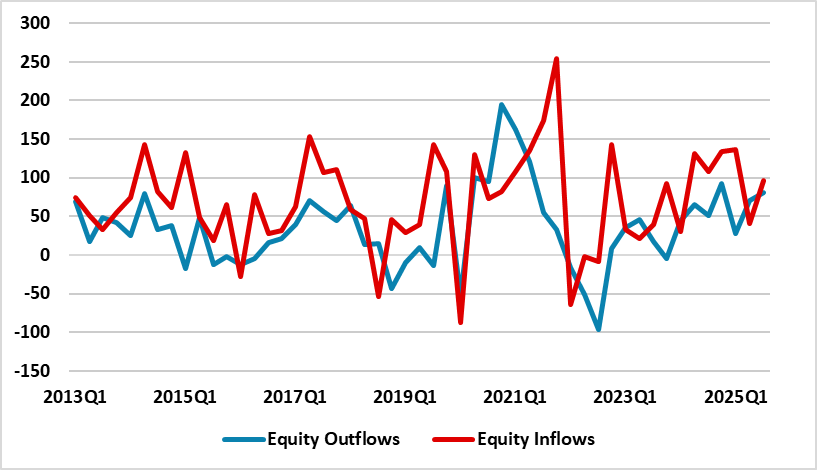

· Restricting holdings in U.S. assets. U.S. officials get jumpy about China selling its U.S. Treasury holdings or in previous decades Japanese investors repatriating from the U.S. However, a formal policy to restrict EZ or European holdings in the U.S. is highly unlikely, both due to the slow EU decision making and as EZ/European investing in the U.S. is from a huge range of investors that would oppose any moves to limit freedom of portfolio movements. However, could European investors be less inclined to invest in the U.S.? Our analysis of U.S. capital inflows suggests that global investors have not slowed equity/U.S. Treasury and corporate bond purchases (here) in 2025. Looking at ECB balance of payment data shows that global investor inflows into EZ equities are above the quarterly average since 2013, but EZ investors’ buying of global equities remain solid.

Figure 3: Equity Transaction Outflows and Inflows Into EZ (EUR Blns)

Source: ECB/Continuum Economics (Transactions are the underlying flow in ECB data)

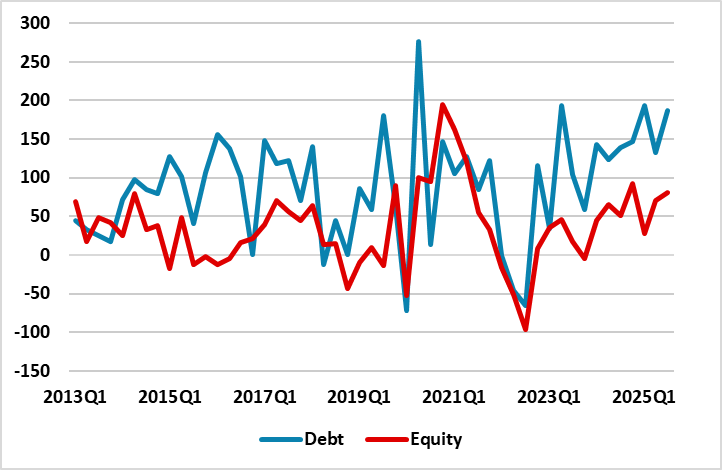

It is also worth noting that EZ purchases of overseas bond markets actually accelerated during 2025 (EUR513bln Q1-Q3 2025), which likely partially reflects the wide bond spread between the U.S. and EZ as the ECB kept cutting rates and yield pick-up became more attractive in overseas bonds. Overall, the EZ BOP data like the U.S. suggests that global and European investors’ underlying portfolio holdings have not been materially impacted by Trump’s erratic and confrontational policies. However, this could change in the future, if a shocking new development occurs. A geopolitical event that hits European interest e.g. Greenland blockade or invasion, could trigger either a reduction in European portfolio inflows to the U.S. or repatriation of existing holdings. However, the biggest threat would be a U.S. recession, which would prompt a rethinking in the bias towards U.S. equities and also see the Fed aggressively cutting interest rates and dragging bond yields down. These are not our baseline, as we attach a 20% probability to a U.S. recession in the next 12 months. What has been evident is large scale hedging of USD FX exposure, which has been a key driver of EUR strength since the start of 2025.

Figure 4: EZ Transaction Purchases of Overseas Equities and Bonds (EUR Blns)

Source: ECB/Continuum Economics

On our baseline, we have EUR/USD at 1.20 end 2026, as we see two further 25bps ECB rate cuts (here) that are not discounted by financial markets. As we noted in the DM FX Outlook (here) EUR/USD is now broadly in line with the long term relationship between real yields and the real EUR/USD. It is certainly the case that the EUR is undervalued versus the USD on fair value exchange rate measures, but it has been since the aftermath of the EZ debt crisis (Figure 5). Though the ECB came to the rescue in 2010-15, EZ politicians do not want to make the leap forward to EZ dominating individual countries in elections/taxes/EZ Treasury/common bonds or capital union. The geopolitical tensions caused by Trump and Russia are an added restraint to further EZ integration, both as the focus is on geopolitics and as European countries act in loose alliances on the security front rather than an EZ or EU basis. The French municipal elections in March will be watched closely as a taster of the May 2027 French presidential election, with the baseline being that France is very slow in necessary fiscal consolidation that could upset rating agencies and foreign holdings of French bonds.

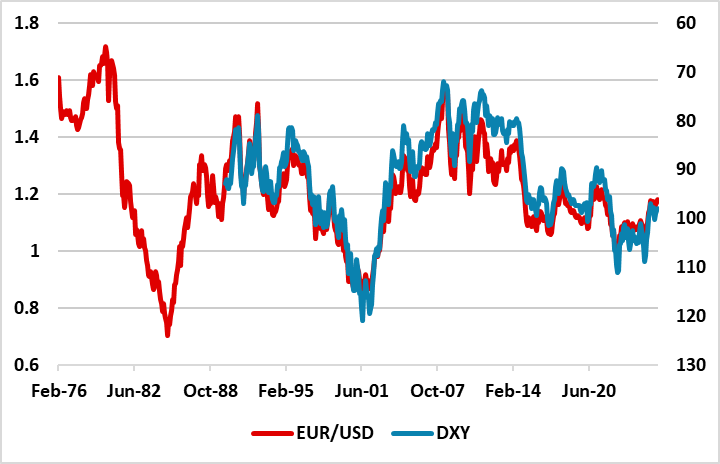

Even so, the EUR could still appreciate more against the USD that our 1.20 forecast. Firstly, European investors could hedge more of their currency exposure for their huge holdings of U.S. assets. Secondly, the USD could continue to decline. The USD is overvalued on a DXY basis (Figure 5), as well as nominal and real exchange rate measures. Trump prefers a lower USD and could use it if the supreme court rule against reciprocal tariffs, though U.S. Treasury Secretary Bessent will repeat the strong USD mantra that the U.S. will not debase its currency. Sentiment could trigger a further USD decline against DM currencies and EUR/USD has a close relationship with DXY (Figure 5). Meanwhile, the ECB is unlikely to stop the EUR, as Lagarde did not signal real concern over EUR/USD or EUR TWI at the February ECB meeting, while the ECB would not cut rates for the EUR alone but rather on broader domestic growth and inflation prospects.

Figure 5: EUR/USD and Inverted DXY (lndex)

Source: Datastream/Continuum Economics (nb Imputed EUR/USD before 1999)