Editor's Choice

View:

September 17, 2025

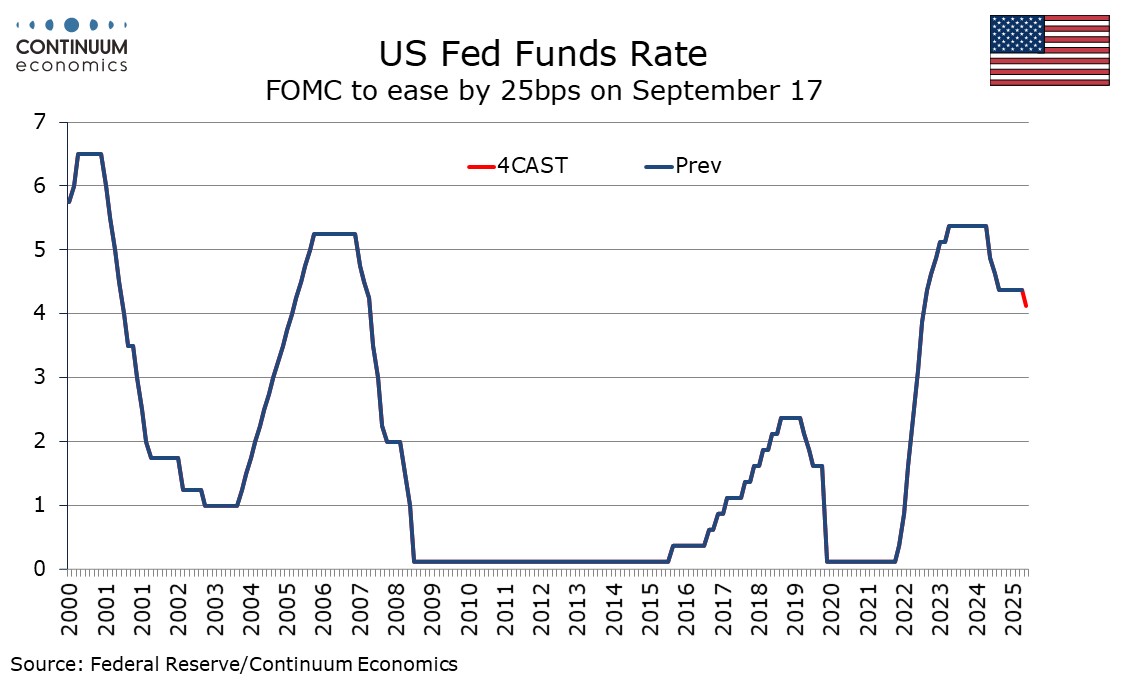

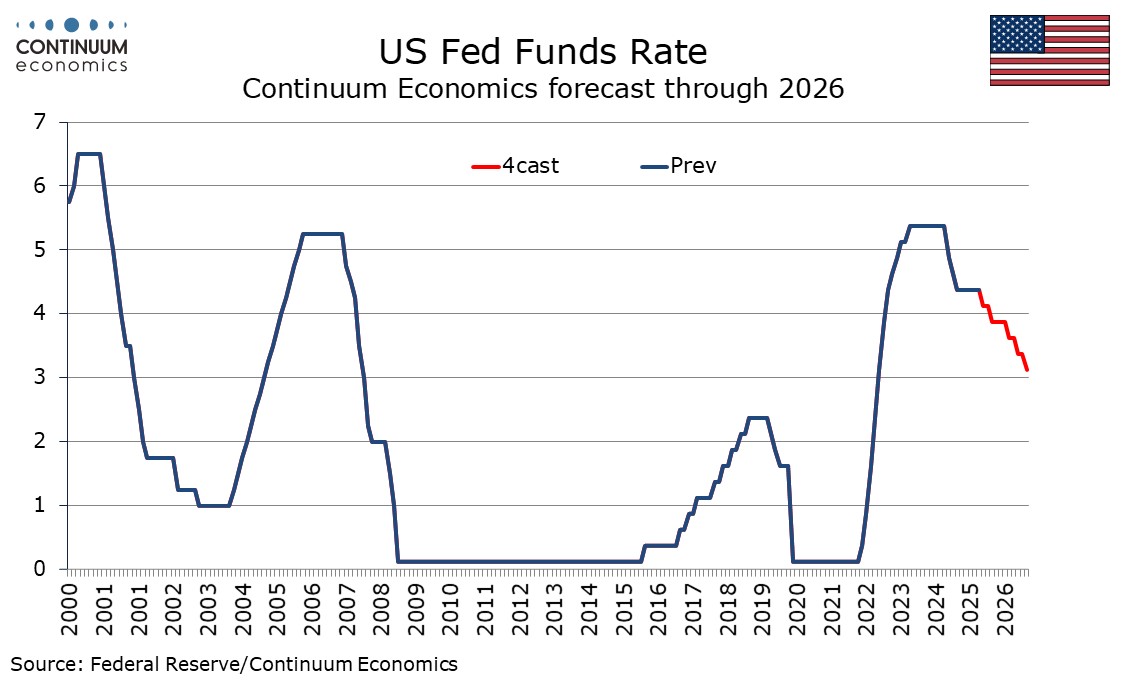

Fed: Signals 25bps October and December

September 17, 2025 7:39 PM UTC

The median Fed Funds is a strong hint that the Fed will deliver an extra 50bps most likely with 25bps in October and December. However, the split in the 2026 Fed Funds dots forecasts from FOMC members suggests that our forecast of just below trend growth and core PCE above target will likely mean

September 16, 2025

Preview: Due September 26 - U.S. August Personal Income and Spending - Core PCE Prices moving higher

September 16, 2025 3:36 PM UTC

We expect August data to show 0.3% gains in both overall and core PCE prices, with personal income also up by 0.3% and personal spending slightly stronger at 0.4%. The data will incorporate historical revisions through Q2 due with the annual GDP revision scheduled for September 25.

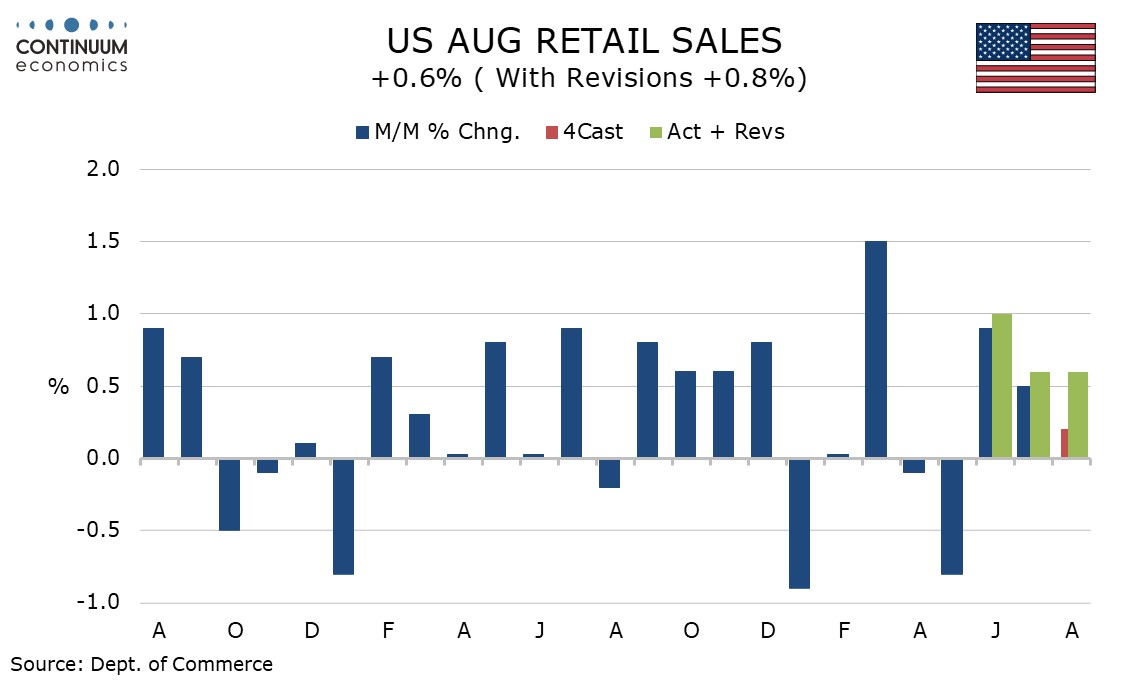

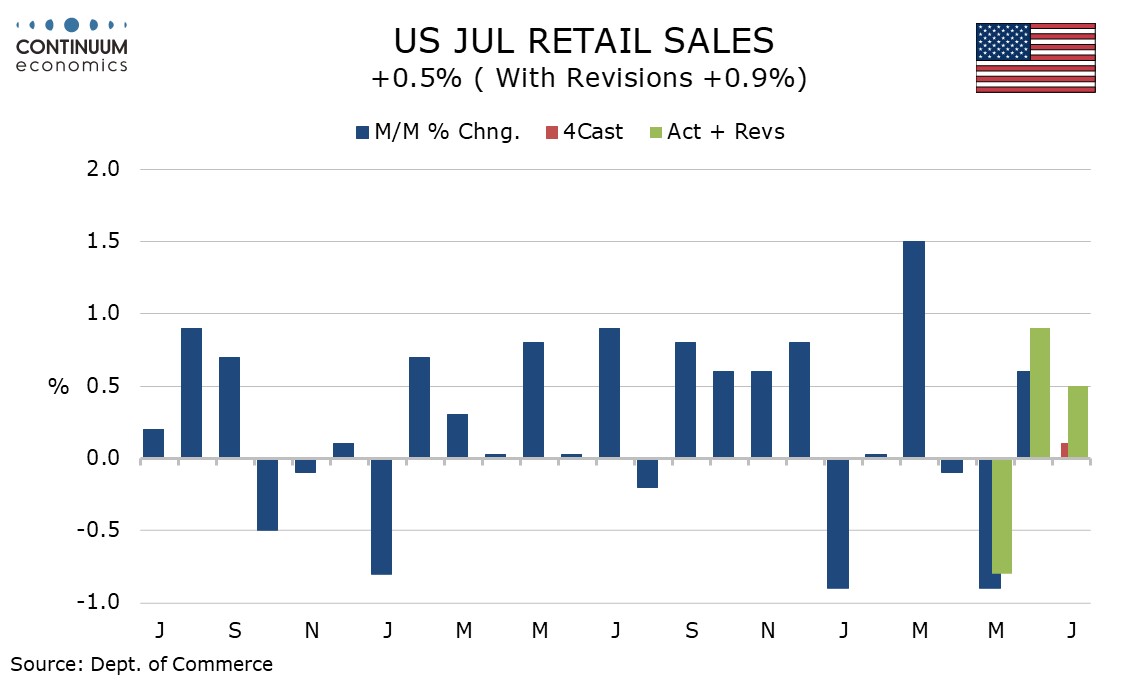

U.S. August Retail Sales - Still Resilient

September 16, 2025 12:48 PM UTC

August retail sales with a 0.6% increase, with the ex-auto and ex auto and gasoline gains both at 0.7%, are stronger than expected and suggest continued consumer resilience despite a slowing in employment growth. The rise modestly exceeds a 0.5% rise in CPI commodity prices in August.

Succession and Strongmen Leaders

September 16, 2025 10:53 AM UTC

In the unexpected scenario of an early death, Putin and Xi have no clear successors, and any new Russia or China leader would have to spend time building domestic strength and compromising on external goals. Erdogan also has no clear successors, which could create political uncertainty. For Trump su

September 15, 2025

China: Broad Based Slowdown

September 15, 2025 7:55 AM UTC

• The latest monthly data from China show a broad based slowdown in the economy, due to the tariffs and structural weakness. Though we keep 2025 real GDP at 4.8%, the underlying trend suggest a slowdown to 4.0% for 2026. China authorities will start to announce fiscal measure

September 12, 2025

Taiwan: Grey Warfare or Naval Quarantine?

September 12, 2025 11:15 AM UTC

· The most likely option for China is to continue the air and naval grey warfare around Taiwan, combined with support for pro-China factions in Taiwan parliament to build pressure for reunification at some stage. With invasion being too high risk for President Xi (with the U.S. main

FOMC Preview for September 17: 25bps Easing on Increased Labor Market Risk

September 12, 2025 10:30 AM UTC

The FOMC meets on September 17 and we expect a 25bps easing to a 4.0-4.25% Fed Funds target range. The FOMC will continue to see similar upside risks to inflation but increased downside risks to the Labor Market. The dots are likely to continue to expect only one more move in 2025, but three moves i

September 11, 2025

ECB Council Meeting Review: Complacency Rules the Day!

September 11, 2025 2:08 PM UTC

A second successive stable policy decision was the almost inevitable outcome of this month’s ECB Council meeting resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. Also as expected, the ECB offered little in terms of policy guidance; after

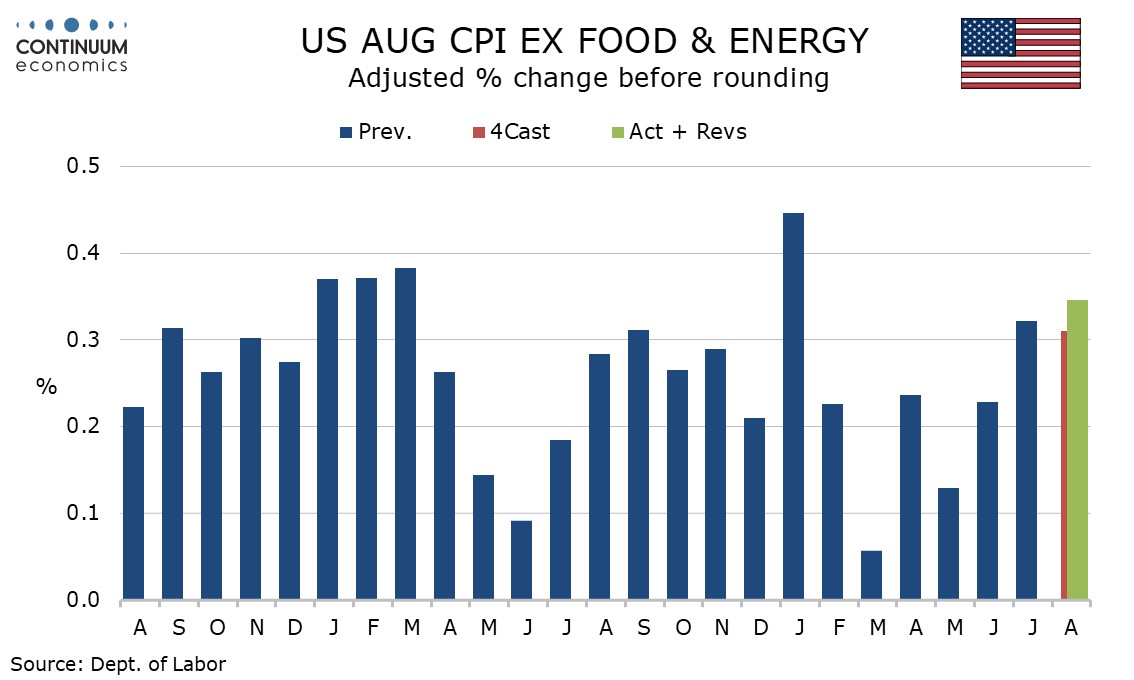

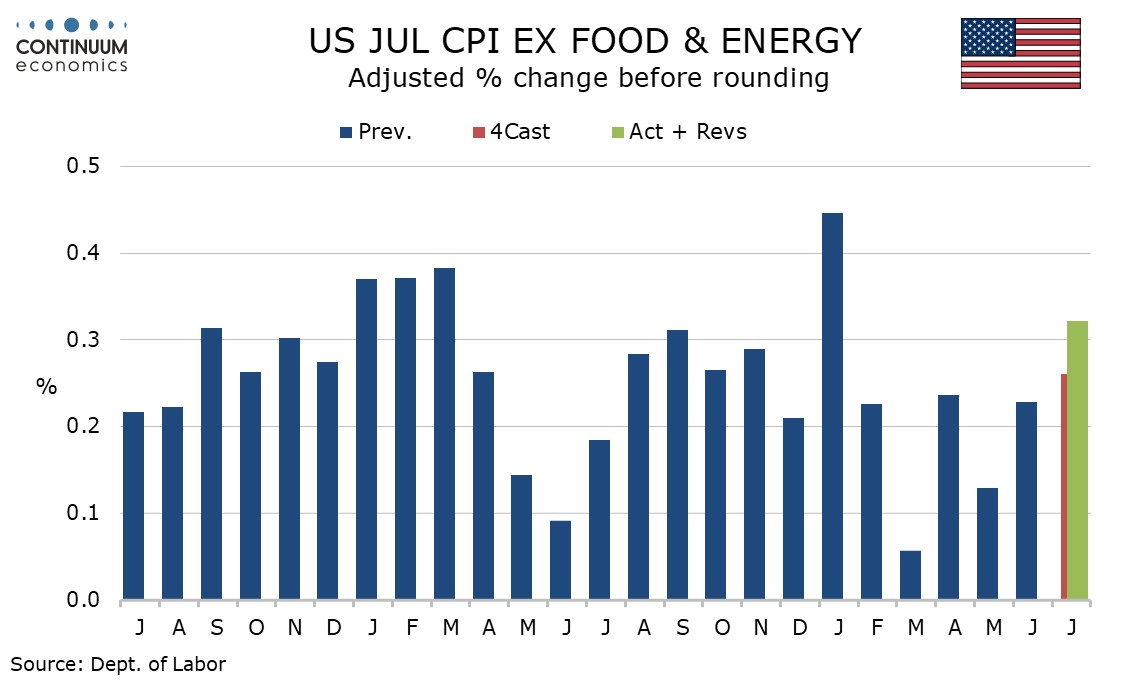

U.S. August CPI, Weekly Initial Claims - Risks on both sides of Fed mandate but possible seasonal adjustment issues for Claims

September 11, 2025 1:07 PM UTC

August CPI is firmer than expected overall at 0.4% and while the core rate was as expected at 0.3% its rise before rounding at 0.346% is uncomfortably high emphasizing the upside risks to the Fed’s inflation mandate. Initial claims at 263k from 236k however point to downside risks to the Fed emplo

September 10, 2025

DM Rates: Steeper Yield Curves: More to Come?

September 10, 2025 10:55 AM UTC

Steeper yield curves are a function of monetary easing cycles, budget deficits, lower central bank holdings of government bonds, a move towards pre GFC real rates and shifting demand from pensions funds and life insurance companies. Scope exists for further steepening in the U.S., EZ and UK with m

September 09, 2025

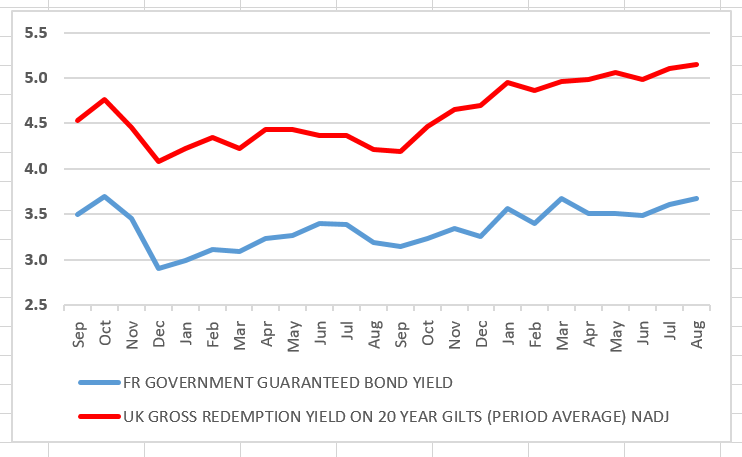

France: Kicking the Fiscal Can (Again)

September 9, 2025 8:41 AM UTC

That France has seen the departure of yet another prime minister is no surprise, hence why financial markets took the confidence vote in its stride. Admittedly, French sovereign spreads and yields have risen in the last month, but even so the actual level of bond yields remains well below that of

September 08, 2025

September 05, 2025

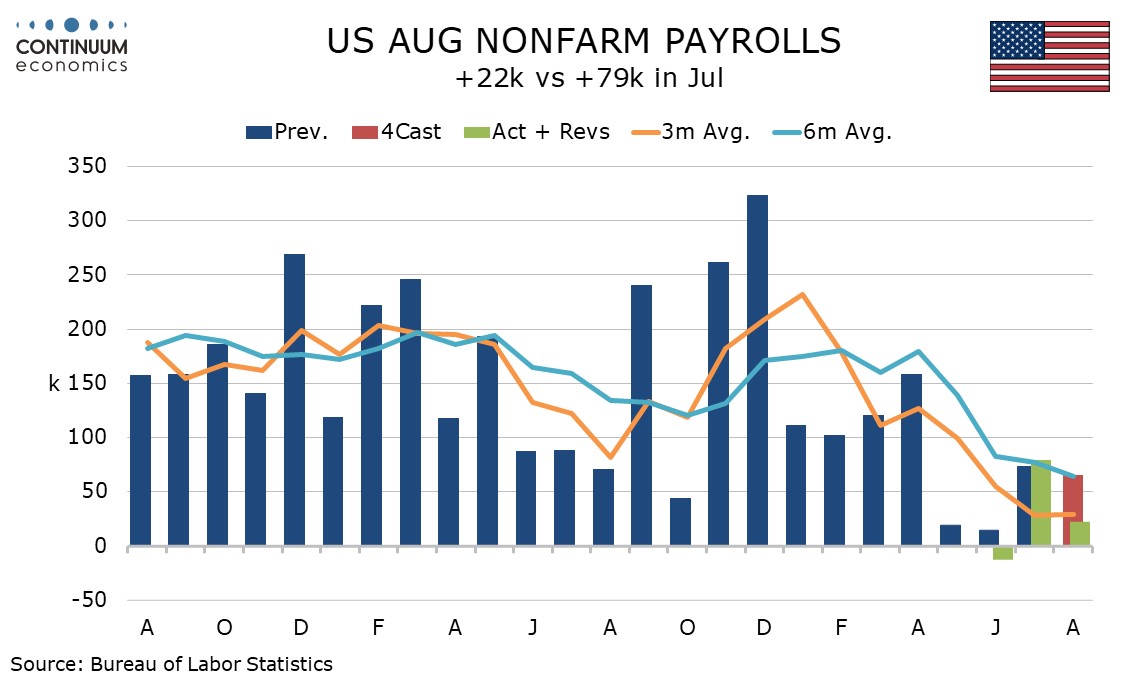

U.S. August Employment - Trend now close to flat, backing case for easing

September 5, 2025 1:03 PM UTC

August’s non-farm payroll shows that job growth is now minimal, with a rise of 22k almost completely offset by a modest 21k in net downward revisions. Unemployment rose to 4.3% from 4.2% while average hourly earnings rose by 0.3%, both as expected, though the workweek was weaker than expected. The

September 04, 2025

September 03, 2025

ECB Council Meeting Preview (Sep 11): No Change and Little Guidance

September 3, 2025 9:20 AM UTC

A second successive stable policy decision is very likely at next week’s ECB Council meeting resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. We see the ECB offering little in terms of policy guidance; after all, in July the Council sugge

September 02, 2025

EZ HICP Review: Headline Inflation Edges Higher as Services Fall to Fresh Cycle-low

September 2, 2025 9:34 AM UTC

As we repeated again, HICP inflation – even now a notch above target – is very much a side issue for the ECB at present, offset instead by moderate concerns whether the apparent resilience of the real economy may yet falter. This mindset will not have been altered by the flash HICP data for Au

September 01, 2025

Aging: Slow Growth for Some in 2020’s

September 1, 2025 8:35 AM UTC

Population aging always seems to be beyond the market horizon, but the 2020’s are already seeing population aging in some countries. What is the economic impact? Aging is already causing a peak in labor force in China and the EU. Meanwhile, the population pyramid also means less consumptio

August 29, 2025

U.S. July Personal Income and Spending and Core PCE Prices as expected, but Advance Goods Trade Deficit up as imports rebound

August 29, 2025 12:58 PM UTC

July’s personal income and spending report is in line with expectations, with the 0.3% core PCE price index matching the core CPI, and gains of 0.4% in income and 0.5% in spending also as expected. However a rise in the July advance goods trade deficit to $103.6bn from $84.9bn is unexpected, and l

August 28, 2025

Preview: Due August 29 - U.S. July Personal Income and Spending - Core PCE Prices to match Core CPI

August 28, 2025 1:35 PM UTC

We expect PCE price data to match the July CPI, with a 0.3% rise in the core rate and a 0.2% increase overall. We expect both personal income and spending to rise by 0.5%, ahead of prices.

ECB July Account: Policy ‘On Hold’ Leaves Easing Door Open But Less Widely So

August 28, 2025 12:37 PM UTC

The account of the July 23-24 ECB Council meeting saw some discussion about cutting at that juncture but with no immediate pressure to change policy rates what was then exceptional uncertainty added to arguments for keeping interest rates unchanged. In particular, it was seen that maintaining policy

U.S. Lagged Interest Rates: Only Hurting a Bit

August 28, 2025 12:08 PM UTC

A big shock from lagged higher interest rates is not being seen in the data looking at financial conditions; the household savings ratio and interest rate sensitive sectors. The impact of the Trump tariffs is still uncertainty, but our alternative scenario of a hard landing remains at 25% and ou

August 26, 2025

US 10yr: Fed Independence V Economy and Budget

August 26, 2025 12:14 PM UTC

10yr yields face upward pressure from Fed independence questions, but downward pressure from a slowing economy and a better supply picture with CBO estimates of USD4trn of tariff revenue over 10 years. One way to continue playing these themes is for yield curve steepening, where we see scope for the

EZ HICP and Jobs Review: Headline at Target as Services Inflation at Fresh Cycle-low

August 26, 2025 11:51 AM UTC

HICP, inflation – still at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation and a low but far from authoritative jobless rate (Figure 3) possibly accentuating existing and looming Council divides. Regardless, despite adverse

France and Italy: Deficit, ECB QT and Foreign Debt Holders Stories

August 26, 2025 7:35 AM UTC

A large budget deficit in France, looking persistent given the current political impasse, combined with ECB QT means that the market has to absorb a very large 8.5% of GDP of extra bonds. Our central scenario is that persistent French supply causes a further rise in 5yr plus French government yields

August 25, 2025

Jackson Hole: Fed/ECB/BOJ and BOE on Labor Markets

August 25, 2025 9:02 AM UTC

Fed Powell focused on the cyclical softening of employment to back a more dovish undertone. In contrast other central bank heads focused on structural labor market issues. While ECB Lagarde was pleased with the post COVID EZ picture, current economic softness still leaves us forecasting two furt

August 22, 2025

Fed Powell: Signals September Cut

August 22, 2025 2:35 PM UTC

Fed Chair Powell spent the first 10 minutes at Jackson hole reviewing current data and discussing the policy stance. Powell clearly signaled a September cut, given downside risks to employment after the July employment report revisions. However, Powell did not signal whether the move will be 25b

August 21, 2025

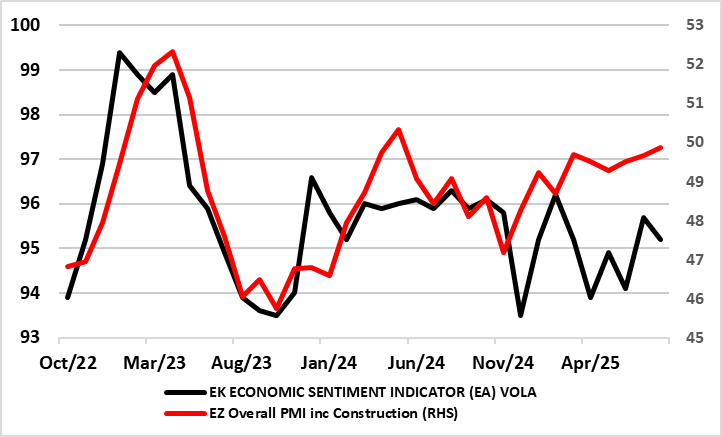

Eurozone: ECB Feels it Has More Reason to ‘Wait and See’?

August 21, 2025 10:02 AM UTC

To suggest that recent EZ real economy indicators, such as today’s August PMI flashes, have been positive would be an exaggeration. But, at the same time, the data (while mixed and showing conflicts - Figure 1) have not been poor enough to alter a probable current ECB Council mindset that the ec

Bank Indonesia Delivers Surprise Second Rate Cut to Shield Growth

August 21, 2025 5:10 AM UTC

BI is opting for early stimulus while macro buffers remain strong—stable rupiah, low inflation, and manageable deficits. However, this window may close quickly if external risks materialise. Business leaders should expect a monetary pause in Q3, but prepare for moderate volatility if inflation or

August 20, 2025

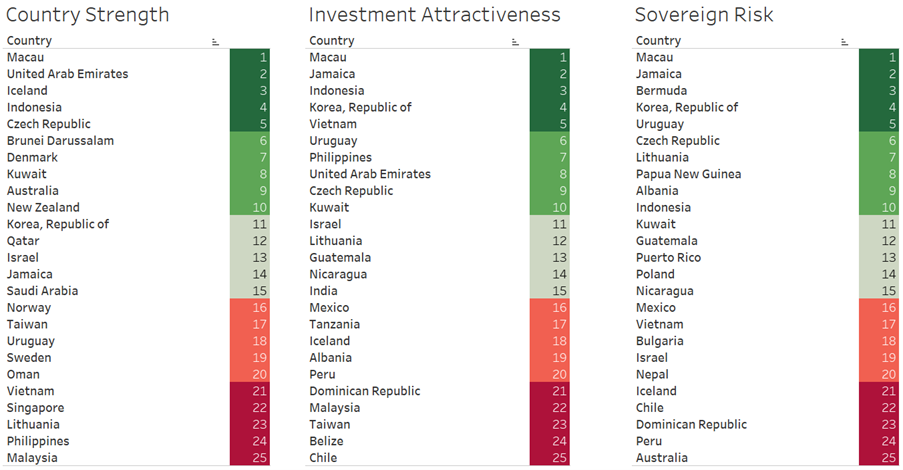

2025 Q2 Country Insights Scores to Download in Excel

August 20, 2025 12:00 PM UTC

The Country Insights Model is a comprehensive quantitative tool for assessing country and sovereign risk by measuring a country’s risk of external and domestic financial shocks and its ability to grow. The access to our full range of scores across 174 countries corresponding to the second quarter

U.S./China Trade Deal: Slow Progress

August 20, 2025 10:25 AM UTC

· Overall, we would attach a 50% probability to a trade framework deal being announced in Q4, though this is unlikely to be comprehensive and could merely be a collection of measures. Even so, the risk also exists of trade negotiations dragging onto 2026 and then reaching a deal or fa

August 19, 2025

China Slow Diversification: Gold And Others

August 19, 2025 8:05 AM UTC

China’s diversification from U.S. Treasuries appears to be at a slow pace. Gold is the obvious alternative if geopolitical tensions were to rise or skyrocket in the scenario of a China invasion of Taiwan. However, Gold holdings are merely creeping higher and suggesting no urgency from China

Rate Hold Expected as Bank Indonesia Eyes H2 Trade Risks

August 19, 2025 6:26 AM UTC

With headline inflation still well-contained, core pressures softening, and the economy showing signs of resilience, Bank Indonesia is expected to keep rates on hold. Further easing may come later in H2—but only if external risks re-intensify or domestic growth falters.

August 18, 2025

U.S. Strategic Fiscal Comparisons

August 18, 2025 9:05 AM UTC

The U.S. short average term to maturity is a structural fiscal weakness if higher rates lift U.S. government interest costs close to the nominal GDP trend. Hence, Trump’s pressure for fiscal dominance of the Fed to deliver lower policy rates and reduce U.S. government interest rate costs. Howeve

August 15, 2025

Preview: Due August 29 - U.S. July Personal Income and Spending - Core PCE Prices to match Core CPI

August 15, 2025 2:34 PM UTC

We expect PCE price data to match the July CPI, with a 0.3% rise in the core rate and a 0.2% increase overall. We expect both personal income and spending to rise by 0.5%, ahead of prices.

U.S. July Retail Sales - Resilient entering Q3

August 15, 2025 12:51 PM UTC

July retail sales with a 0.5% increase are in line with expectations, with net upward revisions totaling 0.4%. Ex auto sales rose by 0.3% also with 0.4% in upward revisions while ex auto and gasoline sales rose by 0.2%, here with revisions of only 0.2%. The data suggest consumer spending is holdin

China Slowdown In July

August 15, 2025 7:03 AM UTC

• Retail sales sluggishness reflects households cautious due to the hit to housing wealth and uncertainty over jobs and wage growth. Investment softness reflects not only residential property weakness, but also a slowdown in government infrastructure. This weakness could see a top up fi

August 14, 2025

U.S. Markets: Soft Versus Hard Landing

August 14, 2025 1:02 PM UTC

A mild recession would likely trigger the Fed to ease quickly to 2.0-2.5%, which would produce yield curve steepening but would likely drag 10yr yields down to 3.50-3.75%. The S&P500 would likely fall to 5000 in this scenario, as corporate earnings are axed; buybacks slow and the price/ea

August 13, 2025

September Fed ease now more likely than not, but far from assured

August 13, 2025 3:29 PM UTC

A September FOMC easing now looks more likely than not, but remains far from a done deal. We are however revising our call to two 25bps FOMC easings this year, in September and December, from just one, in December. 2026 is harder still to call given threats to Fed independence, but we continue to ex

China: Echoes of Japan?

August 13, 2025 8:05 AM UTC

Overall, some of China’s private businesses and households are suffering from Japan’s style balance sheet recession. Combined with slowing productivity and a shrinking workforce, this points to slower trend growth in the coming years. However, fiscal stimulus and the clean-up of Loca

India CPI Review: Headline inflation drops sharply on account of food prices

August 13, 2025 7:38 AM UTC

India’s retail inflation fell to 1.55% yr/yr in July 2025, its lowest since 2017 and below the RBI’s 2–6% target band for the first time in over six years. The drop was driven by a sharp contraction in food prices, even as edible oil and fruit inflation remained elevated. With inflation well b

August 12, 2025

U.S. July CPI - Core rate, particularly services, a marginal disappointment

August 12, 2025 1:02 PM UTC

July’s CPI is in line with consensus at 0.2% overall, 0.3% ex food and energy, but the core rate of 0.322% before rounding is a little high for comfort. The detail shows the acceleration from June was more in services than goods, so the story is not a simple one of tariffs.

August 11, 2025

August 08, 2025

Mexico: Further 25bps Cuts Ahead

August 8, 2025 6:44 AM UTC

Banxico forward guidance, plus trade policy risks with the U.S. now see us forecasting an end 2025 policy rate at 7.25% with two 25bps cuts in September and December. We now feel that the risks to 2026 growth will encourage Banxico to move the policy rate down to 6.5% by spring 2026 by two 25bps rat