China: Broad Based Slowdown

• The latest monthly data from China show a broad based slowdown in the economy, due to the tariffs and structural weakness. Though we keep 2025 real GDP at 4.8%, the underlying trend suggest a slowdown to 4.0% for 2026. China authorities will start to announce fiscal measures to boost 2026 growth later this year though and we keep the 2026 GDP forecast at 4.5%.

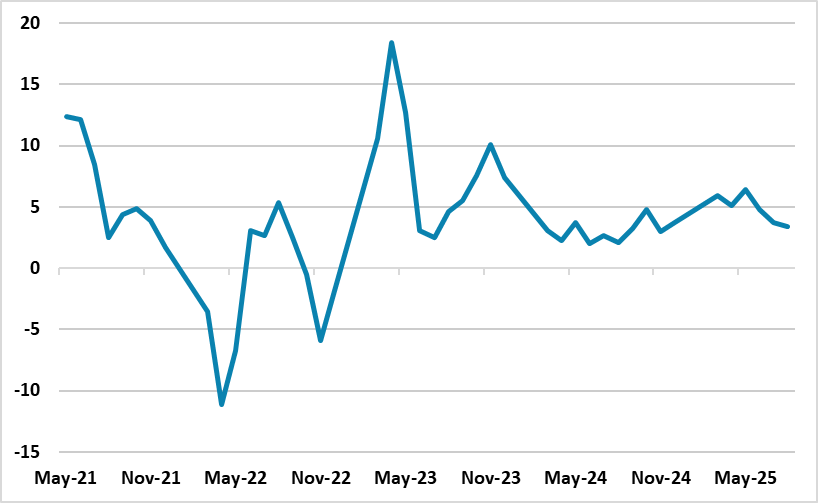

Figure 1: Retail Sales Yr/Yr (%) Source: Datastream

The August monthly numbers from China paint a picture of a slowing economy. Key points include.

The August monthly numbers from China paint a picture of a slowing economy. Key points include.

• Retail sales at 3.4% Yr/Yr was lower than the expected 3.8%, with the effects of trade in programs fading. Home appliances at 14.3% Yr/Yr compared to 28.7% in July, while communications equipment also slowed to 7.3% v 14.9% in July. Other elements of retail sales were sluggish, with auto sales at +0.8% Yr/Yr compared to -1.5% in July. Consumer confidence remains weak, as housing wealth has taken a hit and the housing market has not yet found a bottom. Residential property investment was -12.9% Yr/Yr YTD, while home prices and sales keep falling. Additionally, other indicators suggest wage and employment growth remain sluggish.

• Fixed investment fell -0.5% Yr/Yr YTD versus 1.5% in July, with private investment -2.3% and public +2.3%. This reflects bad weather in the 2nd half of August, but also private investment being hurt by spare capacity and the U.S. tariffs. Public investment has also been sluggish, despite some outstanding 2025 investment commitments not being started. This underlying investment slowdown is a concern for the economy in H2 and going into 2026. Industrial production also slowed to 5.2% Yr/Yr versus 5.6% in July, with export industries slowing. H2 is seeing the lagged effects of the 30% U.S. tariffs impacting exports and it is questionable whether China can persistently redirect exports to other countries – for example Mexico is introducing 50% tariffs on China cars.

• Little new stimulus. The PBOC has been cautious, despite the softening in the economy and the aggressive disinflation. The -0.4% headline CPI inflation is food related, with core at +0.9% Yr/Yr, but the excess of production over domestic demand remains. However, PBOC are reluctant to cut interest rates further, as it would undermine banks profitability and potentially lending. We see no 7 day reverse repo rate cut in the remainder of 2025 and only 10bps in Q2 2026. Re fiscal policy, it is unlikely that new measures for 2025 will be announced, but we could see some new measures for 2026 announced in late 2025 and March 2026.