Preview: Due August 29 - U.S. July Personal Income and Spending - Core PCE Prices to match Core CPI

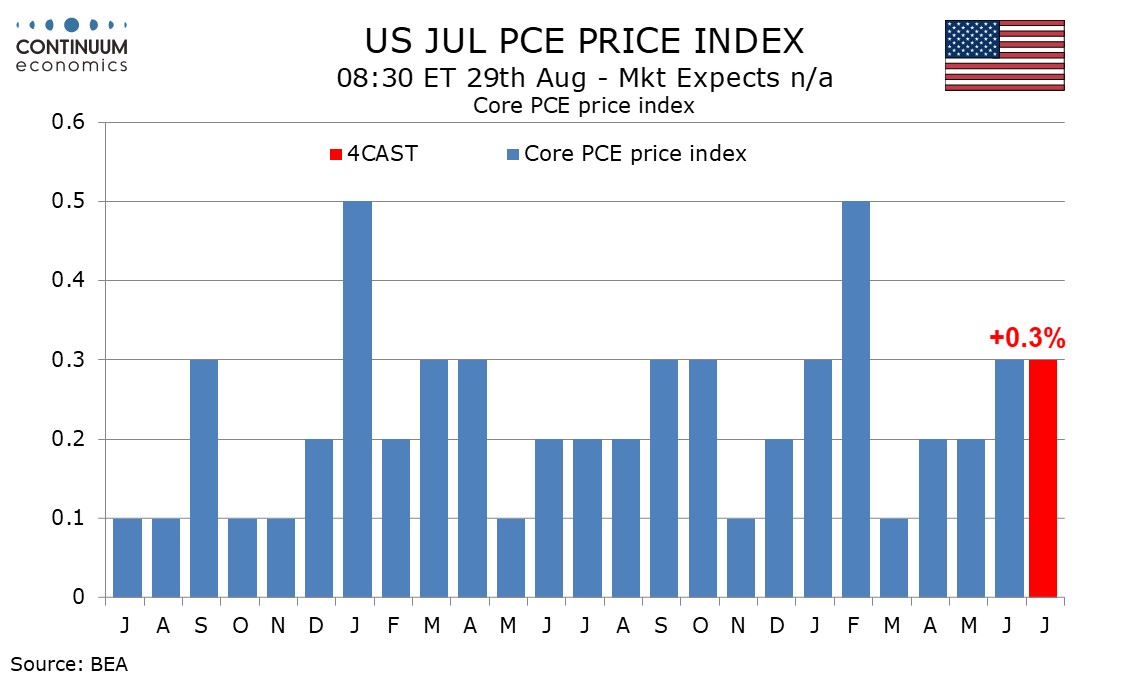

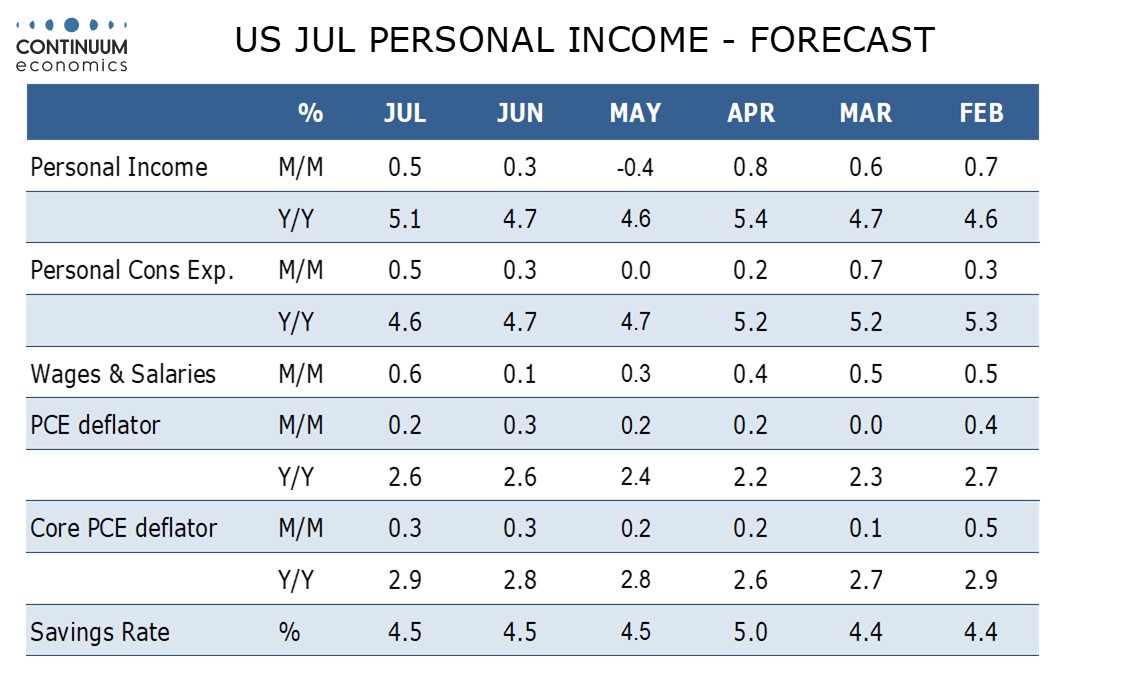

We expect PCE price data to match the July CPI, with a 0.3% rise in the core rate and a 0.2% increase overall. We expect both personal income and spending to rise by 0.5%, ahead of prices.

Core CPI rose by slightly more than 0.3% before rounding but we expect that core PCE prices may be slightly below, with the PCE components of the PPI mostly not alarming despite surprising strength in PPI overall.

This would still see yr/yr core PCE prices rising to 2.9% from 2.8%, reaching the highest since February. We expect overall PCE prices to see yr/yr growth at 2.6%, unchanged from June.

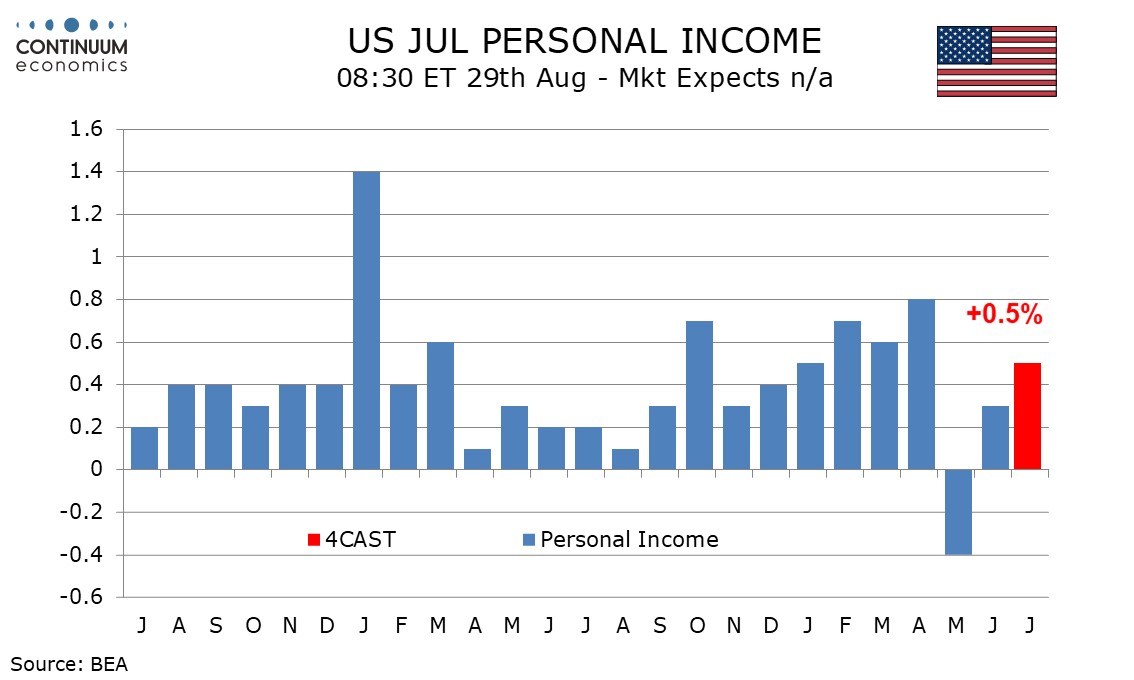

While July’s non-farm payroll was subdued a rise in the workweek should support a healthy 0.6% rise in wages and salaries. The other components of personal income should, as is usual, underperform, leaving overall personal income up by 0.5%.

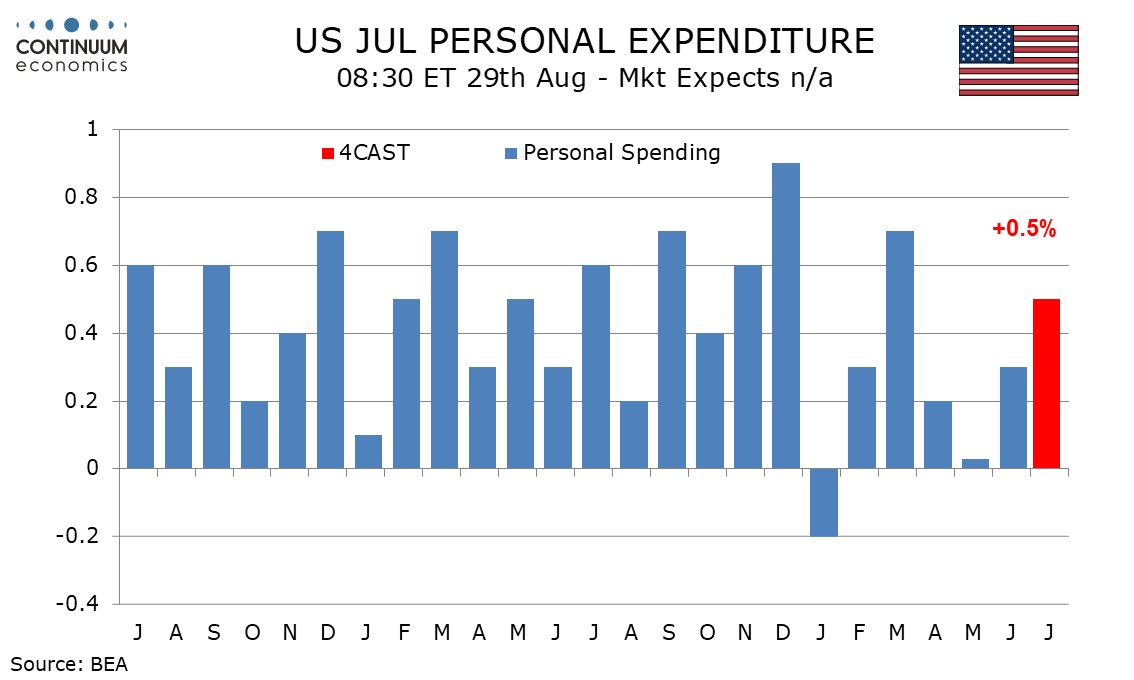

Retail sales rose by 0.5% in July but industry data suggests autos may see a stronger rise than in the retail sales report. We expect services to rise by 0.4%, after three straight gains of 0.3%, with some support coming from prices. This would leave personal spending also up by 0.5%.