U.S. Markets: Soft Versus Hard Landing

A mild recession would likely trigger the Fed to ease quickly to 2.0-2.5%, which would produce yield curve steepening but would likely drag 10yr yields down to 3.50-3.75%. The S&P500 would likely fall to 5000 in this scenario, as corporate earnings are axed; buybacks slow and the price/earnings ratio falls to average levels. USD losses can also extend in this scenario, but most likely on USD/JPY.

The U.S. money market has discounted more Fed easing in the next 18 months, but U.S. markets are still biased to a soft landing for the U.S. economy. How would the asset outlook change with a hard landing (e.g. mild recession)?

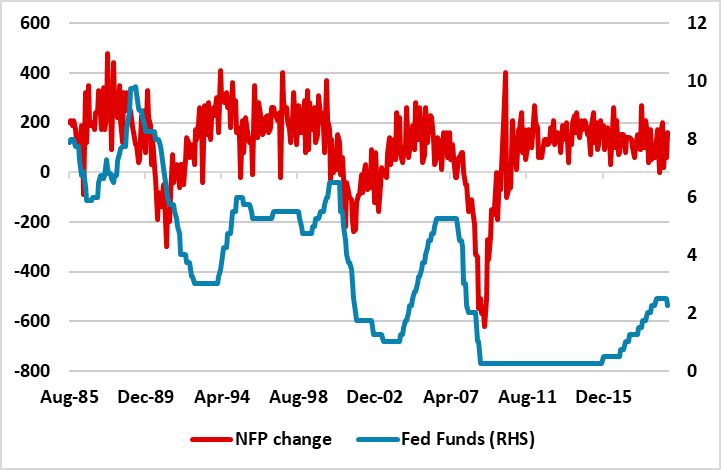

Figure 1: Non-Farm Payroll Change (Mth/Mth) versus Fed Funds (%)

Source: Datastream/Continuum Economics.

Though the U.S. money market is now discounting 25bps cuts in September/December 2025, the terminal policy rate is seen at 3% in line with Fed neutral policy estimates. This is a soft landing story that is helping the front end of the U.S. Treasury curve, but with the long-end seeing yield curve steepening (here) due to long-term heavy supply and Fed independence concerns. U.S. equities are optimistic with better than expected corporate earnings results; buybacks and the AI story. The USD is seeing a choppy consolidation over the summer versus DM currencies, after the noticeable H1 2025 losses. Our baseline view in the June outlook remains that U.S. equities and the USD are still overvalued. We see risks of a correction in U.S. equities down to 6000 by end 2025, as the economic slowdown extends. Meanwhile, our end 2025 USD forecasts are for 1.20 and 135 on EUR/USD and USD/JPY respectively, as USD overvaluation continues to unwind with erratic policymaking under the Trump Administration. What happens if a hard landing occurs for the U.S. economy?

A mild recession is a 25% probability scenario for Continuum Economics, which would likely trigger quick and more aggressive Fed easing to a 2.0-2.5% Fed Funds rate. When the trend in NFP went negative in 1990; 2001 and 2008, the Fed accelerated easing noticeably (Figure 1). One complication is if CPI and PCE inflation push above 3%, which could mean a quick move to a 3% Fed Funds with a mild recession but then more a bumpier path downwards. Our view remains that this would cause yield curve steepening, but asset allocations switches into U.S. Treasuries would likely drag 10yr yields down to 3.50-3.75% (here).

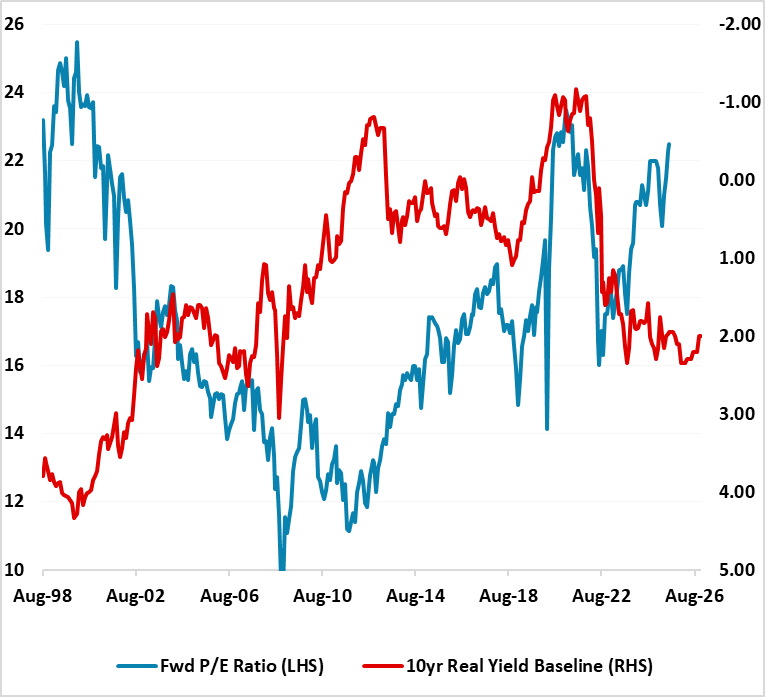

U.S. equities would benefit from lower short-term rates, but only with a lag. Corporate earnings downgrades would dominate, with a risk to the pace of buybacks as seen in other recessions. Additionally, the U.S. equity market currently is overvalued in equity terms and against 10yr U.S. Treasuries (Figure 2). Previous recessions have seen a fall in the 12mth forward price/earnings ratio and this would likely be the case if the alternative scenario of a hard U.S. landing occurs. A mild U.S. recession could bring the S&P500 down swiftly to 5000.

Figure 2: 12mth Fwd S&P500 P/E Ratio and 10yr Real U.S. Treasury Yield Inverted (Ratio and %)

Source: Continuum Economics with forecasts to end 2026

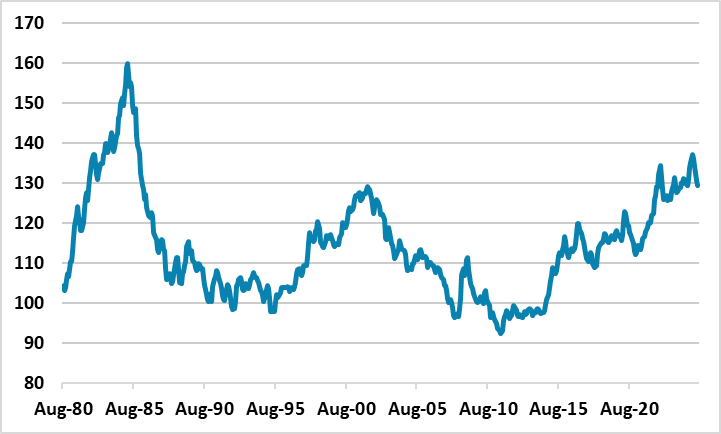

For the USD, a mild U.S. recession would hurt the USD, as cyclical Fed expectations factor in deeper cuts and an adverse shift in interest rate differentials for the U.S. With the USD still overvalued (Figure 3), this could bring forward some of the further USD decline we are forecasting for 2026 and 2027. However, on EUR/USD the H1 USD decline has run ahead of interest rate differentials already and only modest further losses are likely, though on USD/JPY we could see 130.

We will monitor incoming U.S. economic data closely to see whether it is consistent with our baseline soft landing view (June Outlook here) or whether it develops into a harder landing.

Figure 3: USD Real Effective Exchange Rate Based on CPI

Source: Datastream/Continuum Economics