Indonesia’s August CPI Eases

Inflation is well behaved, food remains a wildcard, and core pressures are easing—giving Bank Indonesia continued policy flexibility as it weighs growth support against global uncertainty.

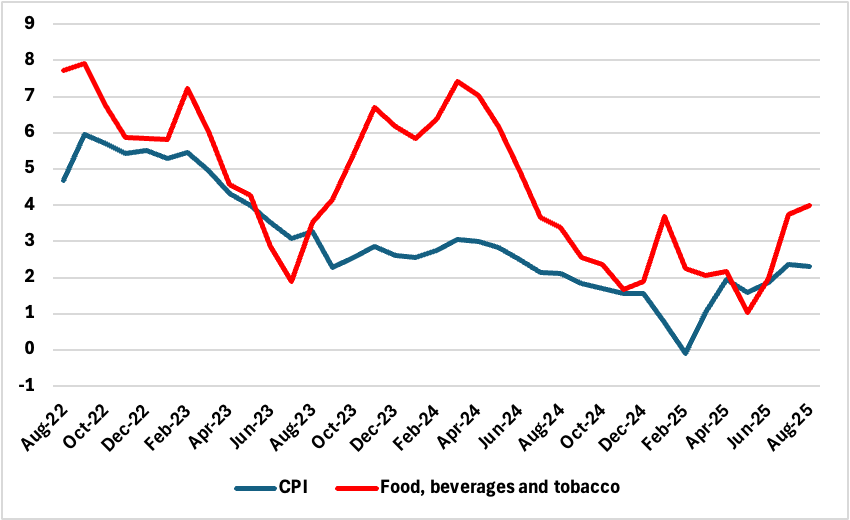

Indonesia’s headline consumer price index (CPI) inflation eased slightly to 2.31% yr/yr in August, down from 2.37% in July, according to the latest data from Statistics Indonesia (BPS). The moderation was primarily driven by falling transportation costs and slower price growth in education, personal care, and clothing, partially offsetting persistent food-related inflation. Core inflation also softened, dipping to 2.17% yr/yr in August from 2.31% the previous month—its lowest level in over seven months.

Figure 1: Indonesia CPI and Food Price Inflation (% yr/yr)

Source: Continuum Economics

The headline print confirms that inflation remains well-anchored within Bank Indonesia’s (BI) official target band of 2.5% ±1%, reinforcing the central bank’s view that recent monetary easing has not yet triggered broader price pressures. Indeed, transport prices fell for the first time in four months, offering the largest disinflationary contribution to the headline rate. The decline in fuel and transport service costs likely reflects both seasonal demand patterns and stabilised energy prices.

Meanwhile, education costs—typically elevated in August due to school-related spending—grew at a more modest pace than in previous years. Additional softening was seen across clothing, household equipment, and personal care, suggesting broad-based disinflation outside of food categories.

Yet, food prices continue to pose a challenge, accelerating for the third consecutive month. Food inflation in August marked its strongest reading since June 2024 and contributed around 1.1 percentage points to headline CPI—accounting for nearly half the overall rate. Items like rice, vegetables, and poultry drove the surge, reflecting supply-side bottlenecks and potential seasonal pressures. Personal care and restaurant prices also added notable upward momentum, with combined contributions nearing 0.9pps.

Despite this, price dynamics across most sectors remain subdued, and core inflation's downward trend indicates that underlying demand-side pressures are still modest. This supports the narrative that BI’s recent 75 basis points of rate cuts in 2025 have thus far stimulated growth without significantly altering inflation expectations.

Looking ahead, CPI inflation is likely to remain in the 2–3% range for the remainder of the year, assuming no fresh supply shocks or currency volatility. While food prices warrant close monitoring—especially with import and logistics costs still elevated—there is little evidence of demand-pull inflation building across the broader economy.