2025 Q2 Country Insights Scores to Download in Excel

The Country Insights Model is a comprehensive quantitative tool for assessing country and sovereign risk by measuring a country’s risk of external and domestic financial shocks and its ability to grow. The access to our full range of scores across 174 countries corresponding to the second quarter of 2025 is now available.

The scores file allows for comparison with other periods and ranking for all countries across the headline indicators and are available as easily accessible time series.

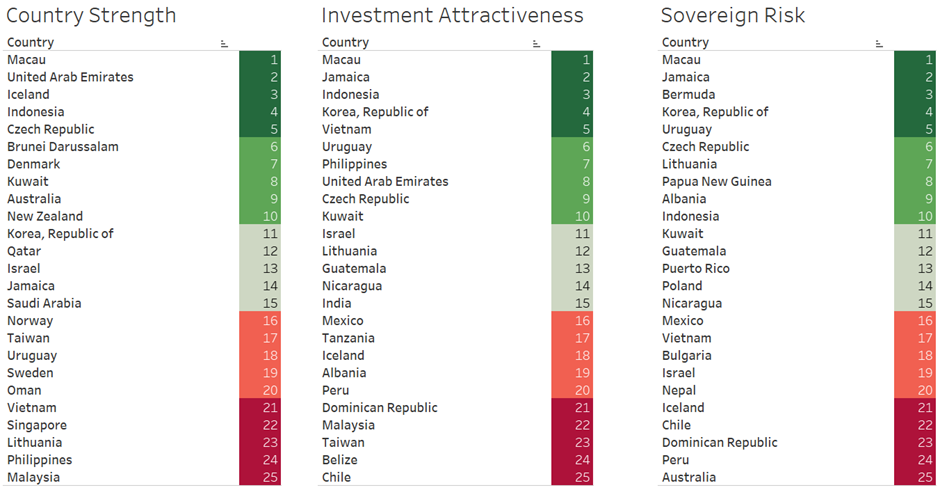

Figure 1: Country Insights Rankings

Source: Continuum Economics

The Country Strength Index highlights meaningful differences across economies, with Macau, United Arab Emirates, Iceland, Indonesia, and the Czech Republic emerging as the strongest performers. These countries are supported by robust external adjustment capacity, healthy reserve buffers, and favorable debt dynamics. Macau, for instance, demonstrates exceptional current account strength, while Iceland and the Czech Republic benefit from credible fiscal frameworks and sound institutional structures. Indonesia combines solid external resilience with sustained growth momentum, reinforcing its position among the stronger economies. By contrast, the Philippines, Vietnam, and Malaysia align more closely with the group average, reflecting vulnerabilities in institutional robustness and political institutions, even though they demonstrate strengths in areas such as human capital, infrastructure, and longer-term growth potential.

The Investment Attractiveness Index reveals a different hierarchy of performance, underscoring that macroeconomic resilience does not automatically translate into investor appeal. Jamaica, Indonesia, and Korea stand out as particularly attractive destinations, supported by favorable growth potential, market dynamism, and comparatively strong institutional environments. Macau and the United Arab Emirates also perform well, combining robust external positions with investor-friendly regulatory frameworks. By contrast, Malaysia, Taiwan, and Chile score closer to the group average, reflecting a mix of structural rigidities, regulatory bottlenecks, and, in some cases, weaker business environments. These findings emphasize that while some economies attract capital through structural strength, others rely more on growth opportunities and reform-driven momentum to appeal to international investors.

The Sovereign Risk Index underscores the role of both external resilience and institutional strength in shaping creditworthiness. Macau and Jamaica rank among the most stable, supported by strong external balances, sizeable reserves, and prudent fiscal management, while Bermuda also benefits from relatively solid institutions and low political risk. Peru shows relative strength through a favorable external position, though its monetary policy and political institutions remain a concern. Australia and the Dominican Republic score lower due to total indebtedness and political constraints, respectively. These results highlight that sovereign stability depends not only on external metrics but also on the credibility of domestic policy and governance.

See Article Resources (below) to access the full range of scores.