Jackson Hole: Fed/ECB/BOJ and BOE on Labor Markets

Fed Powell focused on the cyclical softening of employment to back a more dovish undertone. In contrast other central bank heads focused on structural labor market issues. While ECB Lagarde was pleased with the post COVID EZ picture, current economic softness still leaves us forecasting two further 25bps cuts. BOE Bailey worried over a structurally tight labor market, but the contraction in employment is the worst in the G4 and we see this triggering more BOE rate cuts. Finally, BOJ Ueda made suggestion to reduce the tight Japanese labor market, but these are unlikely to be delivered in the next few years and meaning that the BOJ will likely hike in the autumn.

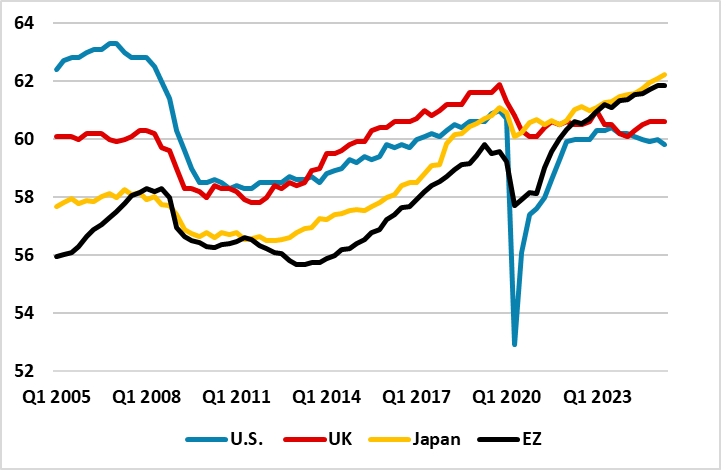

Figure 1: Employment Rate Major DM Economies (%)

Source: Fred St Louis

The Jackson Hole conference saw the head of the Fed, ECB, BOJ and BOE talking about labor markets. Fed Powell focus was on the cyclical situation in the context of monetary policy, which we feel signals a 25bps cut at the September FOMC meeting is now likely (here). However, the U.S. also suffers from structural problems in the shape of poor health for the over 60’s; large ex criminal population with lower employment rate and now the crackdown on illegal immigration. We discussed some of these in a recent article (here) and without measures to rectify they mean that the labor market ends up being tighter than normal and causing a medium to long-term dilemma for the Fed. The Trump administration however are not worried about labor supply.

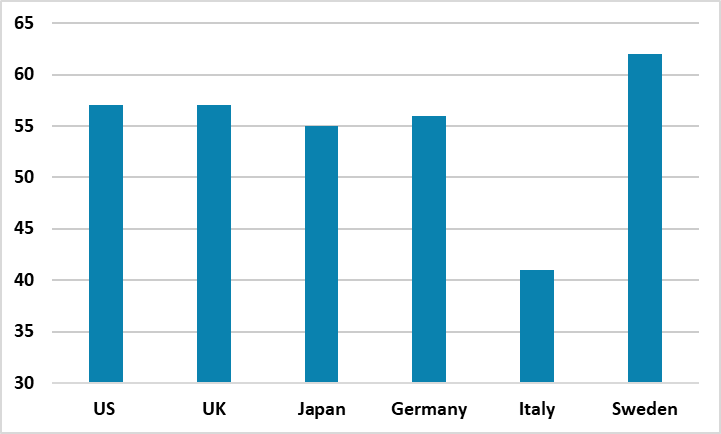

For the BOJ, Ueda noted that a tight labor market had been a factor in driving up wages and the employment rate rise stands in stark contrast to the U.S. (Figure 1). Ueda noted that the labor market situation could be improved by more immigration and also a higher employment rate for women. However, politically mass immigration remains highly unlikely to Japan. In terms of female participation rates it is below the U.S. (Figure 2) and best practice Scandi countries that benefit from universal childcare provided by the government. This would help in Japan, but the current minority government does not appear focused on such a policy change. With a cyclically tight labor market we still look for a 25bps BOJ hike in the autumn to continue the interest rate normalization process (here).

ECB Lagarde was upbeat about the EZ labor market flexibility, where inflation has been brought down via rate hikes without a major cyclically hit to employment. We have also noted in the past that the post COVID rebound in labor force supply and employment has been good and better than for example the UK. However, the cyclical economic situation in the EZ remains weak and we still feel that this requires two further 25bps cuts in Q4 and Q1 2026 (here). The structural labor market situation could also be improved in some EZ countries by encouraging a better female participation rate in Italy for example (Figure 2), while the influx from Ukraine has also provided a one off boost to labor supply.

Figure 2: Female Participation Rate (%)  Source: OECD

Source: OECD

In contrast, BOE Governor Bailey highlighted poor labor force participation (Figure 1). Since COVID this has been hurt by ill health (that extra NHS funding is now trying to address) and life choices (e.g. early retirement helped by more pension flexibility than U.S./EZ). These could improve but only at a slow rate, while legal immigration to grow the labor force and GDP is being restrained by new visa measures and illegal immigration is a major pollical problem in the UK. This had Bailey anxious over a structurally tight labor market and low productivity keeping some inflation persistence in the UK. However, we feel that the BOE is underestimating the cyclical softness in the labor market (here), where the HMRC data suggests that the UK is the worst employment situation of the G4 and is contracting. We see this coming through to hurt consumption and also wage growth, which should bring disinflation and more rate cuts into 2026.