U.S. Lagged Interest Rates: Only Hurting a Bit

A big shock from lagged higher interest rates is not being seen in the data looking at financial conditions; the household savings ratio and interest rate sensitive sectors. The impact of the Trump tariffs is still uncertainty, but our alternative scenario of a hard landing remains at 25% and our baseline is for below trend positive growth.

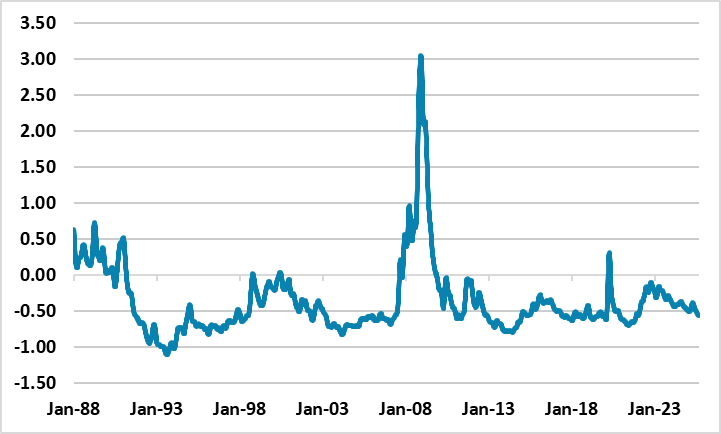

Figure 1: Chicago Financial Conditions Index

Source: Fred St Louis

While the major focus on the U.S. economy is the scale of the slowdown on President Trump tariffs feeding through, U.S. interest rates across the curve are still much higher than the 2010’s in nominal and real terms. Could this surprise with a big lagged impact?

Though U.S. Treasury yields are on the high side, corporate bond spreads are tight; the USD has moved lower this year and the equity market is buoyant. This means that overall financial conditions are not tight (Figure 1) in contrast to other pre-recession periods. The U.S. household sector also benefits from having locked in low interest rates for a long-period of time with long-dated mortgages, while the U.S. corporate sector is expected to only see lagged interest rates bite over a multi-year period due to different maturities of existing loans – corporate profits are also high and providing an alternative source of finance. A 3rd way of looking at tightness is money supply, but the monetary numbers are rebounding in 2025.

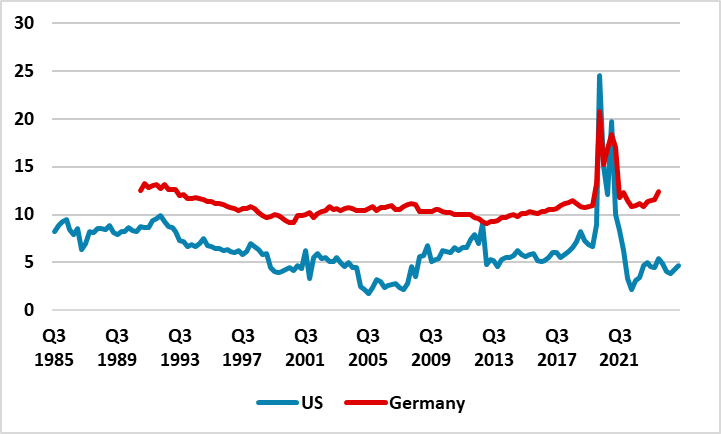

Households could also use higher interest rates to save more or could be cautious for other reasons such as domestic political turbulence under the Trump administration. However, the overall U.S. household savings ratio has settled at a lower level post COVID in contrast to some other DM economies (Figure 2). U.S. household wealth is also very strong due to house and equity price rises over the last 15 years. Though consumption growth is slowing, overall we are not seeing signs to be overtly concerned that this is causing a hard landing risk. Even so, low income households are struggling more than most households and this is causing some volatility beneath the surface. More importantly, companies could be scaling back employment in the face of tariffs, which could feedthrough with a lag to hurt income and consumption. Negative NFP numbers are not our baseline however and we look for slowdown rather than hard landing.

Figure 2: U.S. and Germany Household Savings Ratio (%)

Source: Datastream/Continuum Economics

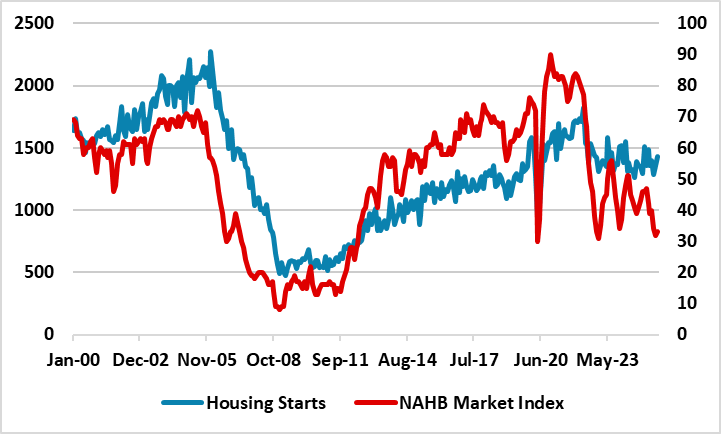

A final way to look at lagged high interest rates is to look at interest sensitive sectors. Housing is seeing a slowdown due to high rates, but this is modest rather than sharp due to the structural demand for houses in the U.S. Meanwhile, business investment is not seeing a dramatic slowdown, with the tech sector focused on the AI opportunity and investing heavily in powerful semi-conductor chips, server centers and power.

Figure 3: U.S. Housing Starts and NAHB Market Index (%)

Source: Datastream/Continuum Economics