US 10yr: Fed Independence V Economy and Budget

10yr yields face upward pressure from Fed independence questions, but downward pressure from a slowing economy and a better supply picture with CBO estimates of USD4trn of tariff revenue over 10 years. One way to continue playing these themes is for yield curve steepening, where we see scope for the 10-2yr to 90bps by early 2026.

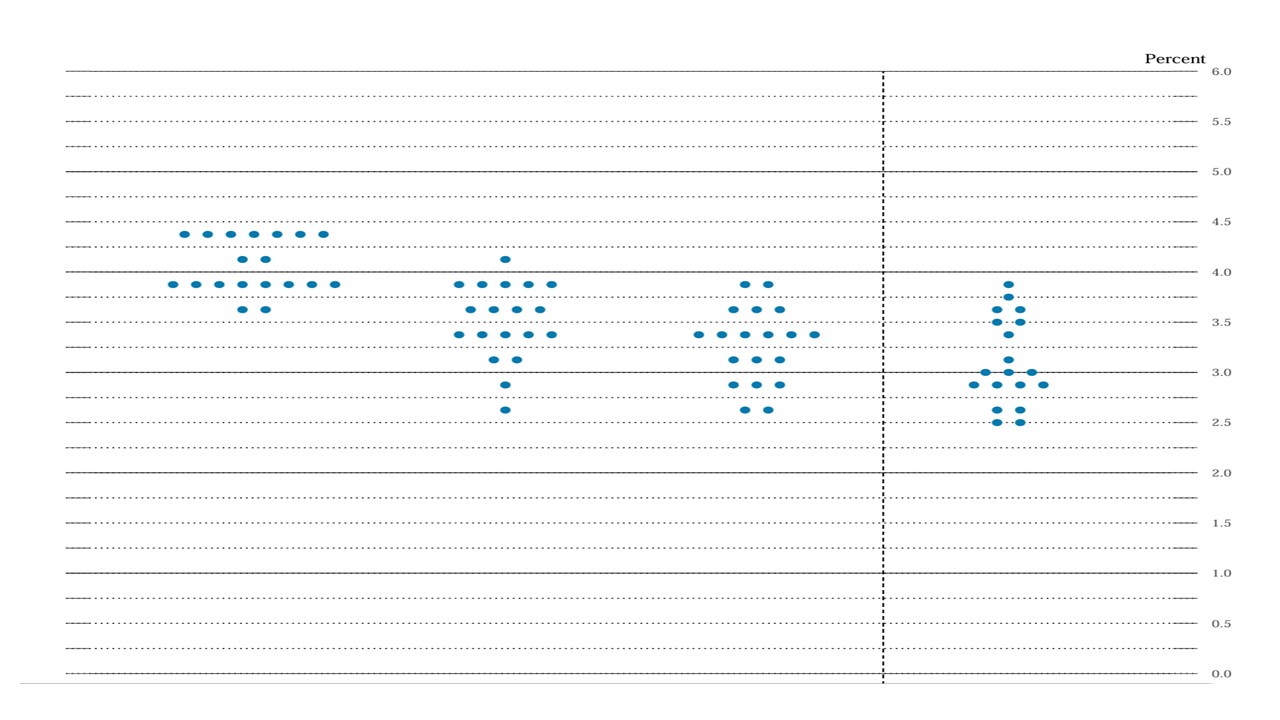

Figure 1: 10yr Breakeven Inflation (%)

Source: Bloomberg

The Fed independence question is getting more news media attention with President Trump announcing he will fire Fed Governor Lisa Cook over alleged mortgage fraud. Cook so far is disputing the legality of the firing and this may not be resolved quickly. It also remains unclear whether Stephan Miran will be in place for the September 16-17 FOMC meeting. Overall, Trump not only wants to blame the Fed, but also try to achieve significantly lower policy rates. So far the U.S. Treasury reaction has been muted to all this drama.

One reason is that the U.S. Treasury market is not clear that new Fed governors will radically shift Fed policy. FOMC votes and shifts in policy tend to be by consensus. If Trump gets a replacement for Cook, alongside with Miran they could vote for radical action at each policy meeting e.g. 100bps of rate cuts. However, the majority of the FOMC would still likely follow the same policy formulation, which from Powell at Jackson Hole appear to be for a 25bps cut at the September FOMC (here) and some FOMC members last week were not even convinced of this stance. The September FOMC voting will be interesting to see whether Bowman and Waller push for a 50bps cut rather than 25bps, especially if the August payrolls are in line with consensus. This would further fuel concerns over Fed independence. A two way split would be unusual, but other central banks have had three way splits (e.g. BOE August decision).

The bond market is also not reacting due to uncertainty over the scale of the economic slowdown. If the employment slowdown continues into negative territory, then the market will become concerned about sub 1% growth or even a mild recession. This would likely justify a 2.5-3.0% Fed Funds rate quickly and drag 10yr yields down to 3.5%, as we outlined in the June Outlook. Additionally, bond market concerns over supply pressures in 2026 and beyond are being tempered by the CBO new estimate that Trump tariffs could raise USD4trn of extra revenue (here). Though some slippage could be seen in tariffs actually collected once import substitution and exemptions occur, the revenue is still large. This means that the budget deficit figures will likely be substantively lower than the initial CBO estimates after the Big Beautiful Bill. Though an economic slowdown could cause a modest cyclical deterioration in the 2026 budget deficit, it is more realistic to now look at a circa 5.5% budget deficit and less supply pressure.

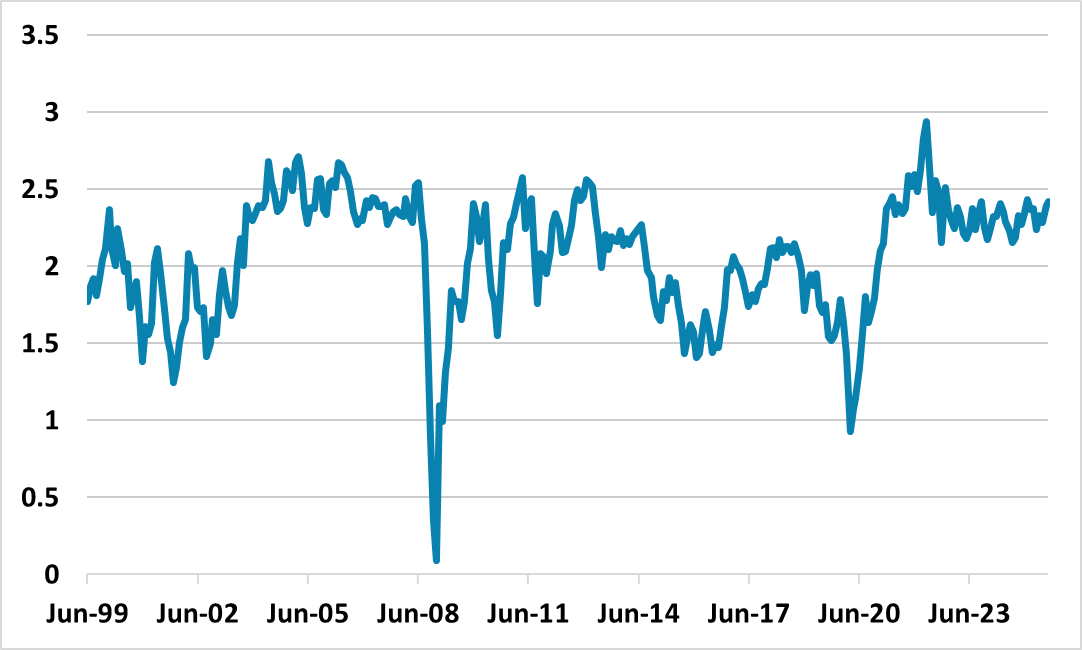

This means that the 10yr area and long-end is looking at Fed independence questions pushing long-end yields higher, but the economy being a swing factor to lower yields and supply now being more neutral. One way to follow the Fed independence question could be to follow 10yr breakeven inflation rates, which have pushed up but not jumped (Figure 1). We will watch the September FOMC voting and dots closely (nobody was forecasting sub 2.5% Fed Funds at the June SEP (Figure 2)), but Trump appears determined to change the Fed and may consider more radical options (e.g. adding more Governors seats to outgun the voting Fed presidents or the majority of Fed Governors opposing the reappointment of Fed regional presidents in Feb 2026). One way to continue playing these themes is for yield curve steepening, where we see scope for the 10-2yr to 90bps by early 2026.

Figure 2: FOMC Member Median Fed Funds Projections (%)

Source: Fed SEP (June)