U.S. July CPI - Core rate, particularly services, a marginal disappointment

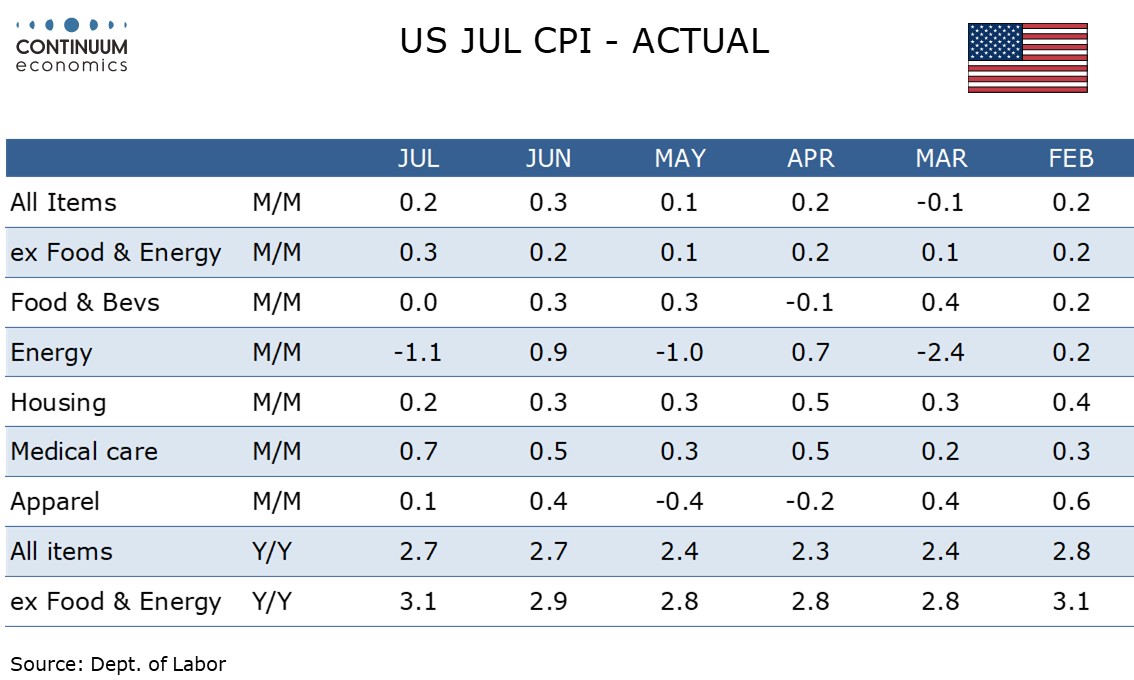

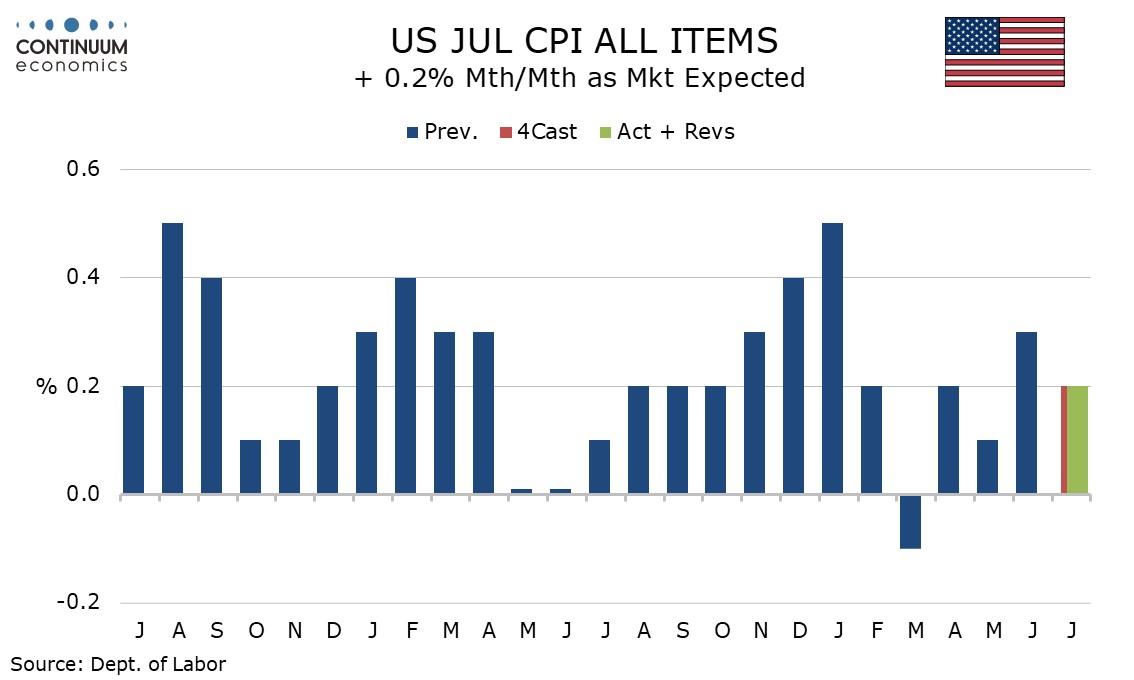

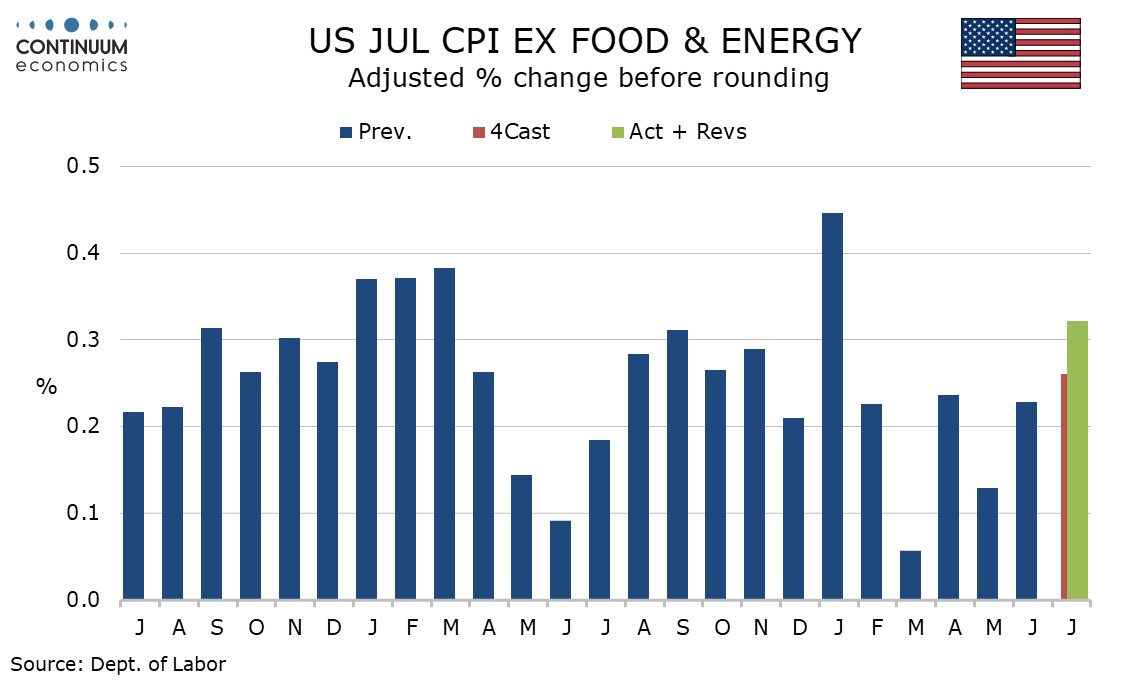

July’s CPI is in line with consensus at 0.2% overall, 0.3% ex food and energy, but the core rate of 0.322% before rounding is a little high for comfort. The detail shows the acceleration from June was more in services than goods, so the story is not a simple one of tariffs.

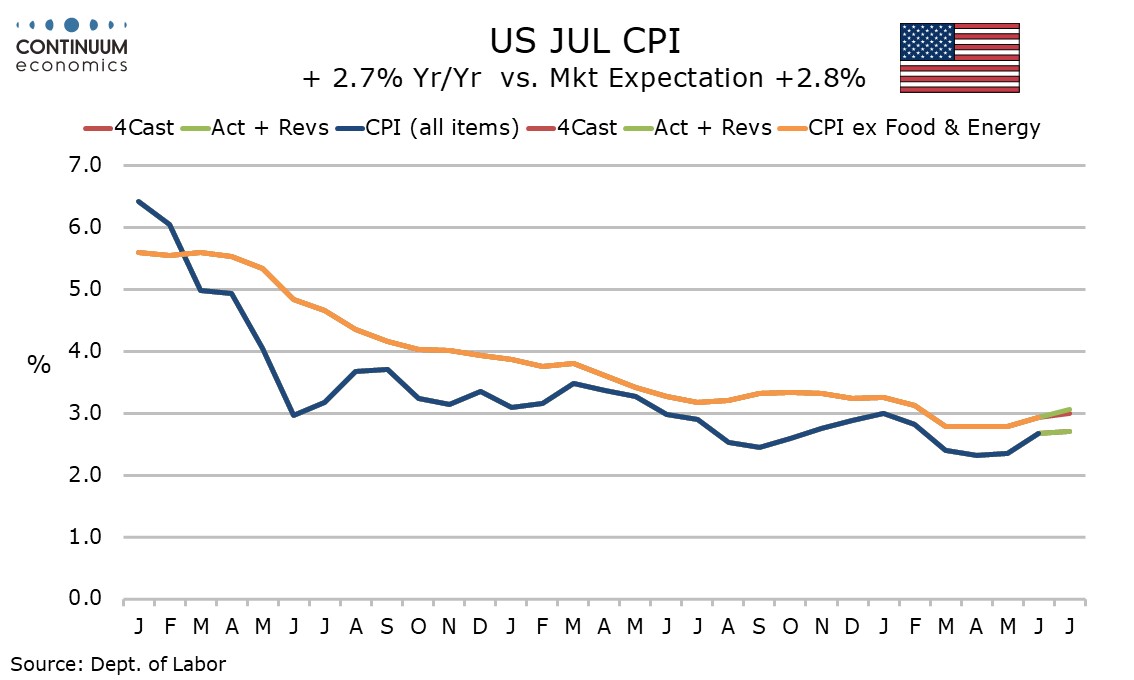

Overall CPI rose by 0.197% before rounding, and the overall yr/yr pace was unchanged at 2.7%, marginally lower than expected, while the core rate of 3.1% yr/yr from 2.9% was higher than expected and the highest since February.

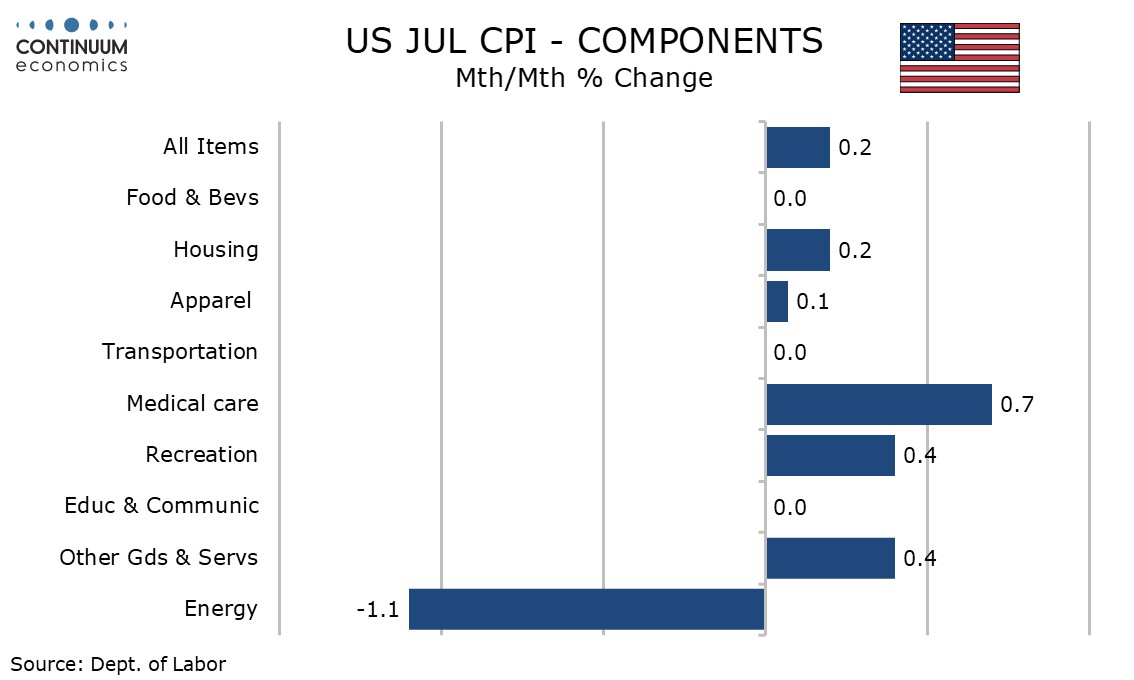

Energy fell by 1.1% led by a 2.2% fall in gasoline while food was surprisingly subdued at unchanged.

Commodities less food and energy rose by 0.2%, matching June’s increase which was stronger than previous trend, though with used autos up by 0.5% after a 0.7% June decline and new autos unchanged after a flat June the data was slower ex autos than in June.

Apparel rose by only 0.1% after a 0.4% June rise reverse a 0.4% May decline. This sector, seen as sensitive to tariffs, has seen limited gains so far. Household furnishings and supplies, up 0.7% after a 1.0% rise in June, appear to be seeing a lift, though the impact of tariffs remains moderate. We do suspect that August CPI may see a stronger impact, with the tariff picture starting to look clearer.

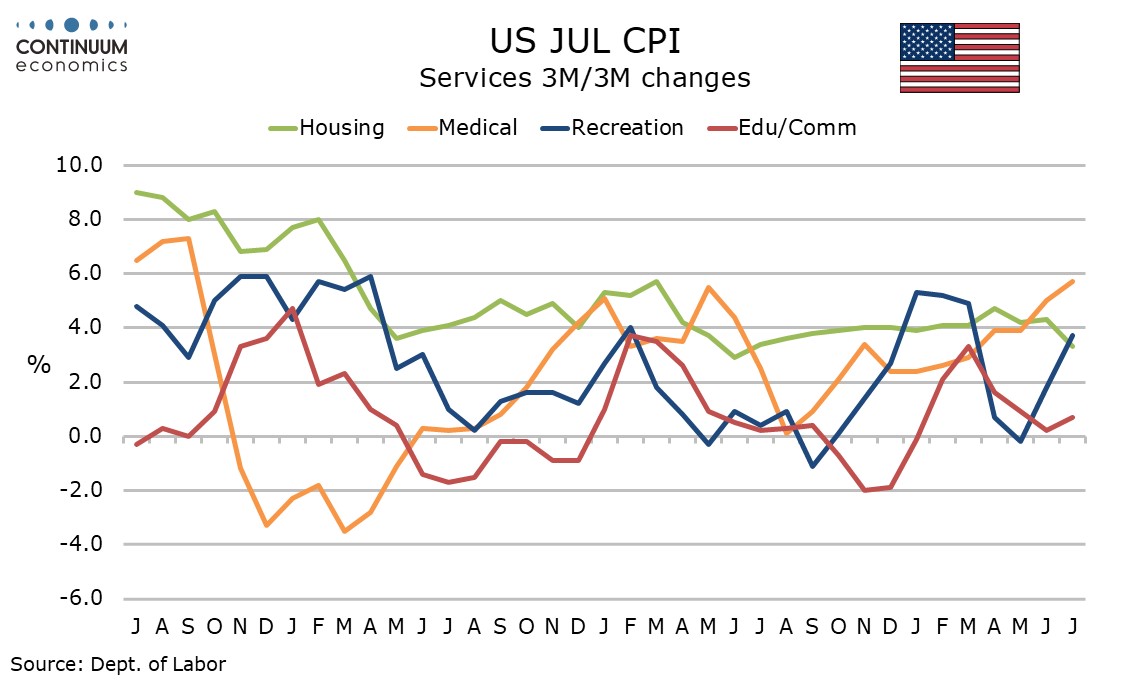

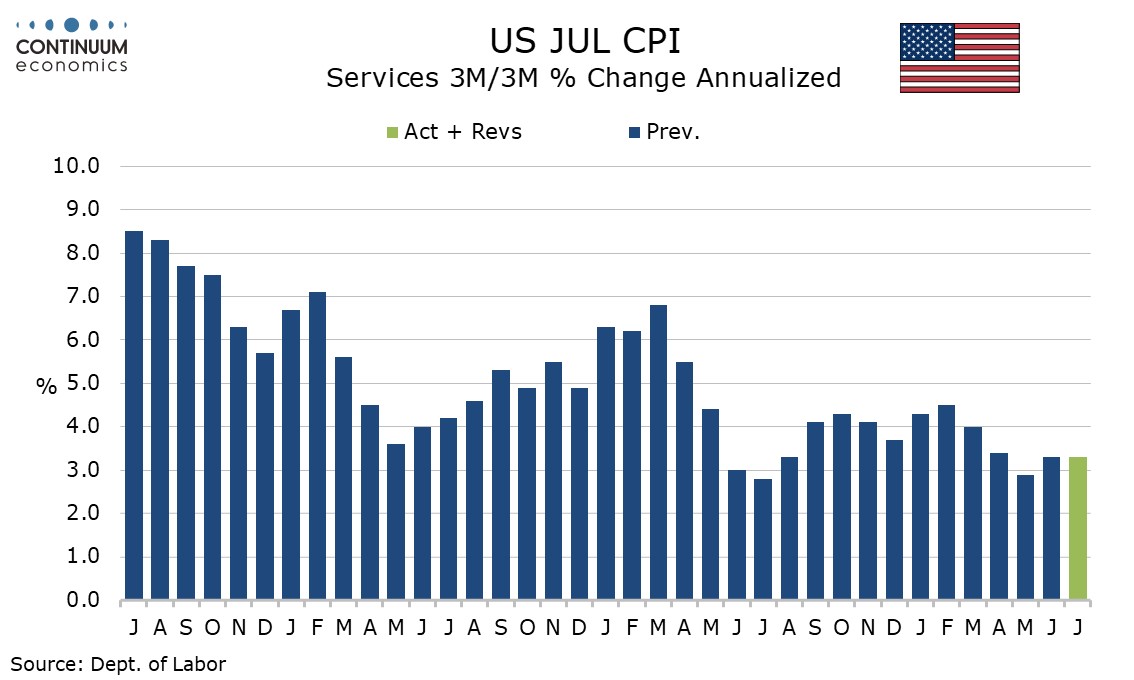

Services less energy services rose by 0.4% after a 0.3% rise in June and a 0.2% rise in April, so led July’s acceleration. This is problematic for Fed doves who have been arguing that a tariff boost to goods should be overlooked as a one-time boost. Strength in services is harder to dismiss.

The most notable area of strength in services was a 4.0% incase in air fares, which can be seen as a correction from recent weakness. This led a 0.8% rise in transportation services. Medical care services were also firm with a rise of 0.8%. Shelter was relatively subdued at 0.2% restrained by a 1.0% fall in lodging away from home. Owner’s equivalent rent saw a third straight rise of 0.3%.

The data is not a major surprise and is not conclusive in determining the Fed policy decision in September, which remains a fairly close call depending on August employment and CPI data. On the margins however the data is something of a disappointment and slightly reduces the probability of a September easing, though significantly less so than the July employment report increased the risk.