U.S. August Employment - Trend now close to flat, backing case for easing

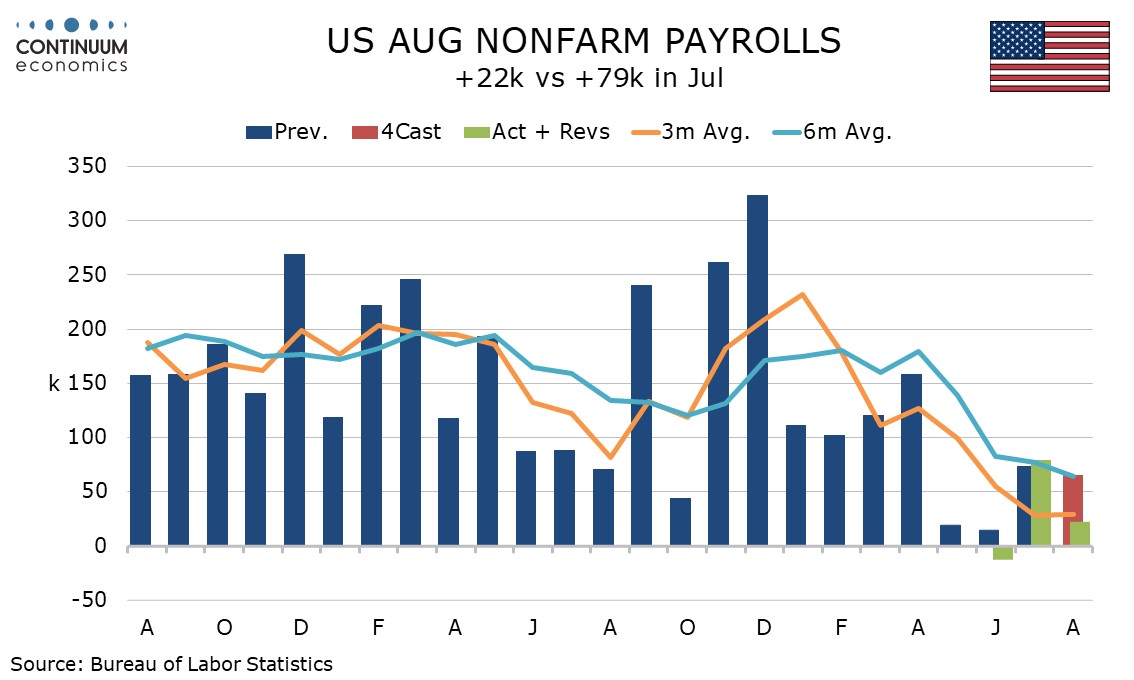

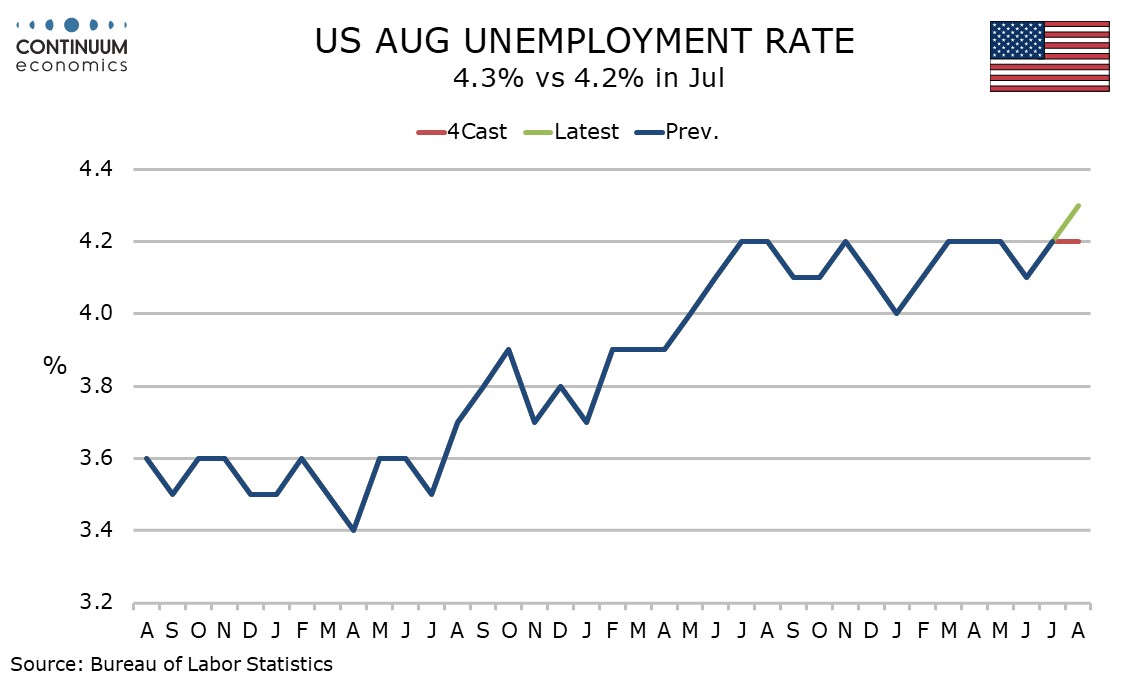

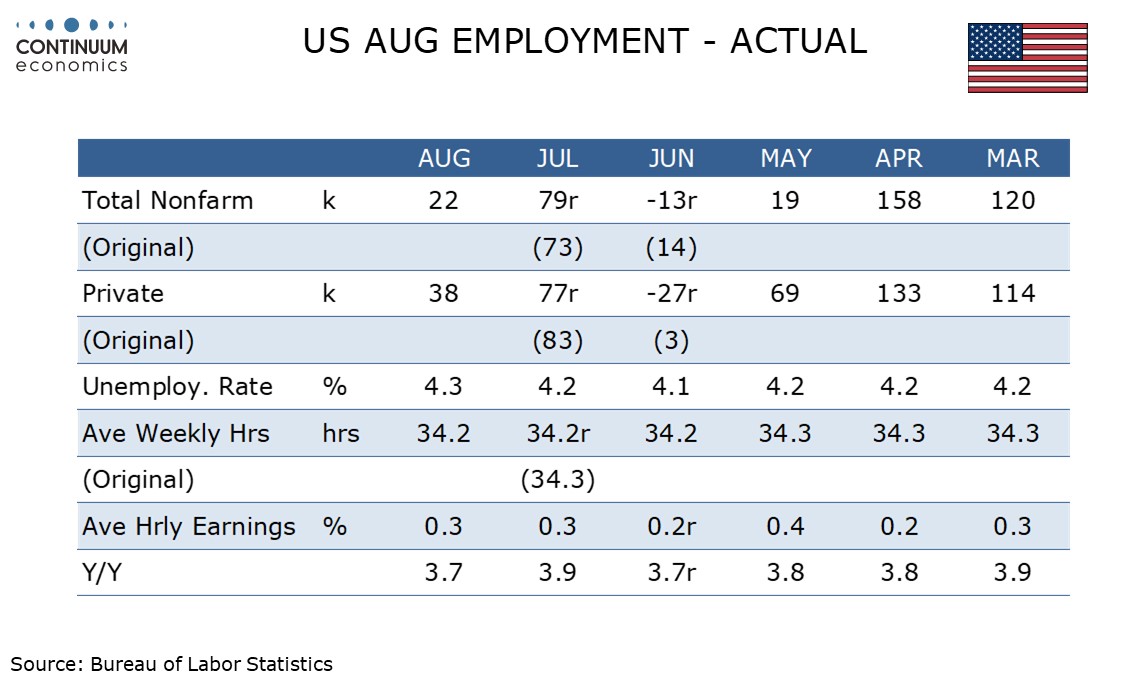

August’s non-farm payroll shows that job growth is now minimal, with a rise of 22k almost completely offset by a modest 21k in net downward revisions. Unemployment rose to 4.3% from 4.2% while average hourly earnings rose by 0.3%, both as expected, though the workweek was weaker than expected. The report strengthens an already strong case for a September easing, though August’s CPI has still to be seen.

July’s gain was revised marginally higher to 79k from 73k but June is now negative at -13k from +14k. Private payrolls rise by 38k in August with 36k of net negative revisions, delivering another net number basically flat.

The details of the household survey are more positive than the rise in unemployment and non-farm payroll data suggests with its estimate of employment being for a healthy rise of 288k, with unemployment only up on a 436k surge in the labor force, unexpected given the immigration clampdown.

The household survey’s rise in employment however does little more than reverse a 260k decline in August and the rise in the workweek follows three straight declines, though of these only May’s exceeded August’s bounce.

Goods producing employment fell by 25k with manufacturing down by 12k and construction down by 6k. Private services increased by 63k with health care and social assistance continuing to provide the bulk of this with a rise of 47k, though this is a slowing from recent trend. Gains of 28k in leisure and hospitality and 10.5k in retail hint that consumers maintain some resilience. Otherwise the data is weak. A 16k fall in government was led by a 15k fall in Federal.

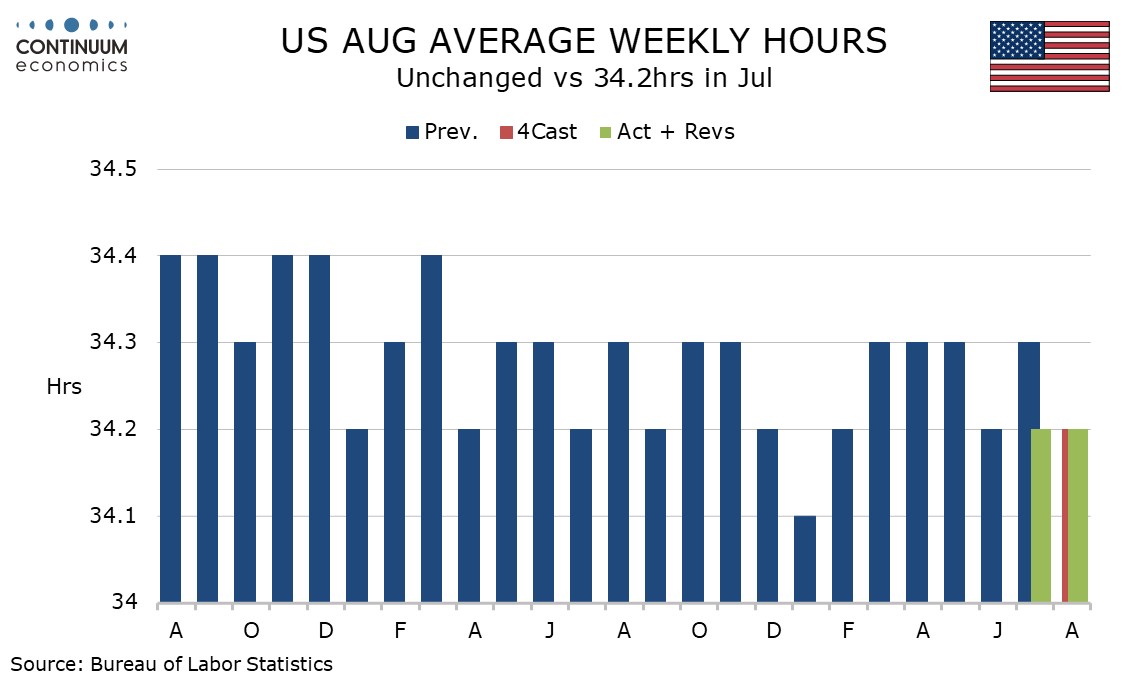

Also suggesting limited economic momentum is a workweek of 34.2 hours, weaker than expected and unchanged only because July was revised from 34.3. That makes three straight months at 34.2 after three straight at 34.3. Aggregate hours worked were unchanged with manufacturing weak at -0.5% but retail seeing a healthy rise of 0.7%.

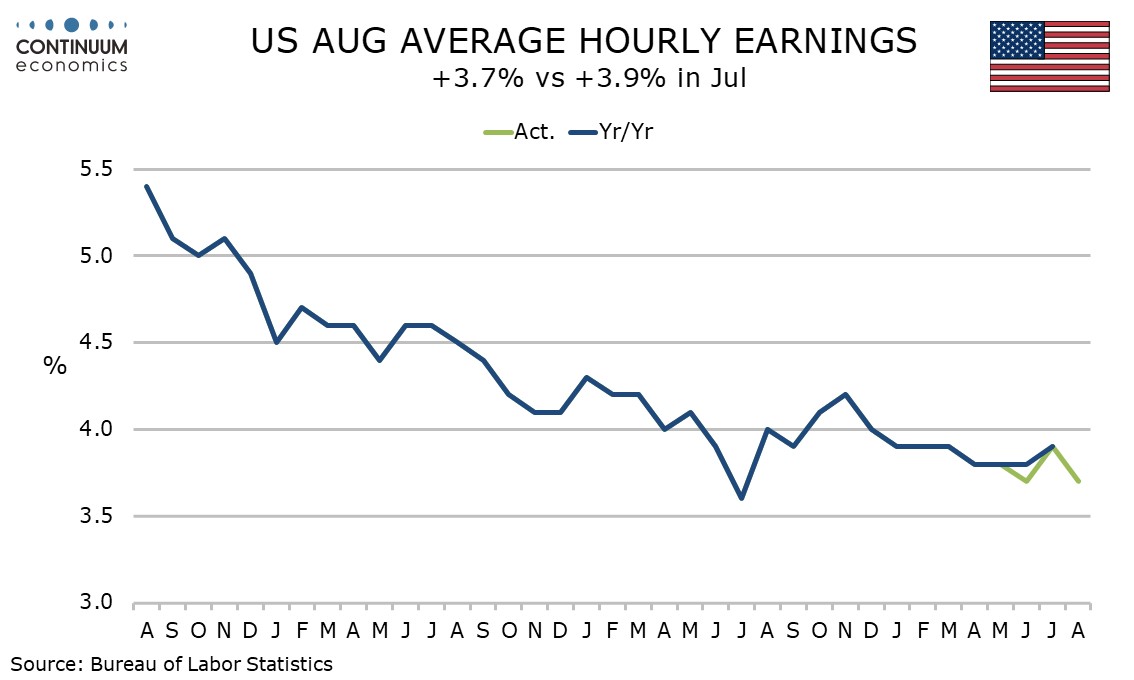

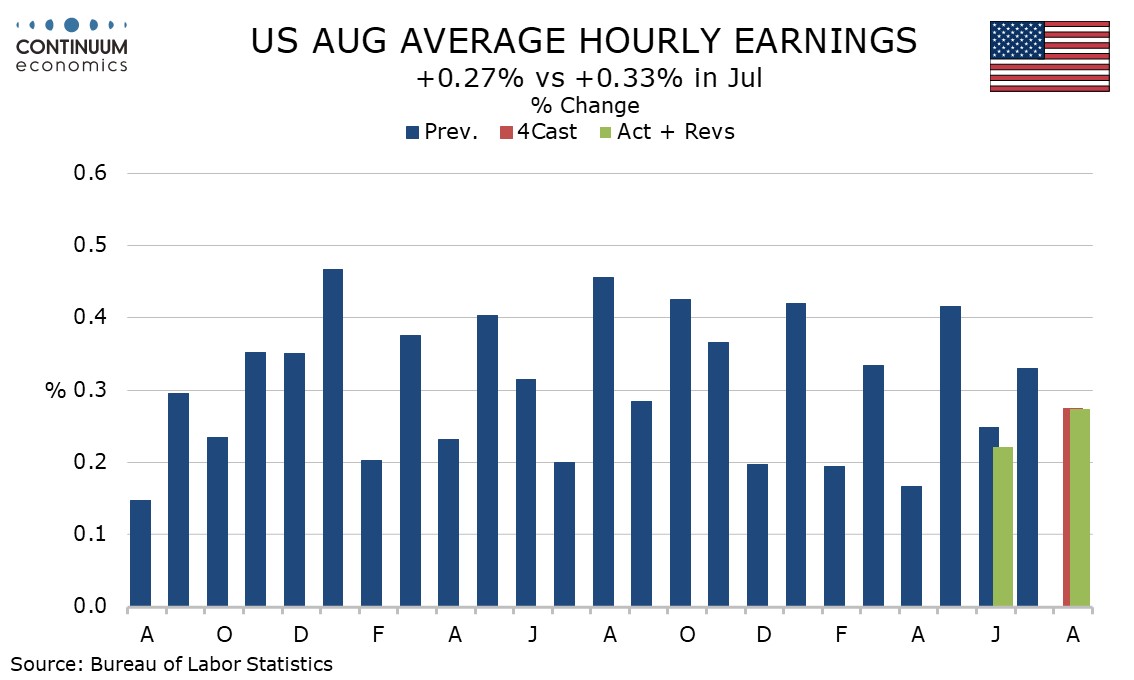

Average hourly earnings rose by 0.27% before rounding and yr/yr growth returned to 3.7% after rising to 3.9% in July. Earnings are far from weak but not a cause for inflationary concern.