Preview: Due September 26 - U.S. August Personal Income and Spending - Core PCE Prices moving higher

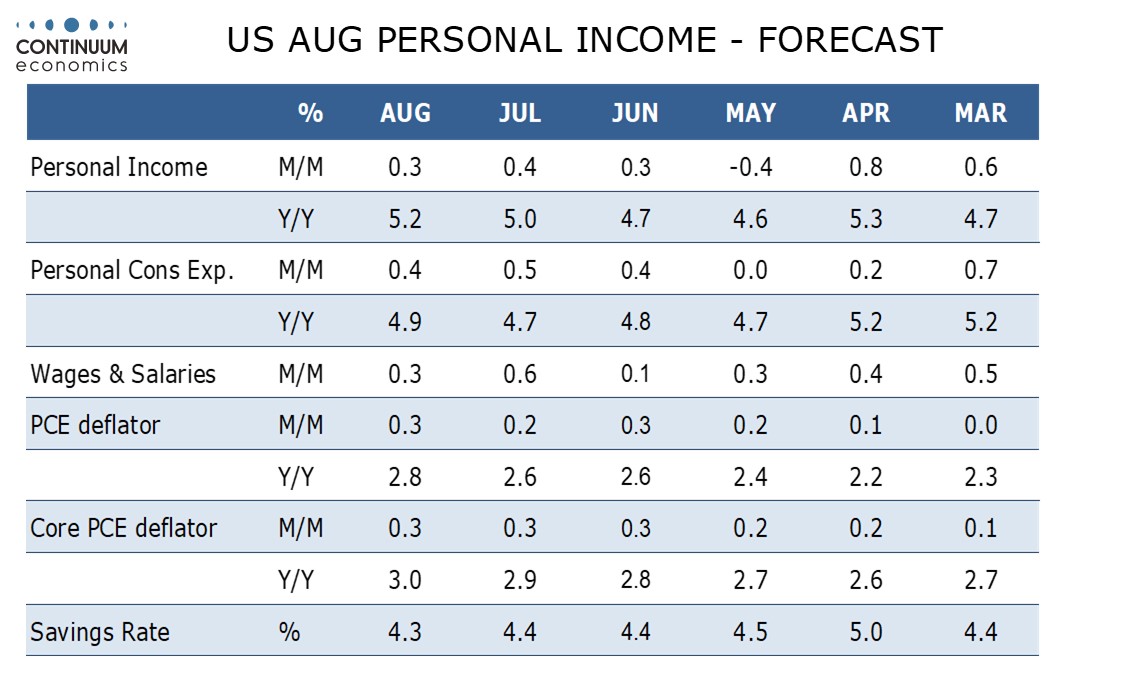

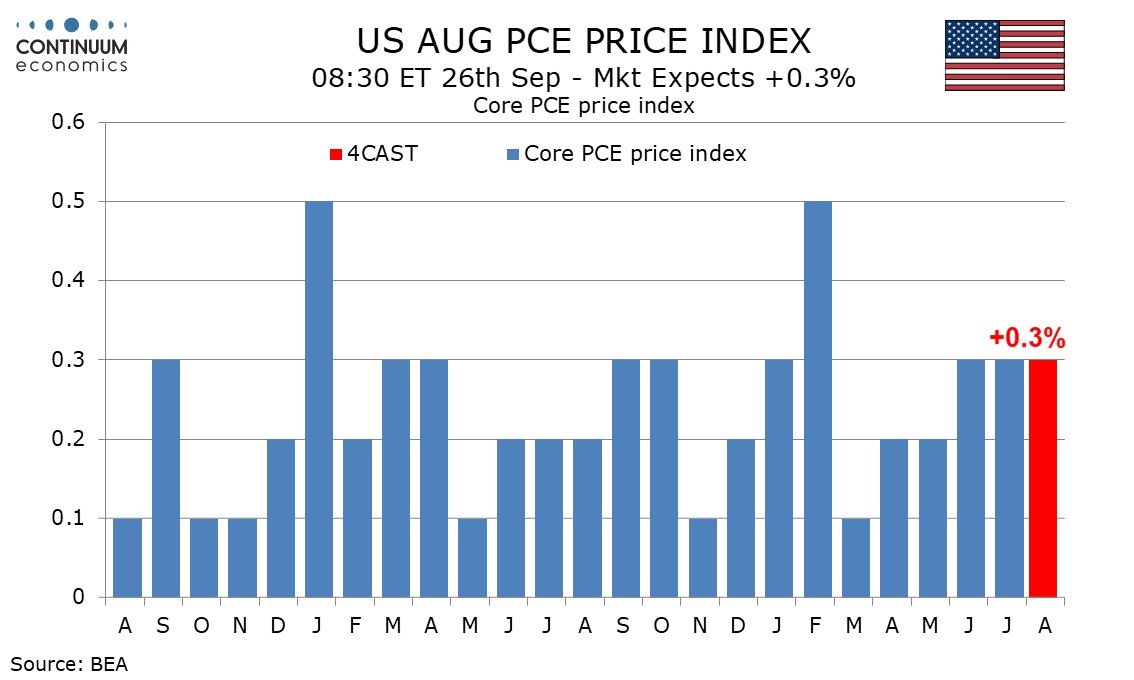

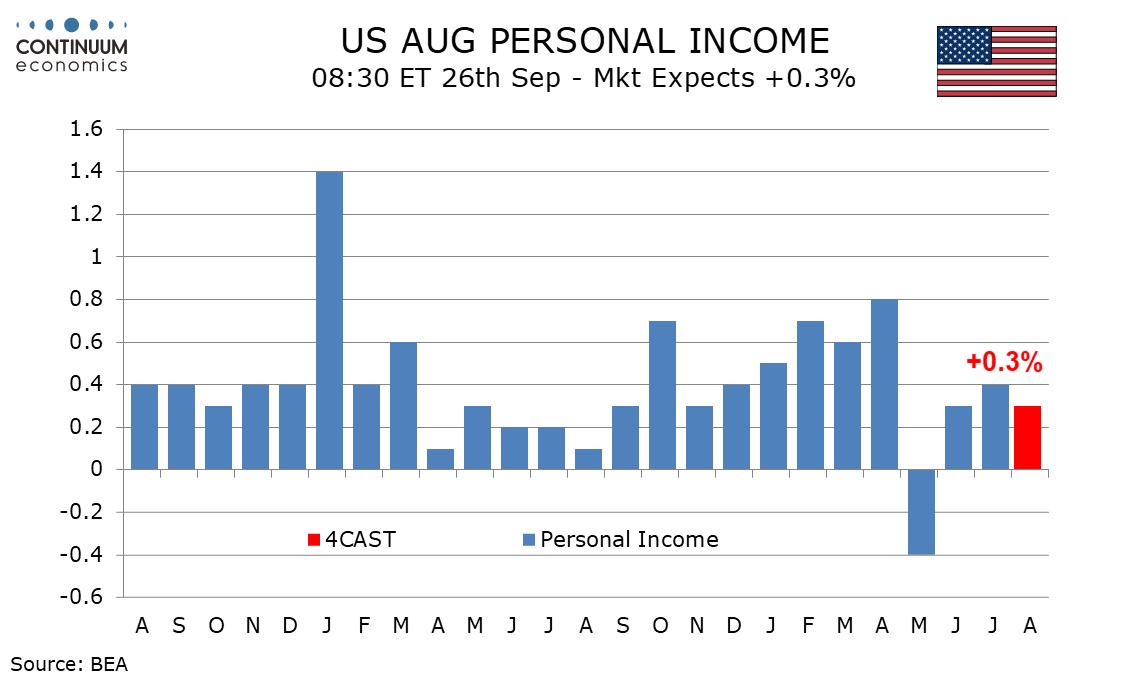

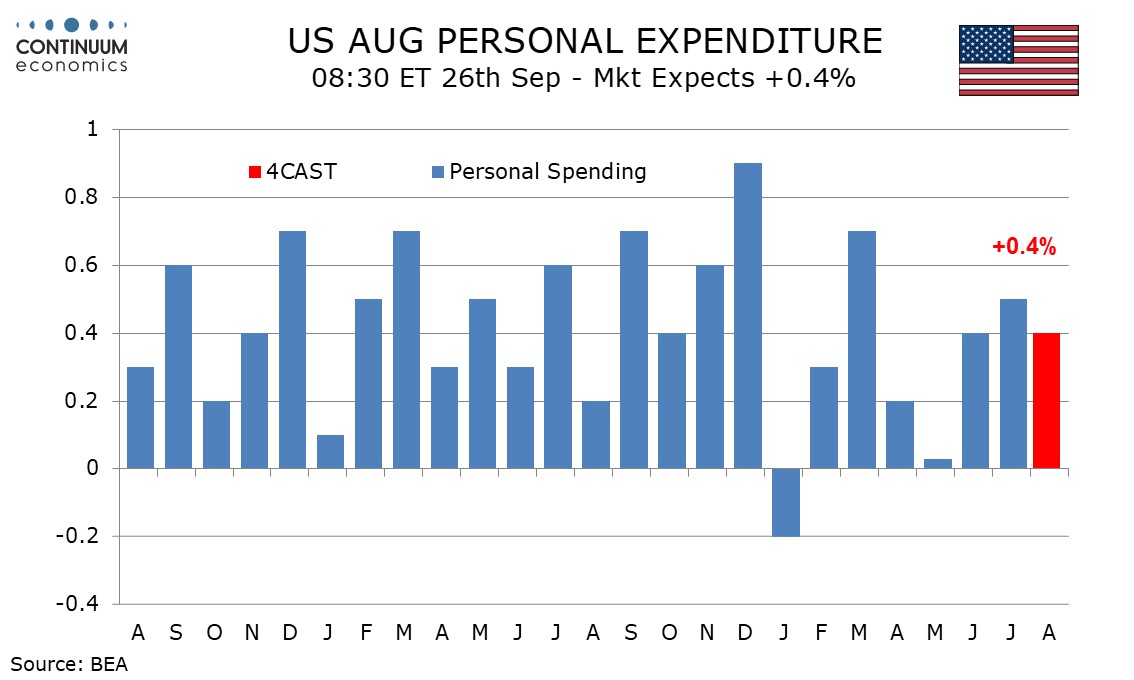

We expect August data to show 0.3% gains in both overall and core PCE prices, with personal income also up by 0.3% and personal spending slightly stronger at 0.4%. The data will incorporate historical revisions through Q2 due with the annual GDP revision scheduled for September 25.

August CPI rose by 0.382% before rounding while core CPI rise by 0.346%. We expect the core PCE price index will be close to 0.3% before rounding while PCE price data tends to be less sensitive to gasoline than the CPI, leaving both headline and core PCE prices up by 0.3%.

Without revisions, this would leave yr/yr PCE prices at 2.8% from 2.6% while core PCE prices would rise to 3.0% from 2.9%, both reaching their highest pace since March 2024.

The subdued non-farm payroll breakdown implies a moderate 0.3% rise in wages and salaries. We expect the other components of personal income to match wages and salaries, with social security unlikely to repeat an unusual a July decline.

Retail sales rose by 0.6% but industry data suggest autos may underperform the retail auto data. We expect a 0.4% rise in personal spending, with services up by 0.4% for a third straight month.