FOMC Preview for September 17: 25bps Easing on Increased Labor Market Risk

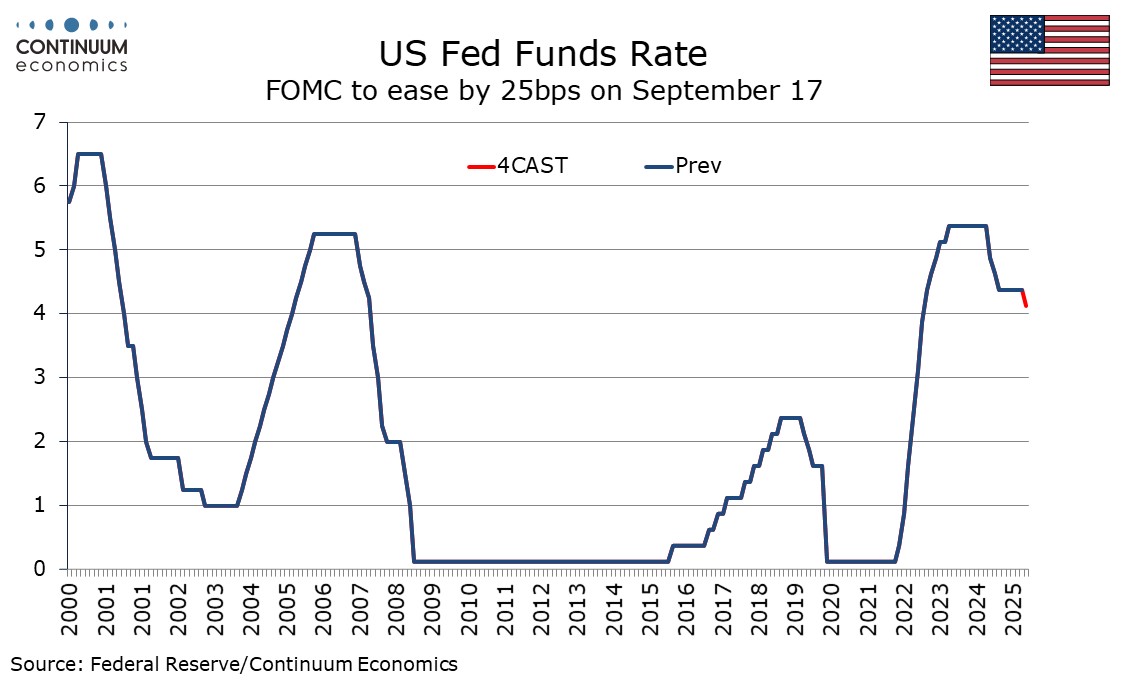

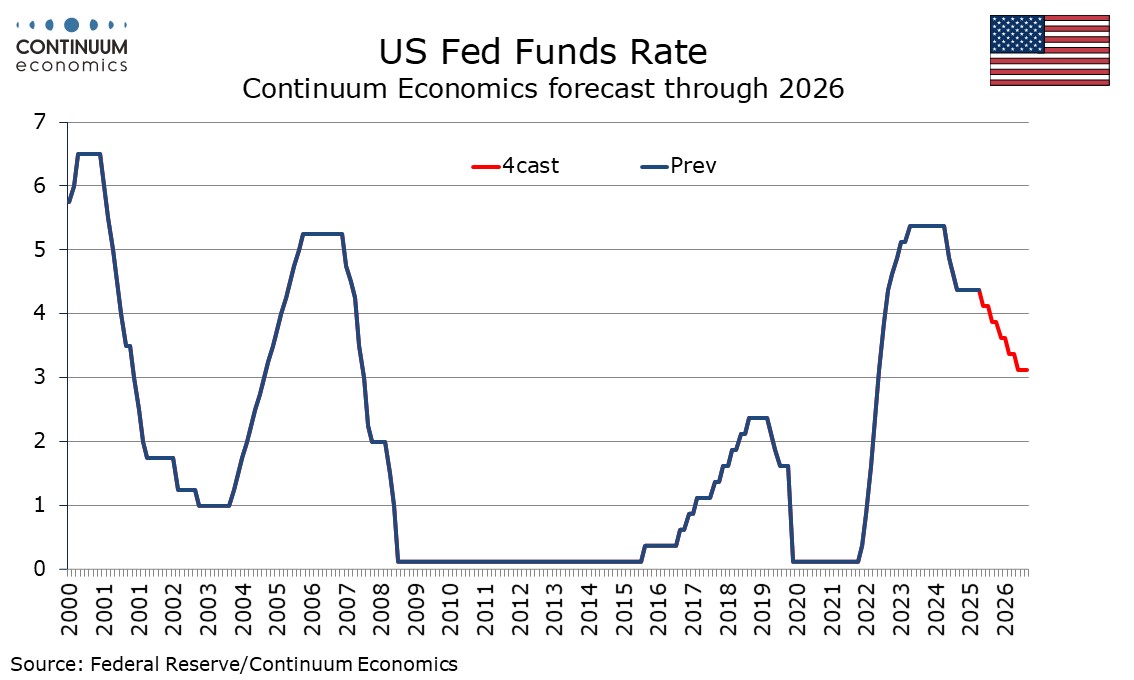

The FOMC meets on September 17 and we expect a 25bps easing to a 4.0-4.25% Fed Funds target range. The FOMC will continue to see similar upside risks to inflation but increased downside risks to the Labor Market. The dots are likely to continue to expect only one more move in 2025, but three moves in 2026 rather than one, which would take the rate close to neutral.

Upside inflation risks unchanged, downside employment risks increased

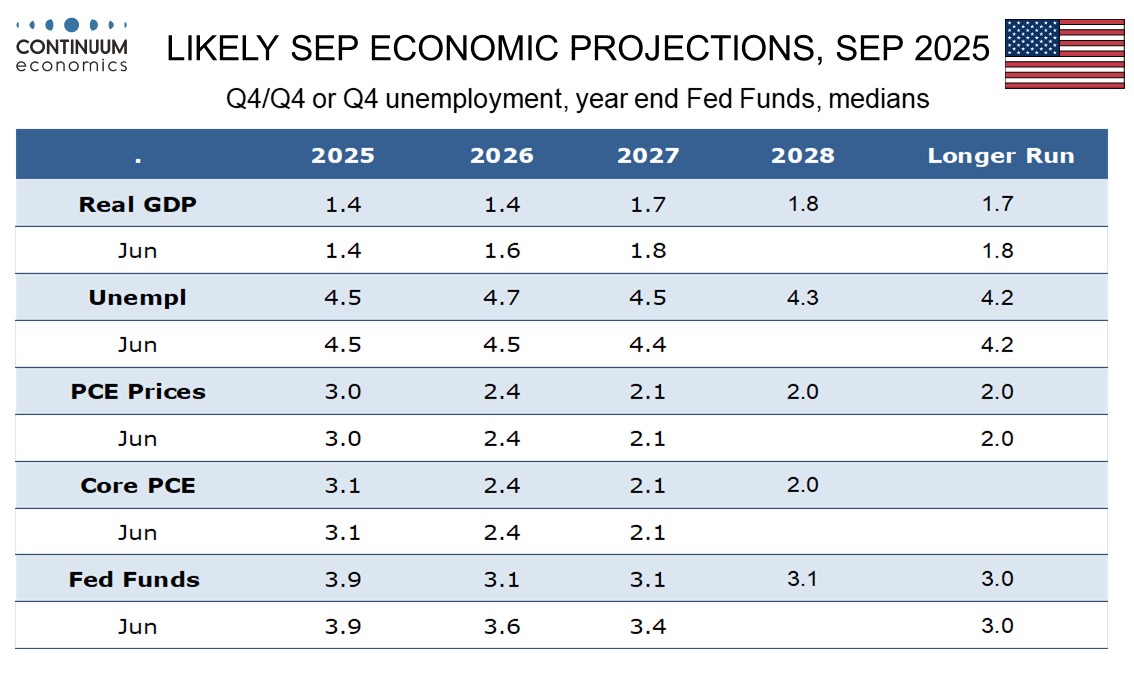

September data showed a second straight core CPI increase that was above 0.3% before rounding, and yr/yr core CPI has moved back above 3.0% after falling below in March. Yr/yr core PCE prices stood at 2.9% in July, well above the Fed’s 2.0% target. There is likely to be more feed through from tariffs to come. While doves are willing to look through that as a one-time impact some FOMC officials noted that July’s CPI also saw disappointment in services, which are less sensitive to tariffs. The FOMC statement is likely to continue to see inflation as elevated while the SEP is unlikely to alter its inflation forecasts significantly. These saw core PCE prices ending 2025 at 3.1%, 2026 at 2.4% and 2027 at 2.1%. Forecasts for 2028 will also be seen at this meeting, A return to the 2.0% target is likely to be projected.

The employment picture has however seen a significant change since the last meeting in July. Firstly May and June payrolls were revised sharply lower with a subdued July report, and then another subdued report for August was seen, leaving recent trend in payrolls only marginally above flat. A 911k preliminary downward revision for the March 2025 non-farm payroll benchmark suggests payroll trend has been below 100k per month for some time. Some may see a sharp rise in the latest weekly initial claims number as a warning for negative September payrolls, but given that the week included the Labor Day holiday, the data should be treated cautiously. We expect the Fed to see the employment picture as essentially flat, with only gradual rises in unemployment likely given a slowing in labor force growth due to reduced immigration. We expect the SEP to continue to see unemployment ending 2025 at 4.5%, compared to 4.3% in August’s data, but see 2026 at 4.7% rather than the 4.5% projected in June. The FOMC is likely to see modest declines in 2027 and 2028. The statement is likely to reiterate that the unemployment rate remains low, but adjust a previous reference to the labor market remaining solid.

We doubt that GDP forecasts will be changed much, with Q2 2025 having exceeded expectations, but 2026 and 2027 may be revised a little lower. The long run estimate may also see a fine tuning lower from 1.8%, given slower labor force growth.

The dots, the vote, and the press conference

We expect the dots will continue to show the Fed Funds target range ending 2025 at 3.75-4.0%, implying only one more easing this year, most likely in December. However the skew is likely to shift significantly. June saw nine above the median and only two below. This time we expect more to see two further easings this year than those who see no more. June’s median dot saw only one further easing in 2026. We expect this time the median will show three, which would take the target range to 3.0-3.25%, close to the median neutral estimate of 3.0% which we do not expect to be revised. The dots are likely to project this target range persisting through 2027 and 2028. Given that the Fed is likely to see inflation returning to target only slowly, we doubt many will advocate moving the rate below neutral. We also expect the rate to end 2026 at 3.0%-3.25%. We now expect the three easings to occur in Q1, Q2 and Q3, rather than Q2. Q3 and Q4 as we had previously expected.

We do not expect unanimous support for easing at this meeting, with at least one of St Louis Fed President Alberto Musalem and Kansas City Fed President Jeffrey Schmid likely to dissent for unchanged policy. Governors Christopher Waller and Michelle Bowman are likely to argue for a 50bps easing, but they may not choose to dissent as long as the door is left open for an October move should data, most notably the September non-farm payroll, disappoint. Fed’s Powell at his press conference is sure to stress that future policy decisions will be data-dependent, though he will stress the upside risks to inflation as well as the downside risks to employment. We expect only one more move this year, in December, but should September’s non-farm payroll come in clearly negative, we would reconsider that view.