Aging: Slow Growth for Some in 2020’s

Population aging always seems to be beyond the market horizon, but the 2020’s are already seeing population aging in some countries. What is the economic impact? Aging is already causing a peak in labor force in China and the EU. Meanwhile, the population pyramid also means less consumption from the growing proportion of over 50’s and less new housing demand/investment from 20-40yr olds. We review structural issues in our long-term forecasting (2027-30) for the annual forecasts for the 23 countries that we cover and this is one of the reasons behind our forecast of 3% trend China growth by 2030.

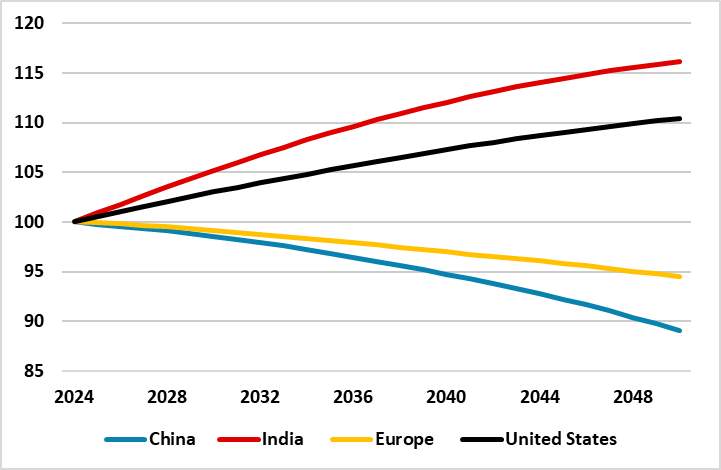

Figure 1: Population Estimates (2024 =100)

Source: UN/Continuum Economics.

Source: UN/Continuum Economics.

The cyclically economic volatility of the 2020’s has been noticeable, with COVID followed by Ukraine war and then the end of the ultra-low interest rate era for DM central banks. This has pushed structural issues off financial markets radar apart from AI and the transformation of technology. However, structural issues can have a large cumulative effect and one issue to monitor is population aging. One measure is the size of the population (Figure 1), which the UN projects a fall in the EU and China in the 2030’s and 2040’s. However, population is a lagging measure of the economic effects of aging. The labor force can peak before population and this is already happening in the EU and China.

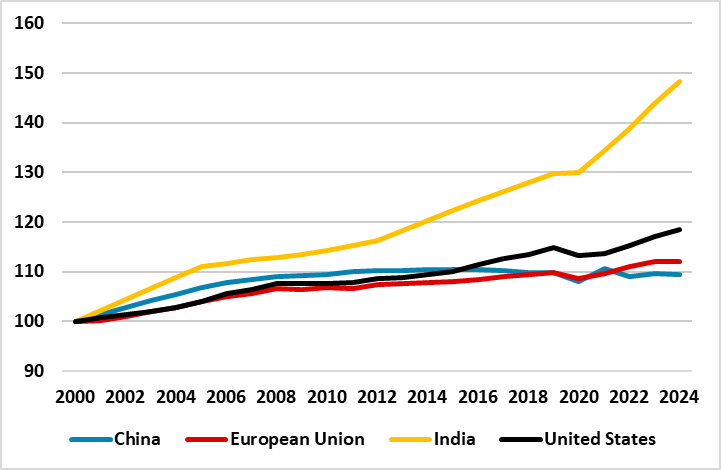

One solution is to increase the proportion of over 60’s still working, but EU countries and China are making only slow progress compared to the best practices in Japan. A 2nd alternative is immigration, which is unlikely in China for cultural reasons and in Europe has caused the rise on right wing parties in a number of countries and a flux over immigration policies. A 3rd option is to increase female participation rates towards best practice seen in Scandi countries, but the scope in the EU and China is only modest as they are relatively high already. At present the peak of the labor force will remain a 2020’s story in the EU and China compared to India and the U.S.

Figure 2: Key Countries Labor Force Total (2000 = 100) Source: OECD/Continuum Economics.

Source: OECD/Continuum Economics.

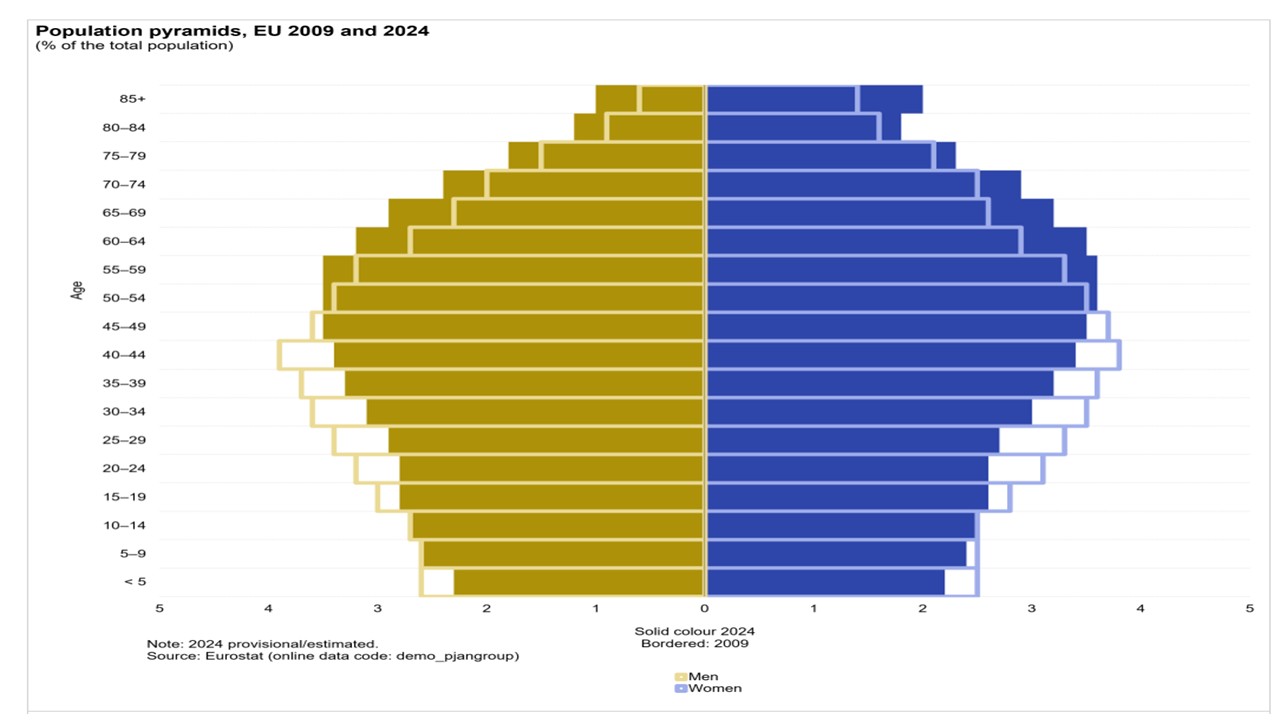

However, the effect of population aging also come through at an earlier stage, though consumption patterns and house purchases. Figure 3 looks at the population profile for the EU, where the over 50’s have seen a steady increase since 2009 and this grouping has passed its peak in terms of income per person and in turn this normally translates into an absolute reduction in consumption given lower income. Additionally, the over 50’s are also keen to save prior to the prospect of retirement in their 60’s. This is a headwind to consumption growth.

Figure 3: EU Population Pyramid 2009 and 2004 (% of total population)

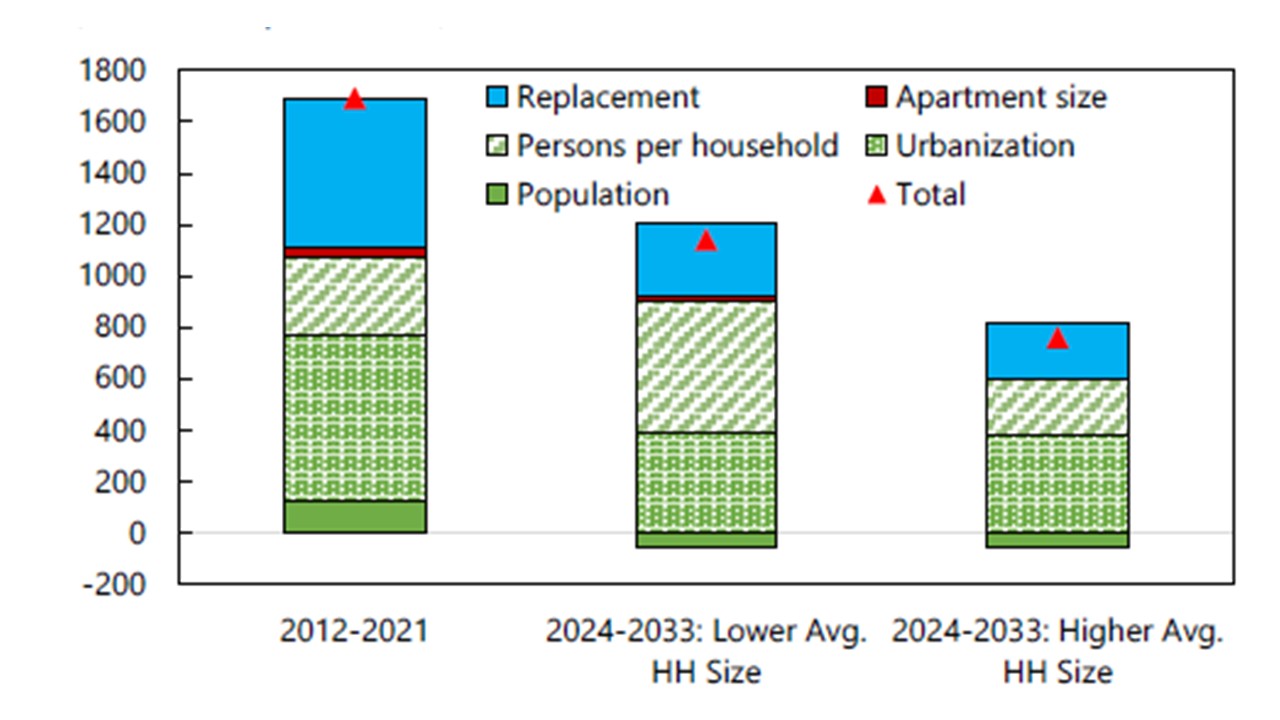

Figure 4: Estimated Annual Average Fundamental Housing Demand (Millions of square meters)

We review structural issues in our long-term forecasting for the annual forecasts for the 23 countries that we cover. The aging factor is an adverse issue for the EU and China and counterbalances the benefit of technology to GDP growth (through better productivity). Indeed, in China’s case we see it contributing to a slowdown in trend growth to 3% by 2030, alongside a further slowing in productivity growth (due to heavy a share of inefficient SOE’s in the economy). 2027-30 GDP forecasts are available on the Forecast tab on our website (here).