EM Country Research

View:

September 18, 2025

Brazil: 15% Well Into 2026

September 18, 2025 6:29 AM UTC

The BCB statement was clear that the deanchored inflation picture still requires interest rates to be kept at current levels for a very prolonged period of time. The consensus for economists is that this will change in Q1 2026 with a 50bps cut, though ideas of December are fading. We suspect it

September 17, 2025

South Africa Inflation Slightly Softened to 3.3% YoY in August

September 17, 2025 1:17 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on September 17 that annual inflation softened to 3.3% YoY in August from 3.5% in July thanks to slower food price growth and falling fuel costs. Despite inflation is still within the South African Reserve Bank’s (SARB) 3%-6% target rang

September 16, 2025

Succession and Strongmen Leaders

September 16, 2025 10:53 AM UTC

In the unexpected scenario of an early death, Putin and Xi have no clear successors, and any new Russia or China leader would have to spend time building domestic strength and compromising on external goals. Erdogan also has no clear successors, which could create political uncertainty. For Trump su

September 15, 2025

China: Broad Based Slowdown

September 15, 2025 7:55 AM UTC

• The latest monthly data from China show a broad based slowdown in the economy, due to the tariffs and structural weakness. Though we keep 2025 real GDP at 4.8%, the underlying trend suggest a slowdown to 4.0% for 2026. China authorities will start to announce fiscal measure

September 12, 2025

Taiwan: Grey Warfare or Naval Quarantine?

September 12, 2025 11:15 AM UTC

· The most likely option for China is to continue the air and naval grey warfare around Taiwan, combined with support for pro-China factions in Taiwan parliament to build pressure for reunification at some stage. With invasion being too high risk for President Xi (with the U.S. main

September 10, 2025

September 09, 2025

September 08, 2025

New GST Slabs to Boost Demand as India Faces 50% US Tariffs

September 8, 2025 6:45 AM UTC

India’s landmark GST 2.0 reform, effective 22 September 2025, simplifies slabs to 5% and 18%, with a 40% rate for sin goods. By easing prices on essentials and mid-market products, the move aims to boost demand and partially offset the drag from US tariffs of 50% on Indian exports. While household

Modi in China: Eurasian Diplomacy Meets US Tariff Tensions

September 8, 2025 6:02 AM UTC

Prime Minister Modi’s visit to Tianjin for the SCO Summit underscored India’s pursuit of strategic autonomy—engaging China and Russia while reaffirming ties with the US. Publicly, India backed Eurasian financial and connectivity initiatives, while tactically reopening dialogue with Beijing. Fo

September 04, 2025

September 03, 2025

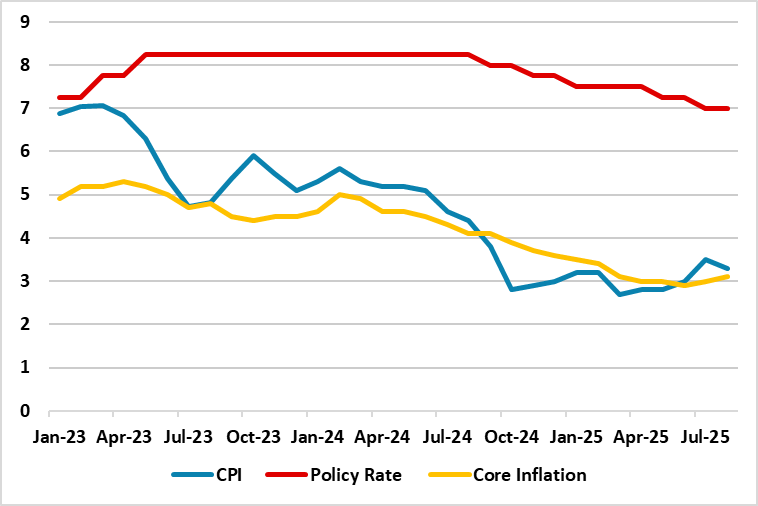

Turkiye’s Inflation Slightly Eased to 32.9% YoY in August... But, Monthly Inflation is Still Over 2.0%

September 3, 2025 4:11 PM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on September 3 that the inflation slightly softened to 32.9% y/y in August from 33.5% y/y in July driven by lagged impacts of previous monetary tightening, tighter fiscal measures and suppressed wages. August figure came in slightly above

September 02, 2025

India GDP Review: Public Spending and Services Lift India’s Growth to Five-Quarter High

September 2, 2025 6:45 AM UTC

India’s economy grew 7.8% y/y in Q1 FY25, beating expectations. Strong gains in construction, services, and agriculture underpinned the recovery, while private consumption and investment remained subdued. However, sustaining momentum in FY26 will hinge on broad-based demand and improving global co

September 01, 2025

Hitting Beyond Expectations thanks to Construction Activities: Turkiye’s GDP Growth Rebounded Strong in Q2

September 1, 2025 10:55 AM UTC

Bottom Line: According to Turkish Statistical Institute’s (TUIK) announcement on September 1, Turkish economy increased by a strong 4.8% YoY despite political turbulence after arrest of Istanbul mayor and opposition’s presidential candidate Ekrem Imamoglu in Q2, prolonged monetary tightening eff

Aging: Slow Growth for Some in 2020’s

September 1, 2025 8:35 AM UTC

Population aging always seems to be beyond the market horizon, but the 2020’s are already seeing population aging in some countries. What is the economic impact? Aging is already causing a peak in labor force in China and the EU. Meanwhile, the population pyramid also means less consumptio

August 29, 2025

India GDP Preview: Q1FY26 Growth - Services Surge, Industry Slows: India’s Uneven Q1 Recovery

August 29, 2025 4:49 AM UTC

India’s economy likely grew 6.6% yr/yr in Q1 FY26, down from 7.4% in the previous quarter, as weak private investment and soft industrial output offset robust government spending. Growth was buoyed by strong public capex and resilient services, while manufacturing lagged. Full-year GDP is forecast

August 27, 2025

South Africa GDP Growth Preview: Moderate Growth Will Resume in Q2

August 27, 2025 3:22 PM UTC

Bottom line: Department of Statistics of South Africa (Stats SA) will announce Q2 GDP growth on September 3, and we expect that South African economy will likely grow by around 1.0%-1.2% YoY in Q2 2025. We think that the growth momentum will continue to be supported by low inflation and interest rat

August 26, 2025

Turkiye GDP Growth Preview: Slowdown Will Continue in Q2

August 26, 2025 5:14 PM UTC

Bottom Line: Turkish Statistical Institute (TUIK) will announce Q2 GDP growth on September 1 and we expect that Turkish economy will expand around 1.7% -2.0% YoY backed by private consumption despite early indicators demonstrate a lower acceleration rate in domestic demand amid tightening financial

August 25, 2025

Jackson Hole: Fed/ECB/BOJ and BOE on Labor Markets

August 25, 2025 9:02 AM UTC

Fed Powell focused on the cyclical softening of employment to back a more dovish undertone. In contrast other central bank heads focused on structural labor market issues. While ECB Lagarde was pleased with the post COVID EZ picture, current economic softness still leaves us forecasting two furt

Tariffs and Tensions: India–US Trade Talks Stalled as Relations Sour

August 25, 2025 6:25 AM UTC

India–US relations have entered a tense phase after Washington doubled tariffs on Indian exports to 50%, the steepest duties applied to any US trading partner. The move, tied to India’s record Russian oil imports, has derailed trade talks scheduled for late August. With USD 87bn in exports at ri

August 20, 2025

South Africa Inflation Surges: 3.5% YoY in June

August 20, 2025 11:12 AM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on August 20 that annual inflation rose to 3.5% YoY in July from 3.0% in June due to elevated prices of food and non-alcoholic beverages; housing and utilities; and restaurants and accommodation services. MoM prices surged by 0.9% in July, m

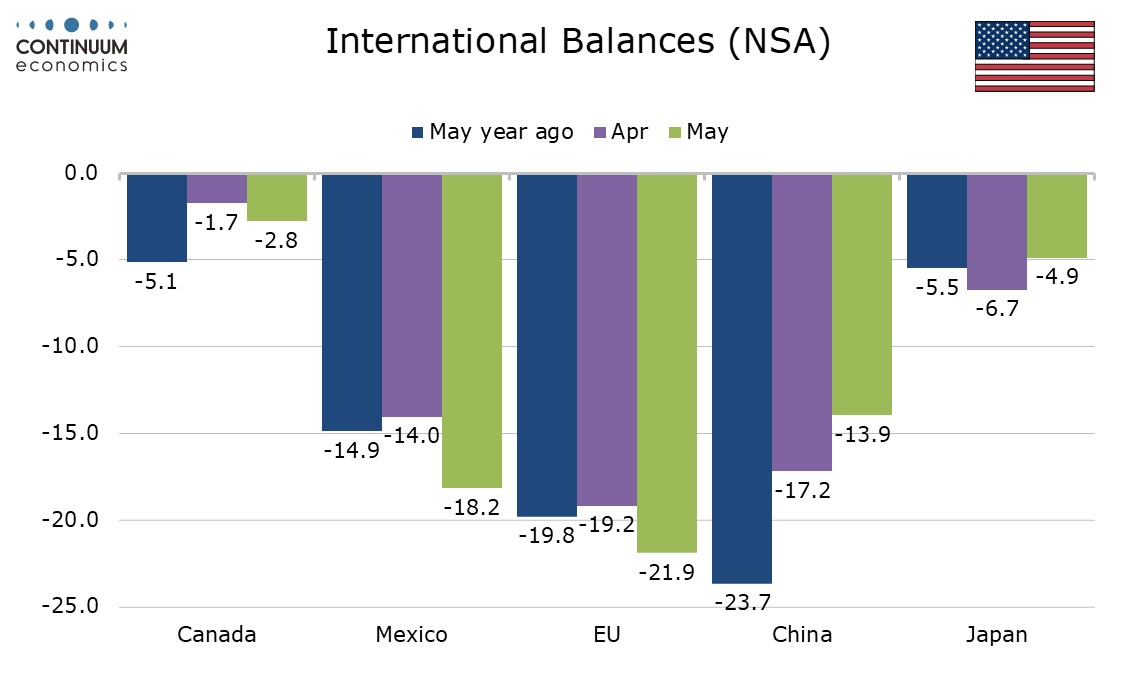

U.S./China Trade Deal: Slow Progress

August 20, 2025 10:25 AM UTC

· Overall, we would attach a 50% probability to a trade framework deal being announced in Q4, though this is unlikely to be comprehensive and could merely be a collection of measures. Even so, the risk also exists of trade negotiations dragging onto 2026 and then reaching a deal or fa

August 19, 2025

China Slow Diversification: Gold And Others

August 19, 2025 8:05 AM UTC

China’s diversification from U.S. Treasuries appears to be at a slow pace. Gold is the obvious alternative if geopolitical tensions were to rise or skyrocket in the scenario of a China invasion of Taiwan. However, Gold holdings are merely creeping higher and suggesting no urgency from China

August 18, 2025

Trump-Putin Summit: No Ceasefire Agreement, Possible Concessions Discussed

August 18, 2025 12:29 PM UTC

Bottom Line: U.S. President Trump and Russian President Putin met in Alaska on August 15 to discuss the fate of war in Ukraine. The meeting lasted three hours, but did not yield an immediate ceasefire agreement as we expected. After the meeting, Trump and Putin both signaled what could happen next i

U.S. Strategic Fiscal Comparisons

August 18, 2025 9:05 AM UTC

The U.S. short average term to maturity is a structural fiscal weakness if higher rates lift U.S. government interest costs close to the nominal GDP trend. Hence, Trump’s pressure for fiscal dominance of the Fed to deliver lower policy rates and reduce U.S. government interest rate costs. Howeve

August 15, 2025

China Slowdown In July

August 15, 2025 7:03 AM UTC

• Retail sales sluggishness reflects households cautious due to the hit to housing wealth and uncertainty over jobs and wage growth. Investment softness reflects not only residential property weakness, but also a slowdown in government infrastructure. This weakness could see a top up fi

August 14, 2025

CBRT Kept Its End-Year Inflation Forecast at 24%, and Announced Its New Interim Targets

August 14, 2025 4:01 PM UTC

Bottom Line: Central Bank of Turkiye (CBRT) released its third quarterly inflation report of the year on August 14, and kept its inflation forecast constant at 24% for 2025, 16% by the end of 2026 and 9% by end-2027. CBRT governor Karahan said the regulator decided to separate the targets from its i

Russian Economy is Slowing: GDP Growth Continued to Lose Steam in Q2 2025

August 14, 2025 9:23 AM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) figures, Russia's GDP expanded by 1.1% YoY in Q2, the slowest pace of growth since the economy resumed expansion in Q2 2023, driven by military spending, investments, higher wages and fiscal stimulus. We think Central Bank of R

August 13, 2025

Deceleration in Inflation Resumes in Russia: 8.8% YoY in July

August 13, 2025 7:28 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data on August 13, inflation stood at 8.8% YoY in July after hitting 9.4% YoY in June, ignited by higher non-food and services prices. Despite inflation eased for a fourth straight month, we foresee inflation will continue to st

China: Echoes of Japan?

August 13, 2025 8:05 AM UTC

Overall, some of China’s private businesses and households are suffering from Japan’s style balance sheet recession. Combined with slowing productivity and a shrinking workforce, this points to slower trend growth in the coming years. However, fiscal stimulus and the clean-up of Loca

India CPI Review: Headline inflation drops sharply on account of food prices

August 13, 2025 7:38 AM UTC

India’s retail inflation fell to 1.55% yr/yr in July 2025, its lowest since 2017 and below the RBI’s 2–6% target band for the first time in over six years. The drop was driven by a sharp contraction in food prices, even as edible oil and fruit inflation remained elevated. With inflation well b

August 08, 2025

Mexico: Further 25bps Cuts Ahead

August 8, 2025 6:44 AM UTC

Banxico forward guidance, plus trade policy risks with the U.S. now see us forecasting an end 2025 policy rate at 7.25% with two 25bps cuts in September and December. We now feel that the risks to 2026 growth will encourage Banxico to move the policy rate down to 6.5% by spring 2026 by two 25bps rat

August 05, 2025

DM Rates: Slowdown Debate Trump’s Independence Question for Now

August 5, 2025 9:50 AM UTC

U.S. Treasury spreads versus other DM government bond markets or 10-2yr U.S. Treasuries are not yet showing a risk premium from the Trump administration attacks on the Fed and economic data. Debate over whether the U.S. is seeing a soft or hard landing are reemerging and this will dominate the outlo

August 04, 2025

Trump Tougher Posture with Russia

August 4, 2025 8:31 AM UTC

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agre

Tariffs and Tensions: India Holds Its Ground Amid US Pressure

August 4, 2025 5:17 AM UTC

India has responded firmly to US tariff escalation, defending its strategic autonomy on Russian oil and domestic market protections. The economic hit is manageable, but the geopolitical signal is clear: India won’t yield under pressure. Talks will continue, but New Delhi won’t trade core interes

RBI to Hold in August as Policy Cycle Enters Pause Phase

August 4, 2025 4:00 AM UTC

The upcoming RBI August meeting is not about action, but observation. With macro indicators largely aligned and risks tilting toward caution, a rate hold by the RBI is expected. Inflation remains subdued, but growth is resilient—requiring no immediate policy move

August 01, 2025

Reciprocal Tariffs: Some Hikes, Deals and Delays

August 1, 2025 8:40 AM UTC

Though high reciprocal tariffs with some countries catches the headline, five of the top 10 countries with large bilateral deficits have reached framework trade deals, two have delays and three have higher tariffs imposed. With exemptions on some USMCA Canada/Mexico goods, plus phones/ semicondu

July 30, 2025

Turkiye Inflation will Slightly Soften in July: Tax Adjustments and Gas Price Hike in July Will Limit the Fall

July 30, 2025 8:35 AM UTC

Bottom line: After easing to 35.1% annually in June, we expect Turkiye’s consumer price index (CPI) will continue to soften moderately in July to 34.1%-34.3% as tax adjustments and energy price hikes in July will limit the downward trend. Despite tight monetary policy and moderately falling dema

July 29, 2025

China/U.S. Trade Talks Into the Autumn

July 29, 2025 8:20 AM UTC

· Our baseline (Figure 1) remains that a U.S./China deal will be reached (most likely in Q4), but a moderate probability exists of no deal being done this year and China being stuck with 30% tariffs – the worst-case scenario of still higher tariffs is now less likely with Trump in a

July 28, 2025

The India–UK Free Trade Agreement: Big Win or Big Gamble?

July 28, 2025 4:37 AM UTC

India and the UK have signed a landmark Free Trade Agreement aimed at doubling bilateral trade by 2030. The deal grants India near-total duty-free access for its goods, boosts prospects for agriculture, textiles, and services, and safeguards sensitive sectors. It also signals New Delhi’s evolving

July 24, 2025

No Deal Yet: India–US Trade Talks Stretch Beyond August Deadline

July 24, 2025 5:42 AM UTC

India and the US have made progress in negotiations for an interim trade deal, but key sticking points—particularly around agriculture and autos—remain unresolved ahead of the August 1 deadline for new US tariffs. President Trump’s tariff-first strategy has pushed India to seek partial relief,

July 23, 2025

Food Prices Lifted South Africa Inflation to 3.0% YoY in June

July 23, 2025 12:36 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on July 23 that annual inflation rose to 3.0% YoY in June from 2.8% in May as food prices reached a 15-month high coupled with elevated restaurant and health services prices. The inflation is still within South African Reserve Bank’s (SARB)

Trump Deals: Japan, Philippines and Indonesia

July 23, 2025 8:26 AM UTC

• Other countries cannot be guaranteed to get a Japan style deal, both as Japan is the key geopolitical ally in the Asia pivot against China and as Trump is keen to agree deals by August 1. India and Taiwan are trying to finalize deals, but the EU is more difficult. China 90 day deadlin

July 17, 2025

Trump’s Tariffs and Markets

July 17, 2025 12:00 PM UTC

The assumption in financial markets is that some trade framework deals will be done by August 1; some countries will make enough progress to be given an extra 30 days and some countries could have higher tariffs implemented. This would be broadly consistent with the average 15% tariff that is widely

July 16, 2025

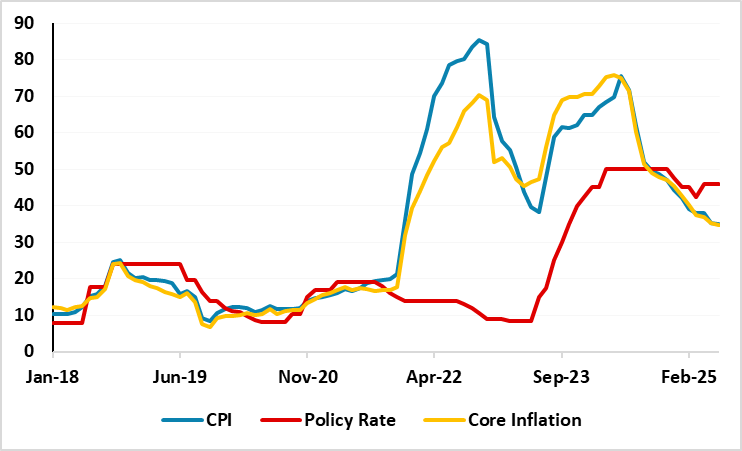

CBR will Likely Cut its Key Rate to 19% on July 25

July 16, 2025 4:32 PM UTC

Bottom Line: After Central Bank of Russia (CBR) reduced its key interest rate by 100 basis points to 20% on June 6, citing continued easing in inflationary pressures, including core inflation, we foresee that the rate will be further reduced to 19% on July 25 taking into account that inflation slowe

July 15, 2025

Turkiye MPC Preview: CBRT will Likely Restart its Easing Cycle on July 24

July 15, 2025 12:09 PM UTC

Bottom Line: After Central Bank of Turkiye (CBRT) held its key policy rate stable at 46% on June 19, we believe CBRT will likely reduce the policy rate by 150-250 bps during the MPC meeting scheduled for July 24 considering the deceleration trend in inflation in June beat forecasts and reinforced ex

Solid Buffers, Soft Spots: India’s Debt Metrics in Focus

July 15, 2025 12:00 PM UTC

India’s fiscal metrics for FY26 show strong early gains, with a sharply lower deficit and robust revenue support from RBI dividends and capital spending. Externally, the country’s debt levels have risen but remain manageable, backed by healthy reserves and a low debt-to-GDP ratio. However, short

China: GDP Resilient in Q2, But

July 15, 2025 7:30 AM UTC

• We do see H2 weakness relative to H1, as exports to the U.S. will slow again and the effects of the government consumption trade in programs fades. However, H1 has been higher than our forecasts and thus we are revising 2025 GDP growth to 4.8% v 4.4% previously. We keep 2026 GDP growt

India CPI Review: CPI at 2.1%: Increased Headroom for One More Cut

July 15, 2025 4:33 AM UTC

India’s retail inflation dropped to a six-year low of 2.82% in May, driven by easing food prices and supported by favourable base effects. While disinflation continues to create monetary space, RBI's next rate cut will be data driven.

July 14, 2025

Tariffs: Seeking a Trigger for the TACO Trade

July 14, 2025 4:28 PM UTC

It has been fairly clear for some time that 10% represented a likely floor for the eventual Trump tariff regime. However, expectations that Trump would not be willing to go dramatically above that are being tested. A rate in the mid-teens still looks the most likely outcome, as the economic damage t

July 11, 2025

Deceleration in Inflation, Albeit Gradual, Continued in June: 9.4% YoY

July 11, 2025 4:48 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation stood at 9.4% YoY in June after hitting 9.9% YoY in May, partly due to favorable base impacts, recent RUB strengthening and falling oil prices. We think the recent tariffs hike for electricity, gas, heating and w