Solid Buffers, Soft Spots: India’s Debt Metrics in Focus

India’s fiscal metrics for FY26 show strong early gains, with a sharply lower deficit and robust revenue support from RBI dividends and capital spending. Externally, the country’s debt levels have risen but remain manageable, backed by healthy reserves and a low debt-to-GDP ratio. However, short-term debt vulnerabilities and weak capital inflows point to areas of concern. Sustaining this balance will require navigating a trickier global landscape in FY26.

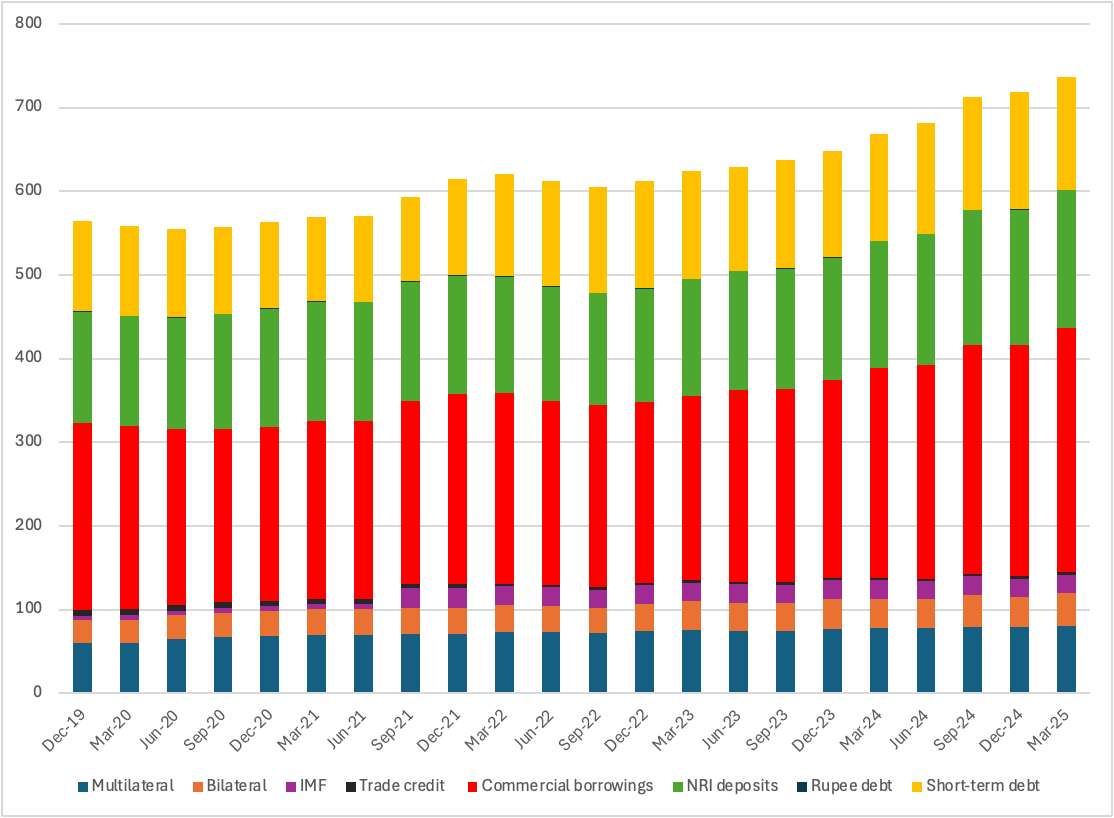

India’s external debt stock rose by USD 67.5bn to USD 736.3bn as of March 2025, a 10.1% yr/yr increase excluding valuation effects, according to the Reserve Bank of India. The rise marks the seventh consecutive quarter of expansion in India’s external liabilities and comes at a time of intensifying global macroeconomic volatility. Despite this uptrend, the broader picture of India’s external position remains one of relative strength, underpinned by robust reserves, manageable servicing ratios, and prudent fiscal metrics.

The external debt-to-GDP ratio edged up modestly to 19.1% from 18.5% last year. This level remains far below early-2010s peaks (~23%) and is substantially lower than emerging market counterparts like Brazil (29%) and South Africa (46%). Importantly, long-term debt now comprises over 81% of India’s total external obligations, reducing refinancing risks and reflecting the country’s reliance on stable, project-linked capital. However, some caution lights are flashing. The short-term debt-to-reserves ratio inched up to 20.1%, its highest in over three years, although still well below the 2013 taper tantrum levels (~31%). On a residual maturity basis, obligations due within a year represent 45.4% of reserves—a manageable level, but one that warrants monitoring given global rate volatility and geopolitical stress.

Figure 1: India External Debt Profile (USD bn)

Source: Continuum Economics

The structure of India’s external debt remains dominated by the non-government sector, particularly non-financial corporates and commercial banks. This speaks to the private sector’s continued reliance on offshore financing but also increases currency mismatch risks if hedging levels decline. Loans continue to account for the largest share (34%), followed by deposits, trade credits, and securities—pointing to a balanced liability profile.

From a servicing perspective, India’s debt service ratio fell to 6.6% of current receipts—down marginally from 6.7%—highlighting comfortable repayment capacity. Foreign exchange reserves, meanwhile, have climbed back to USD 702.8bn as of June-end, bolstered by steady software services inflows and a recovering rupee. This level provides a 90.8% cover for total external debt and over 11 months’ worth of import cover—among the strongest cushions in the developing world.

Fiscal Performance Anchors Stability

On the fiscal side, India is off to a strong start in FY26. The central government’s fiscal deficit stood at just INR 13.2bn, or 0.8% of the full-year target, in the first two months—down 97% y/y. The improvement is largely driven by a record INR 2.69tn dividend transfer from the RBI and restrained growth in subsidies. Total receipts rose 28% y/y to INR 7.33tn, with non-tax revenue surging nearly 42%. Capital expenditure—a key growth lever—jumped 54.1% y/y to INR 2.21tn, reinforcing the government’s infrastructure push. Meanwhile, subsidy spending remained subdued, at just 13% of the annual allocation. These metrics put India on track to meet its fiscal deficit target of 4.4% of GDP for FY26, down from 4.8% in FY25.

Current Account: A Mixed Picture

India’s current account posted a rare surplus of USD 13.5bn (1.3% of GDP) in Q4 FY25, the strongest performance in six years. This was driven by booming net services receipts (up 25% y/y), remittance inflows (up 9.9%), and lower primary income outflows. However, for the full year, the current account still logged a deficit of USD 23.3bn (0.6% of GDP), pointing to persistent structural pressures from merchandise trade. Investment flows were more concerning. Net FDI in FY25 slumped to just USD 1.0bn from USD 10.2bn in FY24—a clear signal of global caution and potential domestic policy bottlenecks. Portfolio investment also turned negative in Q4, with USD 5.9bn in outflows.

Outlook for FY26: Navigating a Narrower Path

India enters FY2026 with solid buffers but limited room for complacency. A deteriorating global trade environment—marked by rising US tariffs and weak Chinese demand—poses risks to export momentum. While India has outperformed on services, sustaining this will require skilling, digital policy clarity, and investment in tech infrastructure. Externally, rising short-term obligations and weak FDI trends are the two pressure points. A failed trade deal with the US or further delays in CEPA negotiations with the EU and UK could weigh on capital flows. On the positive side, the RBI’s rebuilt reserves and lower forward book suggest greater flexibility to manage rupee volatility.

Domestically, fiscal consolidation remains on track. But delivering growth amid tight global financing conditions and erratic monsoon patterns will be a delicate balancing act. The government’s focus on capex and cautious subsidy management provide a good starting point, though execution risks remain high. India’s macro fundamentals remain broadly sound, even as headline debt numbers rise. The quality of external borrowing—longer tenor, project-linked, non-sovereign—and the strength of service exports and remittances help differentiate India from more fragile emerging markets. But with debt levels climbing, investment flows weakening, and buffers getting drawn down, the space to absorb future shocks is narrowing. In our view, FY26 will test India’s ability to sustain growth while preserving external and fiscal discipline.