South Africa Inflation Surges: 3.5% YoY in June

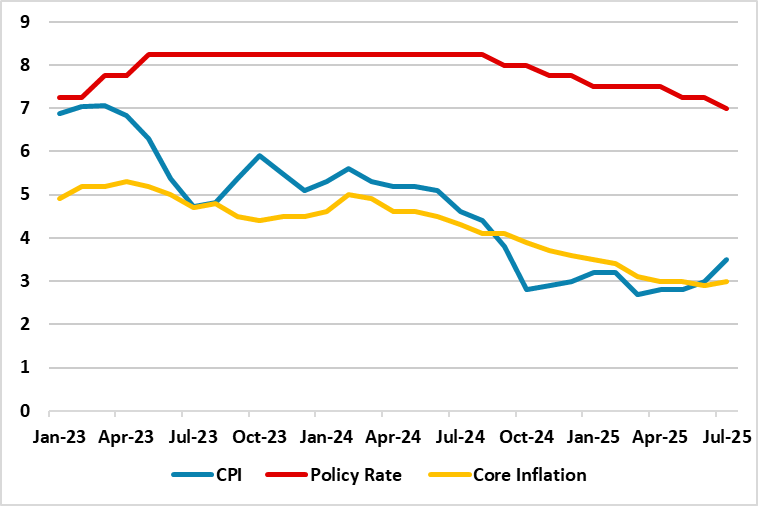

Bottom Line: Statistics South Africa (Stats SA) announced on August 20 that annual inflation rose to 3.5% YoY in July from 3.0% in June due to elevated prices of food and non-alcoholic beverages; housing and utilities; and restaurants and accommodation services. MoM prices surged by 0.9% in July, marking the largest increase since February, after a 0.3% rise in June. Despite subdued core inflation at 3.0% YoY, we think unpredictable outlook for the global economy, increases in utility costs, climate-related agricultural disruptions and power cuts (loadshedding) will likely continue to pressurize prices in H2, and we foresee average inflation will hit 3.4% in 2025.

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – July 2025

Source: Continuum Economics

Hitting a ten-month high in July, annual inflation increased to 3.5% in July from 3.0% in June led by higher food and non-alcoholic beverages (NAB) prices. (Note: According to StatsSA, meat, vegetables and other staples saw double-digit increases, reflecting broader supply chain disruptions and seasonal pressures). The change in food & NAB prices was 5.7% YoY in July, following a 5.1% rise in June. The prices of restaurants and accommodation services edged up by 3.0% YoY in July when compared with June’s 2.0%.

In MoM terms, inflation was at 0.9% in July from 0.3% in June. Annual core inflation rate slightly surged by 3.0% in July, up from an over four-year low of 2.9% in June. We think hike in inflation in July signals the uncertainty over the inflation outlook in the upcoming months since unpredictable outlook for the global economy, increase in utility costs, climate-related agricultural disruptions and power cuts (loadshedding) will likely continue to pressurize prices in H2 2025, and we foresee average inflation will hit 3.4% in 2025.

The housing and utilities prices surged by 4.3% YoY in July as various municipal rates and taxes were lifted. Tariffs for water supply increased by 12.1% in 2025, significantly higher than 2024’s rise of 7.5%, recording the sharpest increase since 2018 when tariffs jumped by 12.9%. Electricity prices hiked by 10.6% in 2025, lower than the 11.5% recorded in 2024. (Note: According to sources, cities like Tshwane and Cape Town introduced new levies and taxes, and their impact is already reflected in household bills).

We feel a significant risk factor for the inflation trajectory is the power cuts. South Africa’s national electricity utility company, Eskom announced that Stage 2-3 loadshedding was implemented in May. The return of loadshedding remain worrisome since it continues to contribute to the inflation readings. (Note: Despite concerns, Eskom recently reported that the power system is showing resilience in meeting the winter electricity demand due to ongoing structural improvements in the generation fleet, and announced that there has been no load shedding since May 15, with only 26 hours recorded between April 1 and July 31).

Speaking about the inflation target, SARB governor Kganyago continues to call for a lower inflation target, saying the current range is too wide and undermines the competitiveness of Africa's largest economy. (Note: Kganyago said on July 31 that the inflation target will be at 3%, and will be used as an anchor at future meetings rather than previous midterm target of 4.5%). Since domestic inflation is on the rise in the last months coupled with global uncertainties such as tariffs, we believe SARB's push for a lower target could be challenging in the short-term.

Under current circumstances, we foresee average inflation will hit 3.4% in 2025. We believe the key for the inflation trajectory will be the global developments, tariffs, oil prices and government’s determination to address the electricity shortages, logistical constraints and financing needs. SARB will have to follow increases in food and utility costs squeezing household budgets in H2.