India CPI Review: CPI at 2.1%: Increased Headroom for One More Cut

India’s retail inflation dropped to a six-year low of 2.82% in May, driven by easing food prices and supported by favourable base effects. While disinflation continues to create monetary space, RBI's next rate cut will be data driven.

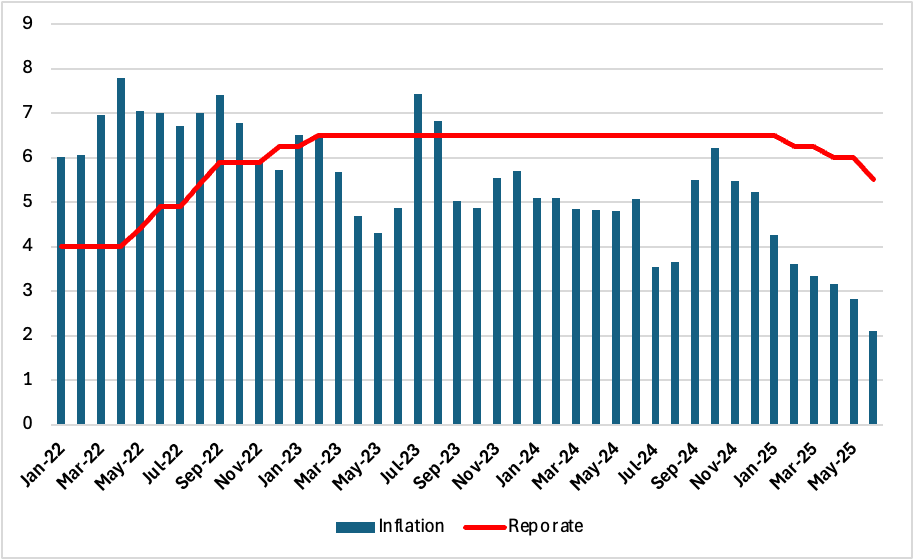

India’s retail inflation dropped to 2.1% yr/yr in June—its lowest level since January 2019—sharply below market expectations and bringing headline price pressures closer to the lower end of the Reserve Bank of India’s (RBI) 2–6% tolerance band. The decline was led by a broad-based disinflation in food and beverages, supported by a favourable base and easing global commodity prices. While core inflation nudged higher, it remained non-threatening in the broader policy context, strengthening the case for the RBI to remain in wait-and-watch mode.

Figure 1: India CPI and Repo Rate (%)

Source: Continuum Economics

The latest CPI print reflects a 19% yr/yr drop in vegetable prices and an 11.8% decline in pulses—the steepest fall in more than seven years. The Consumer Food Price Index (CFPI) slipped into deflation for the first time since 2019, with rural and urban food inflation contracting by -0.92% and -1.22% respectively. Disinflation was also visible across a wide range of items including cereals (3.73%), sugar (3.5%), spices (-3.03%), and meat (-1.62%). Fuel inflation decelerated to 2.78%, while the pace of price increase in personal care and health picked up modestly. Urban retail inflation was recorded at 2.56%, while rural inflation moderated to 1.72%. Among major states, Kerala reported the highest CPI inflation at 6.71%—largely due to its higher share of gold and personal effects in household consumption—while Telangana experienced deflation of -0.93%. Bihar, ahead of upcoming elections, recorded a subdued 0.75%.

The CPI outturn underscores India’s disinflationary momentum and brings Q1 FY26 inflation to an average of 2.7%, undershooting the RBI’s estimate of 2.9%. However, the central bank is unlikely to change course, having already front-loaded 100 basis points of rate cuts in 2025 and shifted its stance to “neutral” in the June policy. We anticipate a rate hold in the upcoming August meeting. A final 25 basis point cut remains on the table if growth momentum slows though.

Meanwhile, wholesale price inflation (WPI) turned negative, slipping to -0.13% in June. This was driven by deeper deflation in food articles (-3.75%), mineral oils, and basic metals. Vegetables, pulses, onions, and potatoes saw steep price declines, while factory gate inflation across manufactured items decelerated further. From a policy perspective, the June data confirms the RBI’s benign inflation outlook. It revised its FY26 inflation forecast downward to 3.7%, projecting Q2 at 3.4%, Q3 at 3.9%, and Q4 at 4.4%, with risks deemed evenly balanced. Nonetheless, the central bank has flagged weather-related disruptions and evolving tariff threats as potential upside risks, especially in the context of global oil and food prices.

Overall, the inflation narrative now tilts further in favour of policy continuity. Despite a slightly firmer core, the disinflation in food, stable services prices, and favourable monsoon dynamics provide the RBI adequate room to hold rates steady or deliver a final shallow cut. More broadly, the combination of softening inflation and supportive monetary policy bodes well for real incomes, private consumption, and macro stability heading into H2 FY26.