Canada

View:

August 13, 2025

Bank of Canada Minutes from July 30 - Differences of opinion on whether further easing would be needed

August 13, 2025 7:32 PM UTC

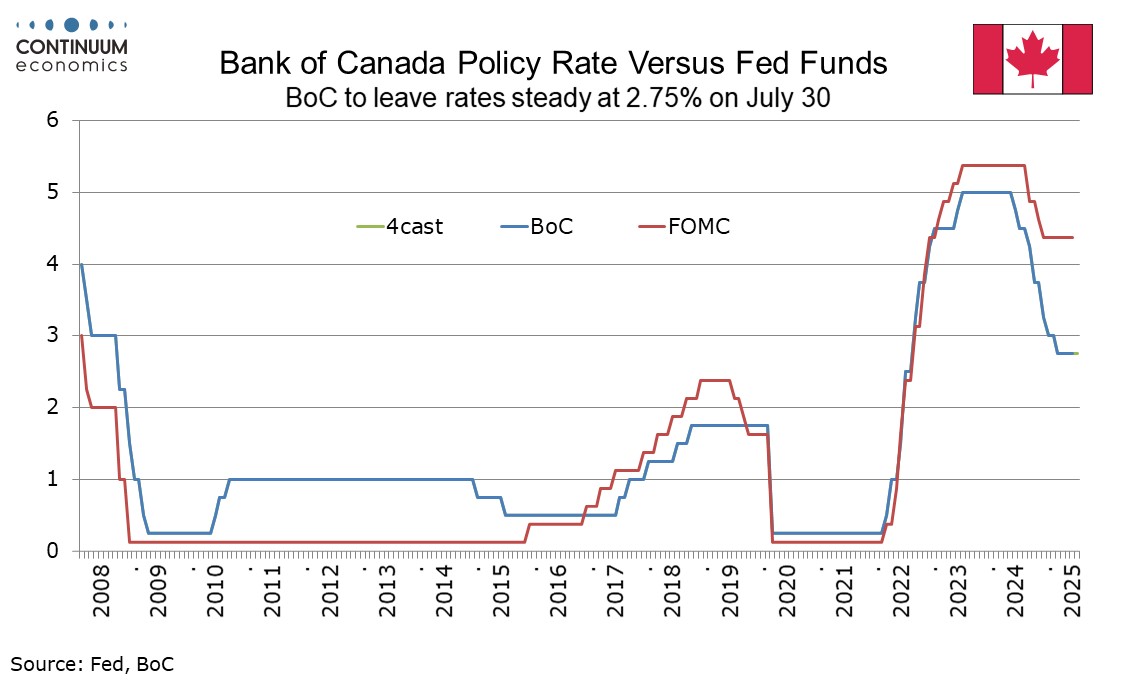

The Bank of Canada has released minutes from its July 30 meeting, which saw rates left unchanged at 2.75% with Governor Macklem stating after the meeting that there was a clear consensus to do so. However the minutes show that some felt the rate had been reduced sufficiently, while others felt that

August 11, 2025

Preview: Due August 29 - Canada Q2/June GDP - Exports plunge to send GDP lower

August 11, 2025 7:54 PM UTC

We expect Q2 Canadian GDP to fall by 1.0% annualized after five straight gains marginally above 2.0%. This would be slightly stronger than a Bank of Canada forecast of -1.5% but weaker than what monthly GDP data is likely to imply for the quarter, with June seen rising by 0.1%.

August 05, 2025

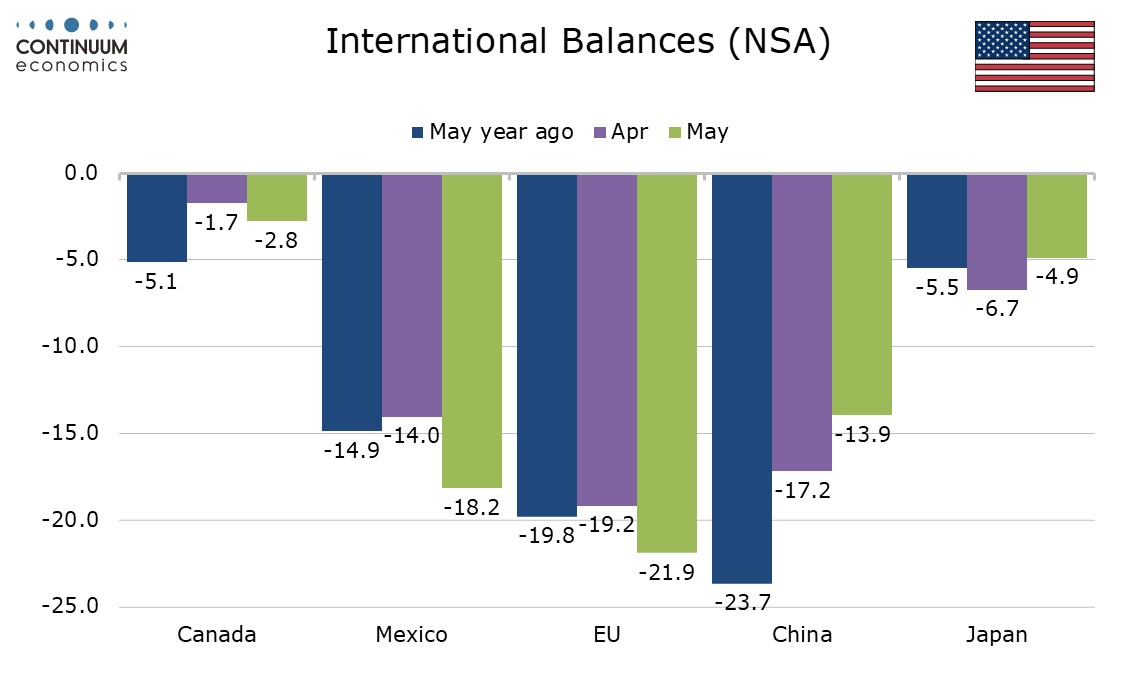

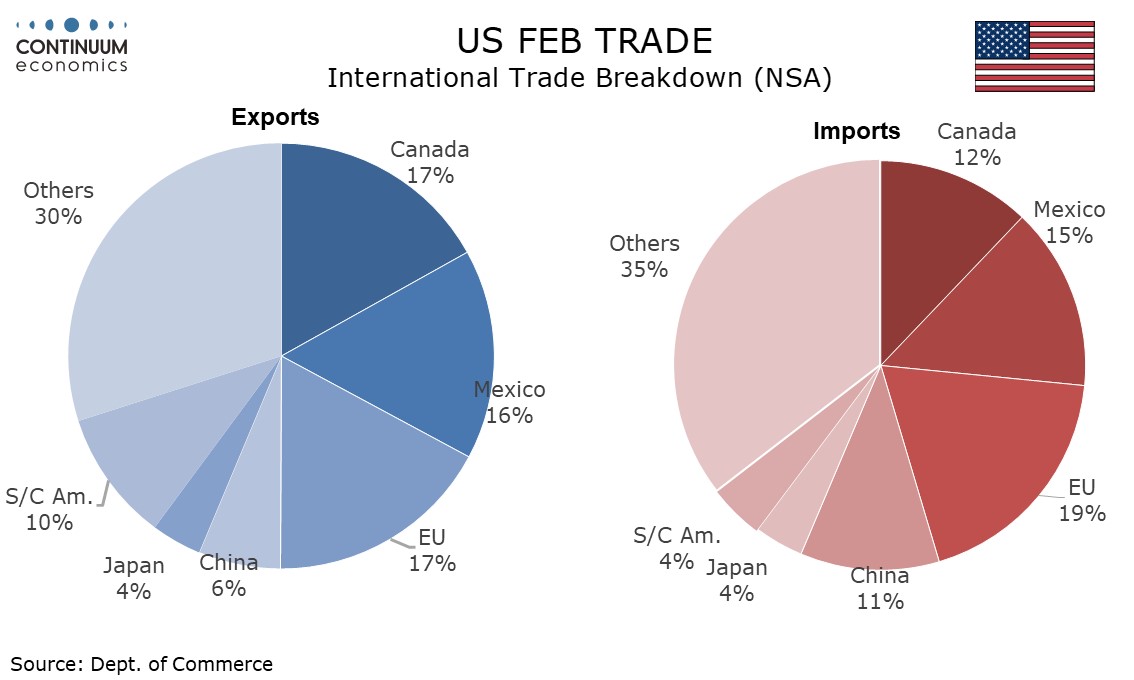

June US trade deficit falls on weak imports, Canada trade deficit increases on one-time imports bounce

August 5, 2025 1:02 PM UTC

June’s US trade deficit of $60.2bn is even lower than expected, down from $71.7bn in May and in slipping marginally below April’s $60.3bn has reached its lowest level since September 2023. Exports fell by 0.5%, a second straight decline, but imports fell by 3.7%, a third straight fall as strong

DM Rates: Slowdown Debate Trump’s Independence Question for Now

August 5, 2025 9:50 AM UTC

U.S. Treasury spreads versus other DM government bond markets or 10-2yr U.S. Treasuries are not yet showing a risk premium from the Trump administration attacks on the Fed and economic data. Debate over whether the U.S. is seeing a soft or hard landing are reemerging and this will dominate the outlo

August 04, 2025

Trump Tougher Posture with Russia

August 4, 2025 8:31 AM UTC

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agre

August 01, 2025

Reciprocal Tariffs: Some Hikes, Deals and Delays

August 1, 2025 8:40 AM UTC

Though high reciprocal tariffs with some countries catches the headline, five of the top 10 countries with large bilateral deficits have reached framework trade deals, two have delays and three have higher tariffs imposed. With exemptions on some USMCA Canada/Mexico goods, plus phones/ semicondu

July 30, 2025

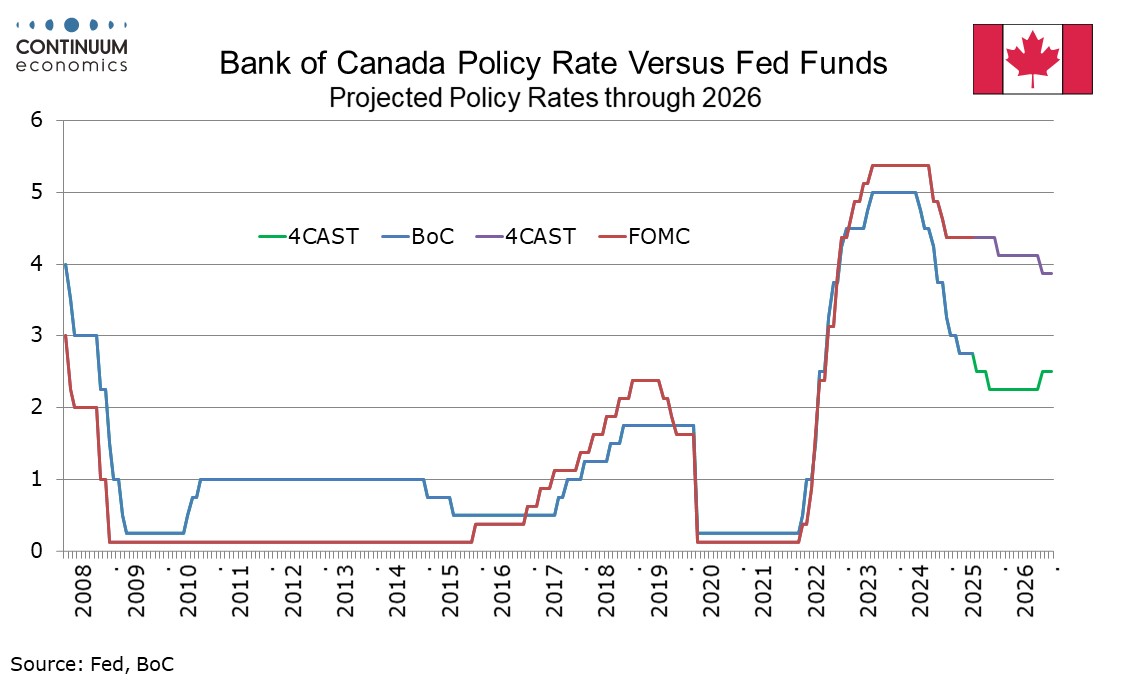

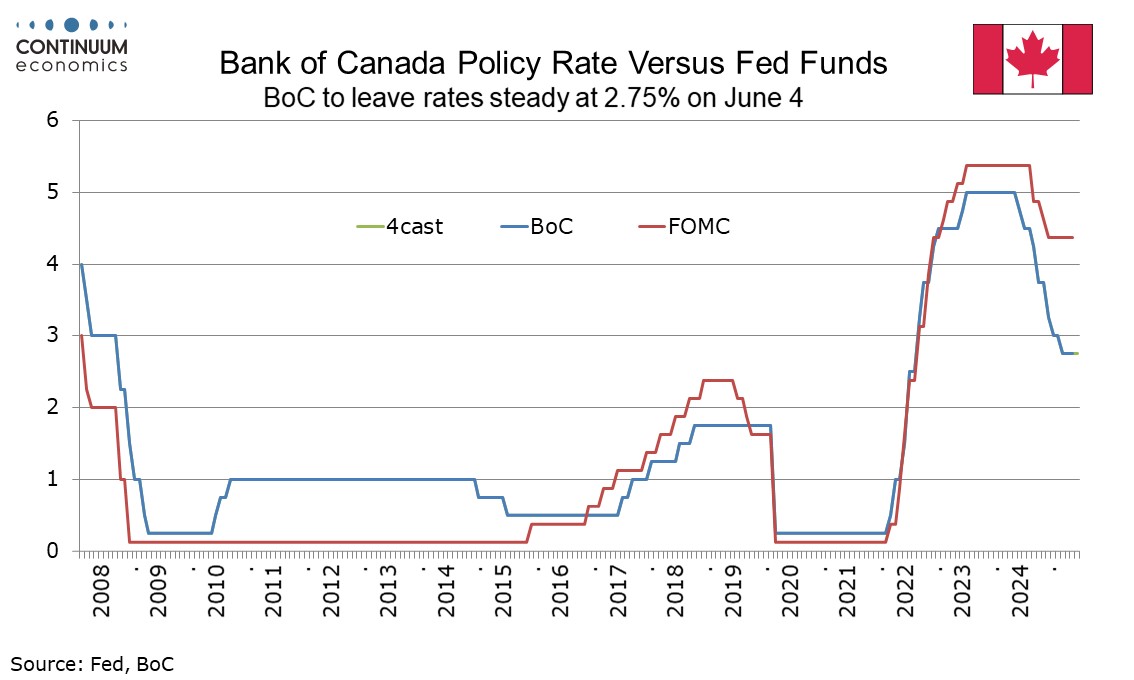

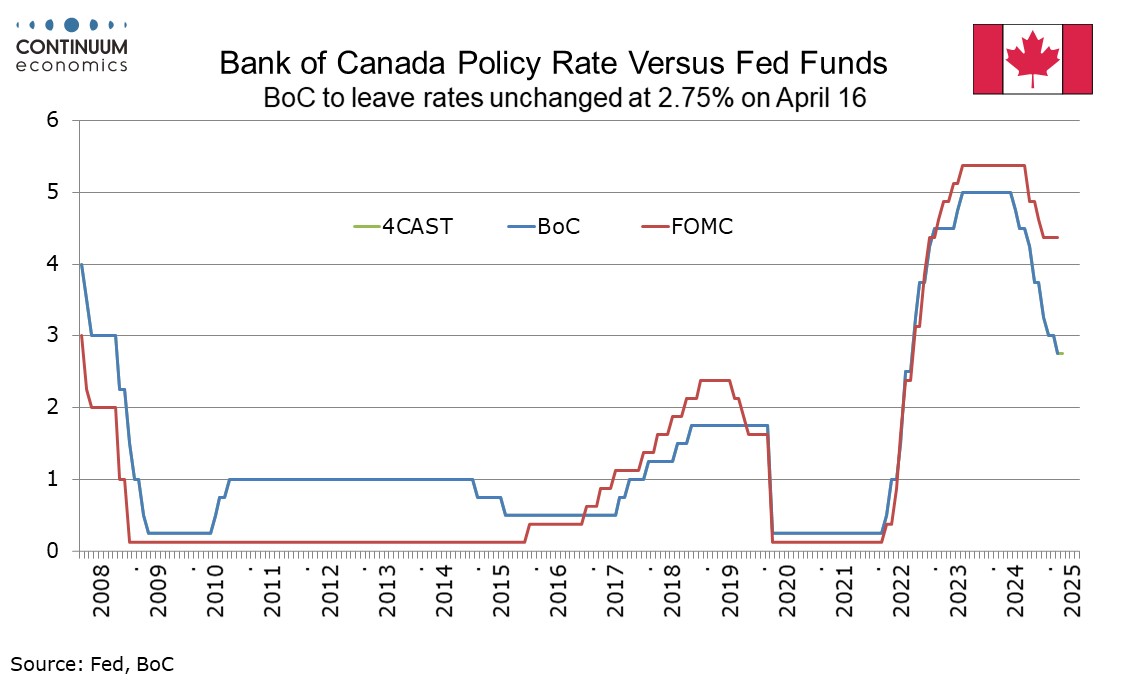

Bank of Canada - Consensus to hold, but cautious bias towards easing

July 30, 2025 3:34 PM UTC

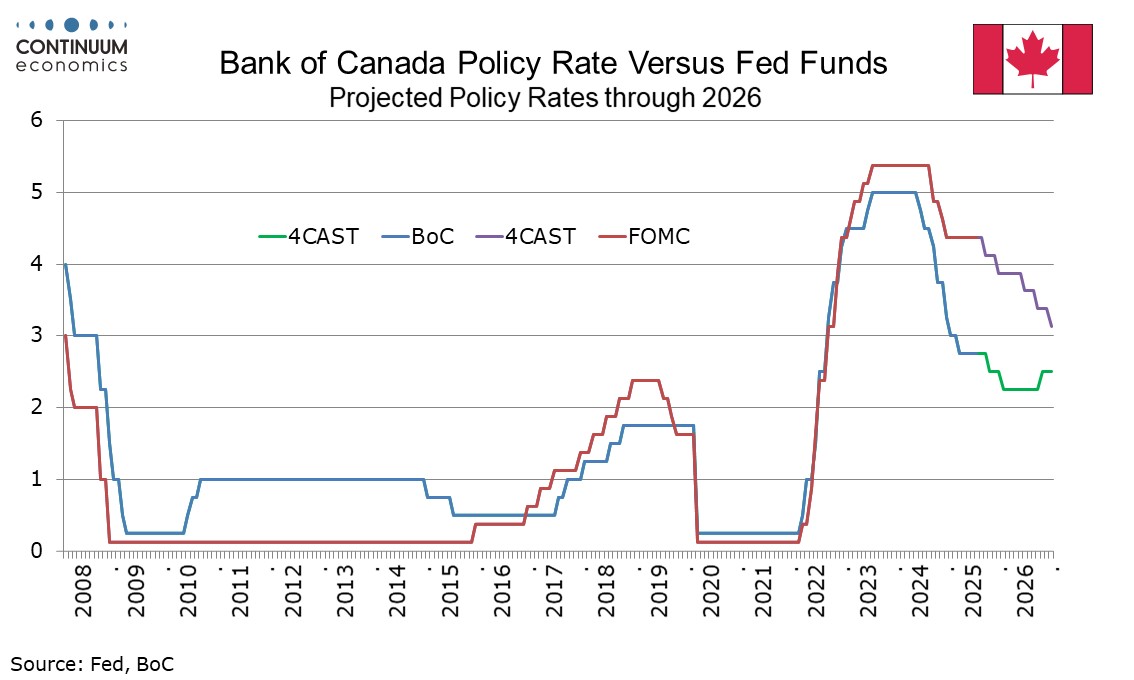

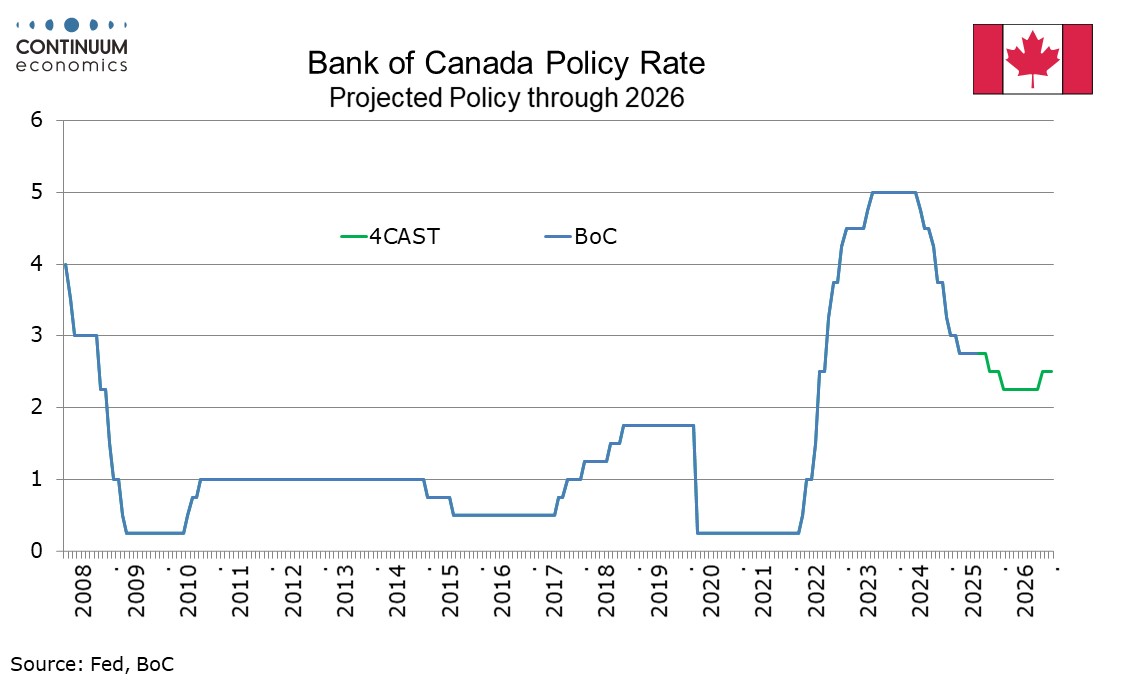

Bank of Canada Governor Tiff Macklem stated that there was a clear consensus to leave rates steady at 2.75% at the latest meeting, as was also the case in June. There does however appear to be scope for further easing ahead. We still expect rates to bottom at 2.25% and end 2026 at 2.5%, but we now

July 23, 2025

Trump Deals: Japan, Philippines and Indonesia

July 23, 2025 8:26 AM UTC

• Other countries cannot be guaranteed to get a Japan style deal, both as Japan is the key geopolitical ally in the Asia pivot against China and as Trump is keen to agree deals by August 1. India and Taiwan are trying to finalize deals, but the EU is more difficult. China 90 day deadlin

July 17, 2025

Trump’s Tariffs and Markets

July 17, 2025 12:00 PM UTC

The assumption in financial markets is that some trade framework deals will be done by August 1; some countries will make enough progress to be given an extra 30 days and some countries could have higher tariffs implemented. This would be broadly consistent with the average 15% tariff that is widely

July 15, 2025

Bank of Canada Preview for July 30: Hold after firm data with uncertainty high

July 15, 2025 3:30 PM UTC

The Bank of Canada meets on July 30 and what had been seen as a close call between a 25bps easing and unchanged now looks likely to leave rates unchanged at 2.75%. Continued above target core CPI data and a strong employment report for June argue against easing, though uncertainty remains high with

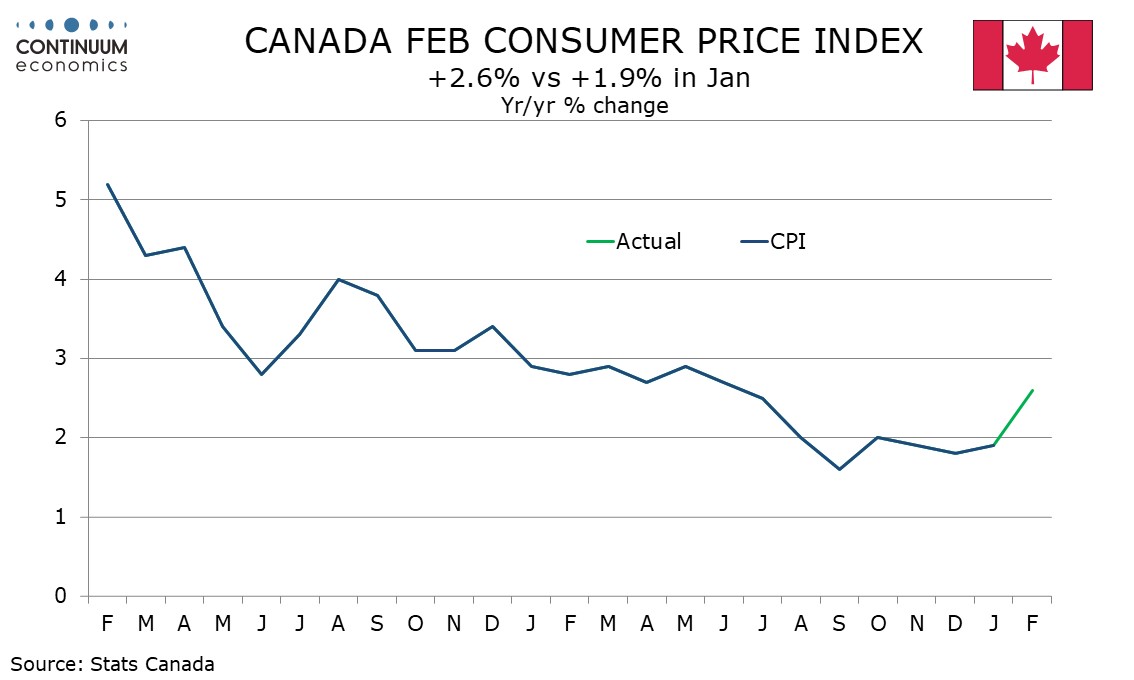

Canada June CPI - Argues against a July BoC easing

July 15, 2025 1:18 PM UTC

June CPI was as expected with yr/yr growth at 1.9% after two straight months at 1.7%, though without April’s abolition of the Consumer Carbon Tax would be standing around 2.5%. The Bank of Canada’s core rates showed no progress lower, and coupled with Friday’s strong employment report for June

July 14, 2025

Tariffs: Seeking a Trigger for the TACO Trade

July 14, 2025 4:28 PM UTC

It has been fairly clear for some time that 10% represented a likely floor for the eventual Trump tariff regime. However, expectations that Trump would not be willing to go dramatically above that are being tested. A rate in the mid-teens still looks the most likely outcome, as the economic damage t

July 01, 2025

Trump Tariffs: Poker Face?

July 1, 2025 12:55 PM UTC

Our central scenario (but less than 50%) is towards a scenario of compromise, with some agreements in principle or trade framework deals, delays for most other negotiating in good faith but with one or two countries seeing a reciprocal tariff rise e.g. Spain and/or Vietnam. This could still be fol

June 25, 2025

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

Canada May CPI - Mixed data leaves July BoC decision a close call

June 24, 2025 12:49 PM UTC

May Canadian CPI has come in as expected, unchanged at 1.7% with this yr/yr rate still restrained by the abolition of the consumer carbon tax which took 0.7% off the rate in April. The BoC’s core rates are on balance slightly softer, but do not fully reverse acceleration seen in May, leaving the J

June 18, 2025

June 12, 2025

Trump Tariffs: China and July 9 Reciprocal Deadline

June 12, 2025 7:17 AM UTC

We attach a 65% probability to a U.S./China reaching a new trade deal that reduces the minimum overall tariff to 15-20% imposed by the U.S., most likely agreed in Q4 2025 and to be implemented in 2026. However, a 35% probability exist of no deal and this could eventually mean higher tariffs (Fig

June 04, 2025

Bank of Canada - Consensus to hold in June, but we now expect easings in July and October

June 4, 2025 3:54 PM UTC

Governor Tiff Macklem stated that the Bank of Canada’s decision to leave rates unchanged at 2.75% was a clear consensus. There was more diversity of views on the path forward, though members thought there could be a need for easing, depending on data. We now expect two further easings in 2025, in

Canada: BoC's Macklem - Consensus to hold at this meeting but scope for future easing seen

June 4, 2025 2:04 PM UTC

The opening statement from BoC's Macklem suggests the decision to hold at this meeting was not the close call seen by many, but scope for future easing is seen, depending on how data evolves.

June 03, 2025

Nato Summit 5% Target and Trump

June 3, 2025 10:48 AM UTC

Trump’s natural instincts will likely see extra pressure applied on Europe in the coming weeks to commit to 5%, but we do not see existential threats from Trump. In the end, our baseline is that NATO will agree a “soft” aim of 5% (3.5% hard military spending and 1.5% infrastructure/cybersecu

June 02, 2025

Trump’s 50% Steel And Aluminum: Negotiating Leverage?

June 2, 2025 7:42 AM UTC

• President Donald Trump increase in steel and aluminum tariffs from 25% to 50% is not just about boosting the steel and aluminum industry. It also a demonstration that Trump remains in control of tariffs and can aggressively change tariffs to increase negotiating leverage. It is a mess

May 30, 2025

Bank of Canada Preview for June 4: A close call for another policy pause

May 30, 2025 3:43 PM UTC

The Bank of Canada meets on June 4 and it is a close call between leaving rates unchanged at 2.75% and a 25bps easing to 2.5%, though we now lean to the former. The statement is unlikely to give any forward guidance and we still expect further easing this year as the economy weakens in response to U

May 29, 2025

Preview: Due May 30 - Canada Q1/March GDP - A slower quarter, with risk for a weak start to Q2

May 29, 2025 2:44 PM UTC

We expect Q1 Canadian GDP to rise by a five-quarter low of 1.5% annualized, below a 1.8% estimate made with the Bank of Canada’s April Monetary Policy Report. We expect a 0.1% increase in March GDP, matching an estimate made with February’s data. We expect a slight decline in the preliminary est

Court Stops Trump Reciprocal and Fentanyl Tariff

May 29, 2025 7:18 AM UTC

• The Trump administration will likely follow a multi-track response by appealing the judgement but also fast-tracking section 232 product tariffs for pharmaceuticals and semiconductors. The administration could also consider section 301 or 122 tariffs (the latter 15% for 150 days against c

May 20, 2025

Canada April CPI - Core rates highest for over a year

May 20, 2025 12:56 PM UTC

April Canadian CPI in falling to 1.7% yr/yr from 2.3% is slightly stronger than expected with the fall fully due to the ending of a carbon tax. The BoC’s core rates are stronger than expected, CPI-Median at 3.2% from 2.9%, CPI-Trim at 3.1% from 2.8% and CPI-Common at 2.5% from 2.3%.

May 19, 2025

Preview: Due May 30 - Canada Q1/March GDP - A slower quarter, with risk for further slowing in Q2

May 19, 2025 2:47 PM UTC

We expect Q1 Canadian GDP to rise by a five-quarter low of 1.5% annualized, below a 1.8% estimate made with the Bank of Canada’s April Monetary Policy Report. We expect a 0.1% increase in March GDP, matching an estimate made with February’s data. We expect a slight decline in the preliminary est

May 08, 2025

Canada: BoC's Macklem - Getting closer to lower-tariff scenario from April MPR

May 8, 2025 6:11 PM UTC

The BoC is getting less pessimistic about the tariff scenario, though we are not yet in the better of two scenarios outlined in April's MPR, just closer. Earlier today the BoC's Financial Stability Report saw resilience in the financial system with reduced consumer debt relative for income, while no

May 06, 2025

US March trade deficit surges as service export weakness adds to pre-tariff strength in goods imports

May 6, 2025 1:04 PM UTC

March’s record US trade deficit of $140.5bn is even higher than expected though consistent with the assumptions of the Q1 GDP report. Exports surged by 4.4% ahead of the April 2 tariff announcement while exports rose by a marginal 0.2%.

April 28, 2025

US Exit: Lessons From Brexit?

April 28, 2025 8:05 AM UTC

Overall, the U.S. attempt to reshape global trade is unlikely to significantly improve its trade position, but the size and influence of the U.S. may mean it does not get hit in net exports volumes like the UK. Even so, U.S. business investment could be restrained by ongoing uncertainty from the T

April 25, 2025

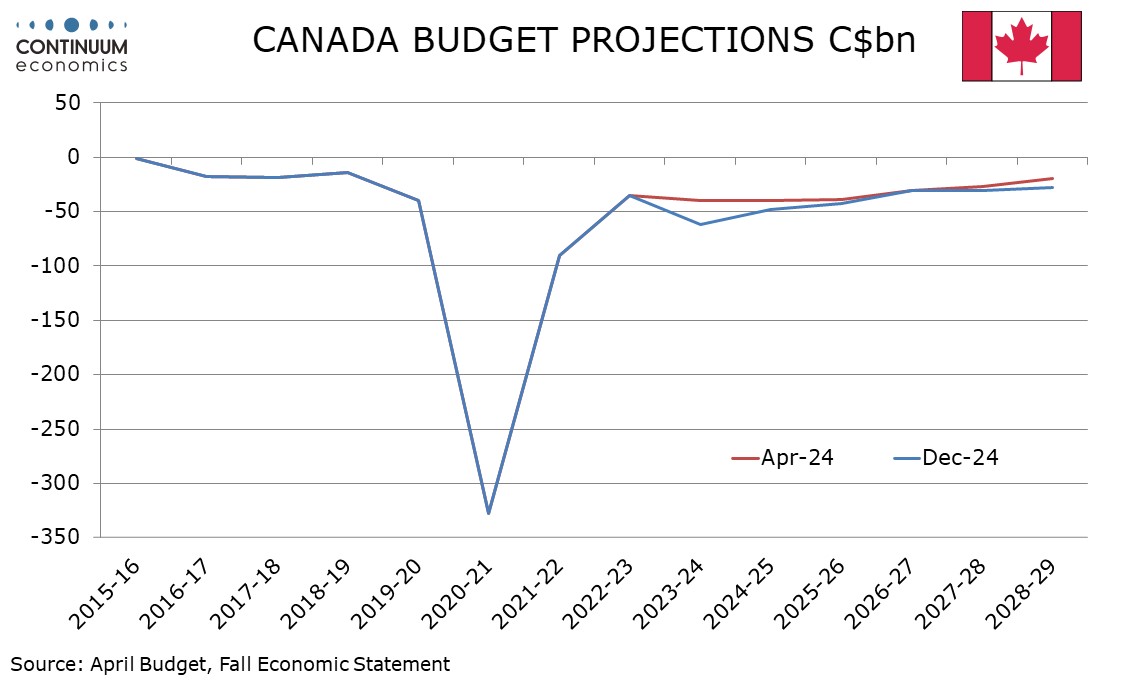

Canada Election: Liberal Victory Likely, Stable Policy Expected

April 25, 2025 4:21 PM UTC

Canada’s election takes place on Monday. A victory for the ruling Liberals looks likely, but polls are close enough to mean that a hung parliament or even a majority for the opposition Conservatives, while unlikely, is not to be ruled out. Should the Conservatives spring a surprise, a more concili

April 23, 2025

Trump Under Pressure

April 23, 2025 7:15 AM UTC

A deteriorating economic; volatile financial markets and weakening approval ratings are all putting pressure on the Trump administration to do trade deals. However, Trump instincts means he still likes tariffs, while negotiations will not be quick with China restraints and non-tariffs list desired

April 22, 2025

Foreign Official U.S. Treasury Holders: The Kindness of Strangers

April 22, 2025 7:30 AM UTC

Official holdings of U.S. Treasuries show a mixed picture with China, Brazil and Saudi Arabia well off peak holdings. Two drivers of some of these country flows are the peak in global central bank FX reserve holdings in 2021 and an increased holdings of other currencies in the last decade. Neverth

April 17, 2025

Safe Havens Other Than the USD

April 17, 2025 8:30 AM UTC

The USD and U.S. Treasuries are currently not acting like safe havens, as the crisis is U.S. centric with the tariff debacle. 10yr Treasuries can regain safe haven status if a U.S. recession occurs, but U.S. equities are still clearly overvalued versus equity and equity-bond metrics. We prefer Ind

April 16, 2025

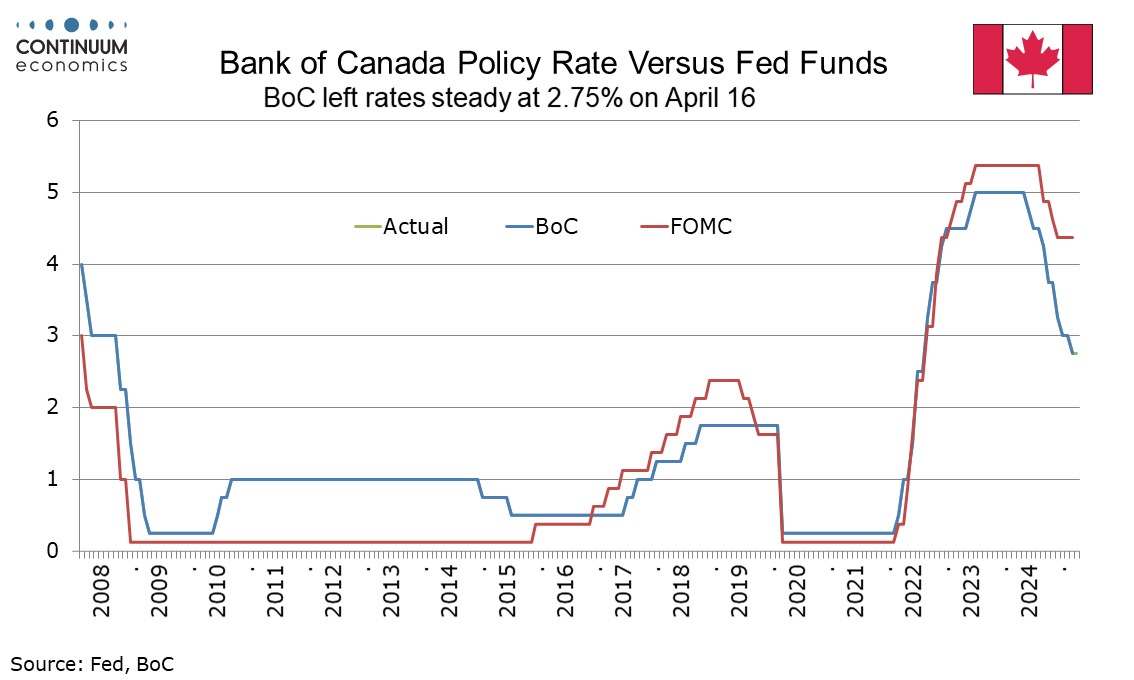

Bank of Canada - Proceeding carefully, but risks still lean towards further easing

April 16, 2025 4:28 PM UTC

The Bank of Canada left rates unchanged at 2.75% as expected. The statement concluded that the BoC will proceed carefully, noting that monetary policy cannot resolve trade uncertainty or offset the impacts of a trade war, but it can and must maintain price stability in Canada. While this shows cauti

April 15, 2025

Canada March CPI - Correction lower led by travel costs

April 15, 2025 12:54 PM UTC

March Canadian CPI in falling to 2.3% yr/yr from 2.6% is significantly weaker than expected. Lower prices for gasoline and travel tours were cited as negative influences, the latter surely impacted by the unwillingness of Canadians to travel to the USA. The BoC core rates are on balance slightly s

Nervous U.S. Long Term Asset Holders

April 15, 2025 8:30 AM UTC

Overall, foreign equity investors can no longer count on U.S. exceptionalism and could face lower long-term corporate earnings growth, which at a minimum will likely slow net inflows. Bond investors also face ongoing policy volatility, which likely means a need for an extra risk premium – t

April 10, 2025

Trade Deals with the U.S.: Pressures and Obstacles

April 10, 2025 7:17 AM UTC

Pressures to do trade deals include the weaker U.S. economy and higher inflation when it arrives/foreigners becoming nervous of their USD30trn plus holdings of U.S. securities and more crucially risks to Trump and GOP approval ratings from Republican voters. Obstacles to quick trade deals include Tr

April 09, 2025

U.S China Trade War: Deal or No Deal Prospects?

April 9, 2025 9:00 AM UTC

The prospect of a trade deal between the U.S. and China are less and likely delayed into 2026, due to the hardline stance of Trump 2.0 due to the extra focus on tariff tax revenue and shifting production back to the U.S. It is still our baseline that a deal will be agreed though we would now see a d

April 08, 2025

Bank of Canada Preview for April 16: Easing to pause, but unlikely to be done

April 8, 2025 2:04 PM UTC

The Bank of Canada meets on April 16 and we expect that strength in some recent data and high uncertainty will see rates left unchanged at 2.75%. There will be little forward guidance and the accompanying Monetary Policy Report may avoid providing its usual economic forecasts. We do not expect that

Reciprocal Tariffs: The Hit To Other Countries

April 8, 2025 9:30 AM UTC

Overall, we are still assessing the effects on non U.S. countries from the tariffs being imposed by the U.S. via direct trade/business investment/currency and financial & monetary conditions swings. The impact will be adverse to GDP, but for some major countries could be less than the U.S. How

April 07, 2025

Canada - BoC Q1 Business Outlook Survey shows caution, Consumer Survey more pessimistic

April 7, 2025 2:57 PM UTC

The Bank of Canada’s Q1 business outlook survey is weaker, though probably not by enough to shock the Bank of Canada. The survey was conducted in February, when tariffs were a worry but not yet a reality.

April 03, 2025

Tariffs: Inflation may be the biggest worry for the U.S.

April 3, 2025 4:12 PM UTC

While surprising the market in their intensity, Trump’s “reciprocal” tariffs were in line with previous threats on most countries, and with Canada and Mexico being treated less harshly that feared, the net surprise is modest to us. However we do feel that inflationary risks have increased furt

March 31, 2025

U.S. Trade Surplus Countries: No Special Treatment?

March 31, 2025 9:04 AM UTC

Quick dilutions of tariffs or exemption will likely be slow in coming for countries that the U.S. has trade surpluses with, as the Trump administration are currently more focused on tariffs for tax revenue and trying to switch production back to the U.S. than trade deals. Trade policy uncertainty

March 27, 2025

Car Tariffs Then Lenient Reciprocal Tariffs?

March 27, 2025 8:59 AM UTC

The 25% tariffs on cars underlines that tariffs are not just about getting better trade deals, but in Trump’s view raising (tax) revenue and trying to shift production back to the U.S. Combined with other tariffs being implemented, plus policy uncertainty, we see a moderate overall hit from t

March 26, 2025

Bank of Canada Minutes from March 12 - Debate over the 25bps easing, agreement to proceed carefully

March 26, 2025 6:19 PM UTC

The Bank of Canada has released minutes from its March 12 meeting, and these show some debate about the meeting’s decision to ease by 25bps to 2.75% and agreement to proceed carefully with further changes to policy. A lot can happen before the BoC next meets on April 16, but these minutes suggest

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t