Bank of Canada Preview for June 4: A close call for another policy pause

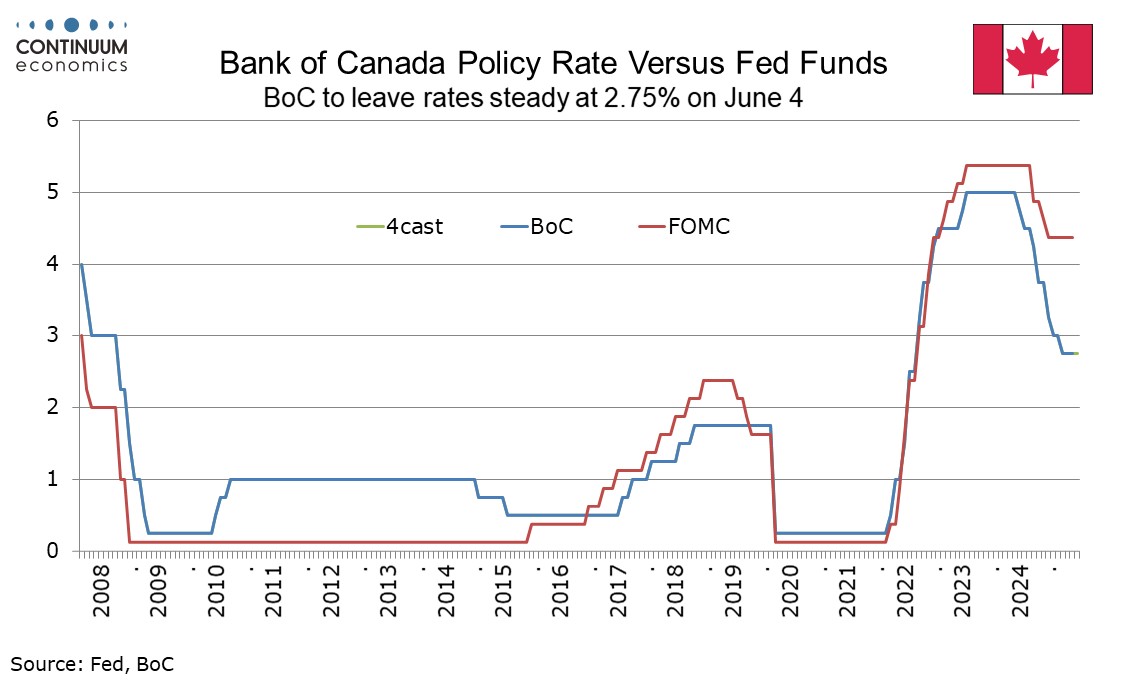

The Bank of Canada meets on June 4 and it is a close call between leaving rates unchanged at 2.75% and a 25bps easing to 2.5%, though we now lean to the former. The statement is unlikely to give any forward guidance and we still expect further easing this year as the economy weakens in response to US tariffs.

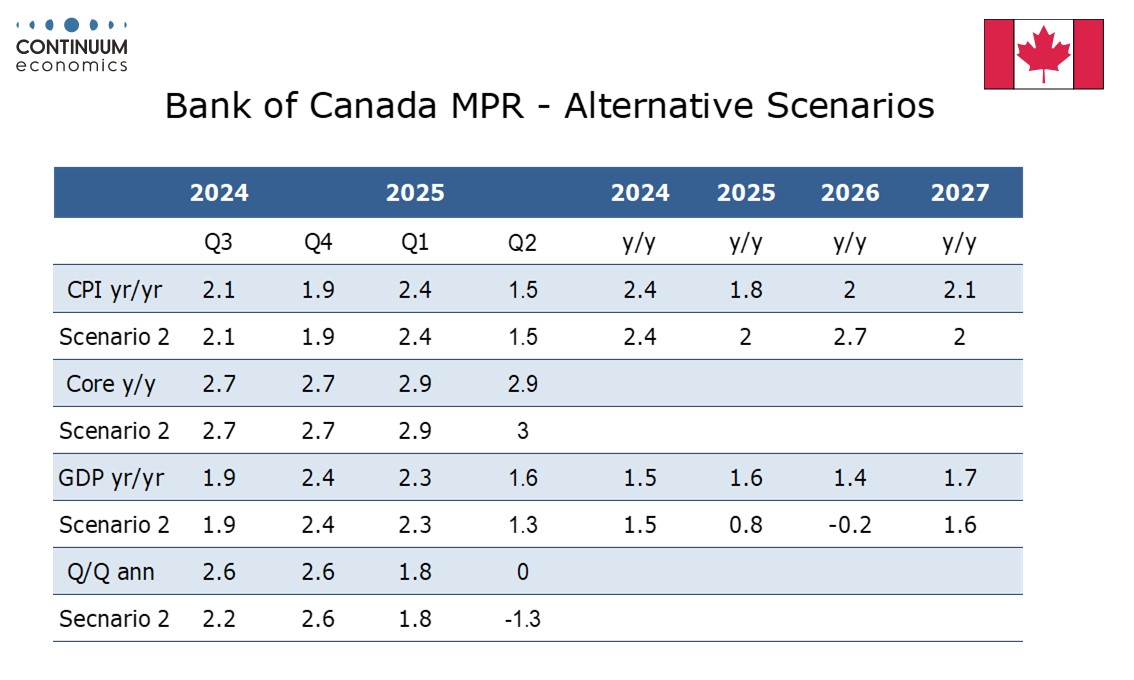

This meeting will not see the release of a quarterly monetary policy report. At the last meeting on April 16 the BoC’s MPR avoided giving its usual economic projection, instead giving two alternative scenarios. In the first it is assumed most of the new tariffs get negotiated away but uncertainty persists. GDP then stalls in Q2 and then expands only moderately while inflation drops below 2.0% for the rest of the year and into 2026.

The second scenario assumes a long lasting global trade war. Then GDP falls in Q2 and Canada remains in recession for a year. Growth gradually returns in 2026 but remains soft through 2027, while inflation rises above 3% in mid-2026, before falling as weak demand limits ongoing inflationary pressures.

BoC Governor Tiff Macklem stated that the April 2 tariff announcement suggested a situation similar to the second scenario but a partial climb down had the BoC seeing a scenario near the middle of the two scenarios by April 16. On May 5 he stated the situation was getting closer to the first scenario. A defeat for Trump in the courts on tariffs, while not yet removing the tariffs, is a further helpful development.

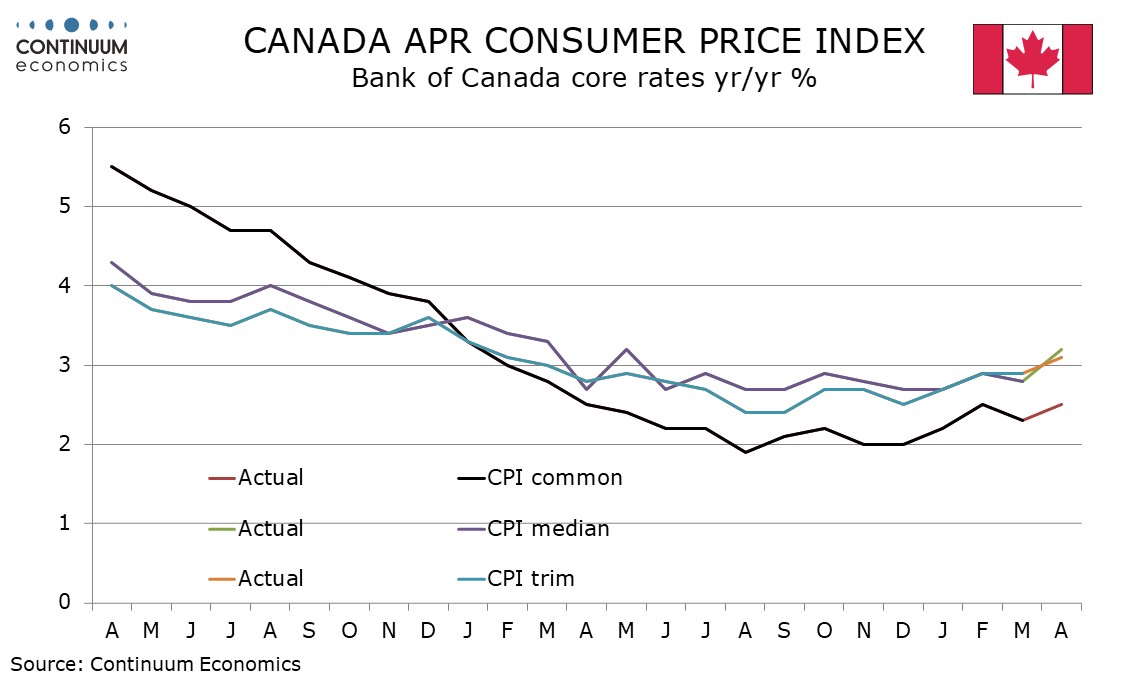

This suggests downside risks to growth have been reduced. A lower tariff scenario may also reduce downside risks to inflation, but disappointing core inflation data for April, when the average of the BoC’s three core measures reached their highest in over a year, means that inflation risks may be seen as higher than in April. A fall in April’s headline CPI to 1.7% was purely on the abolition of a carbon tax, something the BoC had expected to reduce headline inflation to 1.5%.

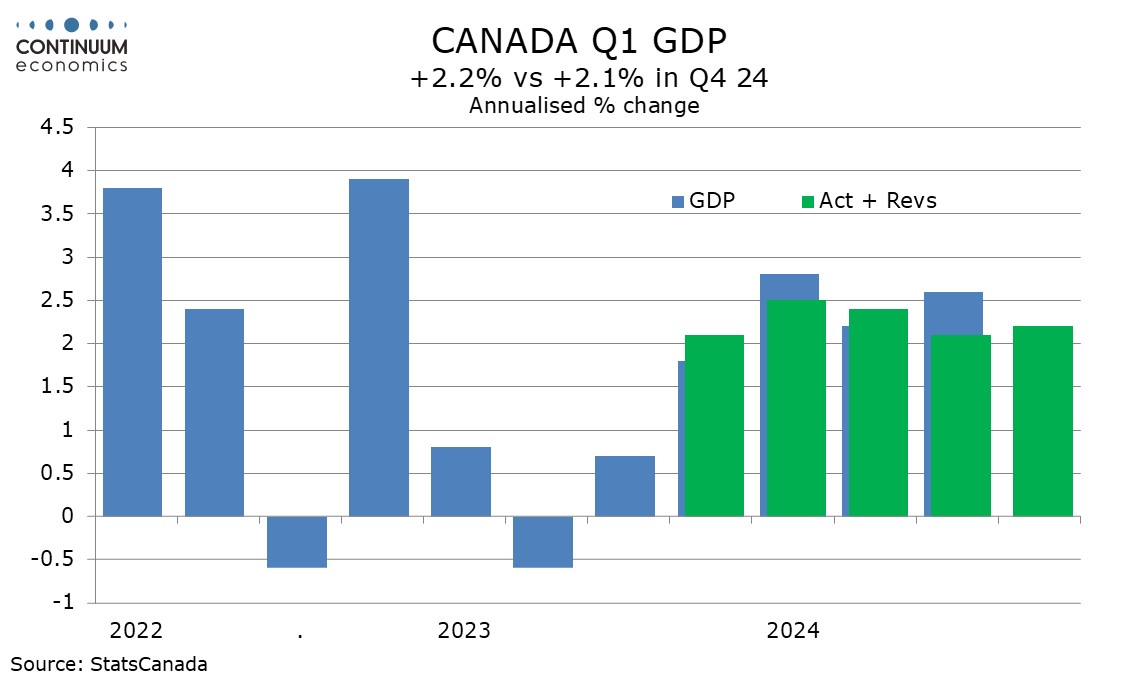

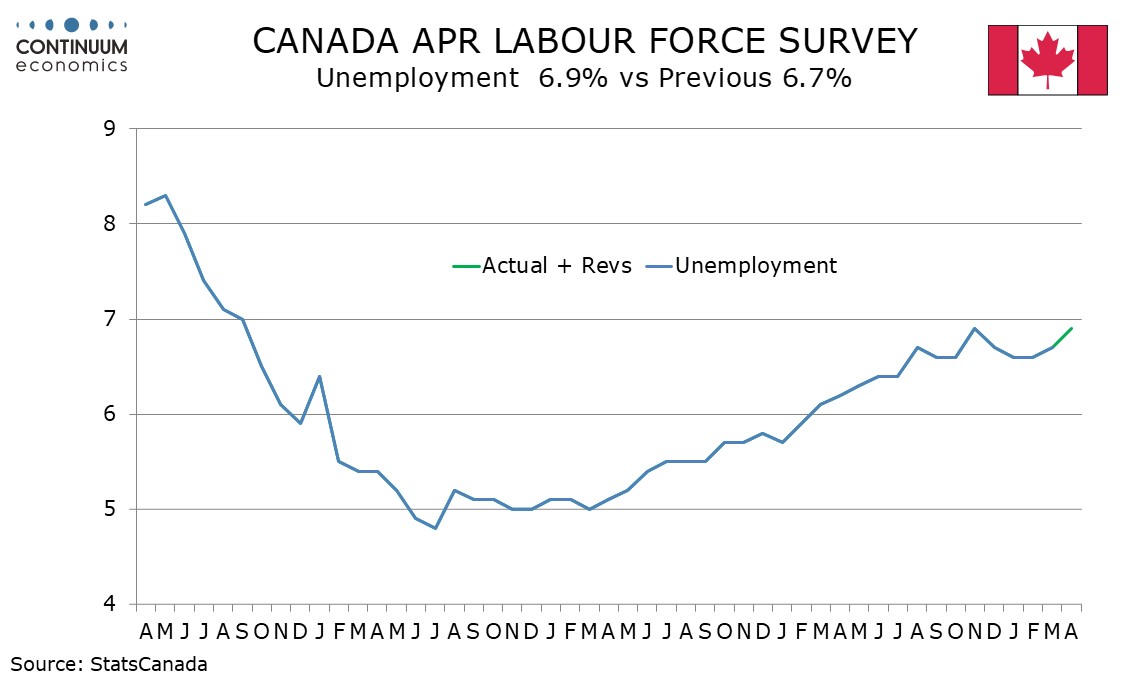

A stronger than expected Q1 GDP gain of 2.2% annualized adds to the case for no change, as does a preliminary estimate for a 0.1% monthly increase in April, suggesting Canada is not yet in recession. However, doves could point to a 0.1% annualized decline in Q1 domestic demand, correcting from a strong 5.2% increase in Q4, as evidence of growing downside risk. April saw a third straight weak employment report, lifting the unemployment rate to 6.9% from 6.6% in January.

Minutes from the April 16 meeting shows that easing was debated, despite a decision to leave rates unchanged. However the statement said that the BoC would proceed carefully, and that monetary policy could not resolve trade uncertainty or offset the impacts of a trade war. It went on to say that it can and must maintain price stability for Canadians. While there is a case for easing to combat expected slowing in the economy, the downside risks have reduced somewhat, and recent inflationary data has caused some concern. We expect the BoC to pause at this meeting, though easing is likely to resume in the second half of the year as economic weakness become more apparent and recent strength in core inflation starts to fade.